Joe Raedle/Getty Images News

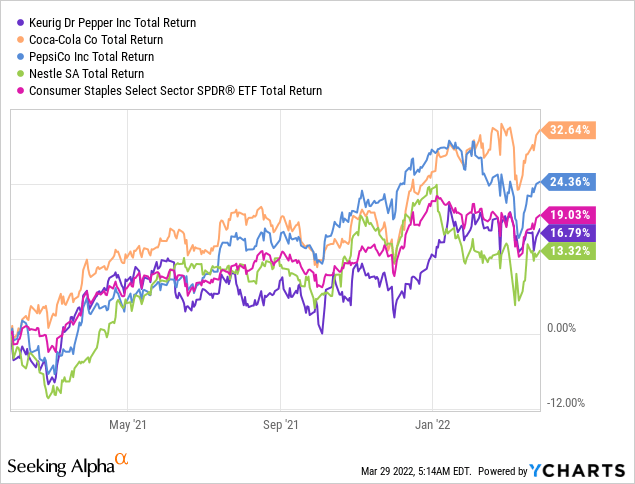

Keurig Dr Pepper (NASDAQ:KDP) total return has been lagging behind those of Coca-Cola (KO), PepsiCo (PEP) and Nestle (OTCPK:NSRGY) since I initiated coverage on the com pany back in January of last year.

pany back in January of last year.

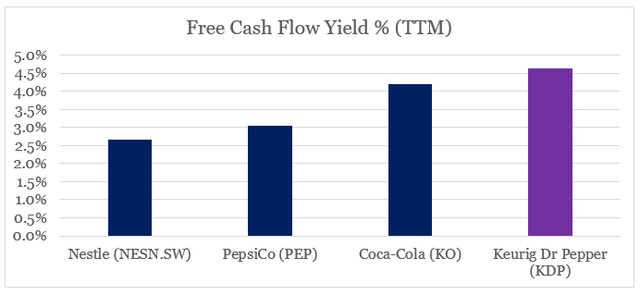

This has made KDP the cheapest of the companies listed above on a free cash flow basis. With a free cash flow yield on a trailing twelve month basis of 4.6%, the gap between KDP and the rest of the peers is still quite high.

prepared by the author, using data from annual reports

Of course, truly global businesses, such as Coca-Cola and Nestle, and a well-diversified enterprise into both beverages and snacking, such as PepsiCo, deserve their higher valuations. However, KDP is in a good position to challenge its much larger peers and with that to close the valuation gap. Although this is unlikely to be a smooth sailing and short-term headwinds are to be expected, KDP now appears in a better position than it was a year ago.

Growing The Business

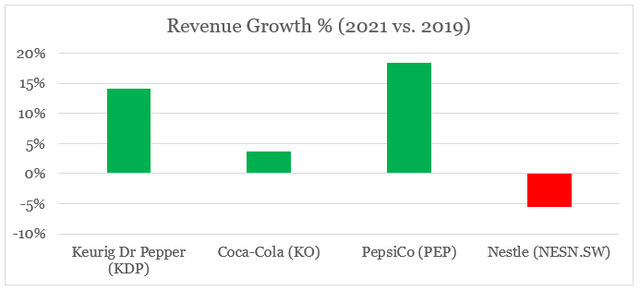

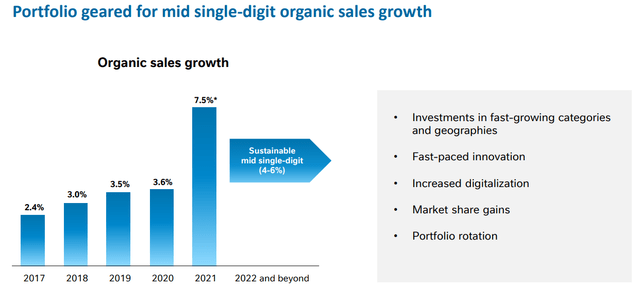

Compared to pre-pandemic levels KDP grew its topline in 2021 by nearly 15%, which is much higher than the total revenue growth rates of other peers except for PepsiCo.

prepared by the author, using data from annual reports

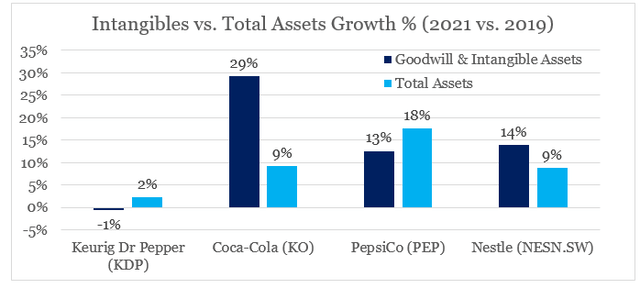

These numbers, however, do not take into account any large M&A deals and divestitures that occurred during the period. A good proxy of the impact of inorganic growth is the gap between the growth of total assets and goodwill & intangible assets, which are mostly recorded on the balance sheet following an acquisition. From the graph below, we could see that only KDP did not engage in any major deals during period.

