zhazhin_sergey/iStock via Getty Images

A Quick Take On J-Star Holding Co., Ltd.

J-Star Holding Co., Ltd. (YMAT) has filed to raise an undisclosed amount in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides carbon reinforcement and resin systems for various end products.

YMAT has produced uneven growth but is slightly profitable.

I’ll provide an update when we learn more IPO details from management.

Company & Technology

Taichung City, Taiwan-based J-Star was founded to develop carbon composite structures for a wide variety of consumer and other products.

Management is headed by Chairman and CEO Jing-Bin Chiang, who has been with the firm as CEO of the group since May 2016 and was previously Chief Financial Officer at LCY Elastomer, a thermoplastic rubber manufacturer with a factory in Houston, Texas.

The company’s primary offerings include carbon composite products used in:

J-Star has booked a fair market value investment of $15.3 million as of June 30, 2021 from investors including New Moon, Radiant Faith, Star Centurion and Barium Glory Financial.

J-Star – Customer Acquisition

The company seeks customers among equipment manufacturers in the industries of bicycles, tennis racks and other products such as automobile parts and healthcare products.

The firm’s customer base for its bicycle parts and tennis rackets segments is located primarily in Western Europe.

Sales of bicycle parts accounted for 65.9% of its revenue for the six months ended June 30, 2021, while tennis racket products represented 34.1% of the revenue mix.

Selling expenses as a percentage of total revenue have dropped as revenues have fluctuated, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2021 |

5.9% |

|

2020 |

6.3% |

|

2019 |

8.5% |

(Source)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling spend, swung back into positive territory in the most recent reporting period, as shown in the table below:

|

Selling |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2021 |

3.6 |

|

2020 |

-0.4 |

(Source)

J-Star’s Market & Competition

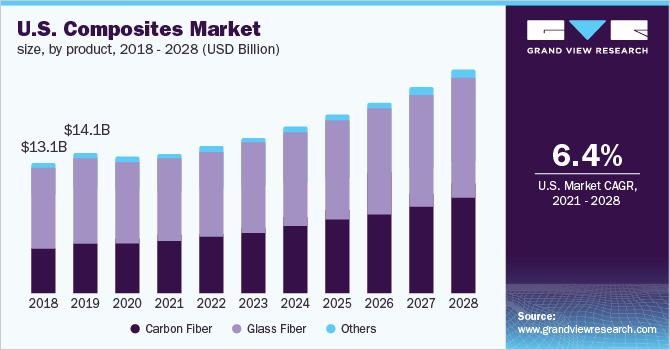

According to a 2021 market research report by Grand View Research, the global composites market was an estimated $86.4 billion in 2020 and is forecast to reach $144 billion by 2028.

This represents a forecast CAGR of 6.6% from 2021 to 2028.

The main drivers for this expected growth are a growing demand for higher performance materials with lighter weight in major industries such as transportation, wind energy, aerospace and defense.

Also, below is a chart showing the recent historical and projected future demand of various types of composites in the U.S.:

U.S. Composites Market (Grand View Research)

Major competitive or other industry participants include:

-

Teijin Ltd.

-

Toray Industries

-

Owens Corning

-

PPG Industries

-

Huntsman

-

SGL Group

-

Hexcel Corporation

-

DuPont

-

Compagnie de Saint-Gobain S.A.

-

Weyerhaeuser Company

-

Momentive Performance Materials

-

Cytec Industries (Solvay. S.A.)

-

China Jushi Co.

-

Veplas Group

-

Kineco Limited

J-Star Holding’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Uneven topline revenue growth

-

Growing gross profit and gross margin

-

Reduced operating profit

-

A swing to cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2021 |

$ 12,184,064 |

27.3% |

|

2020 |

$ 22,178,572 |

-2.7% |

|

2019 |

$ 22,786,951 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2021 |

$ 4,484,340 |

86.3% |

|

2020 |

$ 7,361,667 |

60.6% |

|

2019 |

$ 4,583,825 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2021 |

36.80% |

|

|

2020 |

33.19% |

|

|

2019 |

20.12% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2021 |

$ 692,951 |

5.7% |

|

2020 |

$ 1,700,077 |

7.7% |

|

2019 |

$ 11,131,795 |

48.9% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2021 |

$ 968,012 |

7.9% |

|

2020 |

$ 940,595 |

7.7% |

|

2019 |

$ 11,011,108 |

90.4% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2021 |

$ (2,338,841) |

|

|

2020 |

$ 874,538 |

|

|

2019 |

$ (1,414,527) |

|

(Source)

As of June 30, 2021, J-Star had $928,772 in cash and $26 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2021, was negative ($1.7 million).

J-Star Holding’s IPO Details

J-Star intends to raise an undisclosed amount in gross proceeds from an IPO of its ordinary shares.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

approximately 25% for acquiring and investing in production plant in the U.S. for the production of electric bicycle;

approximately 25% for purchasing equipment for our second production plant in Yangzhou, the PRC, for the production of key structural parts of electric bicycle, robotic arms, automobile and prepreg material;

approximately 15% for investment on electric bicycle and sports bicycle brands in Michigan State, the U.S., through acquisition, joint venture and/or co-branding production;

approximately 15% for establishing our R&D center in Houston, the U.S., for developing automation and advanced composite material and chemical technologies;

approximately 15% for general administration and working capital; and

approximately 5% for establishing our sales and administration office in Houston, the U.S., to closely work with our office in Taiwan on U.S. market sales and expansion.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says it is not aware of any legal proceedings that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is ViewTrade Securities.

Commentary About J-Star’s IPO

YMAT is seeking U.S. public capital market funding to increase and broaden its production capacity in the PRC and in the U.S.

The firm’s financials have produced variable topline revenue growth, increasing gross profit and gross margin, lowered operating profit and a swing to cash used in operations.

Free cash flow for the twelve months ended June 30, 2021, was negative ($1.7 million).

Selling expenses as a percentage of total revenue have dropped as revenue growth has varied; its Selling efficiency multiple swung back into positive territory at 3.4x in the most recent reporting period.

The firm currently has no specified dividend policy and said any future decisions on dividends would be made by the Board at that time.

The market opportunity for composites is quite large and expected to grow at a moderately quick rate of growth over the coming years, so the firm has favorable industry growth dynamics as a tailwind to its expansion efforts.

ViewTrade Securities is the lead underwriter and there is no data on IPOs led by the firm over the last 12-month period.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

When we learn more details about the IPO, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment