EXTREME-PHOTOGRAPHER/iStock via Getty Images

Welcome to the November 2022 edition of the “junior” lithium miner news. We have categorized those lithium miners that won’t likely be in production before 2023 as the juniors. Investors are reminded that many of the lithium juniors will most likely be needed in the mid and late 2020s to supply the booming electric vehicle and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

November saw another very strong month for lithium prices and enormous interest in the lithium juniors. The juniors are progressing very well.

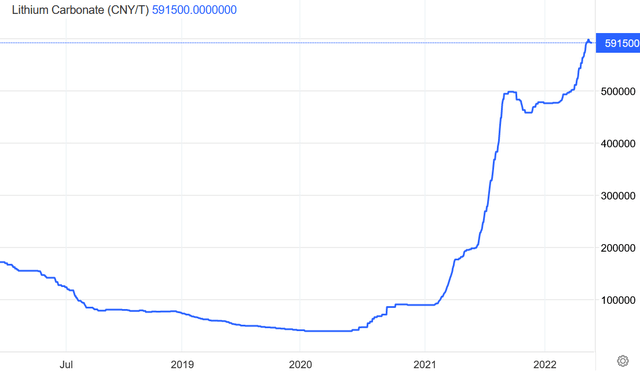

Lithium price news

Asian Metal reported during the past 30 days, the 99.5% China lithium carbonate spot price was up 1.6% and the China lithium hydroxide price was up 1.56%. The Lithium Iron Phosphate (Li 3.9% min) price was minus 0.08%. The Spodumene (6% min) price was up 0.98% over the past 30 days.

Benchmark Mineral Intelligence reported China lithium prices of (battery grade carbonate – RMB 568,500 ($80,150), hydroxide RMB 564,000 ($79,525), and Benchmark stated (paywalled): “Contacts reported to Benchmark that rumours were circulating the market regarding cell manufacturers limiting their production in November, weighing on lithium demand sentiment, however these speculations are yet to be confirmed, with some players confirming publicly that operations were running as normal… overall demand in 2023 is expected to continue to rise, meaning any softening is likely to be transitory.”

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 39,058 (~USD 5,470/mt), as of November 22, 2022.

In mid-November Pilbara Minerals reported the results of their latest 5,000t spodumene BMX auction stating: “….the highest bid of US$7,805/dmt (SC5.5, FOB Port Hedland basis) which on a pro rata basis for lithia content and inclusive of freight costs equates to a price of ~US$8,575/dmt (SC6.0, CIF China basis).”

China Lithium carbonate spot price 5 year chart – CNY 591,500 (~USD 82,838)

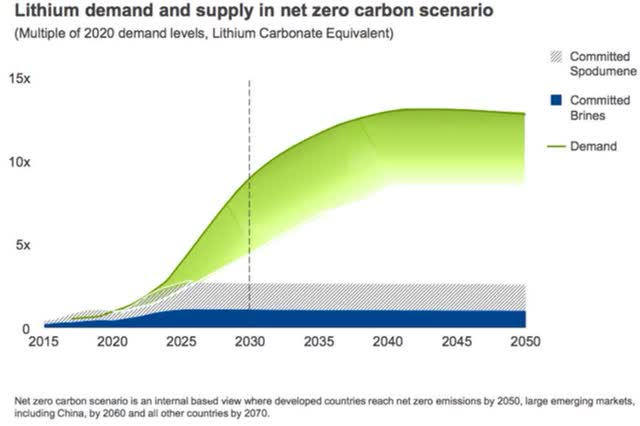

Rio Tinto forecasts lithium emerging supply gap (chart from 2021) – 60 new mines the size of Jadar needed

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of November 2022″ article. Highlights include:

- Volkswagen says: “We never used to talk to mining operators – now we know their business model.”

- Deglobalization of lithium-ion supply chain key for transition to new generation energy for Western economies.

- CATL aims to mass produce sodium-ion batteries in 2023.

- Fastmarkets: It’ll be tight, but global battery metals supply WILL be able to meet surging EV demand.

- Panasonic to start building Kansas battery plant next month, primarily for Tesla.

- European Union concludes a strategic partnership with Kazakhstan on raw materials.

- Democrats supercharged US EV investment with US$13b of investments announced so far, led by battery manufacturing.

- S&P Global: Raw material supply a challenge to meet battery demand. Lithium could present greatest challenge.

- Goldman Sachs changes its lithium forecasts – “84kt deficit in 2022 (vs 8kt surplus previously) and a small surplus in 2023 (vs 76kt surplus previously).”

- Posco Chemical finishes largest cathode plant in world. Ford, GM in talks with Posco on investing in battery metal hubs.

- U.S. military weighs funding mining projects in Canada amid rivalry with China.

- Lithium expert Joe Lowry expects the price of battery quality lithium carbonate to continue its upward trajectory into 2027 before hitting highs of US$97,000/t…..has identified a base value of just below $US80,000 and a potential 2027 low of around $US70,000.

- MinRes CEO Chris Ellison says there is “way more demand than supply.”

- Macquarie expects the lithium market to remain in deficit through to 2030.

- U.S. Republicans aim to shorten EV mine permitting after House win.

- JPMorgan upgrades lithium spodumene prices to $6,500/$5,700/t in 2023/24 (+44% & 66% respectively), three years of deficit (until 2026).

- Canada’s battery supply credibility jumps as multi-billion announcements keep coming.

- Lithium giant says global lithium demand will increase by 40% this year.

Junior lithium miners company news

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

On October 27, Sayona Mining announced: “Further advances on NAL restart.” Highlights include:

- “Restart of North American Lithium – NAL – picks up speed, with permitting and procurement 96% completed.

- New senior hires strengthen NAL management; community engagement efforts continue together with investor site visit.

- Latest progress follows selection of mining operator and rail contract for NAL, with operation on track for restart of production in Q1 2023.”

On October 31, Sayona Mining announced: “September 2022 quarterly activities report.” Highlights include:

…..Western Australia

- “Morella capital raising completed to support exploration of Morella/Sayona earn‐in tenure.

- Sayona exploration continues, repositioning to lithium focus over 100% owned tenements.”

Post‐Quarter

- Pre‐feasibility study – PFS – launched for production of lithium carbonate at NAL.

- PFS commenced for Moblan Lithium Project, targeting development of lithium mine and concentrator.

