ImagePixel

Introduction

When last discussing Martin Midstream Partners (NASDAQ:MMLP) back in September 2021, green shoots were emerging that hopefully foretold a recovery starting, as my previous article highlighted. Since almost a year has passed, it now feels time to provide a refreshed analysis that sees investors still having a chance to buy before their distributions surge higher and thus leaves their very low yield of only sub-1% a relic of the past.

Executive Summary & Ratings

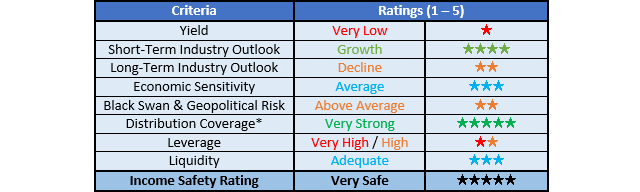

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

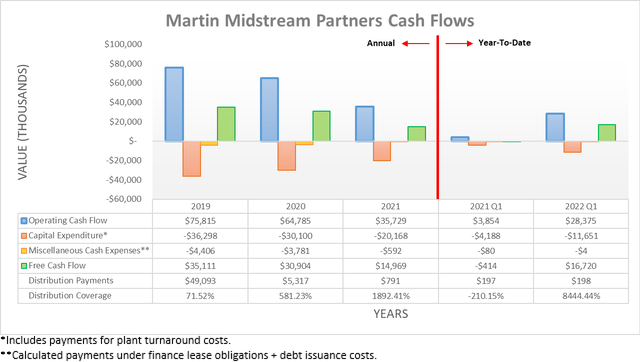

On the surface, their cash flow performance for 2022 does not show any sign of the green shoots that my previous analysis saw emerging, given their operating cash flow of $35.7m was down a hefty 44.85% year-on-year versus their previous result of $64.8m during 2020. Once digging deeper and removing their temporary working capital movements, this comparison was heavily skewed by a far greater extent than is normal for full-year results because 2020 saw a sizeable draw, whilst 2021 saw a sizeable build. If both are removed, it shows that these green shoots turned into a material recovery with their underlying operating cash flow for 2021 landing at $64.3m and thus actually 62.20% higher year-on-year versus their previous equivalent result of only $39.7m during 2020.

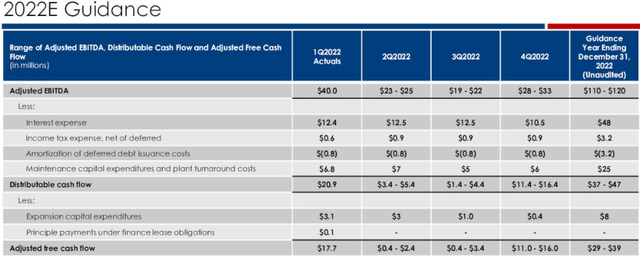

When turning to 2022, this stronger cash flow performance continued with the first quarter seeing operating cash flow of $28.4m, which was many magnitudes higher year-on-year versus their previous result of only $3.9m during the first quarter of 2021. If once again removing their working capital movements, their underlying operating cash flow for the first quarter of 2022 was only down slightly to $25.4m and thus still 36.43% higher year-on-year versus their previous equivalent result of $18.6m during the first quarter of 2021. Despite their stronger cash flow performance, when looking ahead into the remainder of 2022, it seems likely to ease back towards their 2021 level given their full-year guidance, as the table included below displays.

Martin Midstream Partners First Quarter Of 2022 Results Presentation

When reviewing their guidance for 2022, it shows management expects an adjusted EBITDA of $115m at the midpoint, which is effectively right on their results for 2021 of $114.5m, as per slide three of their fourth quarter of 2021 results presentation. Since any relative changes to their operating cash flow should broadly track their adjusted EBITDA, it indicates that the former should ease back during the last nine months of 2022 to see its full-year result broadly match their 2021 result, excluding any working capital movements. They also expect free cash flow of $34m at the midpoint during 2022 of which they have already generated $16.7m due to their seasonal earnings being weighted towards the first quarter of each year, leaving another circa $17m remaining for the last nine months. Whilst their rather run-of-the-mill cash flow outlook for 2022 does not sound too exciting, the same cannot be said after overlaying the outlook for their financial position.

