cagkansayin/iStock via Getty Images

Introduction

All areas of fixed income have been battered in 2022 along with the stock bear market. Inflation and rising yields are key factors, with the 10-year treasury yield rising from about 1.67% at the start of the year to 3.18% as of this writing. We note that the 10-year treasury yield has hovered in the current range for nearly two months and signals a more modest view for rates longer term. A drop in bond prices and a rise in corporate bond yields make sense in today’s environment, but it has also resulted in many bargains. We believe that these opportunities may be short-lived and recommend taking advantage while this window of opportunity is open.

In our opinion, one such opportunity is available with the bonds issued by Golub Capital BDC (NASDAQ:GBDC). Golub is a business development company (BDC) with a $5.4 billion investment portfolio and a $2.2 billion market cap. The company is investment grade rated by both S&P and Moody’s at BBB-/Baa3 and reflects the company’s large size, excellent track record of performance, and high-quality first-lien loan portfolio.

Golub issued a series of corporate bonds in recent years when market-clearing interest rates for investment grade issuers were very low, at stated annual coupon rates of 2.05%, 2.50% and 3.375%. With investment grade bonds plunging in 2022, these bonds now trade at substantial discounts, resulting in yields of up to 7%. We recommend these bonds as a way to lock in an attractive yield for the next ~5 years while the stock market continues along a highly volatile and uncertain path. The key risk to the bondholder is a bankruptcy by Golub, which we consider to be extremely remote given the company’s history, size and performance.

Golub Capital Overview

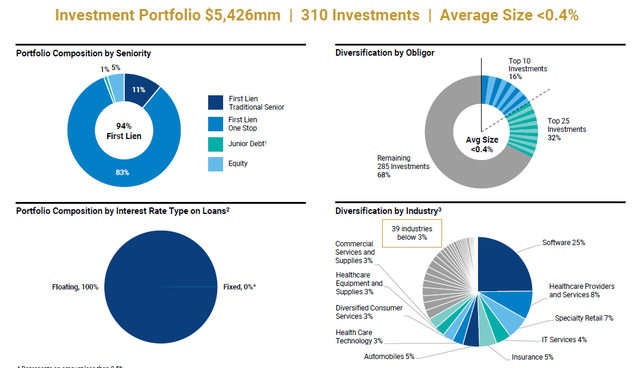

Golub is one of the leading Business Development Companies with a highly diversified $5.4 billion loan portfolio to middle-market companies, primarily backed by a private equity sponsor. A summary of its portfolio is shown in the chart below.

Golub Loan Portfolio (Golub Capital Website)

The balance sheet is critical to understanding the credit quality of the bonds. As of Q1 2022, Golub holds total assets of $5.62 billion, comprised primarily of a loan portfolio plus cash of $165 million. Liabilities are $3.0 billion, comprised primarily of borrowings, including the bonds that are the subject of this article. Asset coverage is thus 1.87x which provides in our view a high level of safety that protects against default. Another way to look at it, Golub’s loan portfolio would have to decline in value by roughly 45% ($5.42 billion down to $3.0 billion, not taking into account cash balances) for the bonds to be covered 1:1. Importantly, by regulation, a BDC must maintain asset coverage of at least 150% which provides strong protection to bondholders. As noted, Golub is well ahead of this minimum requirement at over 187% coverage.

