blackdovfx

How Does The Market Feel About Micron?

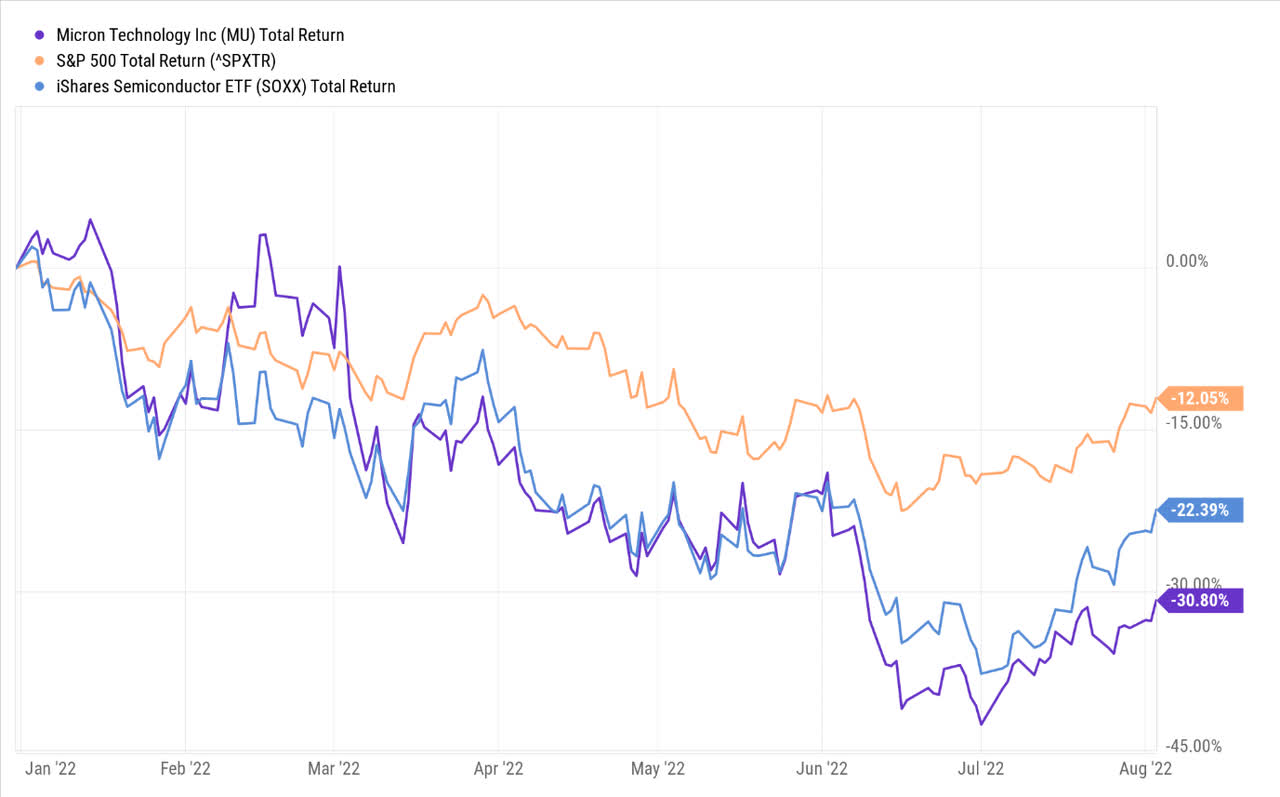

The stock of Micron Technology, Inc. (NASDAQ:MU), the fourth largest semiconductor entity in the world, with specializations in DRAM, NAND, and NOR, has had a poor year so far; admittedly, most of its peers haven’t done well this year either, with the iShares Semiconductor ETF (SOXX) contracting by 22%, and underperforming the broader markets by 1.8x; nonetheless, Micron has fared a lot worse, delivering negative returns of 30%.

YCharts

Much of the recent weakness has been on account of developments in the PC and smartphone markets where inventory levels will need to be readjusted to reflect the current reality (much of this is still expected to play out in H2-22). PC shipments which were previously poised to grow in CY22 will drop by 10% this year, whilst mobile shipments which were initially poised to witness mid-single digit growth will now come in lower by mid-single digits (there’s reason to believe it could be even worse than mid-single digits as Gartner’s recent forecast points to a 7% decline). Whilst there’s more to the DRAM and NAND stories than just the PCs and smartphone sub-plots, one can’t overlook the massive contribution of these two segments (they jointly account for almost 50% of the $161bn valued memory and storage market). It also doesn’t help that some of Micron’s enterprise OEM customers from the data center segment, have been going slow on memory and storage inventories on account of macro concerns and other non-memory component shortages.

Nonetheless, Micron’s management, who had previously drawn up some exciting medium-term bit demand forecasts of 15-19% for DRAM (until CY25), and levels of high 20s% for NAND (until CY25), has been recently forced to scale this down, primarily on account of the inventory resizing issues in the smartphone and PC markets.