- Québec company Solurail Logistique Inc appointed to transport spodumene (lithium) concentrate from NAL to port……”

On November 14, Sayona Mining announced: “Strategic acquisition offers potential swift increase to NAL resource, production capacity.” Highlights include:

- “Strategic acquisition and earn‐in by Sayona subsidiary North American Lithium [NAL] at Jourdan Resources’ (TSXV:JOR) Vallée Lithium Project (48 claims spanning approx. 1,997 ha), located adjacent to NAL operation.

- Opportunity to swiftly expand NAL resource base and future mine production capacity.

- NAL acquiring 20 claims outright, with right to earn up to 51% stake in remaining 28 claims of Vallée project, based on spending and funding milestones.

- Pegmatite targets located close to and along strike from NAL orebody; additional leases allow for further optimisation of mine design, production and infrastructure.

- NAL to acquire 9.99% shareholding in Jourdan for approx. C$1.5M, with any Vallée ore to be fast tracked through NAL plant as Sayona enhances leading lithium resource base in North America.”

On November 17, Sayona Mining announced: “Northern lithium hub expands in major acquisition.” Highlights include:

- “Sayona Mining Group acquiring 1,824 claims spanning 985 sq km near Moblan Lithium Project from Troilus Gold Corp. (TSX:TLG), in major boost for northern Québec lithium hub.

- Consideration of C$40M payable in SYA stock; additional C$10M investment for 9.26% equity stake in Troilus.

- Claims adjacent to Moblan project, securing key area for potential extension to known mineralisation……”

Upcoming catalysts include:

- Q1 2023 – Restart of NAL (SYA 75%: PLL 25%) operations.

Piedmont Lithium (PLL) [ASX:PLL]

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of North American Lithium [NAL].

On October 24, Piedmont Lithium announced:

Piedmont Lithium partner Atlantic Lithium confirms high-grade mineralization, completing drilling program for Ghana Project. Plans advance for Atlantic Lithium’s flagship Ewoyaa project in Ghana, which is expected to be a primary source of spodumene concentrate for Piedmont’s Tennessee Lithium project…..

Upcoming catalysts include:

- 2022 – Carolina Lithium – Possible further off-take, permitting or project funding announcements.

- Q1 2023 – NAL (25% PLL, 50% off-take PLL) production set to begin.

- Q3, 2024 – Ghana Project (50% PLL) targeted to begin.

You can view the company’s latest presentation here or a Trend Investing article here.

Atlantic Lithium Limited [LSE:ALL] [ASX:A11] (OTCQX:ALLIF)

Atlantic Lithium is progressing its Ewoyaa Project in Ghana towards production. Piedmont Lithium has a 50% project earn-in share.

On October 27, Atlantic Lithium Limited announced: “Quarterly activities and cash flow report for the quarter ended 30 September 2022.” Highlights include:

- “Delivered a Pre-Feasibility Study with robust project economics for the Ewoyaa Lithium Project, targeting to deliver Ghana’s first lithium mine.

- Received further high-grade assays for the Project, extending mineralisation beyond the current Mineral Resource area.

- Admitted to the Official List of ASX on 21 September 2022 and commenced trading on 26 September 2022.

- Cash on hand at end of quarter was A$23.4 million.”

On November 2, Atlantic Lithium Limited announced: “Highest reported grade to date of 4.52% Li2O over 1m multiple high-grade and broad drill intersections Ewoyaa Lithium Project Ghana, West Africa.”

- ……..Recently announced Pre-Feasibility Study (refer RNS of 22 September 2022) delivers exceptional financial outcomes for a 2Mtpa operation, producing an average c. 255,000tpa of 6% Li2O spodumene concentrate (“SC6”) over a 12.5-year operation: LOM revenues exceeding US$4.84bn, Post-tax NPV8 of US$1.33bn, IRR of 224% over 12.5 years.

- US$125m capital cost estimate with an industry-leading payback period of <5 months.

- C1 cash operating costs of US$278 per tonne of 6% lithium spodumene concentrate Free on Board (“FOB”) Ghana Port, after by-product credits.

- Average Life of Mine (“LOM”) EBITDA of US$248m per annum.

- 18.9Mt at 1.24% Li2O Maiden Ore Reserve.

- Average annualised US$1,359/dry metric tonne SC6 pricing used.

- Significant potential for resource upgrades and exploration upside; potential for project metrics to substantially improve with increased scale.”

On November 9, Atlantic Lithium Limited announced: “Mineralisation extended – multiple intersections ongoing resource extension and infill drilling results significant potential for resource upgrades Ewoyaa Lithium Project Ghana, West Africa.” Highlights include:

- “……Newly reported drilling results fall both within and outside the currently defined 30.1Mt @ 1.26% Li2O Ewoyaa JORC (2012) Compliant Mineral Resource Estimate (“MRE” or the “Resource”); extending mineralisation at the Grasscutter West and Ewoyaa North deposits and providing further confidence in Resource conversion at the Ewoyaa Main deposit……”

Liontown Resources [ASX:LTR] (OTCPK:LINRF)

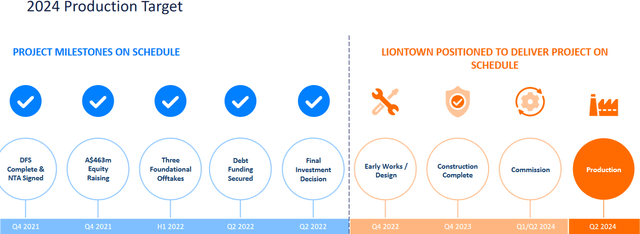

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. DFS completed in November 2021.

On October 31, Liontown Resources announced: “Quarterly activities report for the period ended 30 September 2022.” Highlights include:

- “Leading engineering firm Lycopodium Minerals Pty Ltd appointed to complete the engineering, procurement, construction management (EPCM) and commissioning of services for the Kathleen Valley Lithium Project.

- Power Supply Contract awarded to Zenith Energy for the development, on a Build, Own and Operate (BOO) basis, of what is currently expected to be the largest off-grid wind-solar-battery storage hybrid power station for a mining project in Australia.

- Approval of the Mining Proposal and Works Approval received from the Western Australian (WA) Government for a 4Mtpa operation, marking a major milestone for the Kathleen Valley Lithium Project and allowing major site works to commence.

- 5C Water Extraction Permit and Native Vegetation Clearing Permit received for the Kathleen Valley tenements.

- Significant progress achieved for the Kathleen Valley Lithium Project design and construction activities, both on and off-site and camp construction major works and supply packages well progressed…..

