Tim Boyle/Getty Images News

One of the largest and most iconic food companies in the world today is none other than Kellogg Company (NYSE:K). From its humble founding back in 1906 through today, the company has grown into a global brand focused on a variety of food products like snacks, frozen breakfast items, noodles, and more. The company is especially well known for its cereal products. From time to time, large companies like this will make the decision to sell off or spin off some of their operations in the hopes that the remaining enterprise or enterprises will be able to create even more value for shareholders by allowing management to focus on core quality assets. On June 21st, the management team at Kellogg made that leap, announcing their decision to split the company into three separate operations. Although some uncertainty does exist, it is likely that this maneuver will help generate more value for shareholders than if the company remained as it has been. Add on top of this the fact that the company seems to be reasonably priced at this time, and I cannot think of a reason not to rate it a ‘buy’ prospect.

Kellogg’s spin-off: A monumental decision

Kellogg

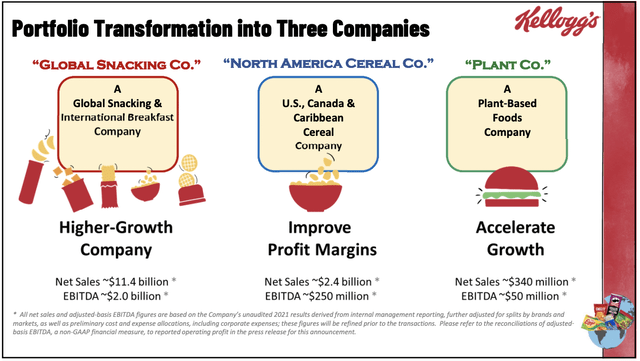

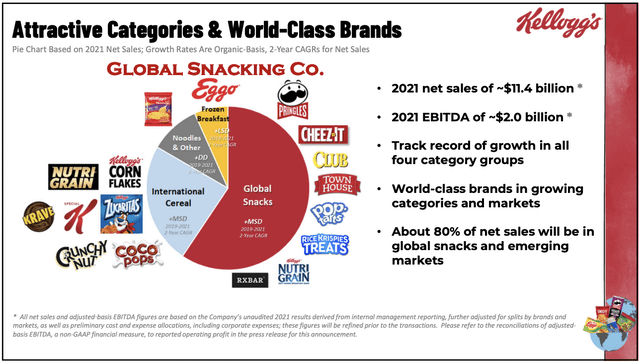

As I mentioned already, on June 21st, the management team at Kellogg announced plans to split its operations off into three standalone firms. Management has assured investors that the transaction will be done on a tax-free basis and it is being done for the purpose of better positioning its assets in order to unlock additional value for investors. To best understand exactly what is happening, we should dive into which assets are going where. For starters, the majority of the company’s assets will fall under what management is currently calling ‘Global Snacking Co’. Using data from the 2021 fiscal year, this particular standalone enterprise will account for $11.4 billion of the roughly $14.1 billion in the current entity’s revenue. Sales here will center around the global snacking operations of the business, as well as on its international cereal and noodles operations and on its North American frozen breakfast products.

Kellogg

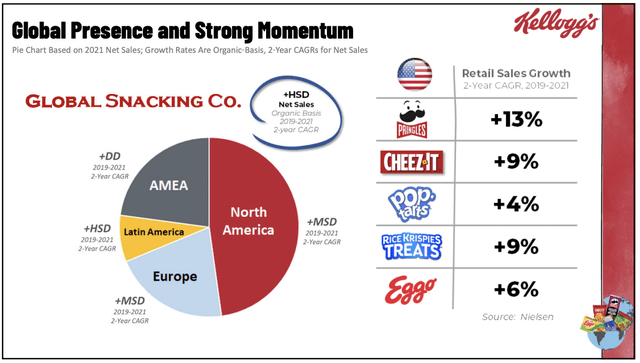

Products included under the global snacks category include Pringles, Cheez-It, Club, Town House, Pop-Tarts, Rice Krispies Treats, Nutri-Grain, and others. Under the international cereal operations, product lines include Corn Flakes, Coco Pops, Crunchy Nut, and others. The noodles and other category largely consists of its own branded noodles products, while the most iconic brand under the frozen breakfast is Eggo. Geographically speaking, nearly half of the revenue associated with this new enterprise will come from North America. However, it will also have a significant presence in both Europe and the AMEA (Asia, Middle East, and Africa) regions. Some operations are also located throughout Latin America.

Kellogg

For investors who have followed Kellogg for a long time, this should not be viewed as much of a surprise. For years, management has been positioning the enterprise as a snack-oriented firm. Back in 2012, for instance, management acquired the Pringles brand. In 2015, the company made various acquisitions and entered into various partnerships throughout Africa. In 2016, they made a purchase in the snacks category in Brazil. Snacks expansion by means of organic growth and acquisitions continued in 2017, while the company continued to place an emphasis on Africa by making additional investments and focusing on consolidating certain operations. Along the way, management was also diligent in selling off non-core assets.

As a result of the $11.4 billion in revenue generated from this particular enterprise, the company anticipates EBITDA associated with it of roughly $1.97 billion. This represents approximately 86.8% of the combined company’s overall profitability. Moving forward, management has high hopes for this unit. They expect growth to be fairly strong, with organic revenue likely expanding at a high single-digit rate. For instance, in the two years ending in 2021, the Pringles brand experienced an annualized growth rate of 13%. Cheez-It also grew at a rapid 9% rate, while Rice Krispies Treats matched that. For investors focused on attractive growth and strong cash flows, especially cash flows that come from industry-leading brands, this would be the business to hold onto.

Kellogg

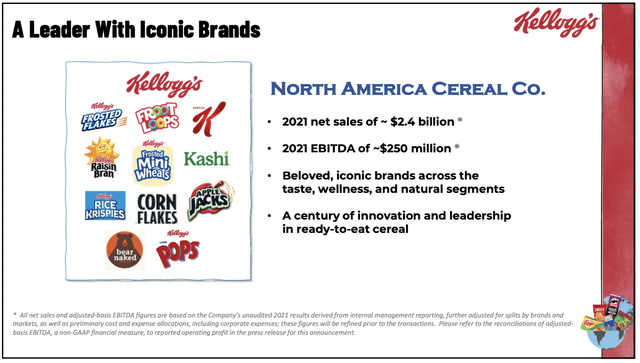

Of course, there are other operations to focus on. The second-largest company that will come from this transaction is what management currently refers to as the ‘North America Cereal Co’. This firm will focus on leading cereal brands sold throughout the US, Canadian, and Caribbean markets. Top brands that fall under this include Kellogg, Froot Loops, Raisin Bran, Bear Naked, and more. What makes this standalone company so interesting is the fact that it currently has a leading market share across many of its brands. For instance, on the whole, it has the #2 market share throughout the U.S., with five of the top 11 cereal brands in the country under its umbrella. It also has a number one market share position in both Canada and Puerto Rico. Management seems less concerned about growth for this business and more concerned about nurturing these quality brands and paying out what they deem an ‘attractive’ dividend. Overall revenue associated with this company should be around $2.4 billion, with EBITDA of roughly $250 million.

Kellogg

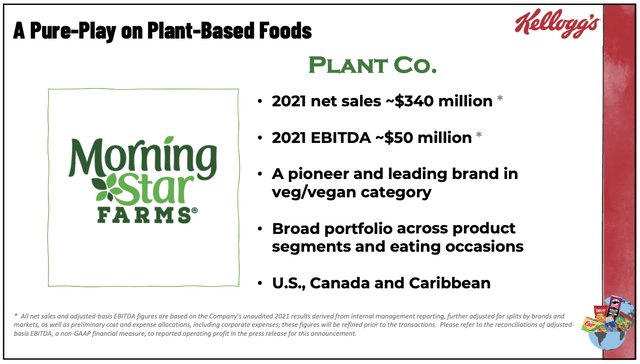

And finally, we have the smallest entity that will come from this transaction. This is currently being referred to as ‘Plant Co’. As the name suggests, this particular enterprise will focus on being a pure-play plant-based foods company. Management says that the primary brand under this unit is Morningstar Farms. annualized growth for this brand over the past few years has been roughly 8.2%. According to management, this enterprise will generate annual revenue of roughly $340 million and EBITDA somewhere around $50 million. This should prove particularly appealing for investors who are interested in a small, fast-growing enterprise.

The process to split off such a large and complex organization is long and tedious. Currently, the company sees both spinoffs taking place no later than the end of 2023. In the meantime, it may make sense for investors to consider adding Kellogg to their portfolios. Using data from 2021, for instance, the company is currently trading at a price to adjusted operating cash flow multiple of 13.4 and at an EV to EBITDA multiple of 13.3. To put this in perspective, I decided to compare the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 8.3 to a high of 25.7. And using the EV to EBITDA approach, the range was from 5.4 to 22.8. In both cases, three of the five companies were cheaper than Kellogg. Although this means that the company looks more or less fairly valued compared to similar firms, the potential for unlocked value stemming from these spinoff activities could be valuable for investors.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Kellogg Company | 13.4 | 13.3 |

| McCormick & Co (MKC) | 25.7 | 22.8 |

| Hormel Foods (HRL) | 20.4 | 17.9 |

| Tyson Foods (TSN) | 8.3 | 5.4 |

| The Kraft Heinz Co. (KHC) | 8.9 | 13.1 |

| J. M. Smucker Co. (SJM) | 11.8 | 11.8 |

Takeaway

These are exciting times for Kellogg and its shareholders. Nobody knows what the future holds, but what data we do have suggests that the company, on the whole, is fairly attractive from a valuation perspective. On top of this, the company will likely benefit from its decision to split off certain assets and focus its energies on what remains. There still exists plenty of time before investors need to commit to a specific approach following the spin-offs. For those who want a large and stable company with attractive growth, the global snacking enterprise will probably make the most sense to hold onto. For those wanting a true bellwether open investment with strong cash flows and attractive cash payouts, the North American cereal operations will be the most sensible. And for those who want a fast-growing company in a niche market, the plant-oriented enterprise is worth considering. All things taken into consideration, I believe that there is sufficient evidence to suggest that upside for the company will be rather appealing moving forward. And as such, I have decided to rate it a ‘buy’ for now.

Be the first to comment