Liudmila Chernetska

Introduction

The Mosaic Company (NYSE:MOS) is one of my favorite companies. Not necessarily because of its performance but because I’ve spent so much time researching the company and its industry. It’s what got me knee-deep in the agriculture industry after I worked on a 9-figure investment in MOS back in 2020. After turning bullish below $10 per share, we were fortunate to watch Mosaic rise to almost $80 in 2022. Unfortunately, the rise was accelerated by the devastating invasion of Ukraine, which keeps a tight grip on the global agriculture supply. As Mosaic shares are trading roughly 35% below their 52-week high, it’s time to re-assess the situation. While fertilizer prices are dropping, I see more upside for the company as both energy and agriculture markets continue to benefit from subdued supply growth and rising demand.

I believe that MOS shares are about to break out, working their way to new monthly closing highs.

So, let’s dive into the details!

What’s Mosaic?

But first, a quick overview of the company, in case you’re new to Mosaic.

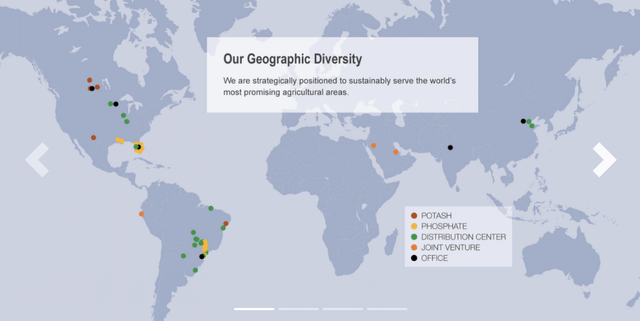

Mosaic is a leading producer of fertilizers, including phosphates and potash. The company was established in 2004 through the merger of IMC Global and Cargill’s fertilizer businesses. Headquartered in the beautiful city of Tampa, Florida, Mosaic operates facilities in several countries around the world, including the United States, Canada, Brazil, and Peru.

The Mosaic Company

Mosaic is one of the largest producers of phosphates, which are used in a variety of applications, including agriculture and animal feed. The company is also one of the largest producers of potash, which is used to make fertilizers that are essential for growing crops. Mosaic’s fertilizers are used to support the production of food, fuel, and fiber for people and animals around the world.

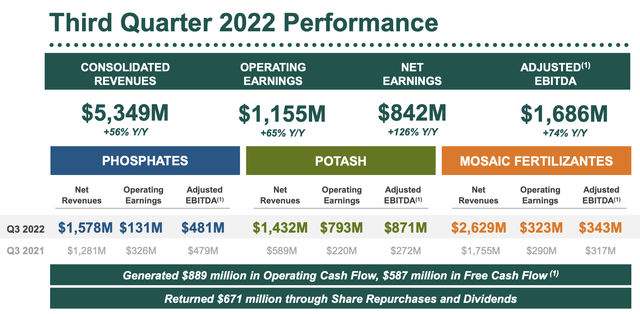

Using 3Q22 data, the company’s revenue breakdown looks like this:

- Phosphates: 28%

- Potash: 25%

- Mosaic Fertilizantes (Brazil): 47%

The Mosaic Company

In addition to producing fertilizers, Mosaic also has a significant presence in the mining and distribution of raw materials. The company operates several mines and production facilities, as well as a global network of distribution centers and ports. This allows Mosaic to efficiently and effectively transport its products to customers around the world.

Fertilizers: Big Picture

Fertilizer prices are all about supply. 2022 showed the importance of smooth supply chains in the industry, as supply from major suppliers was disrupted.

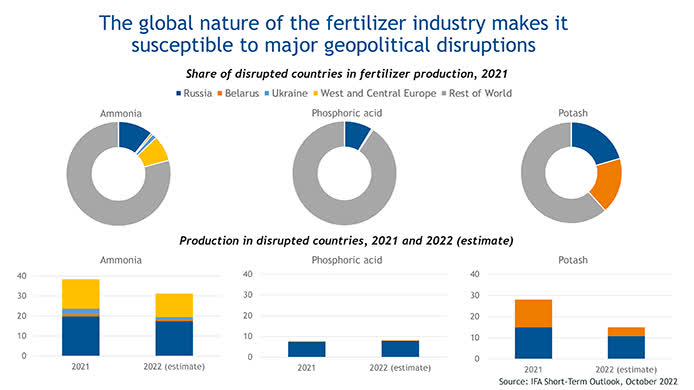

The fertilizer market experienced instability after the conflict in Ukraine escalated in 1Q22. The uncertainty was due to the restrictions on Russian exports as a result of sanctions on the country, its banking sector, and some of its individuals and entities. Additionally, the sanctions imposed on Belarus in H2 2021 led to a shortage of potash. China’s restrictions on nitrogen and phosphate exports and the unprecedented rise in natural gas prices in Europe, which affected nitrogen production costs, further compounded the situation.

