Derick Hudson

This story was originally written for subscribers of Reading The Markets, an SA Marketplace service, on Jan. 10, 2023. The technical chart was updated as of Jan. 13.

Meta (NASDAQ:META), formerly known as Facebook, has rallied by more than 50% since mid-November. Still, that rally may end as a trader bets on the stock declining and analysts cut the companies’ earnings estimates for the fourth quarter and next year.

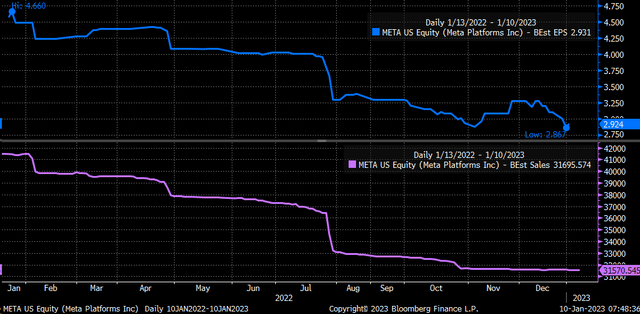

The company is expected to report fourth quarter results on Feb. 1, which isn’t likely to be a stellar report. Analysts estimate that fourth quarter revenue fell by 6.2% year-over-year to $31.57 billion, while earnings plunged 20.3% to $2.92 per share. Analysts have been slashing their earnings estimates for the fourth quarter over the last several months and are at their lows.

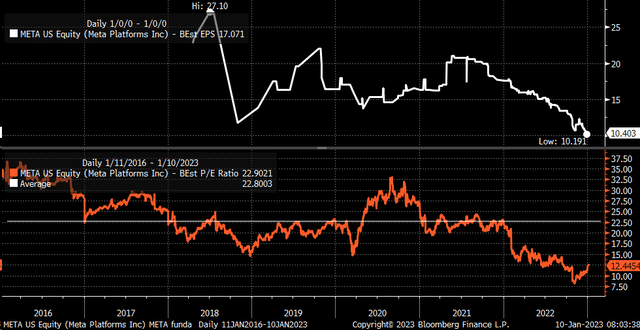

The stock looks cheap, trading at just 12.4 times 2023 earnings estimates, historically very cheap for Meta. Historically, the stock has averaged a PE ratio of about 22.8, so by those standards, the stock is cheap. However, this company is forecast to see earnings fall for the second consecutive year. Analysts currently estimate that earnings will fall 3% in 2023 to $10.40 per share, while revenue is estimated to rise by 4.9% to $121.64 billion. Gross margins are expected to shrink by 2.9% to 77.8% while operating profits drop by almost 9.6% to $28.3 billion.

As long as the company’s growth outlook remains under pressure, the PE ratio is likely to stay depressed, giving the impression the shares are cheap, but in reality, they aren’t as cheap as they appear.

Betting Shares Fall

The weak sales and earnings outlook is causing someone to make a big wager that Meta’s rally is over, and the shares are likely to move lower following quarterly results. The open interest for February 24 $127 puts and the $134 calls rose by around 13,000 contracts each on January 10.

The data shows the $127 puts were bought on the ASK for $8.48 per contract, while the $134 calls were sold on the BID for $9.80 per contract. The trader is betting that Meta’s shares do not rise above $134 and fall below $127 by the middle of February.

Gap Filled

From a technical standpoint, the rally could be over, and shares may be due to fall. The stock has now filled the gap of $130 that was created following the company’s third-quarter results. Additionally, the shares are trading just a little bit below a strong level of resistance around $137.50. The shares are also over-bought, with the relative strength index rising above 70.

Should the share rise above resistance at $137.50, it could result in a further rally to around $160.

If Meta can shock investors and deliver better-than-expected fourth quarter results and better-than-expected full-year guidance, then the stock can break out and continue to rise. But based on what analysts and an options trader think, a move higher doesn’t seem likely.

Be the first to comment