Should MU Investors Be Worried? Tweak Your Perspective

Whilst the circumstances are not ideal, I still feel there’s a lot to like about the Micron Technology story if you look at it from a different lens.

Firstly, Micron’s long-term goal is to transition away from PC and mobile to markets with higher growth potential and stability such as autos, industrial, and networking, not to mention data centers, which could end up as the most prominent segment in three years. The goal is to reduce the PC/mobile share from 55% of business to 38% by 2025. Perhaps these recent developments will only accelerate that shift.

Secondly, think of how Micron’s distribution profile could now become a more prominent aspect of the entire story. Before I get to the distributions per se, let me just touch upon the supporting levers that could facilitate this.

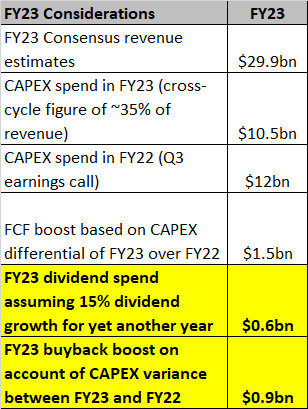

Given the weakness in the market, MU now intends to curb its CAPEX initiatives, particularly in WFE (Wafer Fab Equipment) manufacturing, which should help bring down the supply in the market. Just to put some numbers here, by the end of this year, Micron would have spent $12bn of CAPEX (50% of their CAPEX typically comes from WFE manufacturing alone and this is what will largely be curtailed). According to their cross-cycle financial model, under ordinary circumstances, they would spend around 35% of annual revenue on CAPEX. YCharts analyst estimates, post the recent revisions, currently point to an FY23 annual revenue figure of $29.88bn (implying ~5% annual decline), which would translate to a CAPEX figure of roughly $10.5bn. So, you’re getting a $1.5bn annual uplift in FCF, simply on account of the CAPEX curtailment. Besides that, you could have other levers.

Do note that Micron isn’t the only entity that has spoken of its desire to reduce supply in the market. Whilst there could be some short-term pressures, in a couple of quarters, the market balance will likely be in a much better position, which could bring the ASP (average selling prices) picture to more palatable levels (some of the other competitors in this space have also spoken of curtailing their capacity); hitherto, since FY19, the broad trajectory of NAND and DRAM ASPs, particularly the former, have been very underwhelming.

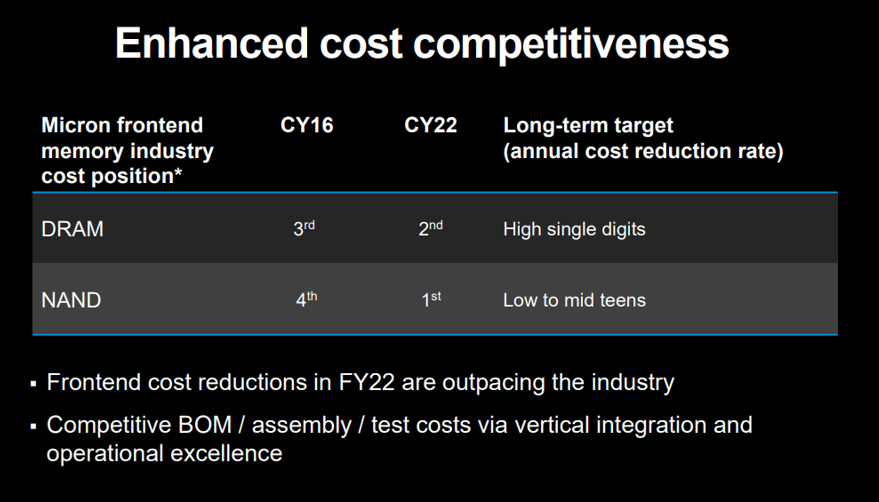

Besides potentially better ASPs over time, also consider that notwithstanding the recent developments in the market, MU has been bringing through annual front-end cost reductions of high single digits in the DRAM space and low-to-mid teens in the NAND space, which are above the industry norm.

Investor Day Presentation

These ongoing developments should provide Micron Technology with the right foundation to inculcate greater flow through from the operating level to the operating cash flow level.

Then of course you also have the inventory situation; note that this has been gradually picking up over time and will likely spike even further in Q4; inventory as a function of current assets was 22% at the end of last year, at the end of the most recent Q3, it was 25%, with $5.6bn worth of inventory on the books. After Q4, I would expect this figure to trend down quite significantly to meet the market demand (sans the support of CAPEX), which could boost the OCF even further. (as of 9M-22, inventories were the largest source of cash outflow for Micron).

I recognize there are a lot of variables in play here, but I don’t believe it is unreasonable to expect an FCF boost of over $1.5bn by the end of FY23. And what is Micron’s FCF and distribution policy? Well, they give it all to shareholders. Previously this was largely related to buybacks ($876m on average, over the last five years), last year, they also introduced dividends, and most recently hiked their quarterly dividend by 15% to 0.115 per share. Some of you may be wondering if they will be able to keep this up going forward? Given what I’ve just written about the FCF dynamics, why not?