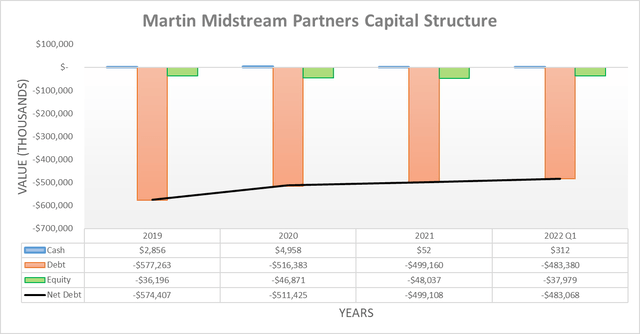

Thanks to their stronger cash flow performance during the first quarter of 2022, their net debt finally started dropping at a faster pace with a $16m decrease seeing it land at $483.1m versus its previous level of $499.1m at the end of 2021, which already surpasses the $12.3m decrease they saw during 2021 that was weighed down by their working capital build. When looking ahead into the remainder of 2022, their free cash flow should slow down given their seasonal earnings, which means a slower pace of deleveraging but not a complete stop given the outlook for another circa $17m of free cash flow.

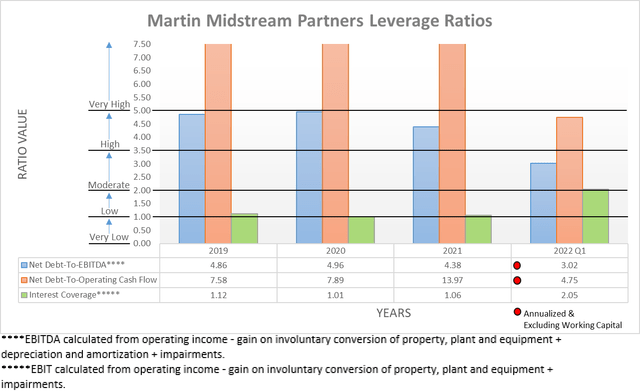

Quite unsurprisingly, their stronger financial performance and lower net debt worked together to push their leverage downwards with their net debt-to-EBITDA ending 2021 at 4.38 and thus the lowest year-end result in recent history with 2019 and 2020 seeing results of 4.86 and 4.96 respectively. Even though their latest result remains within the high territory of between 3.51 and 5.00, its downwards direction steadily reduces risks. Whilst the first quarter of 2022 saw their result plummet to 3.02, this was almost entirely due to their seasonal earnings and thus should be ignored. Meanwhile, their net debt-to-operating cash flow of 13.97 at the end of 2021 was obviously skewed by their working capital build that if removed, sees a result of 7.76, which is well above the threshold of 5.01 for the very high territory. This is significantly higher than their net debt-to-EBITDA due to the inclusion of their very burdensome interest expense, which as subsequently discussed, should be addressed later in 2022.

When looking ahead, their free cash flow stands to keep pushing their net debt steadily downwards and as a result, will see further deleveraging. Even more excitingly, they have also seen significant improvements to their adjusted leverage ratio that is defined by their credit facility, as per the commentary from management included below.

At quarter end, our adjusted leverage ratio was 3.87 times and our first-lien leverage ratio was 1.09 times, both these leverage calculations include our working capital supplement carve-out which excludes certain debt attributed to our seasonal NGL inventory build when the inventory has been either forward sold or hedged.

– Martin Midstream Partners Q1 2022 Conference Call.

