MoMo Productions/DigitalVision via Getty Images

Introduction

As a dividend growth investor, I’m always on the prowl for companies that I’d potentially like to add to my portfolio should the opportunity present itself. With 2023 looming, this time is no different as I hope to initiate a couple of new positions during 2023 that fill my requirements for a high-quality dividend paying company. Several of the companies mentioned in this article will have been on my radar during 2022 or perhaps sooner where I’ve failed to pull the trigger during pullbacks, having gotten too greedy, or found a more compelling offer at the time. I always operate with a list of potential candidates to ensure capital is put to efficient use. I’ll share some of that here for inspirational purposes.

In my own investing universe, I divide dividend paying companies into three baskets, for which I set different criteria:

- Low yield, high growth company: Here I’ll accept a lower starting yield at the expense of knowing what compounding may lead to if held for many years. Expecting several years of double digit CAGR for dividends and the potential to continue so for several years. Examples could be Visa (V), Broadcom (AVGO) or Microsoft (MSFT), all of which are holdings within my portfolio.

- Mature company: Your stable blue-chip company would typically have attained the label “dividend aristocrat” or “dividend king”. Initial yield of 3%+ in perfect scenario, but willing to accept 2.5% and expecting a payout ratio no higher than 65-70% on a free cash flow per share basis. Examples could be Nestle (OTCPK:NSRGY), Texas Instruments (TXN) or Stanley Black & Decker (SWK), all of which are holdings within my portfolio.

- High yield: Characterized by company operations typically at risk for diminishing over time or declared out of favor by Mr. market. Examples could be British American Tobacco (BTI), Enbridge (ENB) or AT&T (T), all of which are holdings in my portfolio.

I would balance the division amongst the three up against my strategy and time horizon, which is very long in my case. At such, time is working for me, allowing the low yield and high growth companies to unfold as I just sit back and wait. This would be combined with perspectives on dividend safety and financial strength, represented by how the balance sheet is structured.

In this article, I’ll present companies belonging to all three baskets, and I think a dividend portfolio needs a bit of all, but with the distribution depending on where you are in your life. For those reading this who doesn’t know me, I’m in my mid 30’s, planning to hold my investments for not only years but decades, so I’ll strive towards holding a significant percentage of the first basket, low yield and high growth, with less focus on high yield even though these companies often can be picked up while at depressed valuations and therefore at significant initial yields. They are however often at depressed valuations for extended periods which may impact the total returns.

The sectors covered herein include industrials, consumer staples, consumer discretionary, semiconductor, traditional finance, healthcare, tobacco, defense and in other words, a bit of everything.

My portfolio currently consists of 31 holdings that pay a dividend, 3 index funds also paying an annual dividend and then 9 companies that don’t pay a dividend today, but perhaps will down the road, if held long enough.

A Look Back At My Top 10 Picks For 2022

Exactly a year ago, I released a similar list looking towards 2022, and I’ll briefly dissect the list here. It included the following companies.

- Caterpillar Inc (CAT), total return of 16.4% YTD

- Robert Half International Inc (RHI), total return of negative 34.4% YTD

- Visa, total return of negative 4.5% YTD

- Anthem, now Elevance Health (ELV), total return of 10% YTD

- British American Tobacco, total return of 14.5% YTD

- Union Pacific Corp (UNP), total return of negative 16.6% YTD

- Tyson Foods Inc (TSN), total return of negative 27.8% YTD

- JPMorgan (JPM), total return of negative 14.8% YTD

- Bank of America (BAC), total return of negative 25% YTD

- Starbucks (SBUX), total return of negative 14.2% YTD

- Texas Instruments (TXN), total return of negative 9.43% YTD

- Alphabet (GOOG) (GOOGL) – a potential future dividend payer, total return of negative 38.5% YTD

The respective up- or down performance YoY shown above, is noted some days prior to this article being published, and with the current market volatility, they may move around. At the same time, the S&P 500 has delivered total negative returns of 19.5% YTD.

Over the past year, I’ve utilized the market volatility to add to my positions within Visa, Texas Instruments, Tyson Foods as well as Alphabet. I’ve initiated a new position with Starbucks, with an average share price of $76.3, currently sitting at $98, meaning my position has appreciated 29%.

Looking at the performance overall, I’m not surprised to see companies like Elevance Health and British American Tobacco being up. They hold pricing power and produce strong and reliable free cash flows. Just what market participants favor in a time of rising inflation and instability. I’m mostly puzzled by the performance of the two banks, given that we approached 2022 knowing that interest levels would be on the rise. In my article I did note the following concerning financial companies in general “To be clear, I have a lukewarm feeling about the prospects and would probably look elsewhere, but interest rates hikes should help drive profitability for traditional banks, something they have thirsted forever since the financial crisis.” I do however remain surprised that they turned out to have gone through such a rough patch over the last year. It is also the third worst performing sector of the year, but that doesn’t mean there isn’t opportunity to be found, as I’ll lay out later within this article.

The Mood As We Enter 2023 – The Late Business Cycle

Global recession (or not) will remain the theme as we begin 2023. At this point, I find it hard to argue against the idea of being late in the business cycle, which would bring us close to a recession, before the cycle can start over.

Economists are split on whether we will face a global recession in 2023 or not, and if so, will it be harsh or mild? We don’t know, and that’s an inevitable fact as we all have to consider how to allocate our funds for the coming years.

