xavierarnau/E+ via Getty Images

The timely delivery of consumer staples becomes more crucial in the evolving economy. Thankfully, Knight-Swift Transportation Holdings, Inc. (NYSE:KNX) remains capable of meeting the market demands. It is a formidable giant in the trucking industry amidst supply chain disruptions. Despite some slippages, its revenue growth and margin expansion remain solid. That is why its low valuation makes it cheap and reasonable. Overall, it is an ideal investment with sound fundamentals and undervalued stocks.

Company Performance

Knight-Swift Transportation Services, Inc. still operates in a turbulent market landscape. Border reopenings remain sluggish, leading to high backlogs that may extend in 2023. Driver shortages remain a tough challenge for many companies. As such, the market is still hammered by supply chain disruptions, and KNX is not spared. Even so, it handles its business with ease and prudence amidst these pressures.

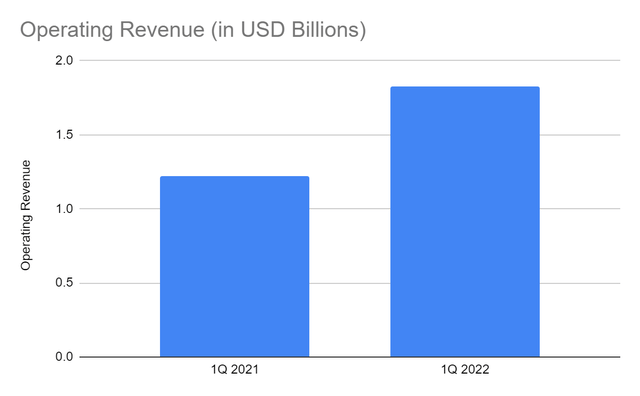

Today, its core operations remain robust. And even these external challenges cannot stop its expansion. From its core truckload market, the LTL freight market is now part of its niches. Thanks to its series of acquisitions in 2021, particularly AAA Cooper Transportation. It expanded its LTL capabilities further with its acquisition of Midwest Motor Express. It now has a larger operating capacity, allowing it to capture more demand. This move appears fruitful as its operating revenue of $1.83 billion leads to a 50% YoY growth. This impeccable growth indicates that it continues to optimize its capacity. All its segments show noticeable improvements this quarter. Even better, we can see that it exceeds the operating revenue in 4Q 2021. Note that many trucking companies like KNX follow a seasonal pattern. The first quarter has a very low demand following a series of holidays in the previous quarter. So, its capitalization on prudent acquisition is bringing more success.

Operating Revenue (MarketWatch)

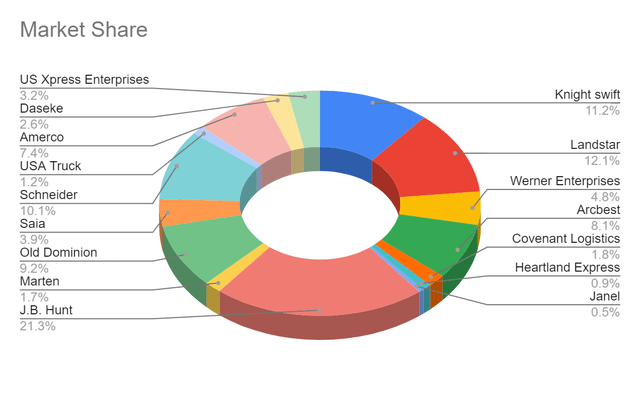

Moreover, it continues to go head-to-head with other giants, such as J.B. Hunt (JBHT) and Landstar (LSTR). Note that the competition in the industry has become tighter. It is a combination of backlogs, supply chain disruptions, and opportunities from e-commerce. Also, it competes with larger companies that have air and ocean cargo segments. Thankfully, its expansion and enhancement of digital capabilities continue. It already has a larger market presence with more efficient operations. These give the company an edge over many of its peers. Relative to them, it holds 11.2% of the market share. It is an impressive increase from 9.8%. Also, its revenue growth is better than the market average of 38%. It is even better than the above-mentioned peers.