Looking at pre-war numbers, Russia and Belarus control more than a third of the global potash supply. The footprint in ammonia and phosphoric acid is lower, yet still remarkable. Moreover, due to the control of gas flows to Europe, Russia was massively impacting the production costs of nitrogen fertilizers.

International Fertilizer Association

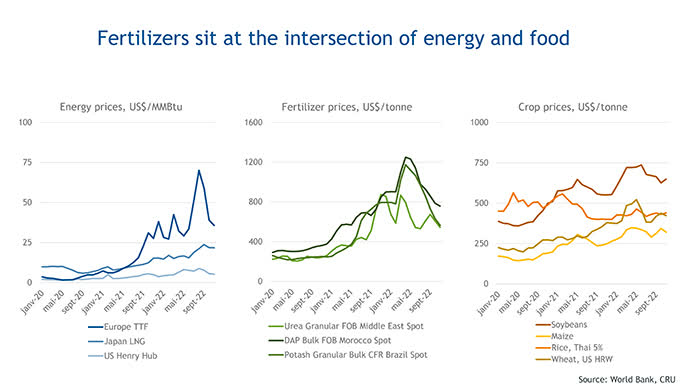

Speaking of energy, fertilizers are at the intersection of energy and food.

Fertilizer prices are determined by global supply and demand, which is affected by production costs. When the market is oversupplied, prices fall to the level of the highest-cost producer. Conversely, when demand outpaces supply, prices rise to the level accepted by well-leveraged buyers.

In 2022, the market saw a unique interaction between these two forces, emphasizing the importance of energy markets on fertilizers and food. The nitrogen production process is energy-intensive, and its cost is mostly driven by energy feedstock costs. The same is true for phosphate production, which is also dependent on energy-derived raw materials.

While prices have come down going into 2023, all major fertilizer prices soared as production costs increased after bottoming in 2020. Needless to say, as this massively impacted the supply of crops, crop prices increased as well.

International Fertilizer Association

The impact on food prices cannot be underestimated, especially not in a situation where global food demand is expected to outgrow supply under normal conditions.

Mosaic has provided us with some numbers which show the importance of sufficient fertilizer application.

A survey of U.S. crop production estimated that average corn yields would decline by 40 percent without nitrogen (N) fertilizer. Even greater declines would occur if other macronutrients, phosphorus (P) and potassium (K), were also limited. Numerous long-term studies have also demonstrated the contributions of fertilizer to sustaining crop yields. For example, long-term studies in Oklahoma show a 40 percent wheat yield decline without regular N and P additions. A long-term study in Missouri found that 57 percent of the grain yield was attributable to fertilizer and lime additions.

