zimmytws

What good are ultra-high distributions if you can’t cover them? This has been my mantra for years, and yet, naive investors continue to fall for funds that appear to be offering much higher yields even while their NAVs erode.

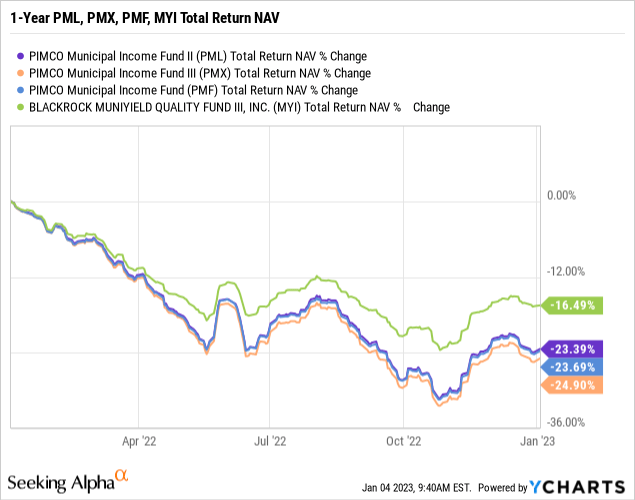

And all of the PIMCO national municipal bond fund NAVs were eroding in 2022, with the PIMCO Municipal Income Fund II (PML), $9.31 current market price, for example, down -23.0%, including all distributions.

Compare that to say, the BlackRock MuniYield Quality III Fund (MYI), $11.11 current market price, whose NAV was down only -16.4% in 2022 and after a distribution cut in October of last year, now has a very reasonable 4.3% current market yield (Federal tax-free) and an even lower 4.0% NAV yield.

Y charts

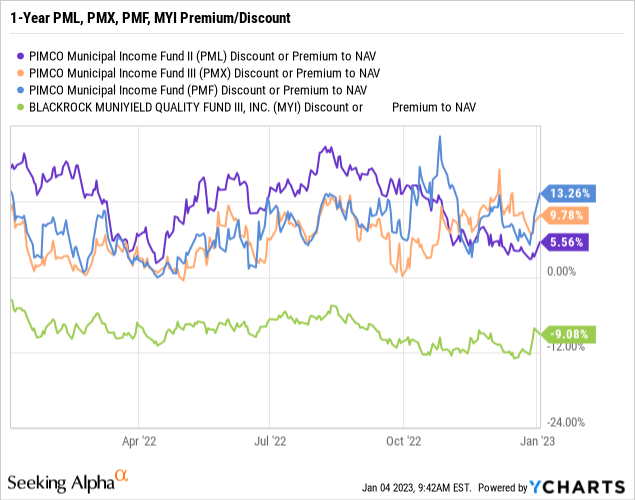

But as a result, MYI, like many of the BlackRock and Nuveen municipal bond closed-end funds (“CEFs”) that had adjusted their distributions down to reflect the current state of the markets, was being thrown out by shareholders last year and trading at up to -12% discounts, while the PIMCO municipal bond funds were maintaining their distributions and rising to higher and higher premiums despite their NAVs eroding even faster.

Y Charts

PML, for example, had an 8.0% NAV yield as of yesterday and was trading at a +5.6% market price premium while the PIMCO Municipal Income Fund (PMF), $10.85 current market price, was trading at a sector high +13.3% market price premium!

To put that in perspective, PML’s NAV yield of 8.0% was TWICE as high as MYI’s 4.0% NAV yield as of yesterday. In the leveraged municipal bond CEF world, that is an anomaly that was beyond compare.

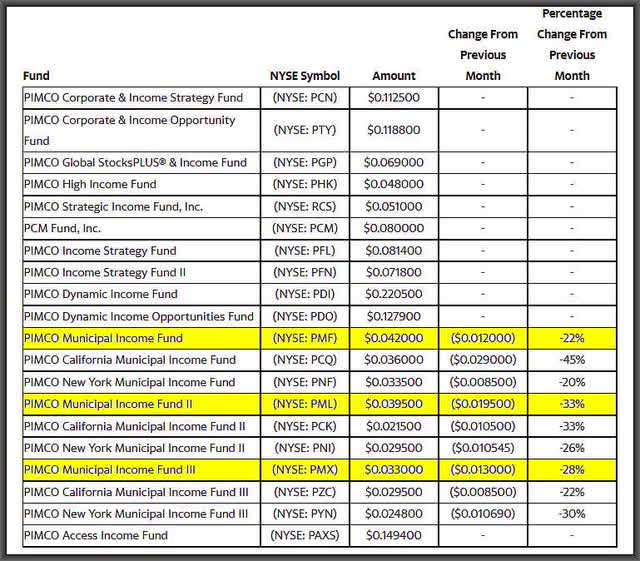

But reality hit yesterday. After the close, PIMCO cut PMF’s distribution by -22%, PML’s by -33%, and PMX’s by -28%, along with many of their state-specific California and New York muni CEFs (see below).

It is insane to me that investors did not see or expect this to happen, especially after the funds were up +2% to +4% yesterday at market price, when they should have known the risk heading into the first distribution declaration for 2023 yesterday. Well, they will learn a very hard lesson today.

Here is PIMCO’s declaration for its CEF January distributions that came out yesterday. PIMCO’s 3 national muni bond CEFs, PMF, PML, and PMX are highlighted in yellow below:

Yahoo!! Business

Thank you for reading my article. My goal is to give you observations and actionable ideas in Closed-End funds while educating you on how these unique and opportunistic funds work.

CEFs can be one of the most exhilarating and yet most frustrating security classes to invest in, and it’s important that you have someone who can be a level head during up and down periods of the market. I hope to be that voice of calm when necessary. ~ Douglas Albo

If you’d like to learn more about my services, please go to this link:

Be the first to comment