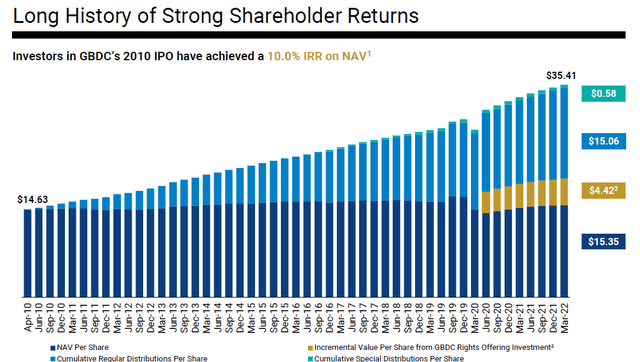

At this time, Golub’s non-accrual rate on its loan portfolio is very low at 1.1% of the fair value of the portfolio, so the notion of a massive 45% impairment to the portfolio is remote and would be unprecedented for any BDC in the history of the industry. In fact, no publicly traded BDC has ever gone bankrupt and not paid back its loans. Golub has been one of the leading BDCs with a low default rate historically (e.g., at the end of 2020, with many companies suffering from the impact of the COVID economy, non-accruals were 1.7%). The success of the company can be summarized in the chart below showing Golub’s net asset value ($15.35 as of Q1 2022) and solid history of dividend payments.

Golub Historical Performance (Golub Capital Website)

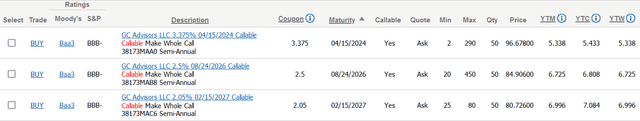

Bond Offerings

The chart below shows the three different bonds of Golub available for purchase. The underlying issuer and obligor is Golub Capital BDC even though the affiliated advisor name, GC Advisors LLC is shown. It should be noted that these bonds are unsecured and subordinated to certain bank lines and other facilities.

Golub Bond Listings (Charles Schwab)

Observe the low coupon rates, especially for the 2027 issue at 2.05%. Our preference is for the 2027 issue which matures in roughly 4.75 years. The bonds are trading at a significant discount at 80.7 of par – it is this discount which results in a 7.0% yield-to-maturity. While the bondholder will only receive a current yield of 2.54% (2.05% divided by 80.7), over the next 4.75 years the bonds will slowly creep up to par value and at maturity in February 2027 the bondholder will receive full face value at 100 face value (of course, except if Golub goes bankrupt). It is this 24% capital gain in the bond that makes a 2.54% current yield into a 7.0% yield-to-maturity. The 2026 bond has similar dynamics, maturing six months earlier; we prefer the higher yield and six more months to maturity of the 2027 issue. The 2024 bonds are another very reasonable option that locks in a 5.3% yield for about two years. We prefer to take advantage of the 7% yield for longer.

With stock market returns over the next few years uncertain, the opportunity to lock in a 7% annualized return, at far lower risk than stocks, for about five years appears highly attractive to us. A couple of considerations to note: first, for investors who are focused on a current income stream, the 2.54% current yield may not be attractive; however, over time the bond will creep up to face value (slower at first, and then far more rapidly close to maturity) at roughly 4.5% percentage points per annum which could be withdrawn to compensate for the lower cash interest. Second, the fact that capital gains comprise the majority of the yield-to-maturity can drastically lower the tax liability depending on one’s tax situation.

Conclusion

The key investment considerations are summarized as follows:

- Golub is one of the leading BDCs with a long track record of success through recent market cycles and the COVID economy

- Golub’s portfolio shows a tiny non-accrual rate and has operated with very low defaults throughout its history

- Golub’s focus on larger middle-market borrowers and first-lien loans further protects the company from bad outcomes on its loan portfolio

- Asset coverage of debt is 187% and by regulation must be at least 150%. The notion of a possible 45% impairment to Golub’s portfolio (which would only then drop asset coverage to 1:1) appears extremely remote and would be totally unprecedented

- No publicly traded business development company, from the smallest of the group to the multi-billion dollar ones has ever filed for bankruptcy and impaired debt holders in the history of the industry

- Golub bonds are rated investment grade by both S&P and Moody’s

- A 7% locked-in return for the next ~5 years is attractive in an environment of high stock market volatility and uncertainty of stock market returns going forward

Please be aware that Downtown Investment Advisory currently holds Golub Capital bonds in client and personal accounts, and may have added/will add to positions at any time prior to or following the publication of this article. It is important to note that fixed income investments carry various risks such as default risk and interest rate risk which must be taken into consideration by investors. Please see the Downtown Investment Advisory profile page for important disclaimer language, which is an integral part of this article.

Be the first to comment