PhonlamaiPhoto Singular Research

Investment Thesis

IRMD reported strong Q4:22 results, essentially driven by strength in its monitors segment, which we believe is continuing to maintain strong momentum. The Company is on the cusp of regulatory approval of its next-generation IV pump, the MRidium 3870. The U.S. FDA approval of MRidium 3870 is lagging more than anticipated and the Company is resubmitting the application; this product’s approval and commercial launch would help IRadimed (NASDAQ:IRMD) experience a new product cycle, thereby providing a new top-and bottom-line growth avenue. The total addressable market IRadimed operates in is quite substantial ($3.1 billion), and we expect IRMD’s MRI compatible devices to continue to gain market share given their superior safety and efficacy. We maintain a Buy rating for the Company given its high revenue growth, improving margins, and solid product pipeline.

Quarterly Summary

IRadimed revenues rose 25.2% YOY to $ $14.9 million in Q4:22 from $11.9 million in Q4:21 and improved 11% sequentially from $13.41 million in Q3:22. Patient Monitors sales grew 51% YOY to $6.1 million, continuing the strong growth momentum from Q3:22. However, IV Infusion Pumps sales decreased by 11% YOY (to $3.5 million). The device product mix was 63% monitors and 37% pumps. Revenues from Disposables grew a robust 32% YOY (to $4.5 million), which was a further acceleration in momentum that started in Q3:22. Disposables contributed 30% of total revenues. Domestic sales were 82.4% of total revenue, representing an increase compared to Q3:22 (80.6%), implying continued strength in the Company’s U.S. business. Ferro Magnetic Detection Systems (which contributed 1% of revenues) were also a growth driver.

Gross profit grew 21.3% to $11.2 million, even as the Company navigated supply chain challenges and an inflationary environment. Gross margin declined 241 bps YOY to 75.5% in Q4:22 versus 77.9% in Q4:21 due to these issues, partially offset by the price increase implemented in H2:21 and the favorable impact of higher domestic sales.

Operating profit improved 37% to $4.3 million in Q4:22 versus $3.1 million one year earlier. Q4:22 operating income benefited from significantly lower General and Administrative costs, partially offset by lower gross margins. Operating margins were 28.6%, a substantial improvement over 26.2% for Q4:21.

GAAP earnings were $3.7 million or $0.29 per share, a slight decrease from $3.9 million and $0.31 per share one year ago. Non-GAAP net income was $4.0 million or $0.32 per share, slightly below $4.2 million or $0.33 per share one year earlier.

IRMD launched a new product in Q3:22 – FMD (Ferro Magnetic Detection Systems), which contributed $194,130 to the Q4:22 revenue stream, a 208% sequential growth over Q3:22. The Company believes that the new FMD device will open doors and help secure new accounts for its IV pumps and patient monitors. In the area of product development, IRMD continues to advance its next-generation IV pump, the MRidium 3870, through the FDA. The Company provided some updates on the regulatory clearance of MRidium 3870. As a reminder, IRadimed had originally expected regulatory clearance in Q4:22, but now the Company expects to resubmit the regulatory application. Though the Company has not provided an estimate of the regulatory approval, we believe the Company is making progress in MRidium 3870’s regulatory process. Simultaneously, the Company is also working to obtain a CE Mark for the 3870, which will allow sales into the EU countries.

The Company announced a special cash dividend of $1.05 per share, which is payable to shareholders of record at the close of business on February 13th, 2023.

Primary Risks

IRMD business model is exposed to capital spending patterns of hospital and other providers.

Valuation

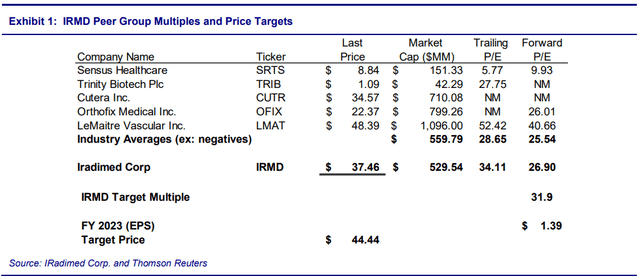

We value IRMD using a combination of multiples based on industry peer companies (a P/E multiple) blended with our Discounted Cash Flow or DCF valuation to derive a fair value target price for the Company.

We value IRMD at 31.9x FY:23 EPS of $1.39, a 25% premium to the average peer group multiple of 25.5x. We believe that a 25% premium is justified since IRMD is experiencing strong growth in its core business, is benefiting from a new product launch, and is better able to withstand supply chain and inflationary environment issues currently faced by its peers. Moreover, management is executing its strategy well and is practicing shareholder-friendly capital allocation. We weight this P/E multiple target to equal 50% of our price target. The multiple-based target price is $44.44.

We weight the other 50% of our target using our Discounted Cash Flow target. Our DCF model uses our forecasted free cash flow to the firm over the next one year and then grows EBIT at 20% in years two to four, 15% in years five to six, 10% in years seven to eight, and 3% thereafter. We apply a weighted average cost of capital of 8.4%. Our DCF produces a value of $58.12.

The combination of $44.44 at 50% and $58.12 at 50% results in a weighted average price target of $51.42, which we round down to $51.00.

Exhibit 1 compares IRMD to other medical device companies with similar-sized market capitalizations.

Be the first to comment