- Cash at bank of $420 million at quarter end.”

You can view the company’s latest presentation here.

Upcoming catalysts include:

- 2023: Kathleen Valley Project construction

- Q1, 2024: Commissioning with production set to begin Q2, 2024

Liontown Resources is fully funded for production start in H1 2024

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On October 27, Vulcan Energy Resources announced: “Quarterly activities report September 2022.” Highlights include:

- “Preliminary EIA approvals and growing community support for the Zero Carbon Lithium™ Project in Germany was seen across the region…..

- Onsite works at Vulcan’s Sorption Demo Plant in Rheinland-Pfalz, Germany commenced.

- Grant of a new exploration license, designated Ried, increasing the Company’s license area in the Upper Rhine Valley Brine Field (URVBF) by 277km2 to a total of 1,440km2……

- Binding agreement signed with Enel Green Power to explore and develop geothermal lithium in Italy……”

On November 2, Vulcan Energy Resources announced:

Vulcan commences strategic expansion of Zero Carbon Lithium™ business into France. Expansion endorsed by Stellantis and Renault, France’s largest automakers.

On November 14, Vulcan Energy Resources announced: “Vulcan successfully develops in-house lithium extraction technology: VULSORB™…..”

Upcoming catalysts include:

- Q1 2023 – DFS, potential permitting and project funding.

- H2 2024 – Target to commence production.

POSCO [KRX:005490] (PKX)

On October 31, Batteries News reported:

POSCO Holdings to invest in salt water lithium factory in Argentina. The board of POSCO Holdings approved investment regarding annual production of 25,000t of lithium…scale of 600,000 electronic vehicle units. Early investment to respond actively to customer demand for lithium supply…Stages 3 and 4 are also progressing rapidly to produce 100,000t annually. Lithium carbonate will be produced in Argentina, then undergo final processing to lithium hydroxide in Korea. The salt water, ore, and dead battery lithium businesses are expected to produce 300,000t/year by 2030.

On November 1, Battery Industry reported:

POSCO accelerates production of lithium in Argentina with early stage 2 investment…..The total amount of the investment is about $1.09 billion (about KRW 1.5 trillion), and financing will be conducted by POSCO Argentina and a newly established domestic corporation.

On November 11, Bloomberg reported: “Ford, GM in talks with Posco Chemical on Battery Metal Hubs.” Highlights include:

- “Posco eyeing North America sites to comply with Biden rules.

- Shift to EVs has made battery metals competitive battleground.”

Upcoming catalysts include:

- 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Wesfarmers [ASX:WES] (OTCPK:WFAFY) (took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There’s also a proposal for a refinery located in WA. Wesfarmers acquired 100% of the shares in Kidman for A$1.90 per share, for US$545 million in total.

No lithium news for the month.

You can view the latest company presentation here and news on the Mt Holland construction here.

Upcoming catalysts include:

- H2, 2024 – Mt Holland spodumene production and Kwinana LiOH refinery planned to begin and ramp to 45–50ktpa LiOH.

Standard Lithium [TSXV:SLI] (SLI)

On October 27, Standard Lithium announced:

Standard Lithium successfully commissions first direct hydroxide conversion pilot plant. Provides additional updates for Project sites in Arkansas and expansion activities…..

On November 1, Standard Lithium announced: “Standard Lithium announces notice of allowance for U.S. patents covering DLE process for recovering lithium from brines.”

On November 10, Standard Lithium announced: “Standard Lithium reports fiscal first quarter 2023 results, achieves key project milestones towards commercialization.”

Leo Lithium Limited [ASX:LLL] (Firefinch Limited spinout 50/50 JV with Ganfeng Lithium)

On October 25, Leo Lithium Limited announced: “Quarterly report for the quarter ended 30 September 2022.” Highlights include:

Corporate

- “Recruitment of key executives and senior project personnel is almost complete.

- Leo Lithium held cash at 30 September of A$71.5 million and the Goulamina JV held cash of US$125.5 million……

- The US$40 million debt facility agreement with Ganfeng was completed.”

Project Development and Site Works

- “All development work continues to progress in line with schedule and budget.

- Detailed plant design is substantially completed. Overall, engineering is 30% complete.

- First major site contract has been let and bulk earthworks contractor about to mobilise.

- Steady progress on procurement with many packages tendered…..

- Investigations underway on product logistics and Stage 2 expansion.”

On November 3, Leo Lithium Limited announced: “Resource drilling reveals thick, high grade spodumene intercepts.” Highlights include:

- “Resource drilling results at Danaya reveal thick zones of high grade mineralisation.

- Spodumene pegmatite intercepts greater than 60 m down-hole width include: 72 metres at 1.77 % Li2O, from 71 m…..

- Average assay results are higher than the current Danaya Resource grade.

- Mineralisation remains open at depth and along strike to the north.

- Updated Mineral Resource Estimate for Danaya anticipated for end of Q4.”

On November 15, Leo Lithium Limited announced: “Port services agreement formalised for export of spodumene concentrate.”

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

On November 2, Critical Elements Corp. announced:

Critical Elements Lithium receives certificate of authorization for the Rose Lithium-Tantalum Project in Quebec…..The issuance of the CA is an important milestone that will allow Critical Elements to advance project financing discussions to start mine construction following the issuance of the mining lease by the Quebec Minister of Natural Resources and Forests (“MNRF”)……has now obtained all main environmental authorizations enabling it to move forward with the Rose Project.

Investors can view the company’s latest presentation here.

Upcoming catalysts include:

- 2022 – Rose Lithium-Tantalum Project provincial permitting. Possible off-take or financing announcements.

You can read the latest Trend Investing Critical Elements Lithium article here.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On October 31, AVZ Minerals announced: “Positive results from initial Roche Dure extension drilling program.” Highlights include:

- “Results from the first 4 of 46 planned resource drill holes at the Roche Dure North-East Extension, confirms further widespread, high-grade spodumene lithium mineralisation including 226.8m @ 1.67% Li2O & 307 ppm Sn and 226.8m @ 1.67@ Li2O……

- The latest drill holes demonstrate grade continuity both down-dip and along strike at Roche Dure…….”

On November 15, AVZ Minerals announced:

Request for extension to voluntary suspension. AVZ Minerals Limited (ASX: AVZ, OTC: AZZVF) (“AVZ” or “Company”) refers to the Company’s request for an extension to its voluntary suspension dated 31 October 2022, in relation to the finalisation and release of an announcement with respect to its mining and exploration rights for the Manono Lithium and Tin Project (Manono Project).

Upcoming catalysts include:

- 2022 – Any arbitration news in the Manono Project dispute with Zijin Mining Group.

Note: July 2022 – AVZ Minerals ‘confident’ despite Manono dispute remaining unresolved

Global Lithium Resources [ASX:GL1]

On October 24, Global Lithium Resources announced: “Quarterly report for the period ending 30 September 2022…..”

On October 26, Global Lithium Resources announced:

Firm commitments received for a$111.4m placement to fund the Manna transaction, exploration initiatives and the Manna feasibility study.

On October 26, Global Lithium Resources announced: “Breaker divests Manna stake for A$60 million in cash plus a royalty.”

On November 2, Global Lithium Resources announced: “Share purchase plan opens…..GL1 is seeking to raise up to A$10.1 million (before costs) under the SPP.”

On November 15, Global Lithium Resources announced: “Manna Lithium Project update drilling on track for resource upgrade in December.” Highlights include:

- “100% Ownership secured for the Manna Lithium Project.

- The drilling program is progressing effectively at the Manna Lithium deposit with two Reverse Circulation – RC – rigs continuing to drill across the deposit.

- Some highlighted intercepts from the infill RC and Diamond Drilling – DD – program are listed below: MRC0063 (RC) 18m @ 1.09% Li 2O from 152m….

- The DD program is now complete with a total of 5,455 metres drilled.

- Diamond core undergoing analysis and assay prior to metallurgical program commencement.

- Results from the Manna drilling campaign are to be incorporated into an updated Mineral Resource in December 2022.”

On November 15, Global Lithium Resources announced: “Completion of Manna transaction and strategic placement.”

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

On October 31, Lake Resources announced: “Quarterly report for the quarter ended 30 September 2022.” Highlights include:

- “David Dickson appointed Chief Executive Officer to lead the company’s transition from exploration focus to development, construction and toward production.

- Following end of quarter Offtake and Strategic Investment Conditional Framework Agreements signed with WMC Energy and SK On for up to 50,000 tpa lithium carbonate from Kachi project.

- Demonstration plant construction and commissioning was completed during the quarter. The demonstration plant will be operated by Lilac Solutions as part of their agreement to earn equity in the Kachi Project.

- Definitive Feasibility Study – DFS – and Environmental Social Impact Assessment (ESIA) studies continue with demonstration plant validation required prior to completion of the DFS.

- Lake is well funded with a cash balance of $A158.8m and no debt at 30 September 2022.”

On November 2, Lake Resources announced: “Lilac Solutions demonstration plant delivers “at spec” product from Lake Resources Kachi project.”

On November 21, Lake Resources announced: “Lake Resources provides Kachi Project update.” Highlights include:

- “Lake Resources and Lilac Solutions have concluded dispute resolution in the form of contract amendment, proceeding with a “one team” approach for project delivery.

- Demonstration plant operating continuously at 90 percent of steady state, over 600 hours to date, toward the 1,000-hour requirement.

- Lithium Chloride concentrates produced well within specified concentration limits, confirming previous test results.

- Demonstration plant on-site observation and validation by Hatch Ltd is planned to take place in the near term.”

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF) (IONR)

ioneer ltd. announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater for US$490m.

On October 31, ioneer Ltd announced: “Correction to September 2022 quarterly cashflow & activities report…..”

Upcoming catalysts include:

- Any debt funding deals on top of the existing Sibanye-Stillwater US$490m to fund Rhyolite Ridge.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTCPK:ERPNF) (OTCQX:EMHLF)(OTCQX:EMHXY)

On October 31, European Metals Holdings announced: “Simplified extraction process delivers exceptionally clean battery-grade lithium product with improved economics.” Highlights include:

- “Simplified Lithium Chemical Plant (“LCP”) extraction process has delivered exceptionally clean battery-grade lithium carbonate.

- Significant reduction in most impurities far exceeds current market accepted battery-grade specifications and steps required in the LCP process reduced from 15 to 7.

- LCP has capability to deliver very high purity lithium hydroxide, lithium carbonate, lithium sulphate or lithium phosphate.

- Simplified process is expected to reduce both Capex and Opex in the LCP by 10-20%.

- LCP recoveries of 88-93% lithium proven in locked-cycle testwork, an outright recovery improvement of 3-6% over locked-cycle testwork for earlier more complex flowsheet.

- Patent application lodged to protect global intellectual property rights.

- Test work proves re-engineered Front-End Comminution and Beneficiation (“FECAB”) circuit recovers >87% of lithium.

- LCP pilot programme to commence in 4Q CY22 with marketing samples available to offtake partners in 1Q CY23; pregnant leach solution containing 48kg of lithium carbonate equivalent is ready to be processed….”

On October 31, European Metals Holdings announced: “Quarterly activities report September 2022…..”

Upcoming catalysts include:

- 2022 – Any off-take or project funding deals.

You can read a recent Trend Investing update article on EMH here.

European Lithium Ltd [ASX:EUR] (OTCQB:EULIF)

On October 26, European Lithium Ltd. announced: “European Lithium Limited announces merger with NASDAQ listed Sizzle Acquisition Corp., equity consideration of US$750 million for Wolfsberg Lithium Project.” Highlights include:

Key Figures

- “Implied pro forma enterprise value of the combined group is US$838 million.

- Consideration payable for Wolfsberg of US$750 million worth of shares in the combined entity.

- Implied pro forma market capitalisation of the combined group of US$972 million.

- Transaction is expected to provide approximately US$159 million in capital before expenses…….

- Definitive Feasibility Study for Wolfsberg on-track to be delivered in Q1 2023.”

On October 31, European Lithium Ltd. announced: “Quarterly report quarter ended 30 September 2022.”

- “EUR has signed a memorandum of understanding (MoU) with BMW to engage in a long term agreement (LTA) supplying battery grade lithium hydroxide (LiOH)…..”

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

On November 9, Savannah Resources announced: “Heads of agreement for potential divestment of last remaining Mozambique Mining Concession.”

Upcoming catalysts include:

H1, 2023 – EIA permit potentially due.

2024 – DFS due.

Galan Lithium [ASX:GLN]

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina. In total Galan Lithium has 3.0m tonnes contained LCE @858mg/L.

On October 31, Galan Lithium announced: “Quarterly activities report September 2022.” Highlights include:

- “HMW Mineral Resource increases 2.5 times to 5.8Mt contained lithium carbonate equivalent (LCE) @ 866 mg/l Li.

- HMW retains its high grade, low impurity profile.

- First time inclusion of a Measured Resource of 4.4Mt @ 883 mg/l Li.

- Enlarged and upgraded resource is driven by increased tenure scale and further drilling delivering increased aquifer size and porosity assays.

- Results to be incorporated into DFS, on track for delivery in Q1 2023 – potential production increase being explored.

- Total Galan Resource (including Candelas) is 6.5Mt @ 839 mg/l Li.

- New permit application submitted for permanent 200-person operational camp at Hombre Muerto West Project.

- High-flow, high-grade, long term pumping test results continued.

- New pegmatite discovery, anomalous lithium soils and pilot geophysics at Greenbushes South……

- Cash on hand at end of quarter was ≈A$47 million.”

On November 2, Galan Lithium announced: “Application to Scale Up Piloting Stage of HMW Project.” Highlights include:

- “Galan submits application to scale up HMW Project piloting stage to 4ktpa lithium carbonate equivalent (LCE), including construction of 120 Ha of evaporation ponds.

- Increased piloting scale designed to de-risk pond construction methodology and evaporation path and deliver accelerated, first-phase 6% Li concentrate.

- Larger pilot pond system may be included in total ponds design of full-scale HMW Project, significantly shortening construction and production timelines.

- Full-scale HMW production profile permitting (20ktpa+ LCE) on track to be lodged in Q1 2023.

- Assuming typical approval timeframes, 4ktpa LCE HMW pilot plant construction could commence in H2 2023.”

On November 22, Galan Lithium announced: “Flow rate data continues to support 4ktpa LCE Pilot Plant – Other HMW work streams progressing well.”

Cypress Development Corp. (TSXV:CYP) (OTCQX:CYDVF)

Cypress Development owns tenements in the Clayton Valley, Nevada.

On October 27, Cypress Development Corp. announced:

Cypress Development engages Thyssenkrupp Nucera dor design and engineering of Chlor-Alkali Plant in feasibility study.

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On November 16, Frontier Lithium announced: “Frontier intersects 338m of pegmatite averaging 1.64% Li2O, including a 68m zone of 2.00% Li2O.” Highlights include:

- “When combining Phase XI and Phase XII delineation and infill drilling, the Company completed 15,984m of drilling in 50 holes in 2022. Analysis from 4 of the Phase XII diamond drill holes and channel are reported herein.

- DDH PL-074-22 intersected 35.8m of pegmatite averaging 2.05% Li2O…..

- DDH PL-075-22 intersected 83.2m of pegmatite averaging 1.66% Li2O……

- DDH PL-076-22 intersected 338.0m of pegmatite averaging 1.64% Li2O….

- DDH PL-079-22 intersected 107.0m of pegmatite averaging 1.37% Li2O…..

- Channel CH-51 totaling 21m in length averaged 1.92% Li2O……

Investors can read the recent Trend Investing article here and the recent CEO interview here.

Patriot Battery Metals [TSXV:PMET] (OTCQB:PMETF)

Patriot Battery Metals own the Corvette Lithium Project in James Bay, Quebec. No resource yet but some great long length drill results.

On November 2, Patriot Battery Metals announced: “Patriot Battery Metals provides exploration and corporate update.” Highlights include:

- “The final hole of the 2022 drill program at the Corvette Property was completed on October 24th, for a total of 26,598 metres over 90 holes (CV22-015 through CV22-104), including 4,345 m over 20 holes (winter/spring), and 22,253 m over 70 holes (summer/fall). The three (3) drill rigs remain at site and will be utilized for the upcoming winter/spring program planned to commence in early January, 2023…..

- A fully financed winter/spring drill program is planned to commence in early-January with the three (3) rigs already at site, with an additional two (2) rigs scheduled to mobilize in early February. The five (5) rig drill program is anticipated to continue through the winter into spring…..

- The Company is in the final stages of submission of the ASX listing prospectus which will start the clock to our final listing on the exchange. The listing process will include a relatively small financing in order to fulfill our ASX 300 shareholder distribution requirements. The final ASX listing processes (inclusive of the Prospectus exposure period) means exploration results (or any other material information) is unlikely to be released without a supplementary Prospectus. It is anticipated that the ASX listing will be complete in approximately 4-5 weeks time.”

Investors can read the recent Trend Investing article here.

Lithium Power International [ASX:LPI] (OTC:LTHHF)

LPI owns 100% of the Maricunga Lithium Brine Project in Chile, plus plans to demerge its Australian assets into a new company called Western Lithium Ltd in Q1 2023.

On October 25, Lithium Power International announced: “Activity report for the quarter ended September 2022.” Highlights include:

- “The consolidation of ownership of the Maricunga Lithium Brine Project by way of a three-party all-scrip merger with our JV partners….The outcome is expected to boost returns to LPI’s current shareholder base by lifting their proportionate ownership from 51.55% to 57.9% of the Maricunga Project.

- MSB continues with its project financing process, which is being assisted by Treadstone and Canaccord. Several expressions of interest in relation to debt and equity funding have been received, which are being reviewed by LPI management and Canaccord. The process will progress as expected during the upcoming months.

- Significantly increased tenement holdings in Western Australia, to become the largest coverage in the Greenbushes Region and adding to the region profile by acquiring additional exploration tenements in the Eastern Goldfields, WA.

- Demerger and subsequent listing of the Western Australia holding company to be deferred until Q1 2023 with the consolidation of MSB taking precedent and was a prerequisite to the demerger.

- Successful raise of $AU25m through a single tranche placement to institutional, sophisticated and professional investors. Funds will be primarily used to progress and accelerate the development of the Maricunga project.”

On October 31, Lithium Power International announced: “LPI consolidates 100% of the Maricunga Project.”

On November 4, Lithium Power International announced:

Key facts regarding media reports on the Maricunga Project…..In response to news that appeared in the Chilean press regarding the exploitation of Lithium in the Salar de Maricunga, LPI confirms that the standing of its concessions and permitting according to Chilean law is solid. This has been reinforced by multiple legal positions during the last three years from the large and specialist law firms in Chile.

On November 17, Lithium Power International announced: “LPI produces battery grade lithium carbonate with 99.92% purity from Maricunga Project.”

Upcoming catalysts:

- Q1, 2023 – Spin-out of Western Australian Greenbushes and Pilgangoora lithium assets.

