Justin Sullivan

Thesis

Mets Platforms (NASDAQ:META) reported a disappointing September quarter – and the markets punished the stock with a 20% sell-off in afterhours trading. But was it that bad? Meta did beat analyst consensus revenue by more than $300 million. And the fact that Zuckerberg is pushing hard towards realizing his ambition with ‘Metaverse’ should not come as unexpected news.

I am being honest here: As a function of valuation, paired with deep intangible value and highly attractive (yet controversial) long-term growth potential, I define myself as a Meta Bull. And following the latest dip, which brings Meta stock down to below $300 billion market capitalization, I will load up on Meta shares to such an extent that it will be my biggest single-stock equity holding. In my opinion, looking at a +5 year period, Meta’s current valuation could provide the dip-buying opportunity of a lifetime.

I have previously written on Meta’s structural opportunities – see here, here and here. So in this article I will focus exclusively on Meta’s Q3 quarter, and highlight what I believe to be the key takeaways.

Meta’s Q3 Quarter

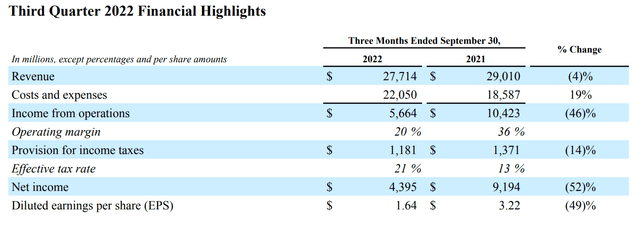

During the September quarter, Meta generated revenues of $27.71 billion, which reflects a year over year contraction of about 4%. Without the currency headwind, however, revenues would have been $1.79 billion higher and growth would have been positive year over year. Moreover, Meta’s topline for Q3 beats mid-point analyst consensus estimates by $300 million.

The great disappointment arguably was connected to the sharp loss of profitability, with net-income dropping by 52% versus the same period in 2021, falling to $4.4bn, or $1.64/share. Analysts had expected EPS of about $1.88.

CEO Mark Zuckerberg commented: (emphasis added)

Our community continues to grow and I’m pleased with the strong engagement we’re seeing driven by progress on our discovery engine and products like Reels …

… While we face near-term challenges on revenue, the fundamentals are there for a return to stronger revenue growth. We’re approaching 2023 with a focus on prioritization and efficiency that will help us navigate the current environment and emerge an even stronger company.

Profitability Drops Sharply

Meta’s profitability was challenged, as ad impressions increased by as much as 17% versus Q3 2021, while the average price per ad dropped by 18% year over year. Moreover, operating costs jumped 19% year over year, to $22.05 billion, as headcount increased and R&D expenses continued to expand.

Investors were hoping that Zuckerberg would scale down on his Metaverse ambitions. But they were disappointed to learn:

We do anticipate that Reality Labs operating losses in 2023 will grow significantly year-over-year.

But management added that:

Beyond 2023, we expect to pace Reality Labs investments such that we can achieve our goal of growing overall company operating income in the long run

Engagement Remains Strong

Meanwhile, engagement remained strong, and Meta’s social media empire continues to grow.

- Family daily active people (DAP) – DAP was 2.93 billion on average for September 2022, an increase of 4% year-over-year.

- Family monthly active people (MAP) – MAP was 3.71 billion as of September 30, 2022, an increase of 4% year-over-year.

Notably, DAP as a percentage of MAP remained stable at 67%, the highest percentage on record. Moreover, according to Zuckerberg and C-suite management:

On Facebook specifically, the number of people using the service each day is the highest it’s ever been — nearly 2 billion

There are now more than 140 billion Reels plays across Facebook and Instagram each day. That’s a 50% increase from six months ago.

In terms of aggregate time spent on Instagram and Facebook, both are up year-over-year in both the U.S. and globally. So while we’re not specifically optimizing for time spent, those trends are positive.

Such numbers should contrast sharply against any claims that Meta’s Social Media empire would be a dying business.

Outlook Neutral

Meta’s outlook fails to convince investors, but the guidance isn’t too bad either. Management expects Q4 revenues to be between $30 and $32.2 billion, compared with analysts’ consensus expectations of approximately $32 billion. With regards to expenses in 2023, Meta estimates costs between $96 and 101 billion.

Going forwards, Zuckerberg said that the company would focus on three key areas: First, building the AI discovery engine, which balances supports new content discovery with social network content. Second, improving/scaling the advertising platform – with special focus on ad messaging solutions. Third, continuing to advance towards the Metaverse ambition.

Other Key Takeaways

Meta continues to buy back shares. In Q3, the company repurchased equity worth repurchased $6.55 billion of our Class A common stock. This compares favorably to Q2, when the company repurchased ‘only’ $5.08 billion.

New partnerships might support an expanded ecosystem for reality labs, as Zuckerberg highlighted: (emphasis added)

To deliver a great work and productivity experience, I’m excited about the partnerships we announced with Microsoft bringing their suite of productivity and enterprise management services to Quest, Adobe and Autodesk bringing their creative tools, Zoom bringing their communication platform, Accenture building solutions for enterprises, and more.

Valuation Still Attractive

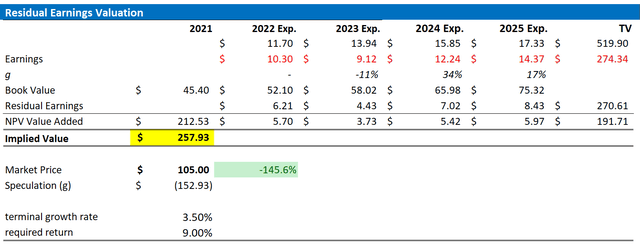

Following a disappointing Q3 from Meta, I upgrade my residual earnings model to account for lower earnings in late 2022, as well as 2023. Moreover, I increase the cost of equity to 9% (8.5% prior) and continue to anchor on a 3.5% terminal growth rate.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $257.93, versus about $282.33 prior.

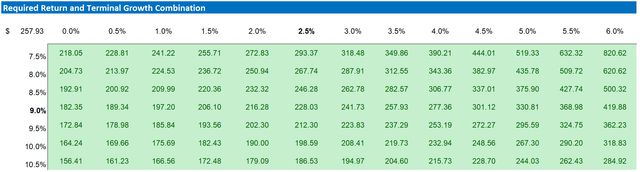

Below is also the updated sensitivity table.

Conclusion

To be fair, Meta’s sell-off should be placed in context of a very fragile environment, after Google (GOOG) dropped almost 10% on Q3 results, and Snap (SNAP) lost as much as 30% respectively.

Reflecting on Meta’s Q3 and a sharp sell-off, here are the three key takeaways for me: (1) Meta’s social media empire continues to claim strong user growth and engagement. (2) The Metaverse investments are increasing. But I have previously cheered for ‘doubling down on the reality Labs strategy’. So, this is in fact a positive for me. (3) From pre-Q3 to today, Meta stock got cheaper by 20%. And as every investment opportunity remains a function of price, the Meta thesis only got more attractive.

In my opinion, Meta stock continues to be a ‘Strong Buy’ and I like to consider the sharp sell-off as a generation buying opportunity. My fair implied value for Meta stock decreases to $257.93, versus about $282.33 prior. But I still see 100% upside.

Be the first to comment