Bim

LyondellBasell Industries N.V. (NYSE:LYB) is a global petrochemical company with a presence in the United States, Europe, and Asia. It is the leading producer of polypropylene and also plays a significant role in the production of polyethylene and propylene oxide. These chemicals are used in a variety of consumer and industrial products. More than half of LYB’s output originates from its operations in North America.

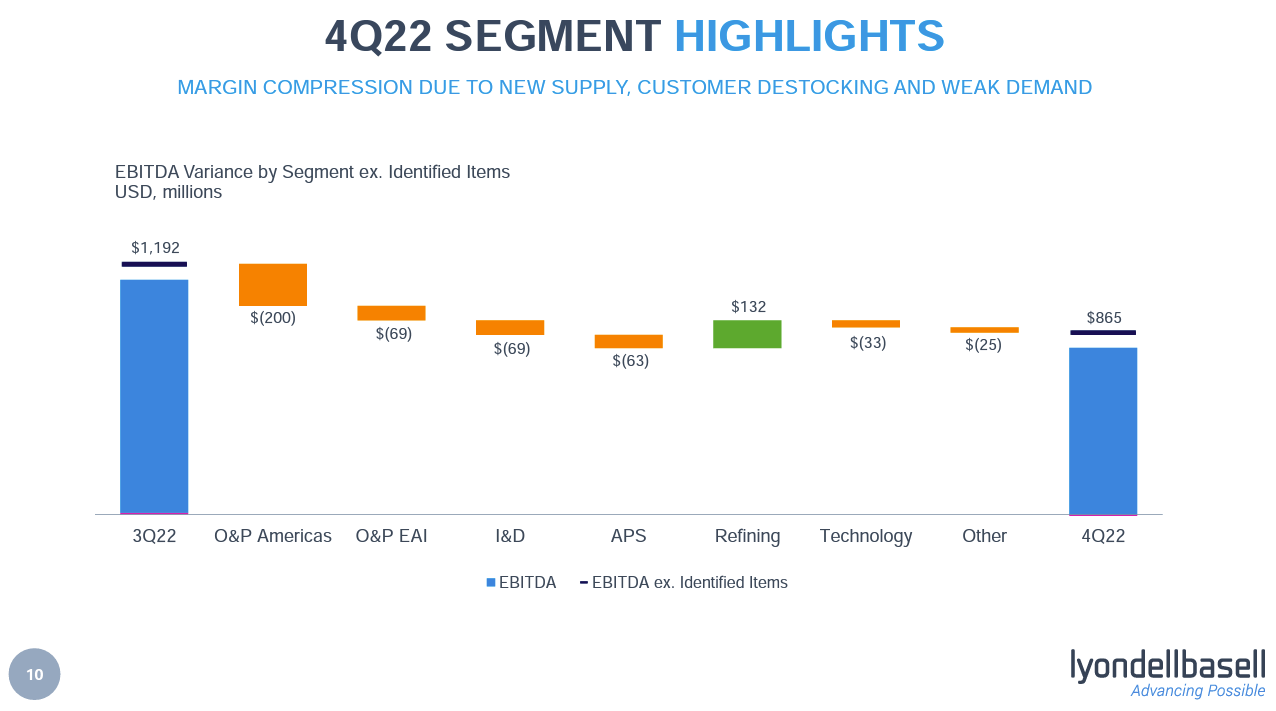

Q4 2022 Earnings Impacted by Global Demand and Unfavorable Conditions

LYB’s earnings in the fourth quarter of 2022 were impacted by various challenges that intensified towards the end of the year. The company saw a decrease in global demand in several of its end markets, due to a combination of economic and political factors and the usual seasonal declines. The quarter was also impacted by unfavorable pricing conditions, higher natural gas costs, and reduced capacity utilization which led to a decrease in EBITDA margins by 120 basis points. Revenue in the fourth quarter decreased 17% from the previous quarter and 20% from the same period the previous year. Despite the challenges, the full fiscal-year revenue increased 9% due to a strong first half. However, cost inflation throughout 2022 led to a decrease in the company’s EBITDA margins by over 600 basis points, to 13%.