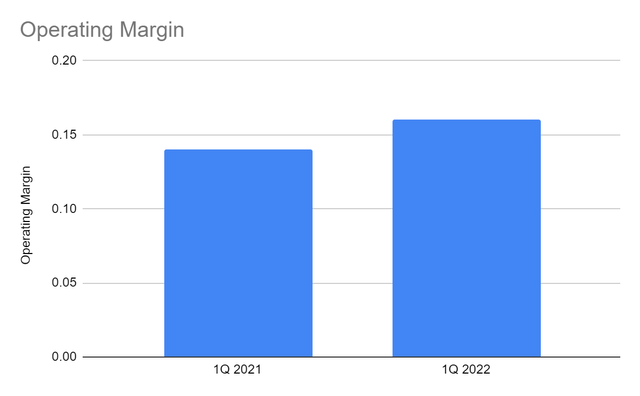

Aside from its expanded operations, it enjoys a strong brand and customer base. It also sees the increased demand for door-to-door transport facilities. It is no wonder that this giant remains fearless of entering more niches. And its move to expand its capabilities into the LTL market is sagacious and timely. So, amidst the rising costs of fuel and backlogs, it remains durable and viable. Its strategic pricing and strong domestic presence are also its core competencies. Its increased fuel and LTL surcharge is a wise move to cushion the blow of rising fuel costs. It also maintains a strong relationship with its truckload carriers and shippers. It can be seen in its increased labor expenses is a vital aspect amidst driver shortages. It pays off as the gap between revenues from costs and expenses continues to widen. Its operating margin is 16% vs. 14% in the comparative quarter. Its net profit margin of 11.4% is higher than 10.6% in 1Q 2021. As such, we can say that both the core and non-core operations are expanding.

Operating Margin (MarketWatch)

Why Knight-Swift Transportation Holdings, Inc. May Remain A Durable Giant

Knight-Swift Transportation Holdings, Inc. has impressive core operations. But it is more important to figure out if it can sustain its growth and expansion. It has become more crucial as the market demand and competition intensifies. Also, it is in a capital and labor-intensive industry, which needs massive resources.

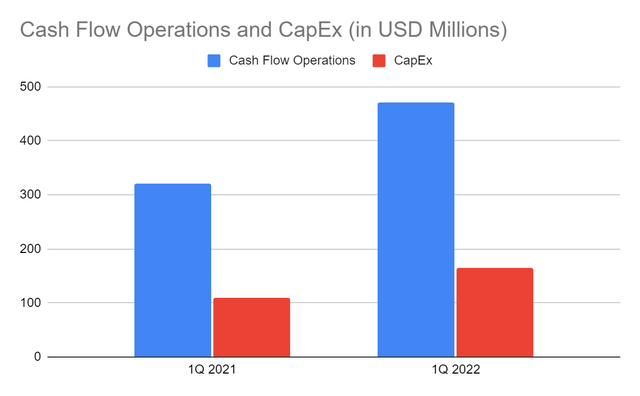

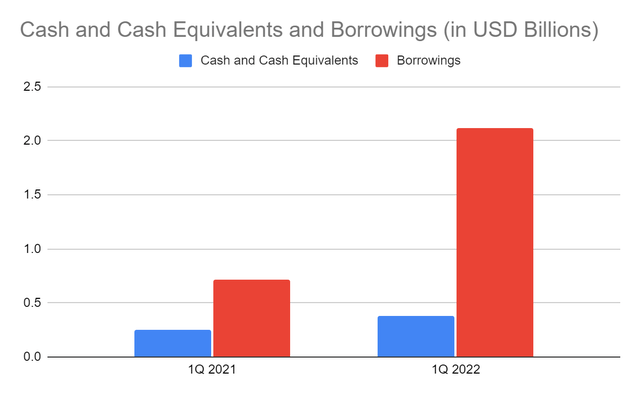

It is indeed a good thing that Knight-Swift remains sustainable as it expands. Since 2018, its expansion continues to generate stable cash inflows. This year, it is more vital, as its series of expansions since 2021 requires more resources. Fortunately, its operating cash flows are adequate to cover its CapEx. Both the OCF and CapEx are in an uptrend, leading to a higher FCF of $300 million vs. $210 million. It can be confirmed in the consistent increase in cash at $380 million vs. $251 million. But because of continued acquisition, its borrowings have ballooned in the last year. So, the percentage of cash to borrowings is 18% vs. 34% in 1Q 2021.