After years of fighting the Covid-19 downturn and battling to deleverage, thankfully the tide finally turned with their adjusted leverage ratio decreasing to 3.87. Apart from representing a significant improvement versus their result of 5.47 at the end of the second quarter of 2021 when conducting the previous analysis, this now sits tantalizingly close to their target of 3.75 that allows for the return of meaningful distributions, as per the quote included below.

In addition, the credit facility contains various covenants, which, among other things, limit our and our subsidiaries’ ability to…

…(vi) repurchase our equity, make distributions (including a limit on our ability to make quarterly distributions to unitholders in excess of $0.005 per unit unless our total leverage ratio is below 3.75:1:00) and certain other restricted payments…

– Martin Midstream Partners 2021 10-K.

To reduce their adjusted leverage ratio from 3.87 to 3.75, it merely represents a 3.10% decrease that can come from a combination of lower debt and higher earnings. Since their earnings guidance for 2022 is effectively unchanged versus 2021, further decreases will have to come via lower net debt but thankfully, their free cash flow should shave another circa $17m from their net debt during the last nine months of 2022, which actually represents a decrease of 3.52% and thus should be sufficient to reach this goal by early 2023. It obviously remains to be seen how quickly they move to increase their distributions but given their guidance for free cash flow of circa $34m for 2022 represents a massive 20%+ yield on the current market capitalization of approximately $144m, even a relatively moderate portion of their free cash flow would send their distributions surging to a high single-digit yield on current cost.

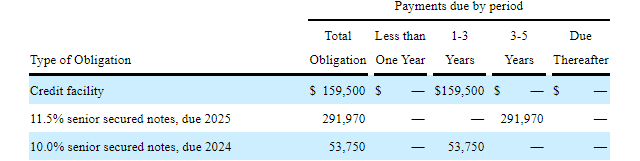

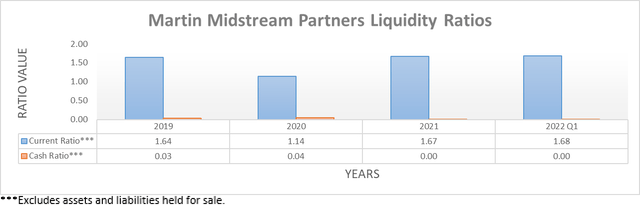

Even though it was not previously problematic, it was still nevertheless positive to see their liquidity has remained adequate with a current ratio of 1.68 making up for their cash ratio of 0.00, which stems from their virtually non-existent cash balance. To help smooth out their cash flow performance, they have $134.2m remaining under their credit facility that matures in August 2023. Whilst this is fairly soon, their deleveraging makes refinancing realistic and thankfully the majority of their remaining debt does not mature for another three years, as the table included below displays.

Martin Midstream Partners 2021 10-K

It can also be seen that their senior notes carry a very burdensome interest rate of between 10% and 11.50%, which significantly draws upon their financial performance but thankfully, refinancing these to lower rates is a top priority for later in 2022, as per the commentary from management included below. If they can shave even a relatively minor 3% from this very burdensome interest rate, it would add another $10.4m per annum to their free cash flow, which would represent a circa 30% increase over their previously discussed guidance for 2022, thereby potentially unlocking even more value for unitholders.

Now we need to continue to execute strong cash flow performance in 2022 in order to ultimately achieve our third quarter goal of refinancing this debt at a much lower cost. I’m very confident we can execute this plan.

– Martin Midstream Partners Q4 2021 Conference Call

Conclusion

The last two years have been painful since their distributions were reduced to their barebones but thankfully, this sacrifice was not in vain with their deleveraging progressing very well and cash flow performance seeing a strong recovery. This now leaves them on the cusp of achieving their adjusted leverage ratio target that is required to see meaningful distributions reinstated and due to their still suppressed unit price, even a relatively modest boost stands to send their yield surging higher and thus I believe that upgrading my rating to a strong buy is now appropriate since this should propel their unit price higher in tandem.

Notes: Unless specified otherwise, all figures in this article were taken from Martin Midstream Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment