Jasmin Pawlowicz/iStock via Getty Images

Note to Readers: This article was published to subscribers on March 9.

Kinetik Midstream (NASDAQ:KNTK) shares sold off on March 9 after the announcement of a secondary offering of shares owned by APA Corp. (APA), formerly Apache. KNTK was formed by the merger between public Altus Midstream and privately-owned EagleClaw Midstream. The merged entity is the largest natural gas gathering and processing (G&P) operator in the Delaware Basin.

In the secondary offering, APA is selling 3.48 million shares at $58.00, a 17% discount to the previous day’s closing price. KNTK units have traded down 14.2%, to $59.88 on the news. We believe the selloff is an attractive buying opportunity for income-seeking investors.

Since the selloff, KNTK shares have since recovered to around $67. While not as attractive as their former sub-$60 price, the company’s unusually good prospects and 9.0% dividend yield make the shares attractive.

Important Facts About the Secondary Offering

The important facts about the offering for KNTK stock buyers and owners are the following:

First, KNTK will not receive any of the proceeds from the offering. The offering allows APA to liquidate some of its holdings. As it does, liquidity in the shares will increase, making them more attractive to larger institutional shareholders and tamping down the shares’ wild volatility. Keep in mind, however, that even after the secondary offering, trading remains thin and the share price will be more volatile than KNTK’s more heavily-traded peers.

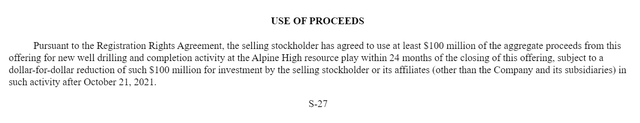

Second, APA has agreed to use at least $100 million from the proceeds of the offering toward increasing production at KNTK’s Alpine High acreage. KNTK’s offering prospectus, filed yesterday after the close of trading, states the following about APA’s use of proceeds.

KNTK SEC Filing

Source: KNTK secondary offering prospectus, March 8, 2022.

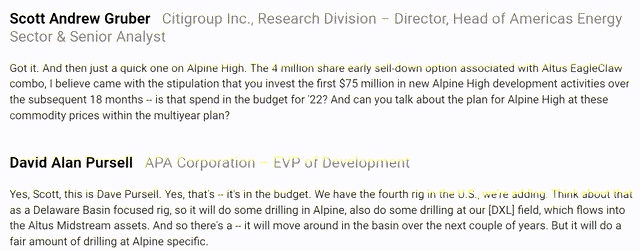

Alpine High was initially touted as an oil play, and as things turned out, management, shall we say, pushed the envelope with regard to Alpine High’s oil prospects. However, nobody ever doubted the play’s prospects for natural gas and NGLs. With prices for these commodities surging to levels that make drilling profitable, APA management has stated its intention to increase activity in Alpine High. Management recently alluded to its plans during APA’s fourth-quarter conference call on Feb. 22.

Thomson Reuters Transcripts

Source: Thomson Reuters transcript of APA Corporation’s fourth-quarter and full-year 2021 earnings conference call, Feb. 22, 2022.

The increased Alpine High drilling will be positive for KNTK. It will increase throughput for KNTK’s gathering, processing, and long-haul pipeline assets.

The third important fact about the offering is that nothing about the company’s fundamental outlook has changed between yesterday and today, certainly nothing to justify the ongoing 14% selloff in KNTK stock. Hence the opportunity to buy low.

Fourth, the secondary does nothing to change KNTK’s share count. APA is selling the Altus Midstream shares it owned before Altus’ merger with EagleClaw. These are not new shares and do not change the number of KNTK shares outstanding.

Fifth and finally, today’s selloff has driven KNTK shares down to prices at which they yield 10%. Aside from the obvious attractiveness of such a high yield, this level has served as a price floor for ALTM/KNTK shares over recent months. Also, the dividend is safe, with 1.3-times coverage. Management intends to grow the dividend by approximately 5% per year beginning in 2023.

Management Has Already Under-Promised and Over-Delivered

From incoming management’s initial conference call, shortly after the merger was announced on October 21, 2021, management has increased its guidance with regard to:

- The timing of integrating the midstream systems of Altus Midstream and EagleClaw midstream, the entities that merged to form KNTK.

- The synergies achieved in the deal, as well as their expected timing.

- The timetable for redeeming the legacy Altus preferreds.

- The timetable for refinancing KNTK’s debt.

- The expectation for 5% annual dividend increases, which was recently brought forward from 2024 to 2023.

We’d point out that management owns 2.8% of this $4 billion market cap company, which is equal to around $112 million, so it is heavily incentivized to continue delivering on its promises.

Other Attractive Features of KNTK

Other attractive features include KNTK’s significant operating leverage, most of which comes from the legacy Altus assets. These assets were constructed to support Alpine High development before APA management pulled the plug on further development in March 2020. These assets are now integrated into EagleClaw’s gathering and processing system, which embeds operating leverage into the fully-integrated system. Management estimates KNTK has 0.8 Bcf/d of excess processing capacity that it intends to utilize to meet its customers’ production growth. The operating leverage means that throughput should be able to increase without the need for significant additional capital spending, which will benefit KNTK’s free cash flow.

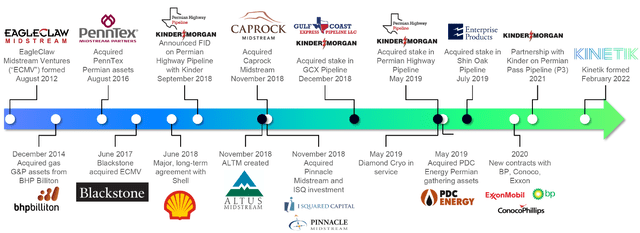

The weighted-average term of KNTK’s contracts with customers spans 11 years. It has a diversified customer roster, so its fate isn’t tied to any single operator. Furthermore, KNTK has grown significantly since EagelClaw’s inception a decade ago.

KNTK Investor Presentation

Source: KNTK February 2022 Investor Presentation.

Management has built an impressive footprint in the fastest-growing basin in the U.S., which is poised to continue its growth for years to come. And it did so without overextending the company. Management expects to achieve a 3.5-times leverage ratio in 2023. No doubt growth will continue via bolt-on acquisitions. We expect continued expansion to benefit KNTK’s scale, pricing power, and free cash flow.

Conclusion

KNTK remains one of the top “Buys” in our portfolio at the moment. The company has a lot of operating momentum that we expect will translate into attractive financial returns for shareholders. Long-term midstream investors should use today’s selloff to buy KNTK at a 10% yield and to benefit as its dividend grows over the coming years.

Be the first to comment