Cash Flow From Operations and CapEx (MarketWatch)

Cash and Cash Equivalents and Borrowings (MarketWatch)

Even so, we can see that its expansion continues to generate more returns. We can see it in the increased percentage of cash to total assets from 2.9% to 3.6%. Also, its Net Debt/EBITDA of 3.95x is within the ideal range of 3-4x. As such, the company generates enough income to cover its borrowings. Its solid and intact fundamentals allow it to prepare for more market opportunities.

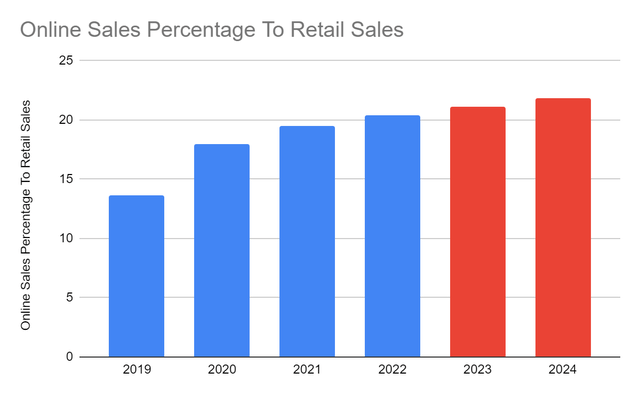

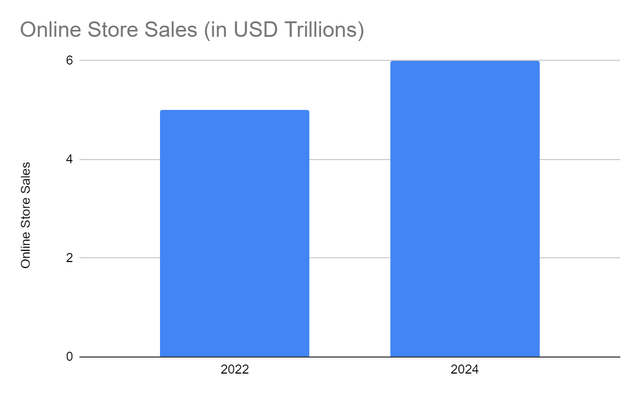

Once the easing of lockdowns speeds up, its supply chain may further improve. But what it has to anticipate more is the peak of the digital revolution. E-commerce is at the forefront of it, which heavily impacts the trucking industry. With more people, the demand for door-to-door transport facilities may skyrocket. As of now, e-commerce sales of $5 trillion comprise 20.4% of the global retail sales. It may become even higher at $6 trillion or 21-22% of the overall retail sales in 2023-2024. By 2040, over 90% of purchases may come from e-commerce. That is why trucking companies must work hard on strengthening their market presence. Their digital capabilities are the most vital aspect in capturing more customers.

Online Sales Percentage To Retail Sales (drip)

Thankfully, KNX is way ahead of its time. From its core truckload and logistics, it continues to expand into the LTL market. Aside from its LTL entry, it has also expanded its digital capabilities. Its acquisition of Embark Trucks is another milestone. KNX will be the first to have tractors with autonomous driving technology. This service dispatch technology helps improve its business and dispatch processes. Drivers can operate the technology inside the trucks or cabs. The company can receive feedback on the technology performance. That way, they may find a way to enhance the job of the drivers. It may also help them monitor the driver’s performance and routes. More improvements must still be done for better performance. Alternative routes during heavy traffic and data analytics are necessary as well.

