Wachiwit

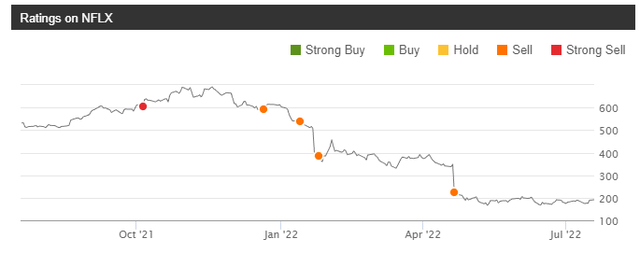

Netflix (NASDAQ:NFLX) has potentially set new records for its destruction of shareholder value. The company has turned what once was a valuation of more than $300 billion to less than $100 billion falling from a 52-week high of more than $700 per share. Despite this weakness, with continued competition from new competitors like HBO Max, the company continues to make decisions that might cause subscribers to re-evaluate their subscriptions.

Netflix’s Financial Problem

Netflix seems to have a financial problem. The company needs to compete against much larger businesses without a cable TV business to support its operations. It also doesn’t earn money from ads (although that might soon change). That’s a pretty big difference from competitors like Disney (DIS) that recently upfront sold $9 billion in ads.

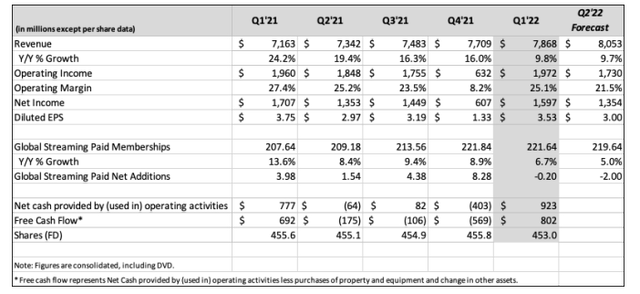

Netflix Financial Performance – Netflix Press Release

Netflix has steadily increased revenue, although a chunk of this has been from price increases. The company’s most recent announced price increase was roughly 10%, helping to support the company’s QoQ revenue increase. From 1Q 2021 to 2Q 2022 the company’s revenue increased from $7.2 billion to $8.1 billion or ~10% YoY increase.

Over the same time, the company’s paid memberships grew heavily throughout COVID-19 before declining into 1Q 2022. Numbers are expected to decline even further going into 2Q 2022. The company’s share count has been decreasing, but just barely, and the company’s profitability has varied. It’s barely managed to maintain positive FCF as investments have varied.

The company’s financial problem here is that content spending is extraordinarily expensive. Netflix spent $17 billion in 2021 and that’s expected to grow slightly into this year. Disney spent $25 billion in 2021 expected to increase to $33 billion in 2022. TimeWarner Discovery expected to spend roughly $22 billion in 2022.

Netflix is barely bringing in $30 billion / year in revenue and it doesn’t have other businesses to subsidize its content spending. Disney’s revenue is more than double that. That means best case Netflix could be bringing in ~$10-12 billion in profit of course assuming no operating expenses outside of content spending.

The company will possibly struggle to both compete from a content standpoint without overcharging its customers or generating sufficient profits.

Netflix’s New Competition

Five years ago, Netflix offered the streaming component to existing content producers portfolios. Some of its most watched shows like Friends, The Office, etc. came from other producers. It has now lost those shows.

Disney effectively completely owns Hulu at this point. HBO Max has launched. HBO Max now owns Discovery+ which it can merge. Disney+ has had the best launch of any streaming service. Amazon Prime gives shows away as an add-on, not even a separate charge. Peacock+ has launched a low cost service, ESPN+ exists.

Netflix is, most certainly, no longer alone. That new competition not only ramps up the price of the company’s existing content creation, at a bare minimum, but it means that Netflix lost a significant part of its existing cheap content library. NBC paid $500 million to grab the rights for The Office, previously Netflix’s most watched show.

That new competition would have compressed Netflix’s margins if the company was already profitable. But the company’s not profitable. The company’s max profits if it had no operating expenses and was solely spending on content would give it a P/E of ~10. The company’s growth is slowing down and it can only increase prices so many times.

Charging for password sharing etc., will potentially push the company’s subscribers to re-evaluate whether their subscriptions are worth it. Unfortunately for Netflix subscriber numbers indicate they’re doing that either way. This new competition for Netflix is at the crux of why we expect the company not to recover.

Our View

We’ve been consistently against investing in Netflix as the company fails to address fundamental concerns.

The company’s share price has been pummeled over the last year. As we’ve discussed, hundreds of billions of valuation has been wiped out. The company is now trading at a roughly $80 billion market capitalization. Peer Warner Bros Discovery (WBD) is trading at a $35 billion market capitalization and Disney is trading at roughly $175 billion.

However, in our view, out of the three companies, Netflix has the worst positioning. It has no non-streaming business to subsidize the remainder of its business. It is spending heavily on content and losing subscribers at the same time. We expect the company to continue struggling to be profitable which will push down its share price.

At current levels we remain against investing in Netflix.

Thesis Risk

The largest risk to our thesis is that Netflix still has an exciting portfolio of content assets. The company has managed to handle price increases so far and it argues that a significant chunk of its recent growth slowdown is due to the effects of COVID-19 waning. The company could generate success from current shows reducing the need for future content spend.

That could enable increased shareholder returns and making the company a valuable investment.

Conclusion

Netflix has a unique portfolio of content assets, however, the company is dramatically worse off than where it was several years ago. The company’s competition has increased dramatically and unfortunately for the company, the competition isn’t a new hip startup, it’s companies that have been around longer and are much larger.

The company even with its weakness is spending less than its peers. Its peers have other businesses to subsidize their massive content spending. It occasionally generates positive FCF, but not enough to justify its valuation, and we expect that to remain true going forward. The company doesn’t seem interested in pausing to appease customers and continues to add pricing pressure.

As a result, we recommend against investing.

Be the first to comment