JNevitt/iStock via Getty Images

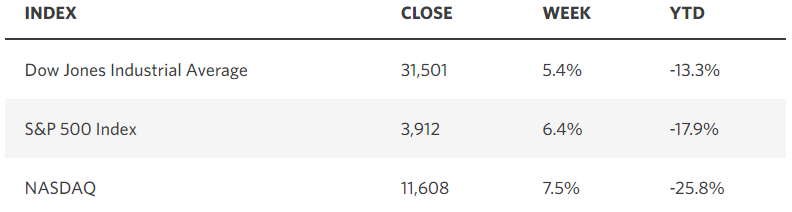

The major market indices had their first positive week in the past four, driven by a decline in interest rates and commodity prices, as the rate of economic growth starts to cool. There also seems to be a lot more clarity on monetary policy moving forward after Chairman Powell’s testimony to members of Congress last week, which boosted investor confidence. Powell’s acknowledgement that there is a risk of recession, as the Fed tightens policy, suggests that he will be more apt to try to avoid one. While last week’s bounce is being viewed as a bear-market rally at this point, it should have legs through the end of the month as pensions and sovereign wealth funds buy stocks to rebalance their portfolios for quarter end. The true test will be second-quarter earnings season.

Edward Jones

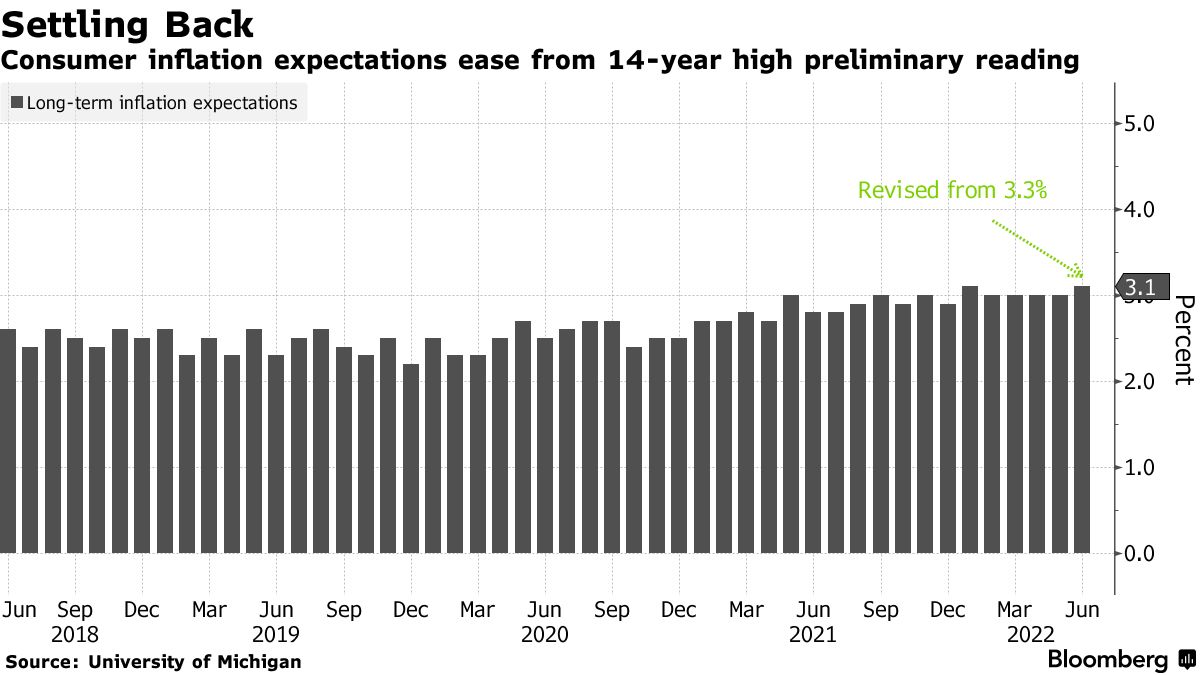

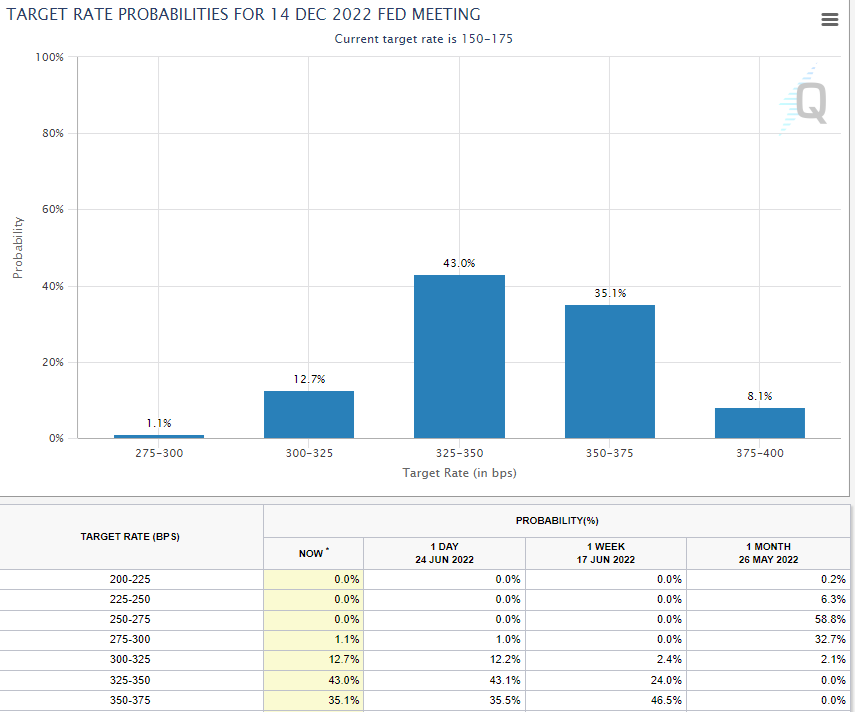

Friday’s monster rally was instigated by a dismal University of Michigan Consumer Sentiment report for June, but not because sentiment fell to the lowest level on record. While that may also be good news from a contrarian standpoint, it was the decline in consumer’s long-run inflation expectations from 3.3% at mid-month to 3.1% at its end. That is a huge drop over a short period of time. What it means for investors is that the Fed may not raise short-term interest rates as high as markets are now expecting for this rate-hike cycle, which has been my base case for several months.