My own guess is, and it remains a guess, that one can consider 2023 as a split year. For the first half, we will continue to linger in uncertainty as inflation recedes and we get a better understanding of how the employment – and housing market – will adjust, ultimately impacting the economy in general. Perhaps just as important, we will begin to understand just how long it may in fact take for inflation to come back down to the long-term targets of global central banks. My guess is, that it will take longer than what the market consensus is today. Here we have to keep in mind, that the US economy is currently doing better than other developed economies. I’d label it, the best in a bad neighborhood. Inevitably, even if you are the best in a bad bunch, should the rest of the bunch deteriorate, then it will also impact the best. We often hear the phrase, when the US economy sneezes, the world catches a cold – but similarly, should the world economy drop, the US will also feel the impact.

Coming back to my stance on the fact that inflation will recede slowly, we can take the IMF as an example. We’ve recently seen reports suggesting that a potential wage spiral is contained, despite the high inflation environment. The same chatter is heard out of the ECB. I’m not a world-renowned economist with access to real-time leading indicators, but I remain skeptical of that conclusion not least by the fact, that large institutions have an interest in not shouting “the wolf is coming”, which would be the equivalent of them saying, that wage growth will get out of control sometime during 2023. As such, my take on 2023 is, that the current market bull run will fade. The 25-30% drawback we’ve experienced so far in 2022 is substantial, no arguing against that, but compared to general recessions, there would still be a ways to go before finding a bottom.

Companies are at record margins and the market appears adamant in its stance towards inflation cooling just enough for a soft landing. Sure, that’s a potential outcome, but I don’t consider it the most realistic.

This will cause the investor community to continue flocking towards companies with pricing power (pharma, consumer staples, software companies upon which large corporations depend, defense, utility, etc).

In essence, the market wants cash flows now, not in five years.

Therefore, the first half of 2023, perhaps extending longer, will be a scorch for discretionary companies, growth companies yet to show sustainable cash flows and companies where margins are thin. Remember, the markets always look half a year into the future.

If we do indeed get closer to understanding the impact on the global economy as we begin to flip the pages on the 2023 calendar, then the second half of 2023 may open up for companies who’ve been out of favor throughout 2022. That is, unless we get hit really hard, which would cause investors to continue gathering amongst the safe harbors and blue chips.

Bottom line as I see it is, that we don’t know where the economy will land, and that the market will continue playing it safe until we do. All we know is that inflation hasn’t been this high in four decades, neither have central banks been hiking interest rates so fast as has been the case in 2022 where 0.75bps hikes became the new normal. We only have to go back to the spring of 2022 to find statements by the FED where 0.75bps was an unthinkable scenario. I’m amongst the crowd who find it more probable that we will experience a somewhat harsh recession, but only time can tell.

This line of thought is what paints my view on the year to come, so if you view the world completely different, then I wouldn’t be as defensive as my trail of thoughts to come in the next sections.

Does that mean I don’t intend on investing? Certainly not, I’ve allocated more than $10,000 in fresh funds to my portfolio this year, and I will continue adding throughout this market drawback. It’s in these times, where it’s difficult to convince yourself to buy something risky, when it’s in fact what you should be doing. Recessions, in many ways, are the friend of a patient investor, and certainly something I try to let my portfolio benefit from.

Having said all that, it’s time to look at what’s on the shelf out there.

Union Pacific Corp

UNP is back on the list for the simple reason that it fits many of the requirements to withstand economic uncertainty. The company has strong pricing power, as the idea of constructing a new set of railroad tracks next to the existing ones is an unthinkable prospect for landowners and regulators, creating favorable pricing structures for those who own the existing network.

There is a consistent need to transport corn, coal, metals, cars, natural gas, consumer goods and anything in between, as rail transport is a favored method due to its unit economics and capacity to carry massive loads over long distances in reliable and consistent timeframes. In combination, we are dealing with a stable business with pricing power, as a dividend growth investor, I truly like that combination.

A company like UNP therefore carries a very interesting balance sheet. Rail tracks have long since been depreciated accounting wise, but the value remains within the network, meaning there is a lot of hidden equity in such a company. Speaking of the balance sheet, this is perhaps also where I can find the only sore point speaking against UNP, as the company has established a substantial debt load during the past decade, which was characterized by unnaturally low interest rates. This is something I would like to see management change, going forward.

There have been issues associated to potential strikes during 2022, but UNP and its peers have the sought-after ingredients in a market characterized by turmoil, and I don’t personally invest with a short time horizon, where such an external event could be a factor.

Last year I argued that UNP was ripe for a pullback, and while the stock has traded lower as recently as October this year, the forward yield is now at roughly 2.46% compared to just a year ago when the yield was hovering just below 2%. At that time, the yield was at its lowest since 2015, suggesting to me the entry point was unfavorable. Given the pullback however, I consider UNP ripe for picking for long-term investors.

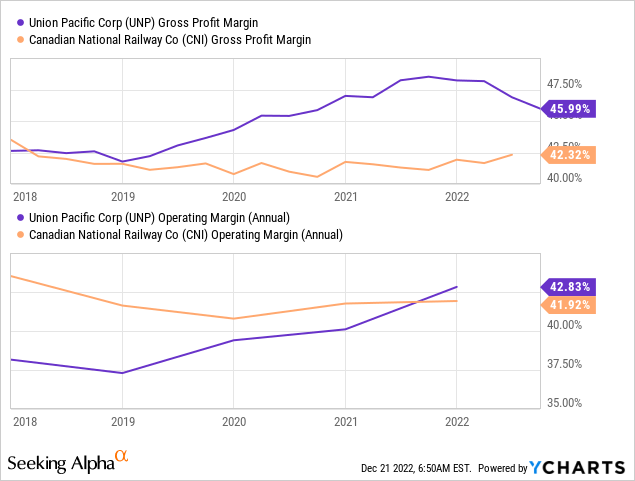

What about its peers? Sure, there is Canadian National Railway (CNI) and Canadian Pacific Railway (CP), but I prefer UNP due to its margin profile, dividend consistency, taxation and dividend growth. Speaking of dividend growth, UNP has a 5Y 15.42% CAGR of its dividend and a payout ratio of 44.2%. For dividend investors, we can still expect a lot to come from UNP.

ASML Holding (ASML)

Just as UNP, this is a company operating in an industry sweet spot. ASML designs and manufactures photolithography machinery utilized for production of semiconductors. Not only that, but ASML is market leading in its niche, being the sole supplier of what is called ‘extreme ultraviolet lithography’, also abbreviated as EUV, the most advanced technology currently available. Unless you were hiding in a cave for the last ten years, you will know that the world relies heavily upon semiconductors. Your car is quickly becoming a computer on wheels, and try turning off the power in your home, and you’ll realize that nothing will work without it, with more or less every single gadget containing semiconductors. So why not invest in a semiconductor manufacturer? Surely, that’s one way to go about it, and I’ll mention one in a minute, but sometimes it’s worth going upstream in the value chain, allowing one to bet on those selling the shovels, as opposed to those digging for gold. ASML is one such company, as the leading manufacturers of semiconductors, all rely on their machinery. With the disagreements between China and the US, labeled the ‘tech war’, we’ve seen restrictions on where companies such as ASML are allowed to sell their products, hampering sales growth and also carving out a unique set of risks. On the other hand, with the US Chips Act, there is also potential for strong growth in the industry as the US will try to persuade companies to establish manufacturing in the US, ultimately requiring more ASML equipment. ASML carries more cash than debt on its balance sheet, so this is a company in great shape, able to weather unforeseen events, such as could be associated to regulatory actions that could impact short-term flexibility for ASML and its peers.

Well, can’t a competitor just come up with something unique and make ASML go out of business? Hardly, as the rule of thumb for operating in this industry, is that process knowledge and mastery is key, before one can make it to the next level of technology. That is why only a couple of companies globally can make the smallest of semiconductors, and similarly, why ASML has reached a duopoly state in its second newest generation of machinery, and a monopoly in its cutting-edge platform.

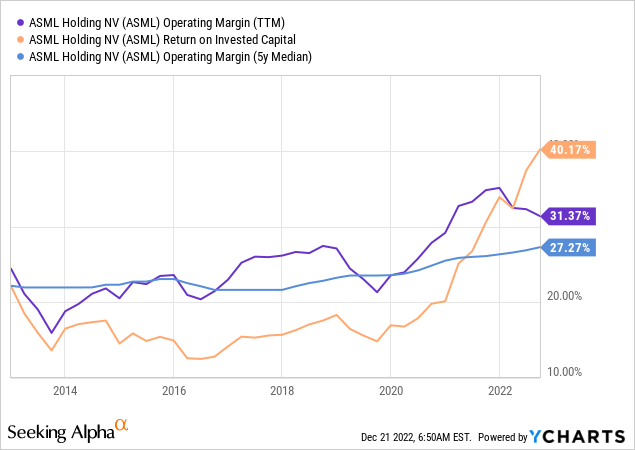

One look at the profitability margin trend and I’m impressed. Similarly, we are seeing an expansion in return on invested capital. The current level shouldn’t be expected to be sustainable given how every single company has been scrambling for semiconductors since the onset of Covid-19, allowing ASML to strike very profitable deals for its production slots due to an imbalance in supply and demand. It does however still tell the tale of a company carving out a very good business for itself with stronger margins over time as the company builds scale and optimizes its production processes. Being at the edge of technology, ASML has suffered setbacks within EUV over the years as they developed and eventually mastered the technology, so that is to be expected also for the coming generation. The only downside here, is that ASML’s management itself has been verbal about how far they might take the technology, which ultimately could allow competitors to catch up one day and drive more competition.

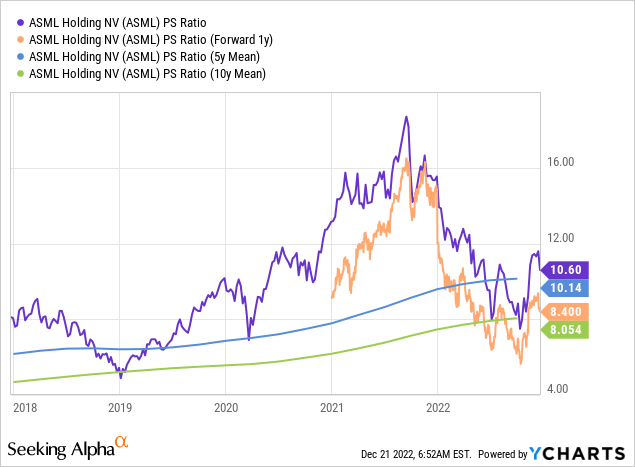

From a valuation standpoint, the market has attached a very steep valuation to this company during the tech craze, and with a market cap north of $200 billion, very few European companies can rival it. As such, there is valuation risk associated to this company, but it’s at a level where one may consider to dollar cost average their way into a position. I’d personally await a market pullback as I don’t find the current bull run sustainable, as I also laid out in my introduction. That is of course, my personal opinion.

What about the dividend? ASML has paid a dividend since 2013, when the first instalment consisted of $0.69 per share. YTD, the company has issues three dividends, totaling north of $6 per share, showing the immense growth, despite the very low starting yield hovering just below 1%. Therefore, this company is a dividend grower in its purest form, with the addition that it doesn’t issue its dividend in USD, meaning the amount will fluctuate in connection to exchange rates.

Lam Research Corporation (LRCX)

Lam Research Corporation is a company which in many ways is similar to ASML. It is smaller however, and not holding quite as strong a position within its niche. Compared to ASML, LRCX comes with roughly half the employees and a market cap just north of $60 billion. Revenue wise, the two companies are almost similar, with LRCX at TTM revenue of $17.9 billion, and ASML at $19.3 billion. A bit of quick math, and we are looking at a much more appetizing valuation, at least looking from afar.

