PeopleImages/iStock via Getty Images

JFrog Ltd. (NASDAQ:FROG) is a DevOps software company whose suite of products and services promise to deliver software from developer to device without friction. FROG initially received a positive response to its last earnings report. The stock even managed a bullish breakout above its 200-day moving average (DMA) (the blue line in the chart below), FROG’s first trip into such trading territory. Less than three weeks later, the market returned all the post-earnings gains. The stock market’s fickle reaction begs the question: did FROG report positive results with encouraging guidance? I think so. However, companies with little to no profitability in the here and now have a high bar to hurdle over market sentiment. FROG is caught in that sentiment drag so strong results have yet to deliver price stabilization.

JFrog Ltd (FROG) remains stuck in an extended downtrend. (TradingView.com)

Seeking Alpha author Arne Verheyde provided a good summary of the financials and headline guidance. I agree with the conclusion that FROG is reasonably priced for a company with strong prospects to grow revenues through customer retention and new customers convinced by existing, compelling use cases. “Reasonable” is an 8 forward price-to-sales (P/S) ratio and 9 trailing P/S versus what was 15-20 in the 14 months after the IPO.

JFrog’s valuation is well off the initial highs. (Seeking Alpha)

Here I build on Verheyde’s conclusions by taking a look at key highlights from the earnings conference call and the earnings presentation.

JFrog’s Guidance

Guidance is the most important part of an earnings release. JFrog provided refreshingly detailed and extensive guidance given the current macro-economic environment typically makes such an exercise very challenging. Management’s confidence comes from “an increased demand for our cloud solution, more usage in the cloud coming from new customers and existing customers” and expansion with existing customers. Moreover, the strategic sales teams continues to break company sales records. Even with IT budgets likely facing pressure in the second half, management still sees an underlying long-term 30%+ revenue growth rate. Given this confidence, I am willing to lock in JFrog’s guidance story until proven guilty. The key highlights include projections with tight ranges for both Q3 and the full-year which together suggest management has good visibility in the business.

- Mid-50% baseline growth rate for the cloud business “with potential upside from increased customer usage as we saw in the first half of 2022.” (emphasis mine)

- Gross margins 83% to 84% during H2, trending long-term towards 80% given the higher margin cloud business is grabbing an increasing share of revenue.

- Breakeven for fiscal year 2022.

- Q3: revenue $70.5M to $71.5M million, non-GAAP operating profit -$0.5M to +$0.5M, non-GAAP earnings per diluted share -$0.01 to +$0.01

- Full fiscal 2022: increased revenue range to $278.5M to $280.5M, non-GAAP operating income -$1M to +$1 million, non-GAAP earnings per diluted share -$0.01 to +$0.01

I did not identify anything alarming in the GAAP to non-GAPP reconciliations reported at the end of the earnings presentation.

Management explained why and how the migration to the cloud is boosting JFrog’s business, including increasing net revenue retention (and thus supporting confident guidance). The migration to the cloud creates more data transfers, “more binary movements in the cloud between regions, between different deployments.” Companies take headcount savings and invest more in JFrog services and even add more capabilities. These customers are transitioning from lower subscriptions to a full cloud platform. Management reported a large range for these upsells of 20% to 80%. The upsell percentage depends on the customer use case.

Management provided solid guidance despite acknowledging some small hiccups in the business environment. Indeed, the company assured analysts that it took into account “the current macroeconomic headwinds emerging globally.” Specifically, JFrog started to experience longer sales cycles for new, large deals. During the Q&A, management clarified that the longer time to close comes from extra levels of required approvals. I was not clear whether management expects these cycle times to come back down on the other side of the global economic headwinds. Management also identified “slower levels of DevOps adoption” in Asia Pacific, the company’s smallest region for revenue.

Compelling Use Cases

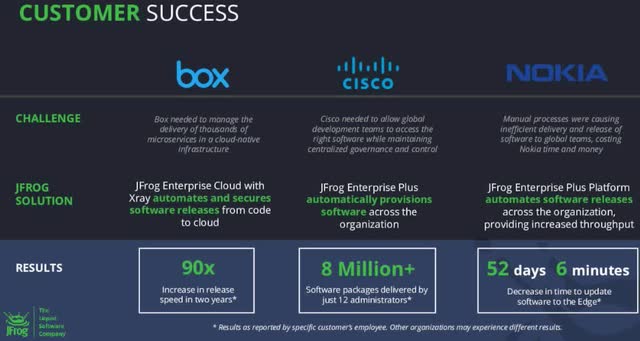

Management’s guidance looks even more solid given compelling use cases. The company always provides uses cases in its earnings calls, but these still deserve call-outs given the economic environment and recession fears. Management talked to examples of unidentified companies. The earnings presentation identified three specific companies which include end results.

Examples of customer success for JFrog (JFrog Earnings Presentation)

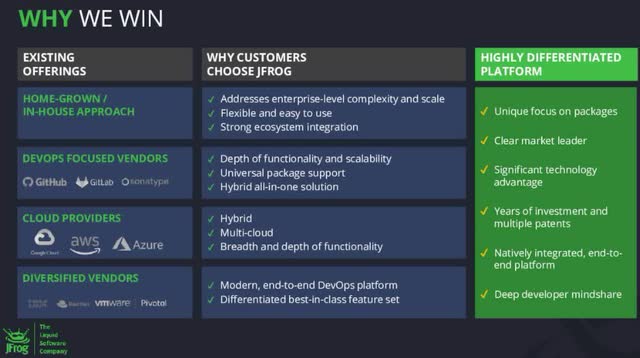

I also liked this table explaining why JFrog wins in the marketplace. The choice points and the market differentiation speaks to a solid platform with a lot of runway ahead.

JFrog has a compelling case for continuing to win. (JFrog earnings presentation)

Cost Control

With an eye to getting to breakeven, JFrog is reviewing its headcount growth. Management is also reviewing what projects it needs to postpone or end because of insufficient ROI.

Investing in the Business

The drive to breakeven still incorporates notable investments in the business. JFrog continues to push research and development projects in its Advanced Security Package, IoT (internet of things), scaling JFrog Connect products, increasing the efficiency of its cloud business, and improvements in Artifactory (a core product). The complexity of JFrog’s product and services requires on-going investments. JFrog is rolling out its Advanced Security Package this quarter. Material financial results will come after Q4.

Per the company’s 10Q, JFrog increased R&D spending 73% year-over-year for Q2 and 84% year-over-year for the first half of the year. Management did not provide specific guidance on R&D spending.

Conclusion: Staying Patient

With the price dive back under the 200DMA, FROG remains in a persistent downtrend starting from the all-time high set soon after the September, 2020 IPO. Accordingly, FROG has under-performed other software growth stocks that did not peak until last November. That under-performance is particularly stark against peers (selected by Seeking Alpha) in the 9-month, YTD, and 1-year total returns.

FROG has some catching up to do…which hopefully translates in significant future upside. (Seeking Alpha)

Thus, it seems the market is still trying to figure out the price it wants to pay for FROG’s high potential business. As a result, I am staying patient before adding to my existing position. I want to see the price action stabilize first. If I had no position, I would start buying small amounts in anticipation of stabilization. The May/June sell-offs seem to have created a technical double-bottom in the stock (see the chart above) which could provide the precursor for stabilization. If those lows break, then I will reset the clock on patience.

Be the first to comment