viking75/iStock via Getty Images

Thesis

Lake Resources (OTCQB:LLKKF) recently made news after it signed an offtake agreement with the Ford Motor Company (NYSE:F). The deal was for 25K tonnes per annum (tpa) of lithium carbonate equivalent (LCE), half the amount it anticipates extracting from its Lake Kachi project in northern Argentina once it begins production in 2024. This comes only a few weeks after the miner made a similar deal for the other half of its production with the Japanese company, Hanwa Co., Ltd. Over the last few years, Lake Resources has been making all the right moves as it guides Kachi to completion. This report looks at where the company currently stands and why it may be a good investment for anyone looking to add lithium exposure to their portfolio.

Kachi

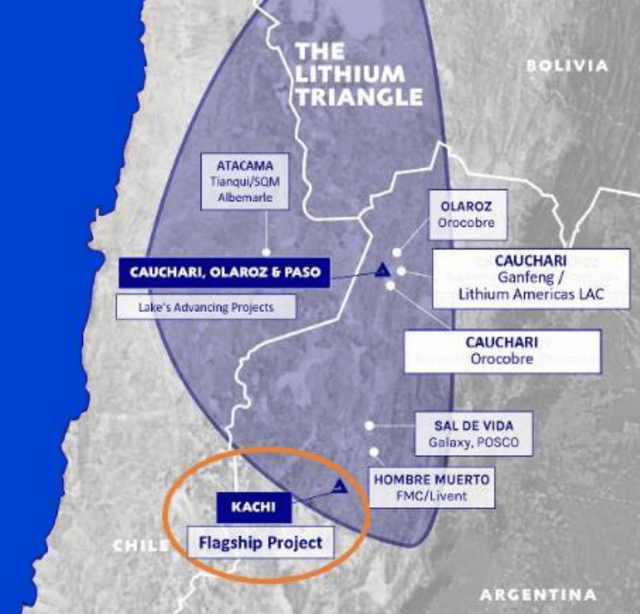

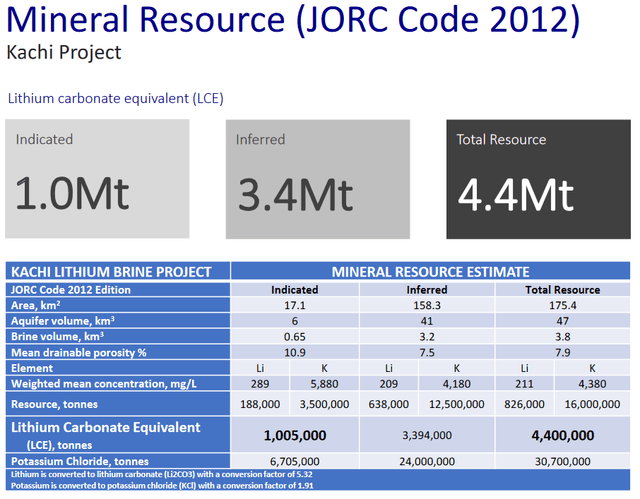

For those new to the stock, Lake Resources is an Australian pre-production lithium miner with 5 100%-owned projects in Argentina. Altogether they cover 2,200 sq kms (~850 square miles) and are located in the Lithium Triangle. In the last few years, the company has been focusing its efforts on developing its flagship Kachi project. Kachi covers an area of 70,000 hectares (170,000 acres) and has 4.4 Mt LCE of indicated and inferred resources (Indicated 1.0Mt, Inferred 3.4Mt).

Lake Resources Kachi Project (Investor Presentation)

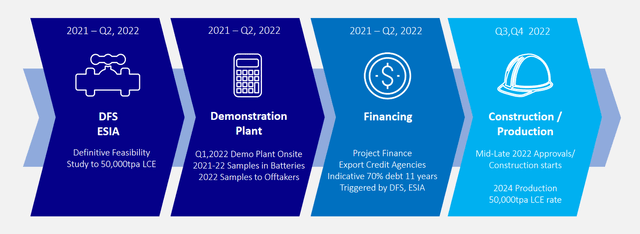

Initially, the project had a targeted capacity of 25.5 tpa LCE when the Pre-Feasibility Study (“PFS”) was carried out. Capex costs for the project were estimated to come in at about $544 million with operating costs of $4,178/metric tonne. Shareholders are currently awaiting the completion of the Definitive Feasibility Study (“DFS”) which management has said will probably be completed by the end of Q2 2022.

For the DFS, targeted production capacity was increased to 50k tpa LCE. This will undoubtedly have an impact on capex estimates but was nevertheless a very positive development for the project. The upward revision for targeted production capacity will probably lead to a reclassification of some Inferred Resources to Measured and Indicated Resources in order to support the production capacity expansion. But management even hinted that the release of the DFS may see an upward revision in the overall size of the resource. A December 15, 2021 press release said:

Drilling to date focused on the southwest corner of the known salt lake and surrounds. The Resource Statement released to the ASX on 27 November 2018 identified considerable upside beyond the large identified total resource of 4.4 Mt LCE (Indicated 1.0Mt, Inferred 3.4Mt).

Another press release issued on January 19, 2022 reiterated the point by saying, “the DFS will be expanded from 25,500 tpa LCE to 50,000 tpa LCE, underpinned by an anticipated increased resource estimate from drilling results.” A sizeable upward revision to the resource estimate would undoubtedly be good news for shareholders.

Kachi Project Mineral Resource (Investor Presentation)

On the negative side, however, the initial capex and opex cost estimates may also be impacted by rising prices on almost everything due to worldwide supply chain problems. However, a design change that occurred after completion of the PFS to incorporate more solar hybrid power should help offset at least a portion of those increases. The incorporation of more solar power should also help with an Environmental and Social Impact Study that’s currently being carried out.