Similarly, to ASML, LRCX focuses on a part of the semiconductor manufacturing value chain, in this instance, the wafer fabrication. Without going into detail, Lam Research specializes within what’s called deposition and etch, where its main competitors are Tokyo Electron (OTCPK:TOELF) and Applied Materials (AMAT). What speaks in favor of LRCX, is the fact that the company is market leading within its niche. As was the case with ASML, LRCX is exposed to a similar set of risks in connection to the US and China disagreement concerning the global tech landscape. Compared to ASML, LRCX doesn’t come with quite as strong a balance sheet, but still carries a balance sheet with good balance between debt and available cash on hand.

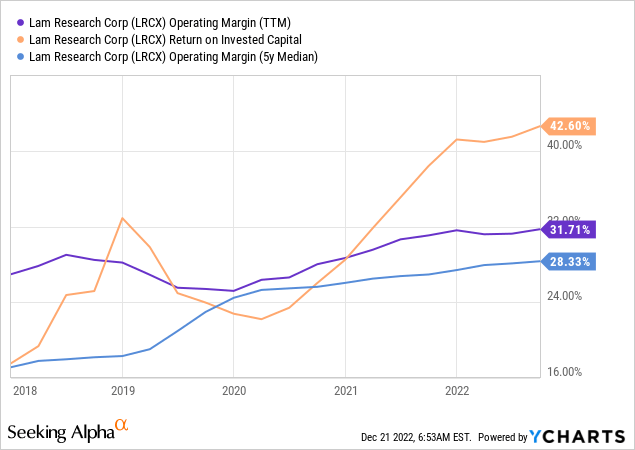

Lam Research is exhibiting some of the same trends as can be observed when looking at ASML. Growing profitability and an expansion in return on invested capital.

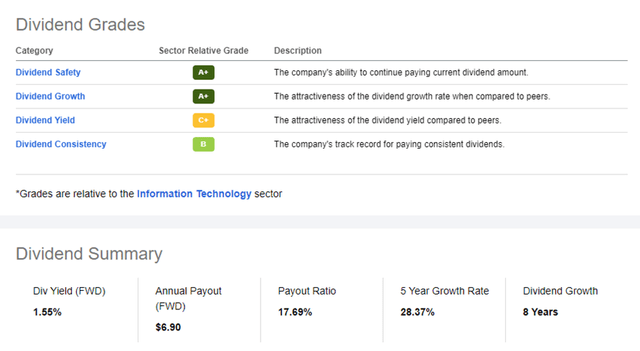

Dividend Grades Lam Research (Seeking Alpha)

The dividend grades shown here on Seeking Alpha also paint the picture of a very appealing company for any investor interested in dividend growth. Consistency in form of eight years of consecutive growth in the dividend, combined with a very impressive 28.4% CAGR and a payout ratio of 17.7%. This is the type of company an investor focused on dividend growth likely wants to hold.

According to Reuters, potential new restrictions by the US government are looming, and could impact the company. Just recently, the company showed a very strong Q1-2023 performance with double digit YoY revenue growth and an expansion in margins, allowing the EPS to grow 25.6% YoY. The Q1-2023 beat Wall Street expectations and caused the stock to surge, but it doesn’t take away the fact that consensus estimates for FY2024 show a steep decline in both revenue and earnings, not least due to the potential impact from restrictions. Personally, I invest in companies for the long-term prospects, and with an expected recovery in FY2025, I would focus on the fact that Lam Research is a leader in its niche, a niche that is highly sought after, and given the current valuation, I find the company attractive today, with a good starting yield and plenty of space to grow it over the coming decades.

Johnson & Johnson (JNJ)

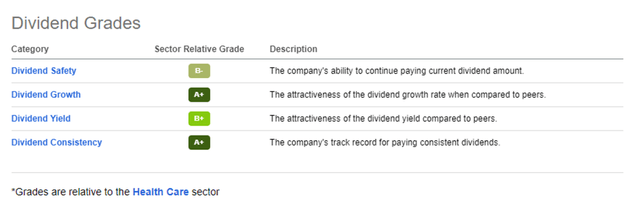

Few companies reek of stability to the extent that Johnson & Johnson does. Some will call it boring, but often times, boring is good when it comes to investments in an uncertain period. A dividend king, JNJ has hiked its dividend for 60 consecutive years. It’s hard to go wrong with this one, and it could be exactly what the market is wanting in times like these – safety. Safety is the name of the game when looking at the dividend grades assigned by Seeking Alpha.

With JNJ, the dividend is not at risk, albeit growing slowly, as could be expected by a mature company. Management continuously manages to grow the business, to the extent that revenue is closing in on $100 billion in annual revenue (before the upcoming company split).

Dividend Grades Johnsn & Johnson (Seeking Alpha)

Within my own portfolio, health care is my second largest exposure towards a single sector. Is that standard for an investor in my age group? Probably not, but it’s what fits my profile and I sleep happily at night knowing that a substantial part of my assets is with companies holding strong pricing power and offering their investors a growing income.