Bloomberg

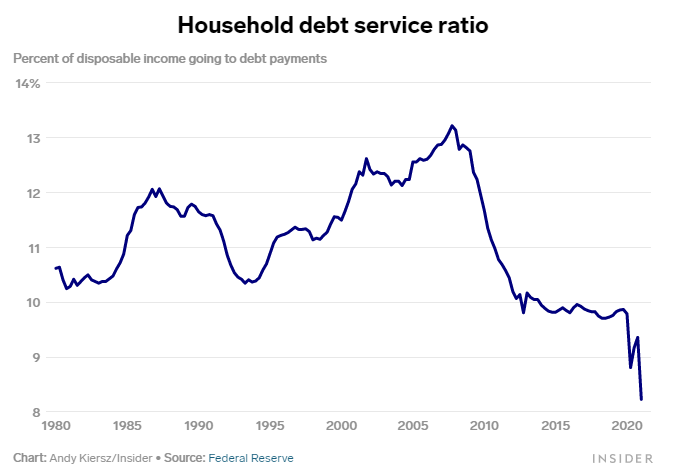

Every economic cycle is unique, as is every bull and bear market. What makes this cycle so unusual is that we have two extraordinary circumstances in the real economy that are largely offsetting each other in that one is a headwind and the other a tailwind. The headwind is a 40-year high in the rate of inflation, spurred on by a global pandemic that just won’t go away, which continues to obstruct supply chains. On top of that the war in Ukraine has exacerbated inflation with its impact on food and energy prices. These higher prices are being met with higher interest rates and tighter financial conditions by the Fed in an effort to weigh on demand, because the Fed doesn’t have the tools to contend with the supply issues. Demand is the tailwind.

Despite record low levels of consumer sentiment, consumer balance sheets are historically strong with low unemployment, strong wage growth, record levels of savings, and a household debt service ratio (9.52%) at the end of the first quarter that still hovers below pre-pandemic levels. Today’s level is also one of the lowest on record going back to the inception of the report in 1980.