Company presentation

A Global Leader in Petrochemical Production and Cost-Effective Innovation

LYB’s products serve as the foundation for downstream chemicals and plastics used in both industrial and consumer markets. Approximately 70% of LYB’s ethylene and polyethylene production capacity is located in North America, which allows the company to benefit from low-cost natural gas-based feedstocks and produce at a cost advantage over marginal cost producers that rely on higher-priced crude oil feedstocks. The company’s exposure to North America, where low natural gas prices and high oil prices have led to strong profits, is expected to continue. Although LYB’s international operations may not have access to the same low-cost raw feedstocks, the company designs its plants to accommodate multiple feedstocks, providing some flexibility against input price volatility. LYB is also one of the largest propylene oxide producers worldwide, used in a range of products including insulation and furniture cushioning. LYB’s production process also yields tertiary butyl alcohol as a coproduct, which is eventually used as a component in high-octane gasoline. This production process sits on the lowest end of the cost curve and is only used by about 15% of global production capacity. In 2023, LYB is opening a new production facility that will nearly double its PO/TBA production capacity in North America. Once operational, the site is expected to enhance the company’s existing cost advantage by using low-cost feedstocks in a unique production process.

LYB’s North American Dominance in Ethylene and Propylene Production: Cost Advantage and Segment Breakdown

