Young777/E+ via Getty Images

There’s a lot of puts and takes with Cleveland-Cliffs’ (NYSE:CLF) last earnings release, highlighting much of what makes the commodity environment so peculiar right now. Effects from Russia, but also an eventual economic burst in China due to an overheating property market, have both applied various effects on the price of steel. Moreover, input prices continue to rise, with increases in coke and coal prices being one of the most unexpected consequences of the pandemic and the Ukraine invasion. On balance, we think the situation is good for CLF though. Steel prices don’t have too many risk factors at this point in time, and booking effects have understated 2021 EBITDA. Moreover, there are some offsetting effects for CLF if the rate environment becomes really unfavourable for equities. So for a mid-cycle expectation baking into the low multiple, despite things looking directionally good for CLF, we think it remains attractive despite trading at pretty high levels.

Is CLF Stock Overvalued?

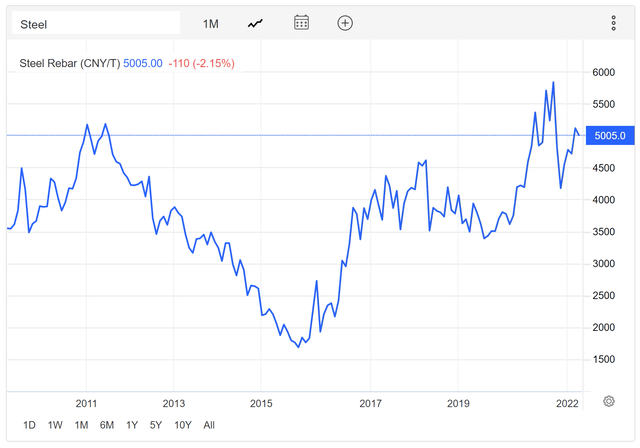

That’s the big question, and we don’t think it is, although when looking at the way the price has evolved, wondering if it’s overvalued is certainly not unreasonable. The environment has been good for commodity companies to be sure, and steel prices are substantially advanced from levels before COVID and all the disruptions that followed it.

Steel Prices (tradingeconomics.com)

The multiples for CLF are consequently very low, as the great environment has meant a ballooning of denominators. These sorts of multiples appear despite a run-up in price as markets remain cognizant of the fact that things work in cycles. The notion of cycles is of course a fundamental force that affects all sorts of phenomenon, especially the prices of commodities where demand begets higher prices which begets supply which lowers prices, etc.

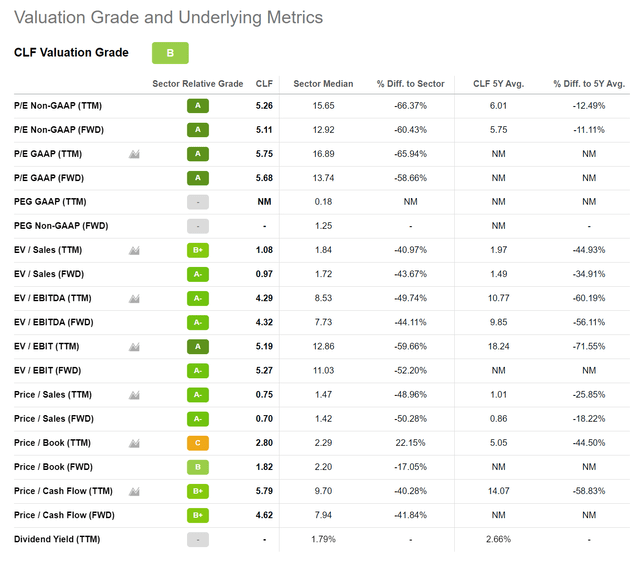

Let’s have a quick look at CLF’s key metrics on valuation.

Seeking Alpha Valuation Score (Seeking Alpha)

For all the metrics except the ones that don’t apply well to a commodity business like Cleveland-Cliffs, the valuation scores are really high. Indeed, the outlook remains strong enough for the price of steel where a 5.75x PE ratio really is selling the story short, where disruptions in the markets can really keep the current levels for long enough to ensure a good deal of payback. So the metrics tell us that there are places in the market where the steel story is better appreciated. Or perhaps we’re seeing the impact of pension obligations not being included in the EV. Let’s take a more thorough look at the forces that CLF is facing to see if it squares with the valuation.

What is The Outlook For Cleveland-Cliffs?

Let’s go through the forces playing in favour and against CLF in terms of future performance.

Positives For The Investment Case

- While rate hikes will hurt equities, and probably also CLF and its businesses which are buoyed by low rates like automotive, CLF is weighed down by very substantial pension obligations over $5 billion, or 30% of the market cap. If rates rise, these obligations fall meaningfully. If rates were to rise by about 2% over the coming quarters, then the value of these obligations would fall by about $2 billion. With pension obligations being a peculiarity that might explain why CLF appears relatively undervalued.

- 45% of sales are being made on fixed contracts that are being priced up due to the commodity environment, and eliminate much of the volatility that would be associated with a commodity business selling on index based contracts. This creates a lot of price and cost stability in longer term agreements that helps insulate the company but also vendors and clients from volatility in the commodity markets. With CLF’s multiple being so low, and with investors looking for a certain amount of guaranteed payback before cycles inevitably turn, these fixed contracts are a boon to the investment case. The company is growing these types of contracts in its sales mix too.