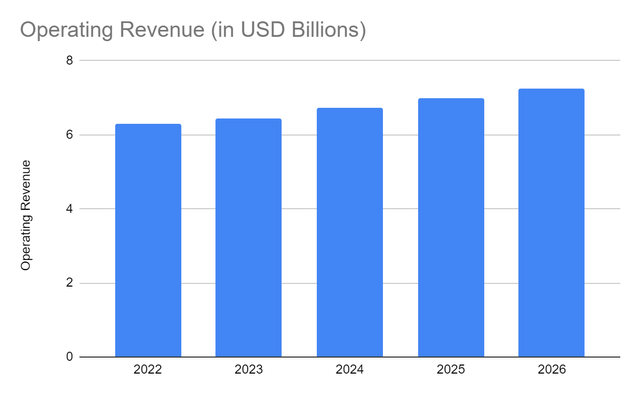

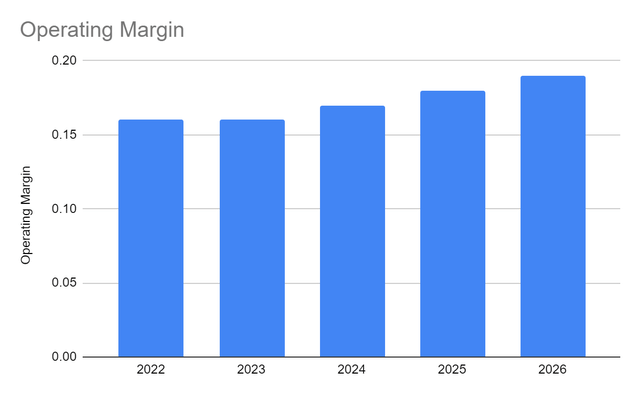

Given all these promising growth prospects, I estimate its core operations to expand further. The operating revenue may increase to $6.3-7.24 billion in 2023-2026. Likewise, the operating margin may remain in an uptrend to 0.16-0.19. The values are a bit with the average growth and quarterly values. It is also conservative estimation, since I consider the potential disruptions of inflationary pressures.

Operating Revenue (Author Estimation)

Operating Margin (Author Estimation)

Stock Price Analysis

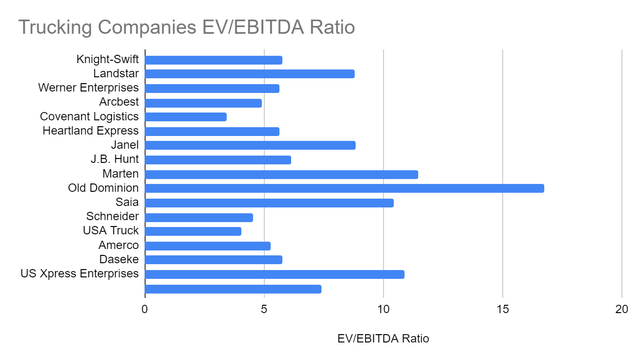

The stock price of Knight-Swift Transportation Holdings, Inc. has been in a downtrend. At $45.17, the stock price has already been cut by 25% from the starting price. But it is a good opportunity to find an excellent entry point to make a position. It appears cheap and undervalued, as shown by the PE Ratio of 9.15. Likewise, its EV/EBITDA ratio of 5.76 shows that the stock price is reasonable. It may not be as low as some of its peers, but it is better than the market average.

Meanwhile, its dividend payments are still covered by its net income. It has a very low dividend payout ratio of 9.6%, which means that KNX has more than enough. Even so, it is still logical for a capital-intensive company. It may even cover its borrowings and expansion. To assess the price better using the DCF Model. EV/EBITDA, and the Dividend Discount Model.

Trucking Companies EV/EBITDA Ratio (Seeking Alpha)

|

FCFF |

$316,000,000 |

|

Cash and Cash Equivalents |

$379,900,000 |

|

Outstanding Borrowings |

$280,000,000 |

|

Perpetual Growth |

4.8% |

|

WACC |

8.8% |

|

Common Shares Outstanding |

163,635,000 |

|

Stock Price |

$45.17 |

|

Derived Value |

$52.39 |

|

EV |

$9,290,000,000 |

|

Net Debt |

$1,740,000,000 |

|

Common Shares Outstanding |

$163,635,000 |

|

Stock Price |

$45.17 |

|

Derived Value |

$47.26 |

|

Stock Price |

$45.17 |

|

Average Dividend Growth |

0.1041666667 |

|

Estimated Dividends Per Share |

$0.48 |

|

Cost of Capital Equity |

0.1147931887 |

|

Derived Value |

$49.87520833 or $49.88 |

The three models show that the stock price is undervalued. There may be potential gains at the current stock price. There may be a 7-17% upside in the next 12-24 months.

Bottom Line

Knight-Swift Transportation Holdings, Inc. has robust operations and sound fundamentals. It keeps expanding and innovating amidst the changing market landscape. There are growth prospects that may sustain its success and dividend payments. But the stock price remains divorced from fundamentals, making it a good entry point. The recommendation is that Knight-Swift Transportation Holdings, Inc. is a buy.

Be the first to comment