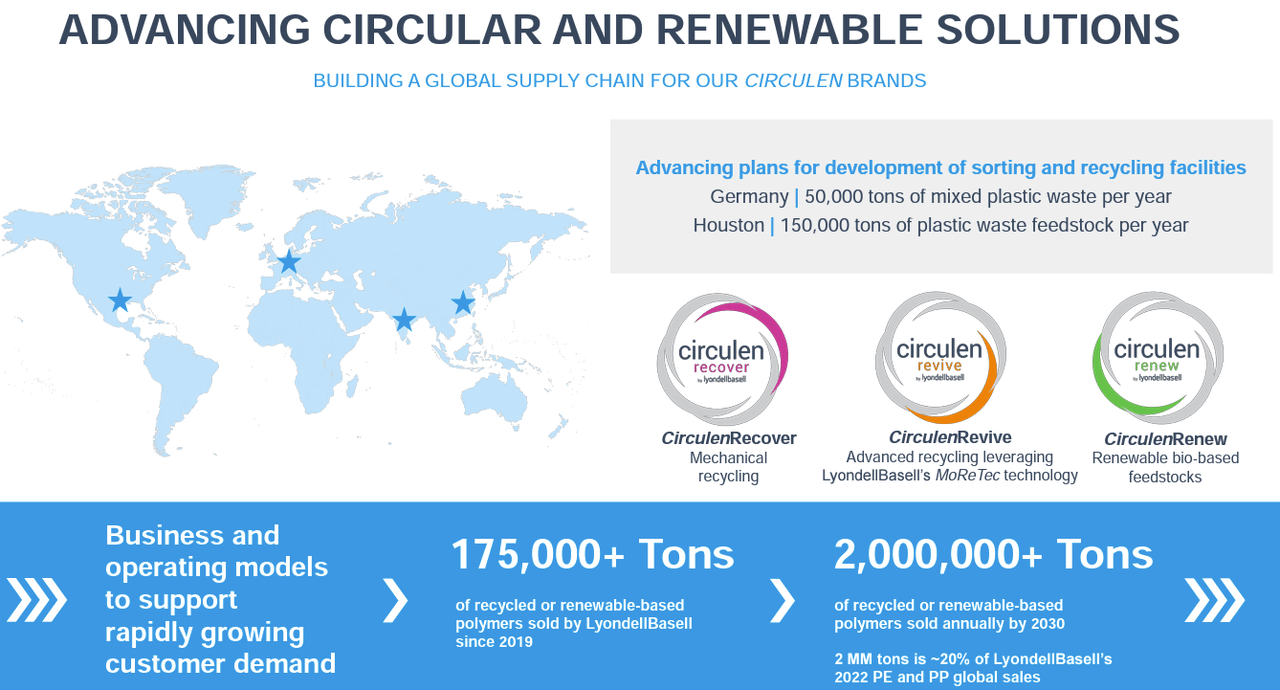

LYB’s Olefins and Polyolefins (O&P) segment in North America accounts for 61% of the company’s business, with operations in North America, Europe, Asia, and international markets. The segment mainly produces ethylene and propylene, which are essential components for a wide range of chemicals and plastics with diverse applications, including automotive components, insulation products, and antifreeze. Most of the ethylene and propylene produced by LYB is consumed internally by the company, extending its cost advantage in North America to the rest of the business. Over 70% of LYB’s ethylene and polyethylene production capacity is located in North America and the majority of it is derived from natural gas feedstock. This makes North American production cheaper than European and Asian production, which relies on crude oil-based feedstock. The cost advantage of North American production has been in place for over a decade and is expected to remain for the next decade based on the outlook of the oil-to-gas price ratio. The O&P-EAI segment, which relies more heavily on crude oil-based feedstock, has a neutral impact on LYB’s overall competitiveness, with a lower operating margin of 13% compared to 35% for O&P Americas. The Intermediates and Derivatives (I&D) segment, which accounted for 22% of the company’s revenue in 2021, utilizes the ethylene and propylene produced by both O&P segments to manufacture propylene oxide and intermediate chemicals. The I&D segment also reduces its raw material costs by using the cheapest manufacturing methods for propylene oxide and exclusive utilization of cost-efficient coproduct methods. The refining segment, which is not closely related to LYB’s other businesses, is set to shut down by the end of 2023 due to low returns on capital. Management intends to repurpose the assets for other projects, such as its circularity solutions business.

Valuation

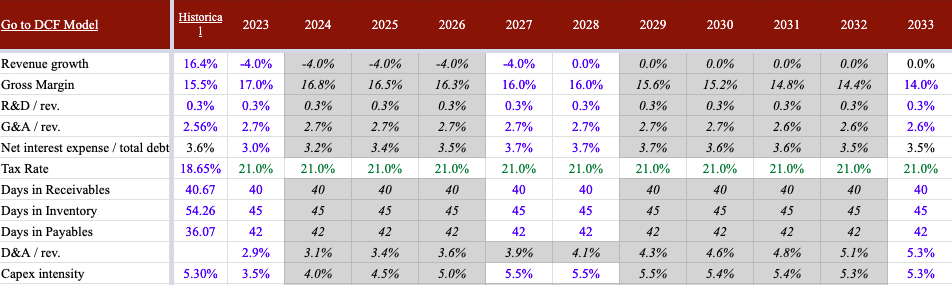

My estimate of LYB’s fair value is $122 per share. LYB’s profitability is heavily influenced by operating leverage at their asset-intensive commodity chemical manufacturing plants, with plant capacity utilization being a key factor. Despite favorable cost conditions, reduced volume can lead to margin decline. As a commodity chemical manufacturer, LYB’s profits are tied to changing feedstock costs, with most prices tied to Brent crude oil. A majority of their ethane and ethylene production is based on natural gas feedstocks in North America, so changes in the oil/gas ratio (Brent crude oil price divided by Henry Hub natural gas price) is a good indicator of profits. My assumption is for a Brent of $70 per barrel and a Henry Hub natural gas price of $4 per MMBtu implying an oil/gas ratio of 17.5 times. According to Mr. Blitz, VP of the Dow Chemical Company, a ratio above 7 is favorable to US petrochemicals.

When natural gas prices are low relative to oil, US chemical manufacturers have a competitive advantage. Recent market activity underscores the favourable climate for US petrochemical industry. When the ratio of oil to gas price is above 7:1, Gulf-Coast-based petrochemicals are more competitive versus the world’s other major chemical-producing regions.