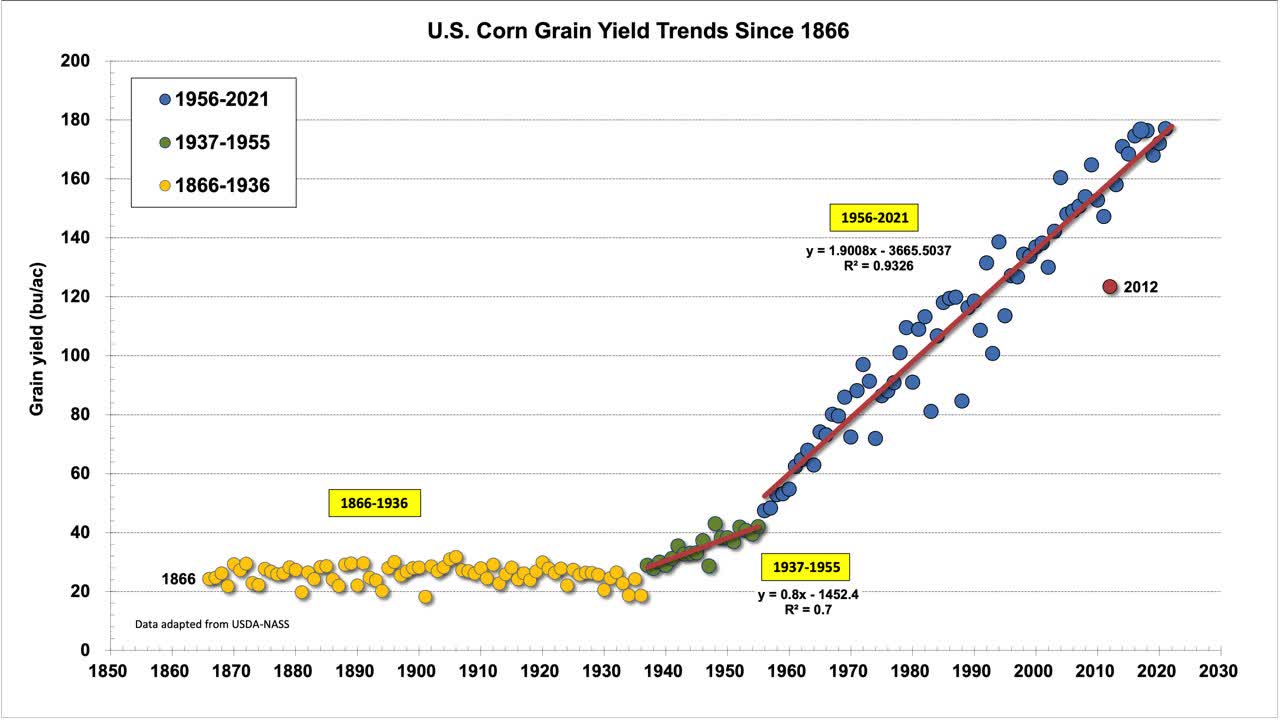

Moreover, the fascinating chart below shows that crop yields (in this case corn) started to explode the moment fertilizers became more available, although this uptrend also includes innovation in machinery and GMO technologies.

Purdue University

With that said, the big question is where we can expect potash prices to go this year.

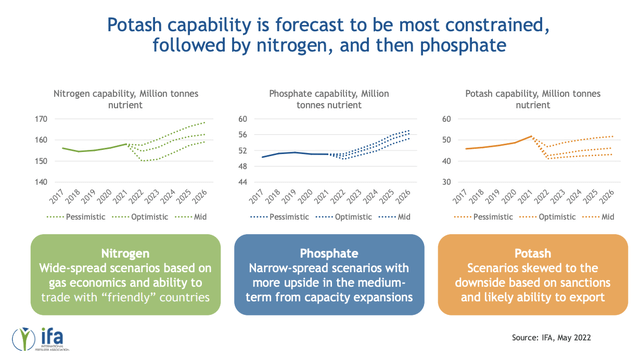

Well, according to the International Fertilizer Association, we shouldn’t expect a steep increase in potash supply. Below is a summarized version of its longer-term outlook:

The global capability of nitrogen, phosphate, and potassium is forecast to increase from 2021 to 2026, with nitrogen capacity ranging from 113.4 to 120.0 Mt N in 2026. Phosphate capacity is forecast to increase from 48.9 to between 50.7 and 52.7 Mt P2O5 in 2026, and potash capacity is forecast to remain below 2021 levels, ranging from 36.0 to 43.2 Mt K2O in 2026. Fertilizer consumption is expected to be affected by a combination of availability and affordability constraints.

International Fertilizer Association

I believe that supply could be a bigger issue than expected. It is expected that 80% of the new potassium supply growth will be controlled by Russia. This means that supply isn’t coming back unless a miracle happens in Eastern Europe, causing sanctions to be lifted.

According to Mosaic:

Similarly to potash, we envision Belarus and Russia’s supply will remain constrained in 2023. And the alternatives as well will not be able to ramp up quickly to offset the continued constraints from that part of the world.