American Lithium Corp. [TSXV: LI] (OTCQB:LIACF) (acquired Plateau Energy Metals Inc.)

On November 2, American Lithium announced: “American Lithium announces financial and operating results for the period ended August 31, 2022.” Highlights include:

- “Launching of Pre-Feasibility Work at Falchani – commencement of Environmental Impact Assessment (“EIA”) with SRK Peru which will run in parallel with updates to the existing PEA.

- EIA Drilling at Falchani – commencement of hydrological and core drilling at Falchani……

- Acquisition of additional concessions in Peru – acquired additional highly prospective mining concessions covering approximately 14,243 hectares in Southern Peru, in close proximity to its existing projects, further broadening the Company’s existing asset base and operations.

- Positive drill results at TLC – initial diamond drill results with best results to date including up to 2900 ppm lithium and averaging 1,550 ppm Li over 50.3 metres in hole TLC-2206C.”

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the right to acquire a 100% interest in the Ignace REE Lithium Property in Ontario, Canada.

No lithium related news.

Investors can view the company’s latest presentation here.

E3 Lithium Ltd. [TSXV:ETL] [FSE:OW3] (OTCQX:EEMMF) (Formerly E3 Metals)

E3 Lithium Ltd. is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an Inferred Resource of 24.3mt LCE.

On November 10, E3 Lithium Ltd. announced:

E3 Lithium announces concentration results from first well….. Based on brine samples retrieved from five zones, the P501 lithium concentration from E3 Lithium’s (E3) first well is 76.5 mg/L.

You can read the company’s latest presentation here.

Iconic Minerals [TSXV:ICM] [FSE:YQGB] (OTCQB:BVTEF)/ Nevada Lithium Corp. [CSE: NVLH]

Joint Venture (Nevada Lithium Corp. earn in option to 50%) in the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

On November 18, Iconic Minerals announced: “Iconic files amended Preliminary Economic Assessment report on Bonnie Claire…..”

Arena Minerals [TSXV:AN] (OTCQX:AMRZF)

On November 9, Arena Minerals announced:

Arena Minerals drills high grade discovery hole at Sal de La Puna Project: 641 mg/l lithium over 255 metres…..The rotary exploratory hole intersected two brine aquifers and was drilled down to a total depth of 620 metres below surface. The two brine aquifers consist of: 90 metres (90-120m) averaging 538 milligrams per litre (“mg/l”) lithium (“Li”). 255 metres (365-620m) averaging 641 mg/l Li.

Investors can view a recent Trend Investing article on Arena Minerals here.

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

No lithium related news.

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

On November 1, Lithium South Development Corp. announced: “Two wells return high grade lithium results.” Highlights include:

- “Hole AS01 seven samples range from 693 mg/L Li to 744 mg/L Li.

- Hole AS01 hole lithium average is 722 mg/L Li.

- Hole AS01 brine zone is defined across a 240 m zone.

- Hole AS03 five samples collected, two assays received.

- Hole AS03 two assays 749 mg/L Li and 752 mg/L Li.

- Hole AS03 hole lithium average is 751 mg/L Li.

- Hole AS03 brine zone is defined across a 140 m zone.

- Drilling will begin on newly added hole AS02.”

On November 10, Lithium South Development Corp. announced:

Lithium South drill program advances to hole five….. The current resource expansion program is located within the Alba Sabrina claim block. The claim block is comprised of 2,089 hectares and is the largest of the 3,287-hectare salar located claim package.

Alpha Lithium [NEO: ALLI] (formerly TSXV: ALLI) [GR:2P62] (OTCPK:APHLF)

No news for the month.

Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M& I Petalite Zone Resource of 6.28mt grading 1.37% Li2O, plus an Inferred Resource of 0.94mt at 1.3%. Avalon also has a Partnership JV Agreement with Indian conglomerate Essar to establish Ontario’s first regional lithium battery materials refinery in Thunder Bay.

No news for the month.

Snow Lake Lithium (LITM)

On November 3, Snow Lake Lithium announced: “Snow Lake Lithium provides update following successful completion of the Grass River Drilling Campaign.” Highlights include:

- “2.8 % Li2O over 2.8 meters at 174.5 meters down hole (SGP-005).

- 2.4 % Li2O over 6.0 meters at 16.0 meters down hole (GRP-003).

- 2.4 % Li2O over 4.9 meters at 78.5 meters down hole (GRP-003).

- 1.3 % Li2O over 10.5 meters at 30.5 meters down hole (GRP-005).

- 2.1 % Li2O over 8.8 meters at 69.0 meters down hole (GRP-008). Includes 3.4 % Li2O over 1.5 meters at 71.0 meters down hole.

- 2.4 % Li2O over 6.0 meters at 131.0 meters down hole (GRP-012)…..

- 3.0 % Li2O over 1.6 meters at 197.3 meters down hole (GRP-014)…..”

Essential Metals [ASX:ESS] (OTCPK:PIONF)

Essential Metals has 9 projects (lithium, gold, gold JV, and nickel JV) all in Western Australia. Their flagship Pioneer Dome Lithium (spodumene) Project has a JORC Compliant Total Resource of 11.2Mt at 1.21% Li2O.

On October 27, Essential Metals announced: “Receipt of lithium assays from latest round of drilling paves way for Resource update. Updated Dome North lithium Mineral Resource expected towards the end of November, to underpin Pioneer Dome Scoping Study.”

On October 31, Essential Metals announced:

September 2022 quarterly report. Pioneer Dome Lithium Project: Resource drilling, metallurgical test work and mining lease application completed – Scoping Study and engagement with prospective offtaker/financiers underway.

On November 16, Essential Metals announced:

Multiple lithium targets identified at the Pioneer Dome Lithium Project…..The updated Dome North Mineral Resource is expected to be completed in three weeks. Together with metallurgical test work results, this will underpin the Scoping Study that is currently underway and expected to be completed by mid-January 2023.

Green Technology Metals [ASX: GT1]

Green Technology Metals [ASX:GT1] (“GT1”) has several very promising lithium projects near Thunder Bay in Ontario, Canada. The current JORC Total Mineral Resource is 4.8Mt @ 1.25% with a projects (spodumene) wide target resource of 50-60 MT @ 0.8-1.5% Li2O.

On October 28, Green Technology Metals announced: “Thick high grade spodumene from surface at Root Lithium Project.” Highlights include:

- “Inaugural Phase 1 diamond drilling at McCombe (Root Project) has intersected thick and continuous high grade spodumene pegmatites from surface.

