MangoStar_Studio/iStock via Getty Images

A lot of the technology companies were racing to spend on next generation opportunities, such as the Metaverse. The recent market correction and pull back of funding for hot projects has provided the perfect opportunity for Meta Platforms (NASDAQ:META) to consolidate spending just as the tech giant launches their next AR/VR device. My investment thesis remains ultra Bullish on the stock, especially now trading at lows not seen in years while the company launches hot new products for the Metaverse.

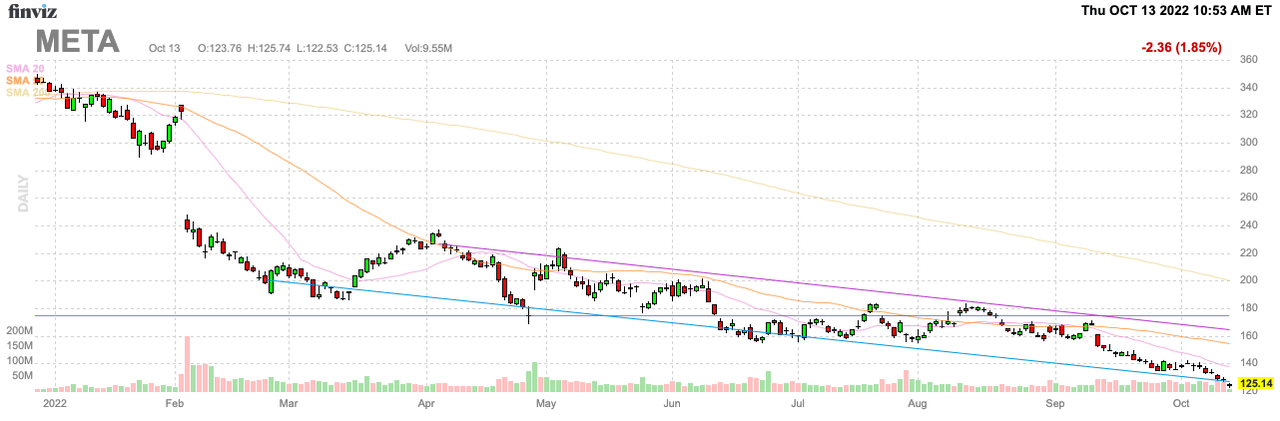

Source: FinViz

Quest Pro Launch

The biggest news from the Meta Connect event on October 11 was the launch of the Meta Quest Pro. The VR/mixed reality headset will have a $1,499 price tag and hits stores on October 25.

Meta has beaten Apple (AAPL) to market with a Pro VR device by months and hit the key holiday season missed by Apple. Meta has already sold millions of Quest units setting the company up with a strong ecosystem.

The Quest Pro has cool new technology such as inward-facing sensors to capture natural facial expressions and eye tracking. In addition the device has high-resolution outward-facing cameras to capture 4X as many pixels as Meta Quest 2 and makes the Meta Quest Pro the first full-color mixed reality device.

The key to this being a Pro device is the need to interact with other people, such as coworkers, versus other VR devices focused on playing games. The goal for the Quest Pro is collaboration and creation setting up a future launch of Quest Business next year.

The bigger news from the Connect event was probably the details on the VR ecosystem with app creators generating millions in revenues already. Meta launched the Presence Platform to provide a suite of tools to developers building upon the existing ecosystem.

Chief Technology Officer Andrew Bosworth confirmed 33 titles are already generating $10 million in gross revenues with double the amount from earlier in the year producing $5 million in revenues. The amounts are probably shocking to most not realizing the Metaverse or VR is already a viable business for some developers.

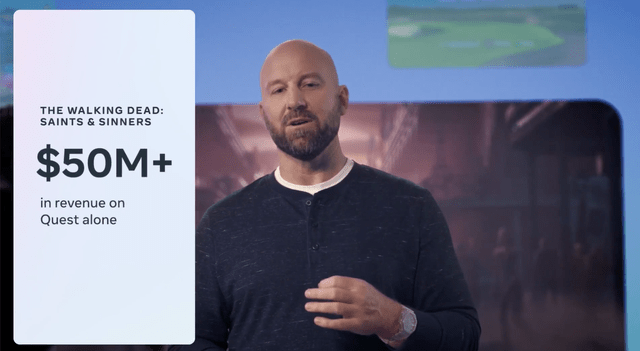

In fact, $1.5 billion has already been spent on VR apps in the Quest store. The Walking Dead: Saints & Sinners game has now topped $50 million in revenues on Quest alone.

Source: Meta Connect presentation

TechCrunch wasn’t very excited about the updated virtual view from Meta. The journalist suggests no one wants to use the solutions offered up by Mark Zuckerberg, but consumers are already dropping money on Horizon Worlds and snapping up Quest devices.

Some actual users appear far more excited by the announcements from Meta.

The market has probably missed that Apple has apparently delayed the second-generation AR/MR devices until the 1H’25. Influential Apple analyst Ming-Chi Kuo has the tech giant releasing their Pro device in January, but a 2-year delay before Apple releases the next product will leave Meta with a huge lead in the sector after already selling millions of devices.

The signs are starting to lineup that Meta overspending on the Metaverse and VR/MR devices has actually placed the company in a leadership position.

Market Correction Benefits

The best possible outcome of the current tough economic environment for tech companies is a reduction on escalating cost pressures. Meta was losing $12 billion annually on Reality Labs and the current product releases combined with a less competitive environment sets the company up to slash losses from the division.

Meta recently announced a plan to freeze hiring with Morgan Stanley (MS) forecasting a 10% boost to EPS from cutting costs. Analyst Brian Nowak has the tech giant saving up to $5 billion annually off a $18.5 billion opex run rate in Q2.

A big question is where expenses crested considering Meta guided to 2022 total expenses in the $85-88 billion level, lowered from $87-92 billion prior. The tech giant only had Q2’22 total expenses of $20.5 billion for an $82 billion annual run rate.

With plans to consolidate offices due to a WFH culture, the company could definitely slash costs by 10% just via a hiring freeze and not replacing employees from natural attrition. A $5.0 billion cut in opex leads to at least a $1.50 EPS boost after accounting for taxes with a diluted share count of 2.7 billion.

As Nowak highlights similar to my previous work, Meta is poised for a strong boost from just reducing the losses of the Reality Labs division. Assuming the company can actually grow revenues while holding runaway costs flat to down, the tech giant is set for a big EPS boost by not having to aggressively invest anymore.

The current analyst EPS estimates for 2023 at $11 should be a base case scenario. The stock trades at only 12x these current EPS targets while any revenue upside will produce far higher earnings per share. Nowak thinks Meta gets to the $11 EPS with just expense cuts while other analysts have the company generating 10% revenue growth next year.

Takeaway

The key investor takeaway is that Meta is clearly mis-priced for the opportunity ahead. The company being able to take the foot off outrageous spending in the Metaverse sets Meta up for a very profitable rebound.

Be the first to comment