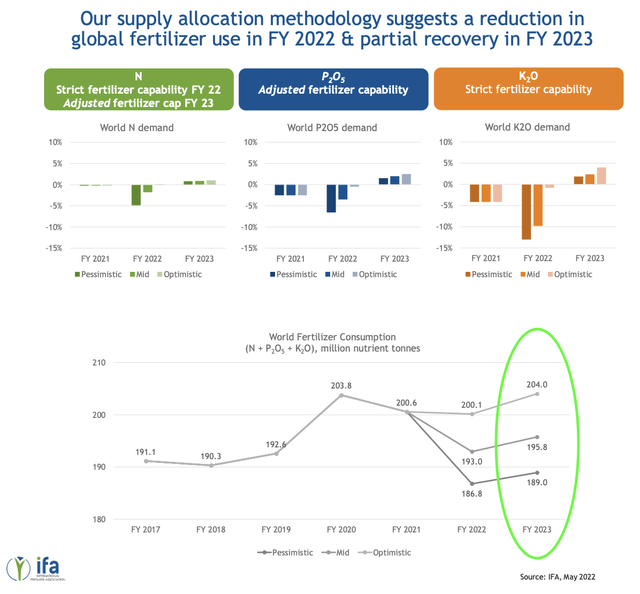

Moreover, demand for all three fertilizers is expected to rebound – even in a very pessimistic scenario. To understand the quote from the International Fertilizer Association below, please be aware that N stands for nitrogen. P stands for phosphates. K stands for potash.

In FY 2023, both the N and the P scenarios were adjusted to account for lower affordability, while the K scenario is expected to directly follow availability. This translates into a partial recovery for all three macronutrients in both the pessimistic and the mid scenarios, and a full recovery in the optimistic scenario.

International Fertilizer Association

So, what does this mean for Mosaic?

Why Mosaic Remains Cheap

In November, Mosaic commented on the global grains and fertilizer market. It noted that the agriculture supply was already tight before the war in Ukraine started. It also does not see a better fertilizer supply situation in its key product categories.

[…] we see a tight market for global grains and oilseeds continuing into 2023 and beyond. The global fertilizer market remains tight with supply constraints in both potash and phosphate still unresolved. Global potash supply remains impacted by the significant reduction in Belarusian exports, which we think will be down 8 million tons in 2022. Of the 4 million tons they will export this year, we estimate about 2 million tons were shipped in the first quarter before the sanctions and Lithuania’s decision to prevent Belarus from using its ports.

Belarus exports are down significantly from the first quarter, and we do not expect much recovery through the rest of the year or for most of 2023. This means the market will continue to be short of potash in 2023. The phosphate market is also impacted by supply constraints

Concerning demand, in the U.S., fertilizer application has been trending back toward normal levels, and the company believes the inventory will be significantly depleted by the end of the season, especially for phosphates. In Brazil, the sentiment for fertilizer is improving, and the prices have retreated enough to encourage sales. In India, importers are taking advantage of the price pullback in phosphates, and farmer demand remains strong.

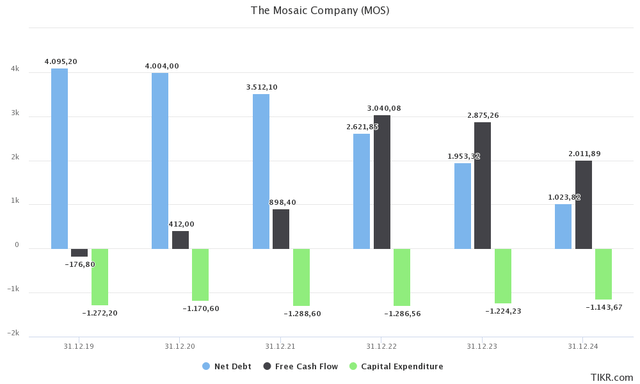

Thanks to these developments, the company remains in a fantastic spot to generate $2.9 billion in free cash flow this year, based on lower capital expenditures. This is expected to lower net debt to less than $2.0 billion.

TIKR.com

In November, the company reiterated its CapEx plans and noted its goal to retire $1 billion in long-term debt in 2022. The company’s net debt ratio has fallen to 1.0x in 2021. In 2022, that number is 0.4%. This is expected to drop to 0.3x in 2024, which indicates high financial stability.