After the DFS is released, the company will begin work on the Final Investment Decision (“FID”) and after that the construction phase will begin. The project is anticipated to begin production in 2024.

Lilac

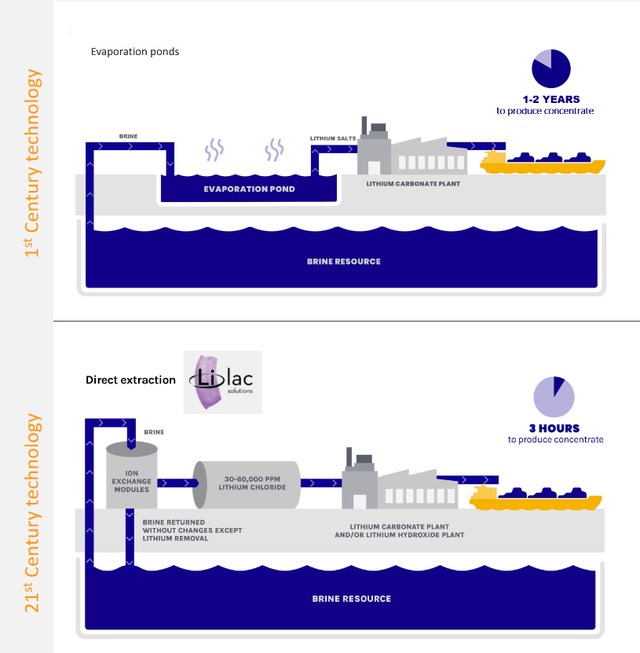

One of the most well-known selling points of Lake’s Kachi project is the 99.97% purity level of the lithium carbonate that it produces. However, there are other advantages to Lake’s lithium. Chief among those is the relatively small environmental footprint that it creates as well as the speed at which the brine will be processed.

That’s because Lake has partnered with Lilac Solutions, a privately held company backed by the Gates Foundation that has created a new extraction method. Lilac’s Direct Lithium Extraction process differs from conventional brine evaporation methods through the adoption of ion exchanges, a water treatment procedure that permits lithium extraction. It also allows for the return of most brine water to the source after lithium removal.

The on-site plant will replace 20-30 km2 of evaporation ponds and allow the company to accomplish in 3 hours what used to take 1-2 years to do. An overview of the process can be seen on the exhibit below. These are two of the reasons why the company has had no trouble finding downstream companies willing to sign offtake agreements and agencies willing to provide financing.

Lilac’s Brine Extraction Method (Investor Presentation)

Financing

At December 31, 2021, the company had $50.4 million in cash and no debt and it went on to raise an additional AUD$39 million in March through the issuance of 40 million shares. This will probably be more than enough to complete both the DFS and FID for Kachi, leaving it in a position where it won’t have to raise additional funds until project construction begins. Lake also owns three other lithium brine projects in northwest Argentina; those being Cauchari, Olaroz, and Paso. It aims to eventually develop these projects over time in efforts to become a multi-asset producer but most of the work, in terms of dollars spent, is currently focused on Kachi.

The financing of Kachi’s build-out looks like it will go rather smoothly as the company has received expressions of interest from both UK Export Finance (“UKEF”) and the Canada Export Credit Agency (“EDC”). These governmental agencies could provide financing for up to 70% of the project’s capex expenditures. The financing comes in the form of loans which is positive for shareholders as junior miners often have to issue large amounts of shares which dilutes existing shareholders. In this case, Lake would issue debt which would be non-dilutive financing for existing investors.

These loans will be repaid over an 8.5-year period post-construction and offer an extremely favorable interest rate for a company in Lake’s position. In its most recent quarterlies, the company writes that the loans would be made at the OECD Fixed Commercial Interest Reference Rate (“CIRR”) applicable at the date of signing and the rate would be for the life of the loan. Presently, the CIRR is at only 3.15% for a term of 8.5 years or longer. Approximately two-thirds of the agency debt could be financed at the OECD CIRR interest rate.

If we use the $544 million capex estimate from the company’s Pre-Feasibility Study, we see that the company will only have to make $7.9 million yearly interest payments on $251 million of debt, a truly excellent rate for a junior miner. That’s calculated by multiplying the $544 million by the 70% UKEF and EDC financing commitment, then multiplying that by the two-thirds of debt financed at the CIRR (544 * .7 * .66*.0315).

The deal is not yet signed and is subject to standard project finance terms, including, but not limited to, the successful completion of Kachi’s Definitive Feasibility Study (DFS), successful completion of the Environmental and Social Impact Assessment (ESIA) and suitable structured offtake contracts.

Lake is in the process of completing the first two of those requirements and, as previously mentioned, recently signed an offtake agreement with Ford for half of Kachi’s nameplate capacity after having signed a similar deal for the other half with Hanwa Co. just a few weeks before. The company is quickly ticking off all the listed requirements in order to lock-up that low-rate non-dilutive financing.

Conclusion

The project continues to run smoothly and predictably and, so far, looks like it will hit the 2024 production start-date target. That will allow both Lake and its investors to start benefitting directly from the run-up in lithium prices.

Kachi Project Timeline (Investor Presentation)

Risk

There are two primary risks to the thesis, the first being a fall in lithium prices. The metal’s price has run up substantially over the last year but if it ever crashed the project’s viability could come into question.

The second risk comes from the macro environment. As discussed in a prior piece on Lithium Americas Corp. (LAC), the global environment is going through a phase of resource nationalism whereby many governments are trying to take control of natural resources within their borders. Argentina has been an exception in Latin America, but if a change in government occurred whereby a more nationalist and protectionist administration came in, then Lake’s project could come under risk.

Be the first to comment