- Assays have been received for the first 9 holes from the Phase 1 diamond drilling including: RL-22-001 for 12.4m @ 1.77% Li2O from 11.8m. RL-22-002 for 15.3m @ 1.20% Li2O from 42.2m….RL-22-003 for 11.5m @ 2.03% Li2O from 72.0m. RL-22-006 for 9.5m @ 1.54% Li2O from 21.7m. RL-22-007 for 9.8m @ 1.51% Li2O from 64.9m……RL-22-008 for 8.8m @ 1.80% Li2O from 71.5m….

- 19 holes have been drilled to date, all intersecting spodumene bearing pegmatites.

- Two diamond drill rigs are now operating 24/7 and due to drill success, the initial program will be expanded along strike and down dip.

- All-weather 20-person camp now fully operational with plans to expand.

- Mapping at Root has identified new untested spodumene pegmatites along strike.

- Stage 1 Archaeology Assessment, desktop and physical inspection in progress at Root.”

On October 31, Green Technology Metals announced: “Quarterly activities report for the quarter ended 30 September 2022…..”

On November 7, Green Technology Metals announced:

Completion of transaction. Green Technology Metals Limited (ASX: GT1) (GT1 or the Company) is pleased to advise that purchase of the remaining 20% interest of the Ontario Lithium Projects from Ardiden Limited has completed. The Company notes that Canaccord Genuity (Australia) Limited acted as financial advisor and Hamilton Locke acted as legal advisor for the transaction.

On November 8, Green Technology Metals announced: “New discovery at Seymour.” Highlights include:

- “First new discovery at Seymour in 50 years: Blue Bear.

- Located approx. 500m south-east of Aubry Complex which hosts MRE of 9.9Mt @ 1.04 Li2O%.

- Surface exposure (under thin cover) has similar strike and geometry to North Aubry.

- Six channel samples have returned assays including: GTC-22-002: 12.4m @ 2.38% Li2O. GTC-22-001: 14.2m @ 1.17% Li2O (incl. 11.5m @ 1.52% Li2O).

- Fourteen (14) diamond holes have been drilled to date, all intersecting pegmatite.

- Six holes have returned assays to date including: GTDD-22-0350: 13.9m @ 1.53% Li2O from 13.8m (incl. 8.8m @ 2.27% Li2O). GTDD-22-0360: 14.4m @ 1.30% Li2O from 21.1m (incl. 10.8m @ 1.72% Li2O)…..”

On November 22, Green Technology Metals announced:

Highest grade intercept to date at Root Project 4.06% Li2O…..Maiden Root Mineral Resource estimate on track for Q1 2023.

International Lithium Corp. [TSXV:ILC] [FSE: IAH] (OTCQB:ILHMF)

No news for the month.

Lithium Energy Limited [ASX:LEL]

On October 31, Lithium Energy Limited announced:

Early exercise of option to acquire Solaroz Lithium Brine Project concessions. Lithium Energy Limited…..is pleased to advise that it has exercised its option to acquire the mineral concessions comprising the Solaroz Lithium Brine Project in Argentina in consideration of a cash payment of US$3.84 million.

On November 16, Lithium Energy Limited announced: “Drilling completed at maiden drillhole at Solaroz Lithium Brine Project.” Highlights include:

- “Maiden drillhole (SOZDD001) at the Solaroz Lithium Brine Project in Argentina has been completed.

- Significant cumulative intersections of up to ~235 metres of lithium brine mineralisation were encountered across upper and lower aquifers in the drillhole.

- Preliminary results from assays of packer sampling of conductive brines have returned highly encouraging lithium concentrations of up to 555 mg/L, with positive flow rates and low Mg/Li ratio.

- Full hole assays are now pending with core samples having been sent to US laboratory….

- Geophysical hole logging will now commence, before the first rig moves on to the next drill hole in the 10 hole (5,000 metre) drilling program.

- A second drill rig is currently being mobilized to site, to accelerate drilling efforts at this exciting new discovery in the lithium triangle, adjacent to Allkem Limited’s (ASX/TSX:AKE) producing Olaroz Project.”

Argentina Lithium and Energy Corp. [TSXV: LIT] (OTCQB: OTCQB:PNXLF)

On October 25, Argentina Lithium & Energy Corp. announced:

Argentina Lithium announces positive results from third and fourth drill holes at Rincon West. “The fourth exploration hole has produced our best results to date. Lithium brines start at 38 metres depth, but the exciting result is the interval from 95 m to 227 m, with lithium values ranging from 334 to 382 mg/litre over a continuous 132 m interval……

On November 21, Argentina Lithium & Energy Corp. announced:

Argentina Lithium increases and closes non-brokered private placement…..$9,085,237 consisting of 36,340,948 units (the “Units”)at $0.25 per Unit.

Winsome Resources Limited [ASX:WR1] [FSE:4XJ]

On October 27, Winsome Resources Limited announced: “Quarterly activities/appendix 5B cash flow report…..”

On October 28, Winsome Resources Limited announced: “Significant pegmatite intercept at Adina from early drill holes.” Highlights include:

- “160m of Pegmatite collectively intercepted in drilling below the recently discovered, well mineralised Jamar outcrop at Adina.

- New targets will be tested as an extension to the current drilling campaign.

- Gravity surveying complete at Adina leading to additional targets.”

On November 1, Winsome Resources Limited announced:

Update on Adina drilling…..Samples and core have been dispatched to SGS for analysis and laboratory results which will be reported in full in a future report.

On November 15, Winsome Resources Limited announced:

Winsome to raise A$6.8m to advance Lithium Projects at Cancet and Adina…..A$6.8m to be raised utilising the “Flow-Through Shares” provisions under Canadian tax law. The Flow-Through Shares will be placed at A$1.67 per share, representing a 98% premium to Winsome’s last close price…..

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

On October 31, Rock Tech Lithium announced: “Chairman Dirk Harbecke reassumes CEO post.”

On November 3, Rock Tech Lithium announced: “Rock Tech completes project study for converter…..”

On November 16, Rock Tech Lithium announced: “Last section for converter application submitted…..”

On November 16, Rock Tech Lithium announced:

Georgia Lake Project: Pre-Feasibility Study published. An Indicated Mineral Resource of 10.6 million tonnes of lithium oxide and an additional Inferred Mineral Resource of 4.2 million tonnes – that is one fact that the Rock Tech Lithium’s Pre-Feasibility Study outlines for its 100%-owned Georgia Lake Project in Ontario, Canada. Together, with a 1,000,000 tonne-per-annum spodumene concentrator, the pre-tax net present value is 223 million US-Dollar and supports the viability of lithium mining activities and the concentration of spodumene.