If one were to assume another 15% hike next year, that would translate to a quarterly dividend of 0.132 (annual dividend of ~0.53); this would represent a dividend outflow of around $600m. That still leaves the company with at least $900m to spend on buybacks (assuming the minimum FCF benefit of $1.5bn in FY23, solely based on CAPEX curtailment and not including ASP developments, front-end cost savings, or inventory drawdowns).

In fact, Micron’s management is on record stating that they will engage in more opportunistic buybacks going forward, particularly when the stock trades at a greater discount to intrinsic value; considering the substantial contraction in the market-cap this year, I would imagine the buyback fervor will only ramp up from now. Just for some perspective, do note that the board of directors had authorized a $10bn indefinite share buyback program, and as of the end of May-22, there was still around $4.32bn worth of buyback ammunition yet to be spent.

YCharts, Quarterly Reports, Earnings Transcripts, Author’s Calculations

Closing Thoughts – Is Micron Stock A Buy, Sell, or Hold?

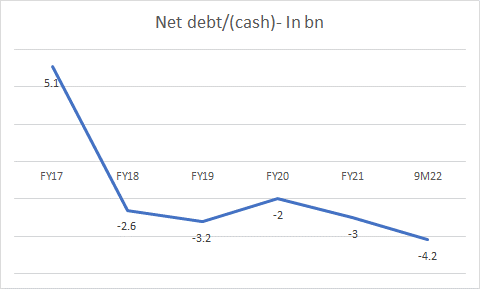

One other underappreciated aspect of the Micron story is its current balance sheet which could come in handy during a down cycle. Around five years back, they had elevated net debt to the tune of $5.1bn, with a gross debt to adjusted EBITDA ratio of 1.1x. That situation has completely transformed over the years, and now you’re looking at a net cash position of $4.2bn with gross debt to EBITDA of only 0.4x. Crucially, cash plus investable securities amount to a whopping $11.7bn, something they can always rely on if the market remains weak for longer than expected.

Seeking Alpha

Besides that, also consider that they have lengthened the maturities of their debt by 2x over the last five years, with the current average maturity stretching to 2031. Incidentally, Micron also currently possesses an investment grade rating.

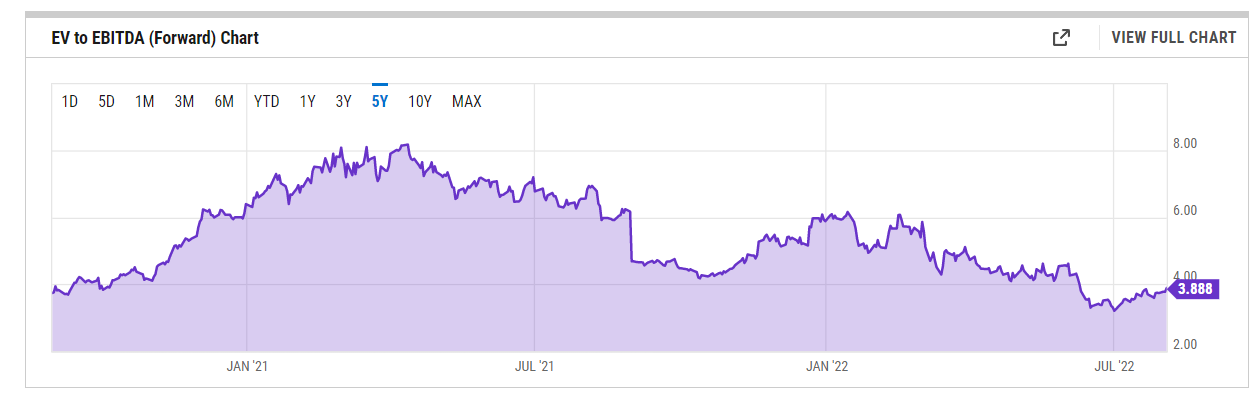

All in all, Micron’s attractive net cash position also makes its forward EV valuations look very attractive. Based on the FY23 EBITDA, you’re looking at an inordinately low forward EV/EBITDA of only 3.8x; that works out to a ~30% discount over the long-term average multiple of 5.5x. Whilst they are not strictly comparable, do consider that something like an Intel only trades at a 5% discount to its long-term forward EV/EBITDA average of 7.8x.

YCharts

For the technically minded, I would also point to how attractively poised the Micron stock looks relative to its semiconductor peers, as represented by the SOXX ETF. This ratio is currently at rather lowly levels and is a long way off from the mid-point of its long-term range as well as the downward sloping upper boundary.

Stockcharts

At current price levels, MU’s stock also offers good risk-reward when viewed over a long-time frame; currently, it appears as though the stock has taken support closer to the lower end of its ascending channel.

Investing

To conclude, I rate Micron as a BUY.

Be the first to comment