prepared by the author, using data from annual reports

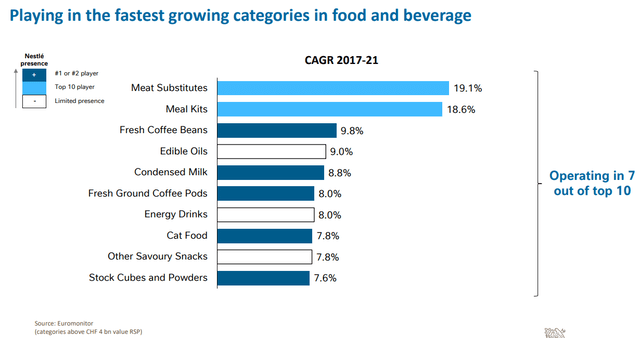

Nestle, for example, engaged in a number of M&A deals in recent years, with the company also divesting a large part of its bottled water business last year.

Nestle Investor Presentation Seeking Alpha

The divestiture is what drove Nestle topline down over the two-year period reviewed above and organic growth has been around 11% for the 2020 and 2021 combined.

Nonetheless, KDP was one of the highest growing large cap beverage companies that managed to achieve that through organic sales growth.

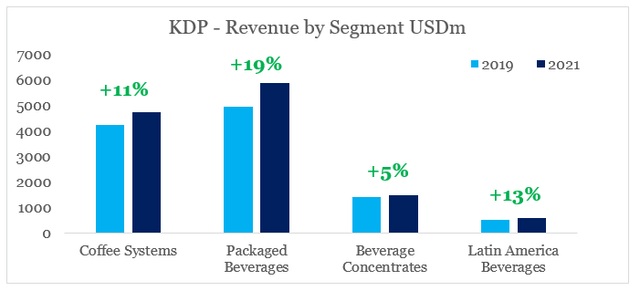

As a matter of fact each business segment grew in double digits when compared to 2019 period, except for beverage concentrates which increased by only 5%.

prepared by the author, using data from annual reports

The strong brand portfolio and strategic positioning in key high growth product segments were among the main reasons why KDP performed better than its high quality competitors in the soft drinks space.

This spectacular performance is now seen as a key risk factor for KDP by Wall Street analysts, who predict a sharp fall in the company’s coffee segment.

Seeking Alpha

Although the coffee segment is likely to experience some short-term headwinds, the analysts are not taking into account the long-term impact of the pandemic boost in demand. Namely, KDP’s strong brands command customer loyalty which is especially strong in segments such as coffee. Moreover, the pandemic brought increased customer awareness and trial of KDP’s products which will be beneficial over the long term.

As mentioned previously, Keurig household penetration continued to be exceptional, adding eight million new households to the Keurig system since 2018. Further demonstrating the power of the Keurig system, for the first time ever, unit market share of Keurig compatible brewers surpassed traditional drip coffee makers in the fourth quarter.

Source: KDP Earnings Transcript Q4 2021

Improving Return on Capital

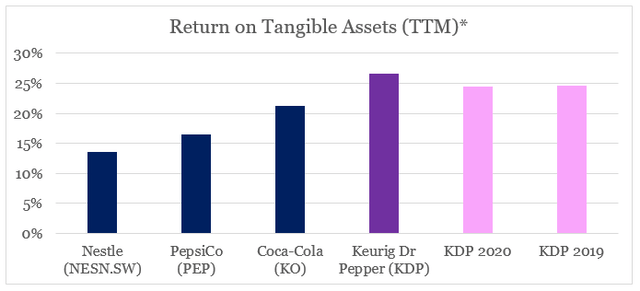

In addition to business expansion, KDP also improved its return on tangible assets over the last year. As a matter of fact, KDP has the highest return on assets, once we account for goodwill and intangible assets.

prepared by the author, using data from annual reports

* Net Income / Tangible Assets

** KDP 2021 result adjusted for 524m gain on sale of equity method investment

The reason for this improvement was twofold:

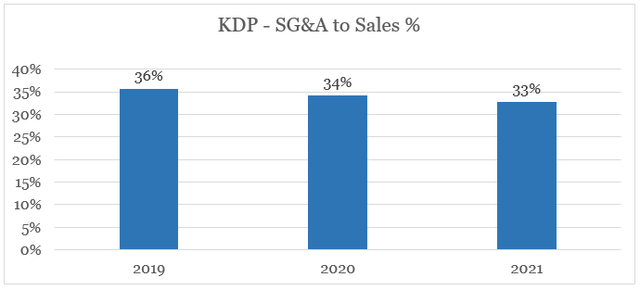

- Selling, general and administrative expenses are falling as a share of revenue.

prepared by the author, using data from annual reports

Even as KDP sales grew from $11.1bn in 2019 to $12.7bn in 2021, selling, general and administrative expenses grew by less than $200m – from $4.0bn to $4.2bn. That was largely achieved by economies of scale and synergies related to the merger.