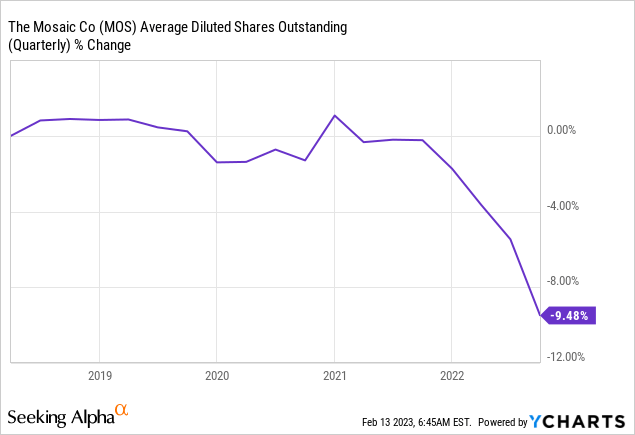

Moreover, the company plans to distribute any remaining free cash flow to shareholders through dividends and share buybacks. After all, balance sheet health isn’t a major priority anymore after 2022. During the quarter, the company returned roughly $670 million to shareholders, including $600 million in share repurchases. Over the past year, the company has successfully reduced its share count from 380 million to 340 million, adding to its financial stability.

With the continued growth in the tight supply and demand for grains and oilseeds in the global agriculture market, investors can look forward to high potential returns, as MOS shares remain undervalued.

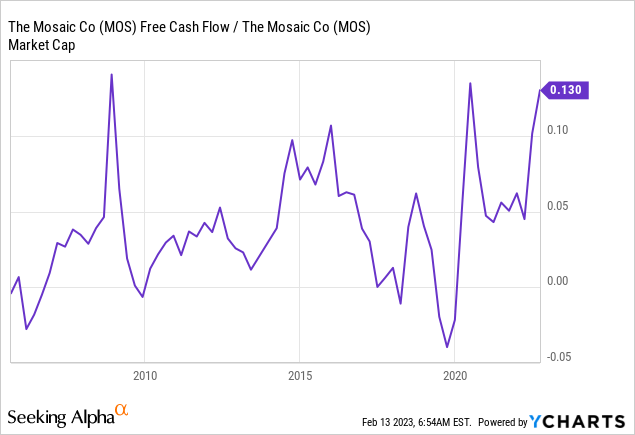

- The company is expected to do $2.9 billion in free cash flow in 2023. This implies an FCF yield of 17%, which implies a lot of room for aggressive buybacks. Even in 2024, when potash prices are expected to normalize (I disagree with that), the company is still expected to have an FCF yield of 11%.

While these numbers are volatile, I consider any number above 7% as too cheap, as it indicates that it’s rather affordable to get access to the company’s free cash flow.

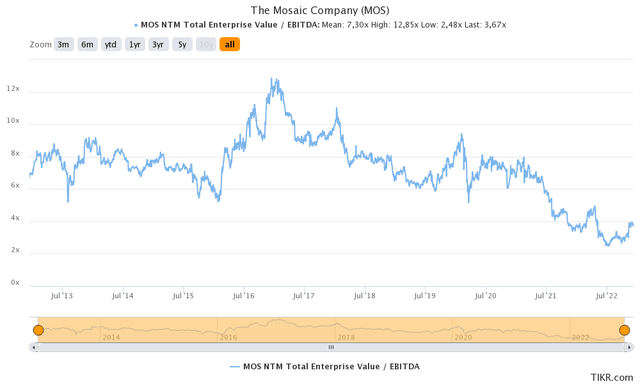

- The company is trading at 4.0x 2023E EBITDA of $4.9 billion. This is based on its $17.5 billion market cap and $2.0 billion in expected net debt. In December, I wrote that MOS deserves to trade between $70 and $80 per share (currently $50). I am sticking to that.

TIKR.com

So, with all of this said, I believe the risk/reward remains terrific for MOS shareholders.

Takeaway

In conclusion, I am of the opinion that Mosaic shares continue to be underestimated in value. Despite the fact that investors sensibly pulled out some of their investments when energy prices began to decline in the second half of 2022, the outlook for fertilizers remains optimistic.

As demand revives, supply remains limited, and it is unlikely that the market will return to pre-pandemic levels in the near future. Mosaic is well-positioned to capitalize on the high profits, increasing demand, and its favorable debt levels.

Thus, investors can anticipate higher buybacks and a slow but steady increase in the stock price, eventually reaching a fair market value of $80.

(Dis)agree? Let me know in the comments!

Be the first to comment