- There was a major under-booking of revenues in FY 2021 due to the timing of some major contracts. Apparently, with a slight date change on some contracts, the EBITDA would be $500 million higher this year, or over 10% higher on a $4.9 billion EBITDA earned in 2021. The tailwind here is that these profits will appear in the next quarter, and explain the more negative revisions score that CLF got in the Seeking Alpha quant grades.

- Russian oligarchs are involved in the world of steel, and the productive assets that they control could be barred from outputting into the western bloc’s markets. Naturally, the risk on Russian supply is causing traders to give a premium to cleaner sources of steel, which is driving up prices in the markets. With the Ukraine war even less likely now to stop than before due to greater support from the west of Ukrainian forces, but also as alleged atrocities make Zelensky constituents less willing to give concessions in negotiations, the premium given to non-Russian steel will remain.

- Finally, steel prices still haven’t seen the support promised by the stimulus from the Chinese government for their local and quite beleaguered economy. With the zero COVID policy having essentially failed for China, and with the property markets in quite a bit of turmoil, these stimulus moves will be very welcome. Remember, unlike the west, China never actually went down the path of major stimulus as a response to COVID. They managed to start controlling the situation there with draconian measures while Europe and the US had only just started realising that COVID was going to be a big problem in 2020. So the stimulus cannon is only now loading up in China and could meaningfully move the needle of economic growth there.

- While key markets like automotive are suffering, CLF is winning share due to higher quality assets. Competitors will have to CAPEX to improve the quality of their output while Cleveland-Cliffs won’t. CAPEX plans remain modest and cash flow generation unhindered for CLF compared to competitors.

While the clients do not tell us why they are taking the order away from another steel company and reassigning this specific item to Cleveland-Cliffs, we can only assume that these other steel companies are not meeting the automotive industry’s high standards. That’s probably why these competitors have to invest several billions of dollars to play catch-up. Cleveland-Cliffs does not have to spend this type of money and will not.

Lourenco Goncalves, CLF CFO

So CLF has going for it a more predictable and less volatile stream of cash with fixed and longer term contracts and premiums on steel prices due to an unfortunately persistent conflict with Russia, incoming stimulus in China and a windfall coming in next quarter as a consequence of revenue booking effects. But there are some issues that the company faces as of now.

Negatives to the Investment Case

- The big one is that almost half of CLF’s steel goes to automotive, and lower shipments has been what has driven sequential declines of EBITDA from Q3 to Q4 in 2021 from $1.9 billion to $1.5 billion. Naturally, we are dealing with the semiconductor issue here which continues to affect automotive production. This will probably be an issue for the whole of 2022 as well, and is accounting for about a quarter’s worth less of tonnage sold than what would have been sold had automotive been unhampered. It’s a meaningful loss of scale, and is unfortunate as the company cannot capitalise on the pent-up demand in automotive which may be depleted as a result of the incoming rate hikes.

- Input prices are increasing, namely of coal and coke, and they are not being fully offset by increases in selling prices because the longer fixed term contracts means that it’ll take some time for contract rollovers to allow those price increases to be passed on. If monetary authorities are not impotent, hopefully rate hikes will be able to put a stop to those price increases together with reducing pension burdens. But if supply side issues are going to dictate inflation to the extent that monetary action doesn’t really impact inflation, which is currently our view on markets, then the macroeconomic conditions could hurt CLF on balance here.

Is CLF Stock A Buy, Sell, Or Hold?

The positives are pretty clear, and directionally there are forces playing in CLF’s favour. Moreover, while a negative for now, pent-up demand in automotive could eventually materialise into restored markets there, which could be another force to keep up steel prices and support tonnage and scale to the benefit of CLF. This would happen maybe next year once automotive bottlenecks finally start to clear up.

The main risk is macroeconomic. It is hard to know what will happen once rates are hiked. Surely equities are going to suffer, and all the private leverage is going to start costing individuals and businesses. But the real scare is that higher rates might do little to stem inflation, which would result in textbook and broad stagflation in the markets. Consumer durables like cars would of course suffer, and while there is a housing shortage, construction that support steel markets may take a hit as well. It’s hard to say what will happen, but the macroeconomic risks around interest and inflation rates is what could take the market and CLF down.

However, the multiples are really low for Cleveland-Cliffs. A 5.75x PE implies an earnings yield just shy of 20%, and a payback period of a little more than 5 years. Steel prices are already doing a repeat performance of 2021 levels, and China and Russia will be forces to keep steel prices within the ranges to produce a similar EBITDA as in 2021. Moreover, the effect of rate hikes on the economy is still pretty debatable, and the Fed does have a double mandate, and markets have been protected and paid attention to by them in the past. With an eventual automotive recovery, that’s another pill that can burst and salve steel markets a little further down the line with pent-up demand. We only need a couple more good years to ensure that the 5.75x PE paid was a bargain price, even if the cycle eventually does turn. And with the CLF earnings quality rising as a consequence of a larger share of fixed contracts and a higher quality asset base keeping their CAPEX needs lower than competitors, there is a quality angle in CLF as well. On balance, it strikes us as an interesting enough exposure, and certainly more of a buy than a sell.

Be the first to comment