MarketWatch

This confluence of factors has allowed the consumer to weather the relatively short period of higher prices without resulting in a decline in overall spending. Instead, consumers have responded by shifting their spending from goods to services. The continuation of discretionary spending in bars and restaurants, as well as on travel-related experiences, tells me that their situation at the moment is not as dire as Wall Street claims.

We are seeing a slowdown in economic activity, which is the most pronounced in durable goods purchases and housing, due to rising interest rates. That has slowed the manufacturing sector and contributed to the rise in inventories, but this still looks more like a mid-cycle slowdown than a recession. Typically, inventories rise in advance of a recession because demand falls significantly, while wages are still rising, which crushes corporate profit margins and leads to a surge in layoffs. Today, we are likely to see margin compression in certain sectors until bloated inventories have been worked off, but demand remains healthy, there has not been a meaningful increase in weekly jobless claims, and wage growth looks like it has peaked.

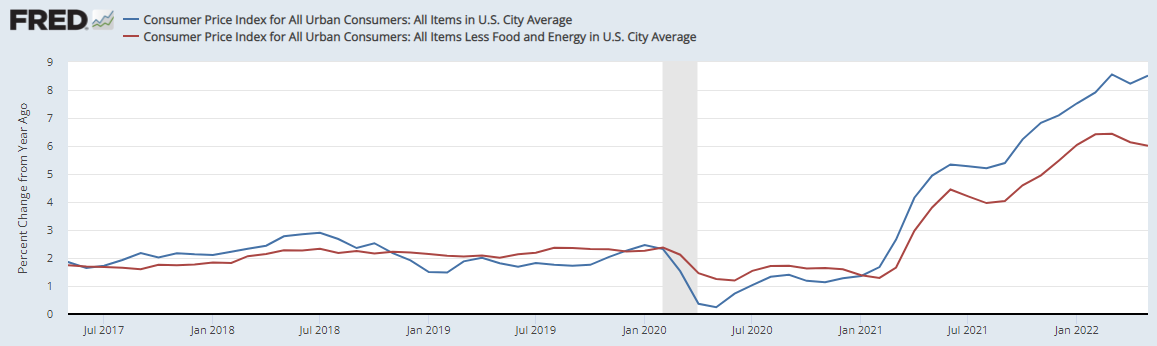

Raising short-term interest rates is like throwing a pass in front of a running receiver, because it takes several months to work its way through the economy and slow growth. The Fed needs to increase the Fed funds rate based on where it sees the economy and inflation in the coming 6-12 months and not where it stands today, much the same way a quarterback throws the football to where he expects the receiver to be when it gets there. The fear is the Fed will throw the ball too fast and too soon (tighten policy), slowing the rate of economic growth too much and resulting in a recession. We have already seen declines in the core rate of the CPI and PCE, which is good news, but we need the nominal rates that include food and energy to also subside.