Neometals (OTC:RRSSF) (RDRUY) [ASX:NMT]

On October 31, Neometals announced: “Quarterly activities report for the quarter ended 30 September 2022.” Highlights include:

Corporate

- Cash balance A$50.8 million, receivables and investments of A$29.8 million and no debt.

- Neometals included in ASX 300, first recycling revenues booked by Primobius and 3rd annual Sustainability Report completed……”

Lithium Chemicals Project (earning into 50:50 JV with Bondalti Chemicals SA via Reed Advanced Materials Pty Ltd (“RAM”) (NMT 70:30 Mineral Resources Ltd)

- Engineering cost study activities well-advanced for ~25,000tpa lithium hydroxide operation using RAM’s ELi® Process at Bondalti’s Estarreja chlor-alkali operation in Portugal.

- Commenced confirmation testing of multiple lithium brine samples to assist with design of, and feedstock sourcing for, proposed pilot trials in Canada and subsequent demonstration plant in Estarreja, Portugal.”

Nano One Materials (TSX: NANO) (OTCPK:NNOMF)

On November 1, Nano One announced:

Nano One announces closing of Candiac Acquisition from Johnson Matthey…….The only existing North American lithium iron phosphate (“LFP”) production facility……An 80,000 square foot, 2,400 tpa capacity LFP production facility on 9.5 acres, strategically located near Montréal. Certification systems supplying tier 1 cell manufacturers for the automotive sector…….

On November 11, Nano One announced:

Nano One provides quarterly progress update and reports Q3 2022 results…..Working capital of ~$45.8 million; cash of ~$45.9 million.

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc [ASX:5EA] (FEAM), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (OTCQB:AZLAF), Atlantic Lithium [LON:ALL] (OTCQX:ALLIF), Atlas Lithium Corp. (OTCQB:ATLX), Bradda Head Lithium Limited [LON:BHL] (OTCQB:BHLIF), Bryah Resources Ltd [ASX:BYH], Carnaby Resources Ltd [ASX:CNB], Critical Resources [ASX:CRR], Electric Royalties [TSXV:ELEC], Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), Foremost Lithium Resources & Technology [CSE:FAT] (OTCPK:FRRSF), Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (formely Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], International Battery Metals [CSE: IBAT] (OTCPK:IBATF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Jindalee Resources [ASX:JRL] (OTCQX:JNDAF), Jourdan Resources [TSXV:JOR] (OTCQB:JORFF), Kodal Minerals (LSE-AIM: KOD), Larvotto Resources [ASX:LRV], Latin Resources Ltd [ASX:LRS] (OTC:LAXXF), Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY] (LRTTF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Lithium Ionic Corp. [TSXV:LTH], Lithium Plus Minerals [ASX:LPM], Lithium Springs Limited [ASX:LS1], Loyal Lithium [ASX:LLI], Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), One World Lithium [CSE:OWLI] (OTC:OWRDF), Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCQB:PWRMF), Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Spearmint Resources Inc [CSE:SPMT] (OTCPK:SPMTF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Tantalex Lithium Resources [CSE:TTX], [FSE:1T0], Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Xantippe Resources [ASX:XTC], Zinnwald Lithium [LN:ZNWD].

Conclusion

November saw lithium chemicals prices and spodumene prices both higher again.

Highlights for the month were:

- NAL (SYA & PLL) on track for restart of production in Q1, 2023. NAL acquiring and JVing into Jourdan Resources’ Vallée Lithium Project, located adjacent to NAL operation.

- Sayona Mining acquiring 1,824 claims spanning 985 sq km near Moblan Lithium Project from Troilus Gold Corp.

- Piedmont Lithium/ Atlantic Lithium – Mineralisation extended and significant potential for resource upgrades Ewoyaa Lithium Project Ghana.

- Liontown Resources – Significant progress achieved for the Kathleen Valley Lithium Project design and construction activities.

- Vulcan Energy Resources onsite works at Sorption Demo Plant commenced.

- POSCO accelerates production of lithium in Argentina.

- Standard Lithium successfully commissions first direct hydroxide conversion pilot plant.

- Critical Elements Lithium receives provincial government approval, financing discussions to start mine construction.

- Global Lithium Resources secures 100% ownership secured of the Manna Lithium Project.

- Lake Resources signs agreements with WMC Energy and SK On for up to 50,000 tpa lithium carbonate from Kachi Project. Lilac Solutions dispute amended contract agreement.

- European Lithium Limited announces merger with NASDAQ listed Sizzle Acquisition Corp., equity consideration of US$750 million for Wolfsberg Lithium Project. MOU with BMW for lithium off-take.

- Galan Lithium applies to scale up piloting stage of HMW Project to 4ktpa lithium carbonate.

- Frontier intersects 338m of pegmatite averaging 1.64% Li2O.

- Patriot Battery Metals completes 26,598 metres of drilling over 90 holes at the Corvette Lithium Project in Canada. Plans ASX listing.

- Lithium Power International consolidates 100% of the Maricunga Project, produces battery grade lithium carbonate with 99.92% purity.

- Arena Minerals drills high grade discovery hole at Sal de La Puna Project: 641 mg/l lithium over 255 metres.

- Lithium South Development Corp. returns high grade lithium results including seven samples range from 693 mg/L Li to 744 mg/L Li.

- Green Technology Metals drills thick high grade spodumene from surface at Root Lithium Project, including 12.4m @ 1.77% Li2O from 11.8m. Now owns 100% of the Ontario Lithium Projects (final 20% bought out).

- Lithium Energy Limited exercised its option to buy Solaroz, maiden drilling returned up to 555 mg/L lithium, positive flow rates and low Mg/Li ratio.

- Argentina Lithium & Energy drills 334 to 382 mg/l lithium over a continuous 132 m interval.

- Winsome Resources drills significant pegmatite intercept at Adina from early drill holes, assay results pending.

- Rock Tech Lithium’s PFS for its Georgia Lake Project 100,000tpa spodumene – Pre-tax NPV8% of US$223m, based on spodumene selling at US$1,500/t. CapEx US$192.2m.

- Nano One closes acquisition, now owns the only existing North American lithium iron phosphate (“LFP”) production facility.

As usual all comments are welcome.

Be the first to comment