Adjusted operating income in the quarter grew 6.1% to $910 million driven by the increase in adjusted gross profit and the benefits of productivity and merger synergies that favorably impacted SG&A, as well as $70 million gain in the quarter from our strategic asset investment program.

Source: KDP Earnings Transcript Q4 2021

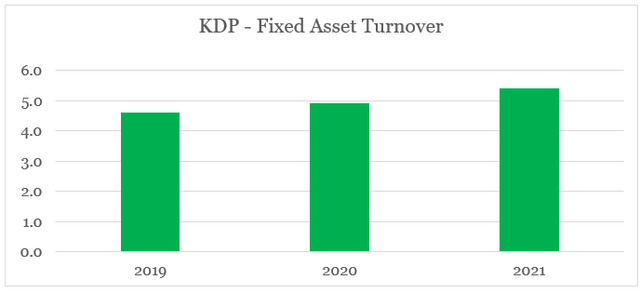

- Higher capacity utilization provided a tailwind for fixed asset turnover.

Fixed asset turnover continued to improve over the course of 2021 as KDP is rebuilding its inventory levels following the pandemic.

prepared by the author, using data from annual reports

Although asset turnover could cool-off in 2022, KDP remains one of the most efficient soft drinks companies in the world and the ability to reinvest profits in its high return on capital business model is what long-term shareholders should be after.

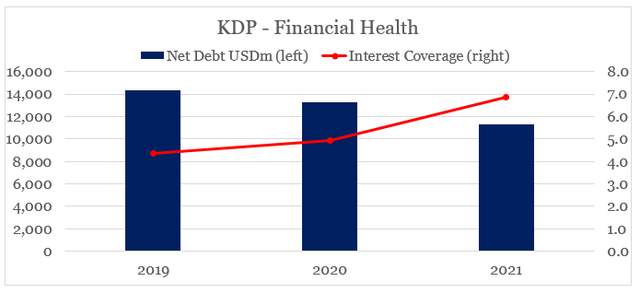

Reducing Financial Risk

As I highlighted in my thought piece “Keurig Dr Pepper: Under-Owned And Well-Positioned To Compete“, one of the major risks for the company is its high debt level. In the analysis from last April, I showed how financial risk of KDP compares to other large Packaged Food & Beverages companies. I also wrote the following:

So far, management has been doing an excellent job at reducing the $16bn of net debt following the Dr Pepper Snapple deal. In about two and a half years, the company reduced its net debt by around $2bn to around $14bn as of Q4 2020.

Source: Seeking Alpha

During the last year, KDP management significantly reduced its net debt to below $12bn, while at the same time significantly improving the interest coverage ratio.

prepared by the author, using data from annual reports

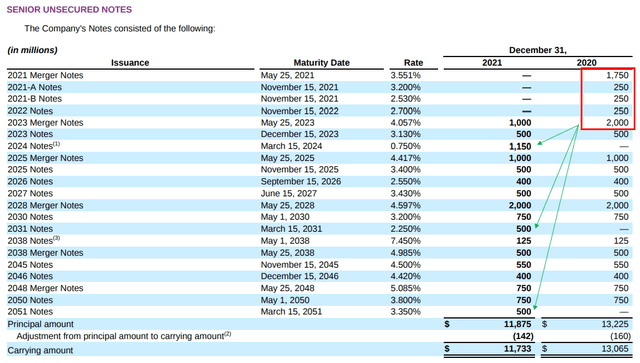

Last year I also commented on the need for further improvements in the debt maturity profile and this is exactly what happened over the course of last year. When compared to end of 2020 debt schedule, notes due in next year (2021) were extended to low rate notes due in 2024 as well as long duration notes due in 2031 and 2051.

Conclusion

Keurig Dr Pepper is a company that attracts far less attention by Wall Street, when compared to Coca-Cola and PepsiCo. Although, it is much smaller in size and predominantly operating in North America, KDP has an exceptionally strong business model backed by a number of iconic brands. KDP did underperform its high quality peers on an absolute basis over the past year, however, fundamentally the business is on an even stronger footing that it was back in January of last year.

Be the first to comment