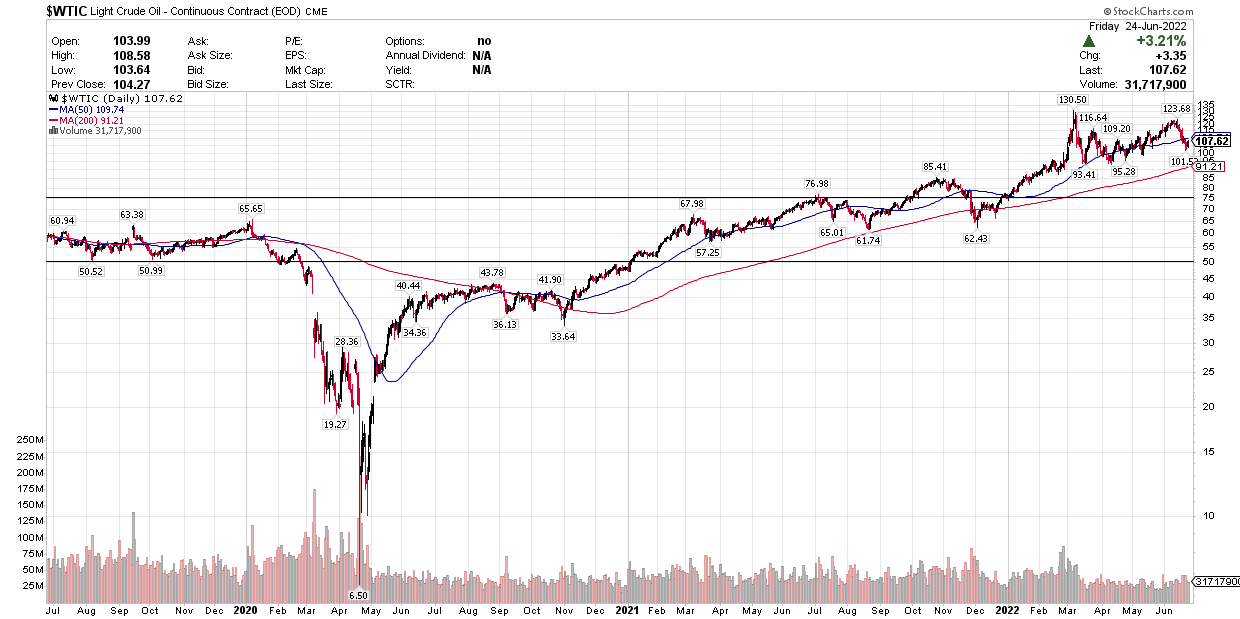

FRED

That is starting to happen with crude oil approaching $100 per barrel last week and falling more than 20% from its March high. This should lead to lower gas prices in coming weeks. We have also seen sharp declines in natural gas and grains like wheat and soybeans. We had a deflationary shock that coincided with the pandemic in 2020, but prices returned to pre-pandemic levels a year later. Now we have had an inflationary shock from the Russian invasion of Ukraine, and I think we will see prices return to pre-invasion levels over the coming year in the same fashion.

Stockcharts

Nothing moves in a straight line. Therefore, the ebb and flow of the high-frequency data that collectively determine the strength of the headwind and tailwind I have described provides plenty of ammunition for both sides of the bull-bear debate. Still, my base case is that the rate of inflation comes down faster than the consensus expects, while consumers fuel a continuation of the economic expansion, allowing the Fed to ease off the brakes during the second half of this year. Friday’s reduction in inflation expectations is a step in the right direction. There is no doubt that the Fed will raise short-term rates by another 75 basis points at next month’s meeting, resulting in a target rate of 2.25%, but by September I expect the consensus to be pricing in a lower target rate for the end of this year than the 3.25-3.5% it expects today. That is what underpins my bullish outlook for the stock market during the second half of the year.

CMEGroup

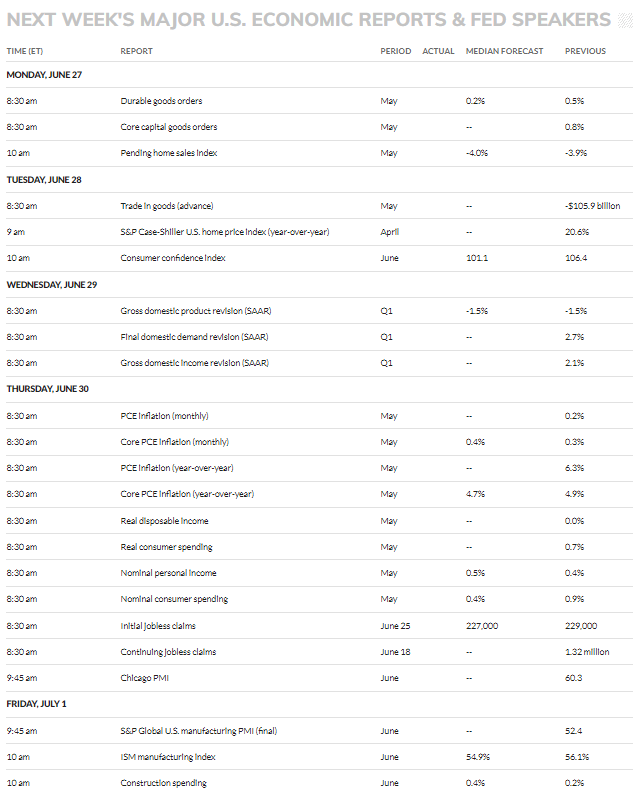

Economic Data

The most important data this week will be Thursday’s personal income and spending report, which includes the Fed’s preferred method for measuring inflation—the Personal Consumption Expenditures price index.