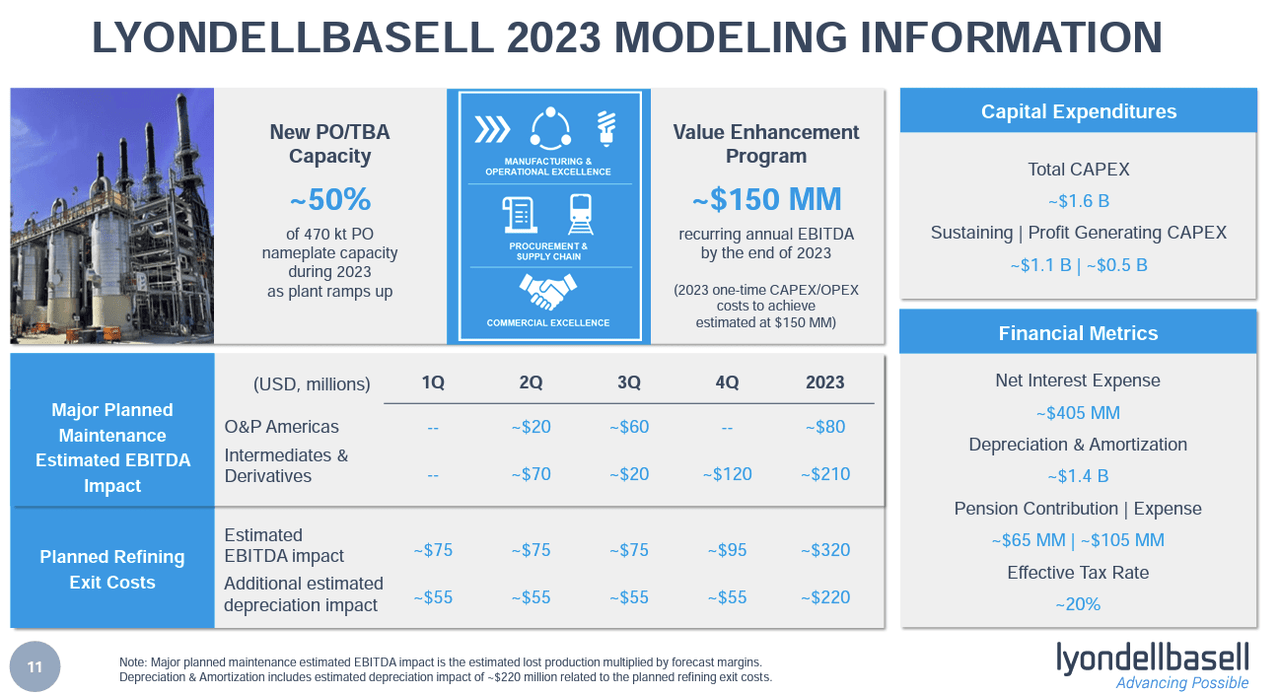

Other factors such as supply-demand dynamics in end markets also affect profitability. Below are the company guidance and my assumptions, as you can see they do not defer materially, the decline in revenues in the medium term is due to the shutdown of the refinery business.

Company Presentation Author estimates & Company 10-k filings

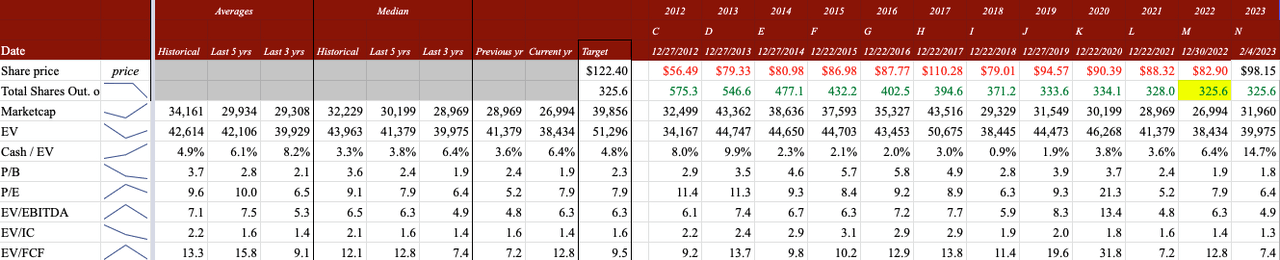

At a fair price of $122, the multiples seem reasonable based on historical multiples.

