Ika84/E+ via Getty Images

4Q22 Results Overview

After the bell on Thursday, Natural Grocers (NYSE:NGVC) (“the company”) reported the Q4 2022 fiscal results. The market reacted with shares falling 15% in response to such results. Unfortunately, the company is not covered by the Street, except by Wolfe Research, so the consensus is made by only one investment boutique.

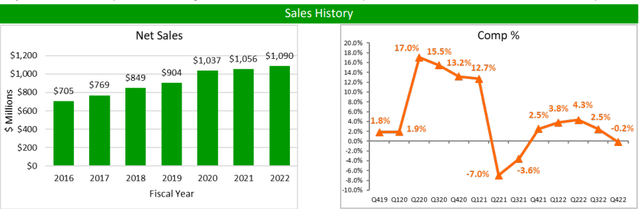

For Q4, revenues came in at $274.2M, up 0.6% over the prior year. The consensus was $282.0M (I personally expected $284.4M), hence, a miss on street estimates by $8M. According to the company, the topline number was a result of the following:

Daily average comparable store sales decreased 0.2% in the fourth quarter of fiscal 2022, comprised of a 2.6% decrease in daily average transaction count, offset by a 2.5% increase in daily average transaction size.

Natural Grocers Q422 Presentation

The bottom line miss was even worse, with the 4Q22 GAAP EPS of $0.09. The number resulted well below the consensus of $0.15 (I personally expected $0.18/share) and down 71.7% YoY. The bottom-line result can be decomposed as follows:

First, the fourth quarter gross margin decreased 20 basis points to 27.6% YoY (unchanged QoQ), which resulted in line with what I personally expected. The gross margin decrease, as stated by the company, was attributed to:

Lower product margin attributed to higher freight, distribution and shrink expenses.

Second, and most important, an operating margin of 1.3% (down 61.4% YoY). Such a decline can be attributed to higher store expenses and administrative expenses (due to increased wage expenses).

In my most recent analysis of the name, for FY2023, I expected a topline growth of 2.5% YoY and a GAAP EPS of $1.02. However, both my expectations were disappointed by the company’s outlook. For the FY2023, management guided to daily average comparable store sales growth of -2.0% to 1.0%, and GAAP EPS between $0.7 and $0.9. Both are well below consensus. As stated by the company, the expectations are attributed to a risk of recession and the loss of some of the tailwinds from the pandemic. I believe that the two downside risks (i.e., consumer squeeze and competition) seem to be the real drivers behind such a poor outlook. However, in the addition to the previously stated downside risks, I would like to add now another downside risk: poor management decisions.

Valuation Update & Final Remarks

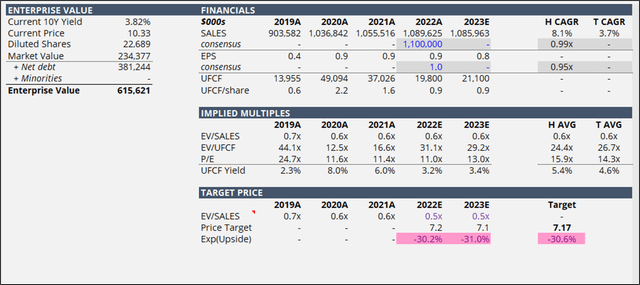

Currently, the company is trading at an EV/SALES of ~0.57x TTM, which represents a premium relative to the peer’s median EV/SALES of ~0.50x TTM. Following the 4Q22 results and the FY23 outlook, I revisited lower my expectations for the year ahead. Now, I expect the company’s valuation to converge to the sector median EV/SALES of ~0.50x TTM supported by fundamentals deterioration.

From the technical analysis point of view, I believe that we are likely to see a “Dead Cat Bounce” pattern, with a price peak of around $11.40/share area.

Overall, I rate shares as Sell with an estimated fair value of $7.17/share, which would represent a 30.0% downside from the current price of $10.33.

Be the first to comment