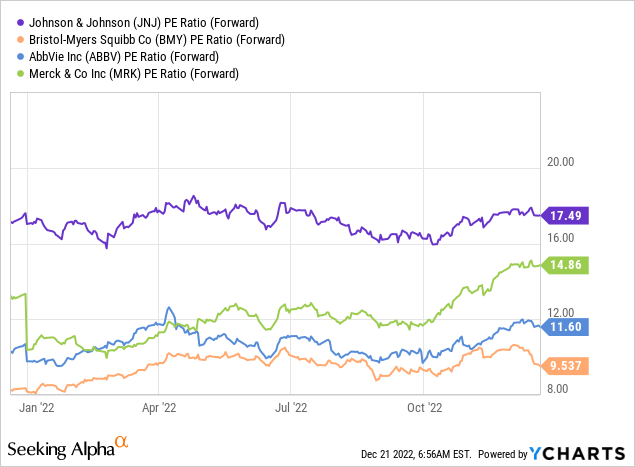

It doesn’t have to be JNJ, there are many other great picks within the health care sector. Have a look at the XLV – Health Care Select Sector SPDR (XLV), and some of holdings include popular names like Bristol-Myers Squibb (BMY), AbbVie (ABBV) or Merck & Co (MRK). All of these are behemoths with revenues close to $50 billion or above, with strong starting yields and high dividend safety. I just selected JNJ as the example here, as it is perhaps the best example of a company within healthcare, where one can know for certain, that the quarterly dividend always arrives on time.

Of the names mentioned here, I’m only exposed to AbbVie, which I managed to pick up at very depressed levels back in 2019, when the stock traded at $70.5 per share, compared to $160.5 today, still allowing for a forward yield of 3.7% today. If I wasn’t already exposed plenty to this sector, I wouldn’t hesitate on going long these names, and I believe a portfolio will stand to benefit from healthcare exposure going into 2023.

Not even healthcare companies can avoid risks, as they go through patent cycles on products, which allowed me to pick up AbbVie at a favorable bargain, similarly, one should of course go through each company before deciding on which to choose. However, with such behemoths, if they are leading within their focus area and carry exposure to several therapeutic areas, providing diversification in its revenue stream, it’s typically hard to really end up on the short end of the stick if one can avoid picking up the company at peak valuation.

Texas Instruments Incorporated

Time to round off the semiconductor related picks. At this point in the article, you might be wondering why I’m upholding such a strict opinion on the late business cycle, and what might be next, but at the same time continuously highlight semiconductor related companies as some of my favorites out there given their cyclicality. First of all, going with the upstream companies as mentioned earlier, might alleviate some of the volatility as they are building their business around long stretching orders books, given more visibility for management. Secondly, even in cyclical industries, there are some companies, who are governed by absolute world class management teams, that make them investable throughout any given period of a business cycle – Texas Instruments is one such company in my opinion. I’ve touted this company several times, while always underlining the management team as one of the best out there in terms of creating value for shareholders.

Richard Templeton has been CEO of TXN since May of 2004, and these are some of the stats during his reign.

- Total returns exceeding 800% since he became CEO, more than doubling the S&P 500’s total return during the same period.

- The dividend has increased just below 5000% from an annual dividend of $0.096 in 2004 to $4.69 TTM

- Number of outstanding shares have been reduced by more than 47% since he became CEO

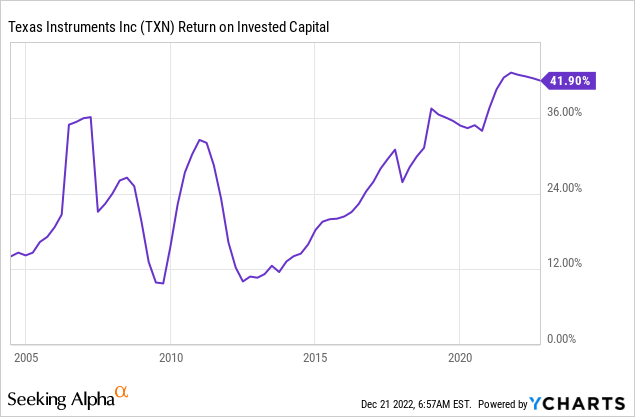

- The company has shown a very strong uptrend in return on invested capital, underlining just how skilled the management team is at allocating capital. In fact, it’s one of the best ROIC levels out there amongst its semiconductor peers

- Beating the S&P 500 YTD, being down only roughly 8.5% compared to the S&P 500 being down roughly 18.5%

- Richard Templeton has a glassdoor rating of 92, outstanding for someone who’s held the corner office for almost two decades

No company is perfect, and my argument against Texas Instruments has been its lack of growth in recent years, but even that appears to have turned a corner, with the company expected to grow its topline going forward. Unfortunately, Richard Templeton is approaching the mid 60’s, and one can wonder for how long he’ll want to continue. However, with such a fantastic track record, I don’t’ see why a new management team, reporting to the same board, should deviate substantially from the strategy that has been in place over the last two decades.

Semiconductors remain a structural play, and Texas Instruments should be able to secure great returns for shareholders going forward.

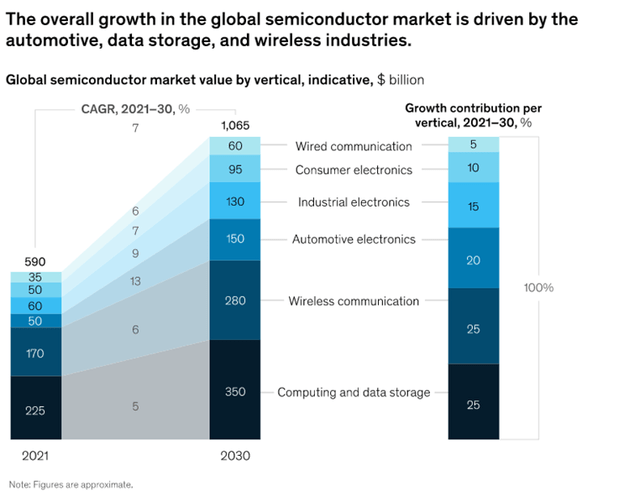

McKinsey Semiconductor 2030 Outlook (McKinsey)

According to McKinsey, the industry will experience strong growth for the rest of this decade, with Texas Instruments having automotive as one of its core segments.