Author estimates, company 10-k filings & Seeking Alpha

Impact of Fluctuating Oil and Gas Prices on the Chemical Company’s Profits

The cost of the company is heavily impacted by the price of oil and gas, which can fluctuate and cause changes in the cost of input materials and the prices received for commodity chemicals. Profits are indicated by the oil/gas price ratio and the fractionation spread. Lower oil prices and higher natural gas prices, along with wider fractionation spreads, usually result in lower profit margins. LYB’s operations outside North America face higher and more unpredictable costs, which could hurt profits. The cost advantage of the North American operations due to low-cost natural gas feedstock is expected to deteriorate in the long run as natural gas prices rise, leading to lower margins.

A Focus on Enhancing Production Capacity and Optimizing Return on Investment

The company’s investment strategy is fair, with a positive outlook on its plan to launch a new propylene oxide/tertiary butyl alcohol production facility in Houston, Texas, in 2023. The new facility will almost double LYB’s PO/TBA production capacity in North America and will enhance its cost advantage. The company has decided to close its refining business by the end of 2023 as returns on invested capital were insufficient. Management is considering repurposing the site for its recycling businesses.

Company presentation

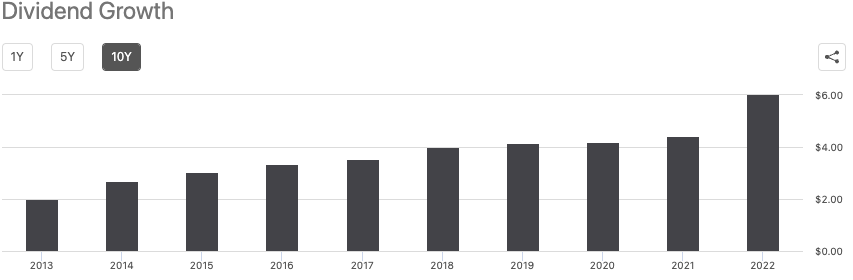

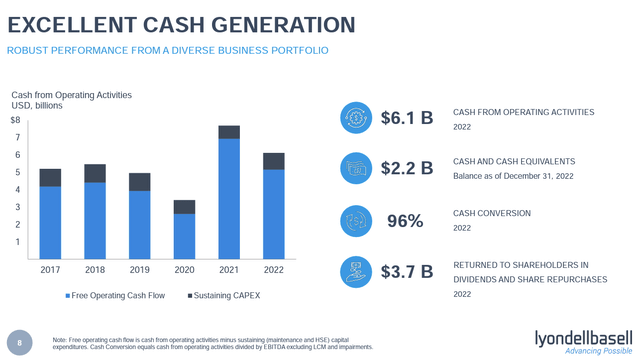

Robust Balance Sheet and Consistent Shareholder Distributions

At the end of 2022, LYB had a robust balance sheet, with $2.1 billion in cash and $11.3 billion in debt, and a debt to EBITDA ratio of 1.4. The company has been consistently increasing its annual dividend since 2012, and in 2022, it made a special dividend payment. As a result, the annual dividend has grown from $2.00 in 2013 to $4.70 in 2022 ($9.90 including the special dividend).

Seeking Alpha

In addition to this, LYB has resumed its share repurchase program and has returned $460 million to shareholders so far. The company’s high cash flow generation supports the continuation of its shareholder distributions moving forward.

Conclusion

LYB is a leading global petrochemical company, with a strong presence in North America, Europe, and Asia. Although the company’s earnings in Q4 2022 were impacted by unfavorable market conditions and reduced demand, it has seen overall growth in revenue for the full fiscal year. LYB benefits from its North American dominance in the production of ethylene and propylene and its cost-effective innovation in propylene oxide production. Its exposure to low-cost natural gas-based feedstocks in North America gives the company a cost advantage over its competitors. The O&P and I&D segments are key drivers of LYB’s profitability, utilizing low-cost raw materials and production methods. The refining segment, which does not have a significant impact on LYB’s profitability, is set to shut down by the end of 2023. Based on the current market outlook and LYB’s business operations, my estimate of the company’s fair value is $122 per share.

Be the first to comment