MarketWatch

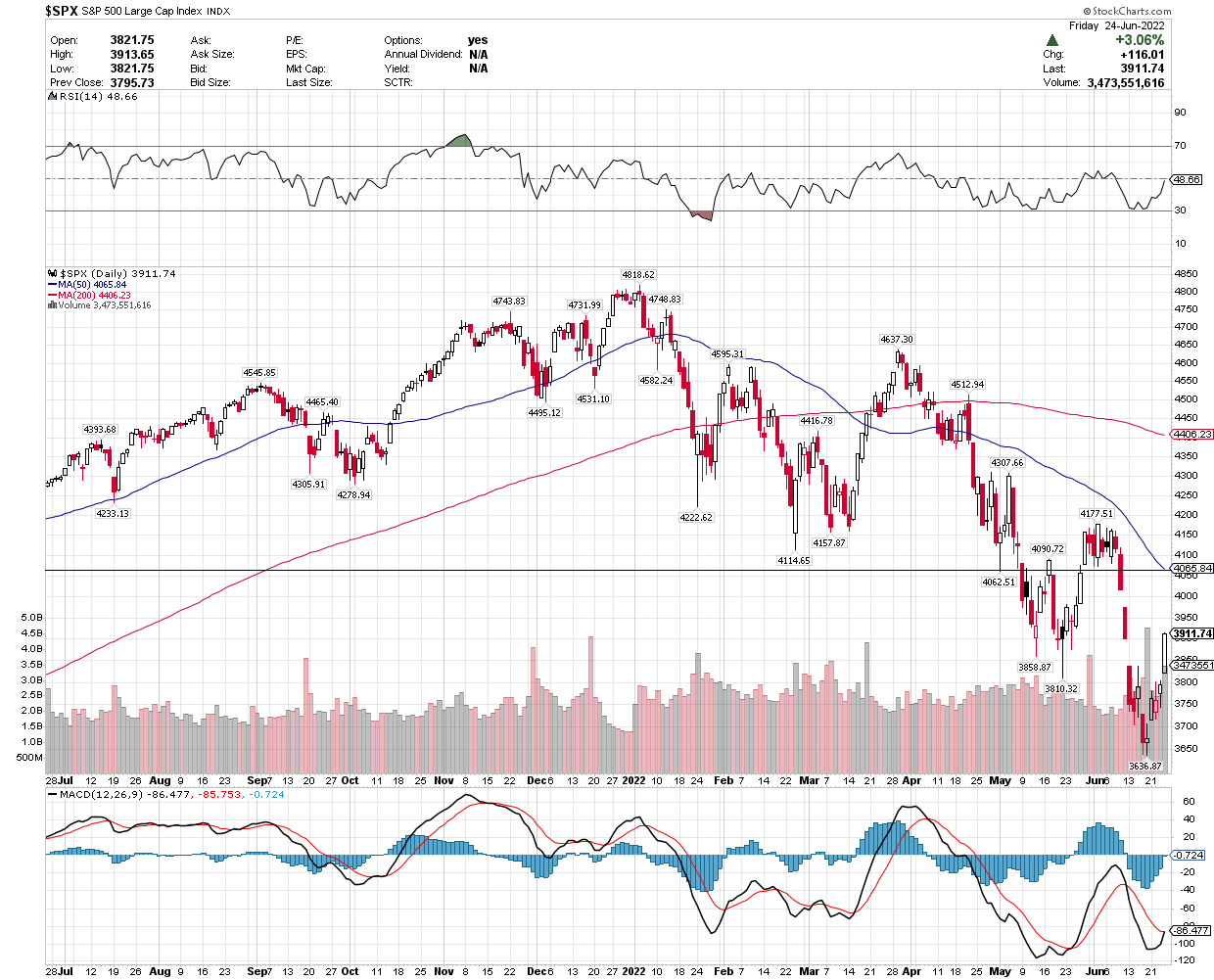

Technical Picture

Deeply oversold technical indicators gave us the bounce we expected last week, which should continue this week through quarter end, challenging the 50-day at 4,062 for the S&P 500. That is a bear-market bounce. What needs to follow is a breakout above that level that is followed by some higher bottoms and tops, along with better economic and market news to swing sentiment. That is what it will take to convert bears to bulls this summer. That is my base case.

Stockcharts

Be the first to comment