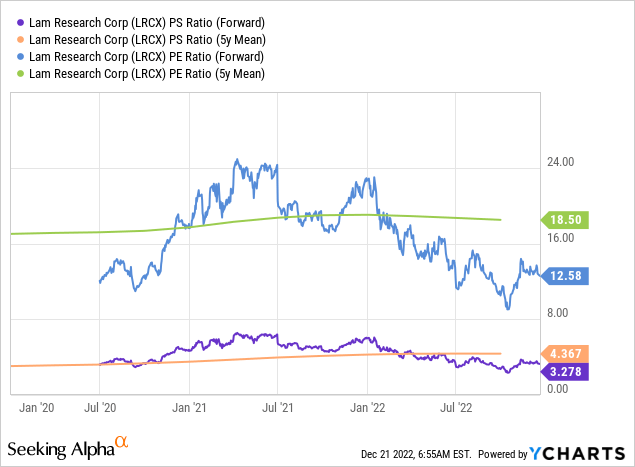

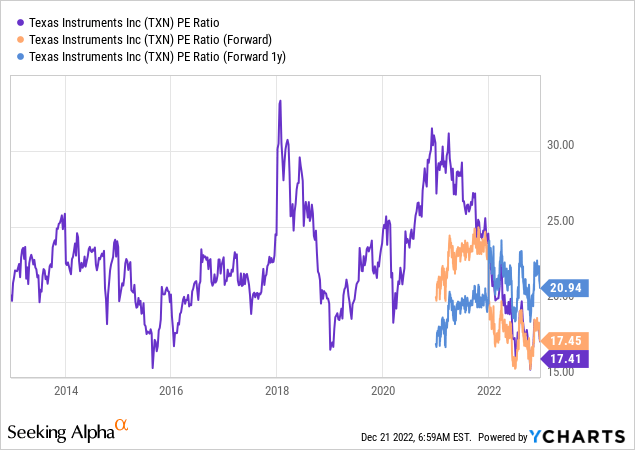

I’ve covered the company several times, and my only quarrel with the stock, is the valuation.

With semiconductors having been in hot demand since the onset of Covid-19, it has rubbed off onto the valuation of companies within this particular segment. However, the drawback experienced in 2022 has made TXN more appetizing, albeit not cheap. I’ve personally been fortunate enough to be able to expand my position this year during some of the drawbacks and I wouldn’t want to add unless I can obtain shares at a forward yield of 3%. This would equal a price pr share of $165, meaning right around now given the current stock price.

I have a full position already dating back to 2019, so I don’t “need” to add, and therefore I apply stricter requirements, meaning I only add if the stock goes below $150, but at the current 3% forward yield, I believe a starter position can be made.

T. Rowe Price Group Inc (TROW)

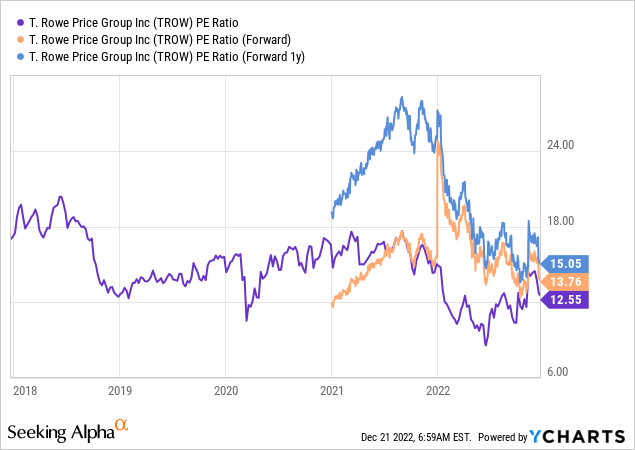

An investment management company, which has been heavily out of favor throughout 2022, down a massive 43.8% YTD. The stock has enjoyed a rally since October, together with the general marked, but that has faded during December, allowing for a favorable entry point once more.

TROW is a dividend aristocrat, meaning it has successfully managed to hike its dividend for 25 consecutive years. In fact, TROW has managed to do so for 36 years, dating back to the mid 1980’s. The company is suffering during 2022 as its ‘assets under management’ base, from which it makes its earnings, has been dwindling substantially due to customers exiting the market. This will cause earnings to contract, therefore weighing heavy on the valuation which naturally has to give way. You can also see this effect in the valuation graph below, where forward earnings are expected to contract.

The company carries very little debt and holds more than $2 billion of cash on its balance sheet, meaning it has a negative net debt position. In other words, the financial muscle of TROW is alive and well, able to handle the ongoing turmoil.

TROW has been under pressure, and remains so, despite the assets under management having begun to grow again month-over-month. Currently, short interest according to Seeking Alpha, makes up more than 8% of total outstanding shares, creating volatility in the stock which is also why it’s been bursting upwards on some days as trading volume can grow thin. Volatility or not, it means there remains a serious bet against TROW even at this point, with the stock having already taken a hammering.

Coming back to the dividend, TROW has weathered plenty of recessions, pullbacks and outright ‘out of favor’ situations before, and I’m confident it will do so again. In my mind, the current price allows for a solid long-term position. This is also why, I’ve established a full position throughout 2022, buying at prices between $124.8 per share and $104 per share.

With the current stock price at $109.3 the stock offers a forward yield of 4.38% with management having hiked the dividend an impressive 11.1% this year. However, with so much market turmoil I would expect a token raise in February 2023. Therefore, it’s also required to initiate a position, at a time where the dividend is attractive.

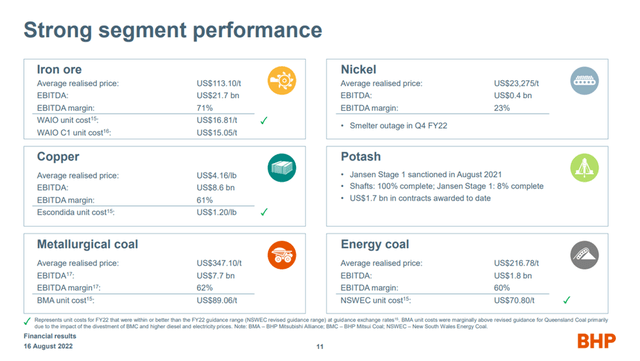

Time for the first high yield company of this article, and this one is a little bit tricky. BHP is one of the largest copper miners in the world, even though its current earnings are primarily driven by its iron ore assets. BHP is at a peak in terms of earnings, as it secured itself a 52.8% operating margin during its FY2022 (ended 30th of June 2022).

The company is forecasted to exhibit a 46% operating margin in FY23, dropping down to 40.9% by FY25. In other words, it’s moving in the wrong direct. However, going back only as far as FY20 and the operating margin stood at 37%.

The net margin (net income) stood at a staggering 47.5% in FY22, while at 18.5% in FY20 and expected to land at 23.8% in FY25. As such, there is a lot of earnings to be expected in the coming years, but that of course all depends on the movements within iron- and copper ore.

The extraordinary earnings of FY2021 and FY2022 has allowed management to pay dividends well above the norm, returning almost 11% in dividends alone throughout this calendar year. Looking ahead, and the expected dividend, at the current share price, remains at the same level. That is of course only a consensus estimate, and not what’s the long-term sustainable level for the company.

The play here, as I see it, is within the correlation between the two ores mentioned before, and the growth of the Chinese economy. With the Chinese economy having gone through a slump due to very strict Covid-19 restrictions, the physical demand for iron- and particularly copper ore could grow substantially once China is back on its growth track. Global production of copper ore in 2021 came in at 21 million mega tonnes. Should China return to its growth level prior to Covid-19, that could add an additional 500 to 1000 kilo tonnes (0.5-1.0 mega tonnes), and as is the case with raw materials, it’s the marginal price that determines the market price.

BHP Full Year 2022 Investor Presentation (BHP Investor Site)

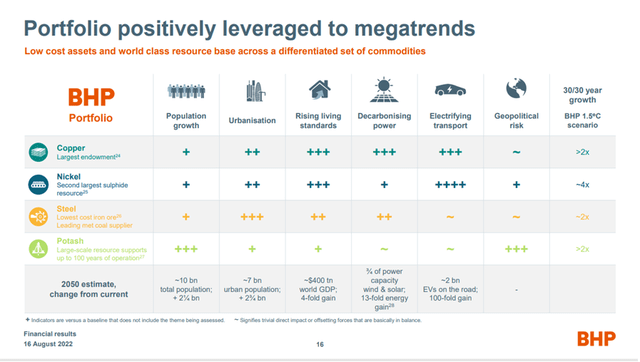

The reason I find BHP interesting however, has nothing to do with the short-term, but is tied to the long-term outlook for particularly copper.

BHP Megatrend Outlook (BHP Investor Site)

I want to direct your attention to the illustration above, which covers a set of megatrends which requires substantial amounts of raw materials. The one I’m focused on, is the transition to a greener energy mix, which requires a lot more copper. This is no secret and has been covered extensively in the news medias of the world. As the mineral of choice for electric conductivity, copper plays a center role in making the transition to a renewable energy mix come to life.

To give an example, a conventional internal combustion engine car requires 18-49 lbs of copper, while a battery electric one requires roughly 180 lbs on average. Charging stations, offshore windmills with subsea cables, solar farms and so on, the demand is set to grow massively. According to this article, copper demand could grow 13% annually throughout 2031.

The company is up 14.4% YTD, and if you include the dividends, it has been a great ride this year with a total return of 28%. If we look at the valuation, the forward P/E comes in at 12.27, with forward 1Y P/E of 13.26. If we could guarantee the forward-looking earnings, that would be a fine deal to strike, but raw materials fluctuate beyond what can be explained from time to time. If we instead allow us to be guided by the price to book, we obtain a picture where the valuation appears to be at a decade high, but we also have to factor in that underlying earnings have increased.

The potential re-opening of the Chinese economy and the megatrends speak in favor of this company, but the valuation could be better in my opinion, so this is a company I would add to my watchlist for now.

The Home Depot Inc (HD)

Back in September, I published an article comparing Lowe’s Companies (LOW) and Home Depot up against one another, trying to decipher which the dividend grower would prefer. I arrived at the conclusion, that Home Depot was the preferred option, but should one prefer LOW, then it’s not that different from Home Depot. Since then, HD has surged 16%, which also means I wouldn’t want to pick it up today. However, for investors with less strict entry requirements, the company has proven to be a very strong compounder for many years.

At this point, you’ll know that I don’t have much faith in the housing market for 2023, but I still decided to include Home Depot as it has everything, I want in a dividend grower, even if being exposed to the housing market and also being characterized as a discretionary company.

There is a very strong correlation between building permits and the stock price of HD, and since I believe building permits haven’t found a bottom yet, I believe the current bull run in HD will fade. I want to be able to pick up the shares with a 2.8-3% forward yield, otherwise I’ll pass, and with the current forward yield of 2.4%, it isn’t yet in the buy zone according to my own principles, which would require it to trade much closer to $250 per share.

However, that shouldn’t stand in the way of just how fantastic a company we are speaking about here. For instance, the dividend has shown 16.4% CAGR throughout the last five years, with a 46% payout ratio. On a ten-year basis, HD has delivered a total return of 535% compared to 221% of the S&P 500, and if we compare on a five-year basis, HD still beats the S&P 500 by having provided 89% in total returns compared to the 55.8% of the S&P 500.

There is a lot of dividend growth left in HD, as the company has an ambitious growth plan. However, given the state of the economy, I would remain patient before I picked up HD. If you are curious about a more in-depth perspective on HD and LOW, I would recommend the article I linked to earlier.

British American Tobacco p.l.c

Another favorite high yield in my book. Entering an uncertain 2023, it’s always great to be in possession of a consumer staple. People might cut back on discretionary items, but they won’t immediately cut back on their staples, cigarette smoking included.

I also had this stock on my list a year ago, and back then it carried a forward yield of a whopping 7.99%, today offering a forward yield of 6.62%.

Coming from an industry that is heavily out of favor with regulators doing a lot to strangle the market participants, while unwilling to ensure an outright ban despite the fact, that if tobacco was invented today, it’d be illegal due to its impact on public health and budgets due to reduced life expectancy from consuming the products. We can expect BTI to be at a depressed valuation for extended periods due to the frame conditions being as they are for the companies within this industry.

With all that said, that doesn’t mean there isn’t an attractive market to be had, and while we shouldn’t expect strong stock price appreciation, the dividend isn’t going anywhere. Management delivers small hikes at this point, as exemplified by the 1.4% hike in February of this year, but what’s important here is also the initial yield.

Currently trading at price to book of 1.02, this is an example of the investor getting almost exactly what they are paying for. Given the intense focus on this sector, it would be preferable to get a small discount on the assets, meaning a P/B below 1.0, but given the economic uncertainty, investors again zoom in on a company like this, it can be accepted. After all, this is a company where you know the consumer will stay around.

One small note here, BTI doesn’t issue its dividend in USD, so it may fluctuate, therefore also causing the lack of a growing dividend track record despite the company having paid a dividend for several decades.

Why not Altria (MO)? Well, in fact I’m long both companies, but Altria’s management team hasn’t exactly been impressive as of late, so I hold BTI in higher regard.

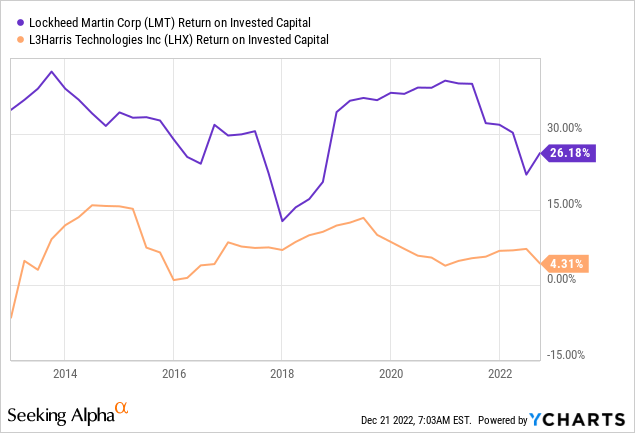

Lockheed Martin Corp (LMT) or L3Harris Technologies Inc (LHX)

This is another one of those picks offering some bolstering against the economic uncertainty, as we are looking at two defense companies. There are only so many of them, but I still had a tough time choosing between Lockheed Martin and L3Harris Technologies as they are quite similar in terms of dividend stats.

- Lockheed offers a forward yield of 2.47% compared to L3Harris’ 2.18%

- Lockheed has a payout ratio of 41.68% compared to L3Harris’ 33.93%

- Lockheed has a 5Y CAGR of its dividend of 8.85% compared to L3Harris’ 15.28%

- Lockheed has a 20-year hiking streak compared to L3Harris’ 21 years

- Lockheed has a forward P/E of 18 compared to L3Harris’ 15.9

- Lockheed has a forward 1Y P/E of 17.9 compared to L3Harris’ 16.2

- Lockheed has a TTM revenue of $64.7 billion compared to L3Harris’ $16.8 billion

L3Harris operates three main segments, Integrated Mission Systems, Space & Airborne Systems and Communication Systems. Lockheed Martin operates four main segments, Aeronautics, Missiles and Fire Control, Rotary and Mission Systems and lastly, Space.

There is little overlap, as L3Harris is heavy on the communication side of warfare, whereas Lockheed is heavy on the equipment side of warfare including the needed guidance systems and so forth.

Looking at the stats, and it could indicate that L3Harris has a stronger outlook in terms of being able to hike its dividend, while Lockheed offers a better starting yield. Given that Lockheed is dominating many of its areas, providing the newest generation fighter planes, I would place my vote with Lockheed even though L3Harris is also an attractive company.

If we look at how the two management teams succeed in allocating capital, Lockheed also comes out on top. In addition, Lockheed has also reduced the number of outstanding shares with more success over the past decade, even though L3Harris is doing so at a faster pace in recent times.

Closing Remarks

That brings me to the end of this, as I’ve been through ten current dividend payers from very low to very high initial yield and everything in between. As I mentioned, I believe that every portfolio needs a bit of both but tailored to where one finds themselves in terms of timeline, appetite for risk and focus. The sprinkle on top would be to catch companies’ years ahead of them issuing a dividend while they still hold a strong growth outlook, which is one of the reasons why I allocate a significant chunk of my portfolio to companies where total returns are the focus as opposed to growing the passive income stream.

Remember, these ten picks aren’t meant to constitute a portfolio on their own, which is also why several sectors, such as REITs, aren’t represented here, but merely to provide perspective and options for the reader.

Thank you for reading and I encourage you to contribute with better options than what I’ve presented here, after all, I don’t know every corner of the market and I’d be interested to hear what I might have missed?

Wishing everybody who reads this, happy holidays.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment