jetcityimage

By The Valuentum Team

Investors should steer clear of 3M Company (NYSE:NYSE:MMM) as there are better investment opportunities out there, in our view. The company’s potential legal liabilities have become sizable of late, it has a large net debt load on the books, and its outlook is deteriorating in the face of various exogenous shocks. Ongoing corporate restructuring efforts further complicate 3M’s outlook. While 3M is a solid enterprise that has historically been very shareholder friendly, we see shares of MMM facing sizable selling pressures for some time to come.

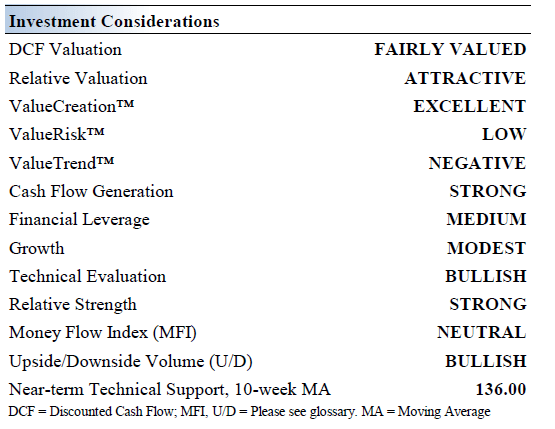

3M’s Key Investment Considerations

Image Source: Valuentum

3M is fundamentally a science-based company with an extensive patent portfolio. The company makes imaginative products, and it is a leader in many markets–from health care and highway safety to office products and abrasives and adhesives (though please note its business model is changing as 3M is in the process of spinning of various business segments, something that we will cover in just a moment). Believe it or not, the company started as a small mining venture in 1902.

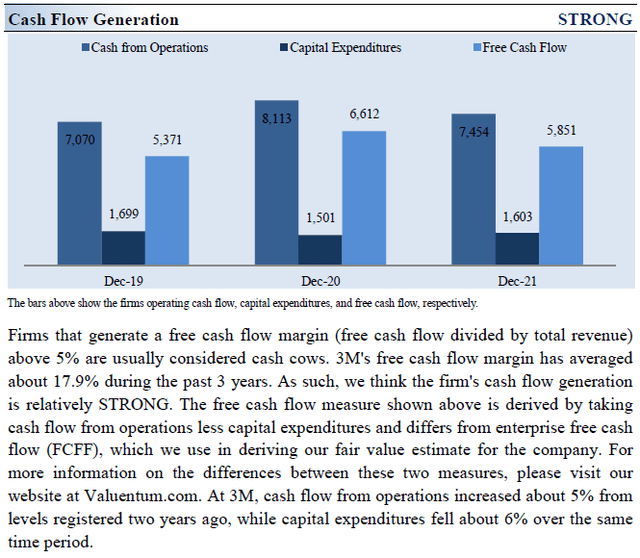

3M is a great cash flow generator and aims to post a free cash flow conversion rate of 90%-100% in 2022 (free cash flow divided by net income) according to the guidance released during its second quarter earnings update in July 2022. We define free cash flow as net operating cash flow less capital expenditures. The company’s top priorities for growth include connected safety, automotive electrification, and data centers, among others.

Its strong free cash flows have enabled the Dividend Aristocrat to grow its annual dividend over the past 60+ consecutive years. Management expects to grow the dividend in line with earnings over time while pursuing meaningful share repurchases as well. Rising raw material and logistical expenses are pressuring the outlook for 3M’s margins, however. The strong US dollar seen of late represents another hurdle for the firm, especially as it concerns its reported revenue performance.

The 3M “story” has a lot of hair on it. The firm is dealing with substantial PFAS-related legal risks (known derisively as “forever chemicals”), on top of the $850 million settlement reached with Minnesota in 2018. Its legal obligations on this front continue to grow and grow in the US and abroad. Furthermore, 3M is now exposed to substantial potential legal obligations stemming from defective earplugs it sold to the US military. In August 2022, a US federal judge ruled that lawsuits against 3M could proceed even though 3M placed the company that made the earplugs (Aearo Technologies) into bankruptcy proceedings. The company is facing hundreds of thousands of lawsuits from service members and will likely enter legal settlements worth billions and billions of dollars to settle these claims. 3M issued out a short statement on the issue in August 2022 that simply stated it, along with its subsidiary Aereo, intended to appeal the decision.

3M is incurring meaningful restructuring expenses as it seeks to improve its productivity. The company is preparing to spin off its health care operations through a plan announced in July 2022, with the new enterprise focused on wound care, oral care, healthcare IT, and biopharma filtration operations. 3M intends to complete the tax-free transaction by the end of 2023, and will initially retain a 19.9% stake in the new publicly traded company. Over time, that equity stake will get monetized. Additionally, 3M recently spun out its food safety business as the company has embarked on a major restructuring drive to improve its growth prospects and profitability metrics over the long haul.

There are a lot of moving parts to 3M’s investment thesis. In our view, the substantial legal risks facing the company combined with complexities arising from its ongoing restructuring initiatives will pressure shares of 3M for some time, with headline risks regarding legal proceedings representing a major downside risk to its stock price.

Earnings Update

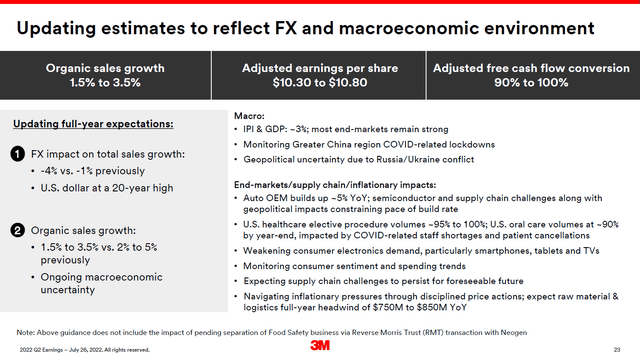

On July 26, 3M reported second quarter 2022 earnings that matched consensus top-line estimates and beat consensus bottom-line estimates. However, 3M lowered its full-year guidance for 2022 in conjunction with its latest earnings report with management citing “the strength of the US dollar is having an increasing impact on our top and bottom line, which is the primary factor driving our update to full year guidance” during the firm’s second quarter earnings call. The company’s latest guidance can be viewed in the graphic down below.

3M reduced its full-year guidance for 2022 during its latest earnings report. (3M – Second Quarter of 2022 IR Earnings Presentation)

During the second quarter, 3M reported that its GAAP revenues declined by 3% year-over-year to reach $8.7 billion. Weakness at its electronics-related and consumer businesses was cited by management during 3M’s latest earnings call as key reasons why its revenues declined, on top of headwinds facing the firm from the strong US dollar seen of late. Its GAAP operating income tanked from $2.0 billion in the second quarter of 2021 to $0.1 billion in the second quarter of 2022 as restructuring charges, costs associated with placing Aereo Technologies into bankruptcy, rising operating expenses, and headwinds facing its gross margins all took a heavy toll on its profitability. 3M posted $0.14 in GAAP diluted EPS last quarter, down 95% year-over-year.

While 3M still forecasts that its non-GAAP organic sales will grow by 1.5%-3.0% in 2022 (down from 2%-5% previously), please note that on a reported basis its revenues will be well below that growth rate (if not negative). Underlying demand for 3M’s offerings is holding up alright, but things are not going great for the firm.

During the first half of 2022, 3M generated $1.3 billion in free cash flow and spent $1.7 billion covering its dividend obligations along with $0.8 billion buying back its stock. There is room for 3M’s free cash flow performance to improve going forward after the firm experienced a large working capital build last quarter, which weighed negatively on its net operating cash flows. 3M generated $5.9 billion in free cash flow in 2021 and its run-rate dividend obligations stood at $3.4 billion last year.

At the end of June 2022, 3M had a net debt load of ~$13.3 billion (inclusive of current marketable investments and short-term debt). We caution that 3M’s net debt load indicates that the firm will likely need to turn to capital markets to raise funds to cover its potential future legal obligations, which could be quite substantial. Its bloated balance sheet and deteriorating outlook underpin why we think investors should steer clear of 3M.

3M’s Economic Profit Analysis

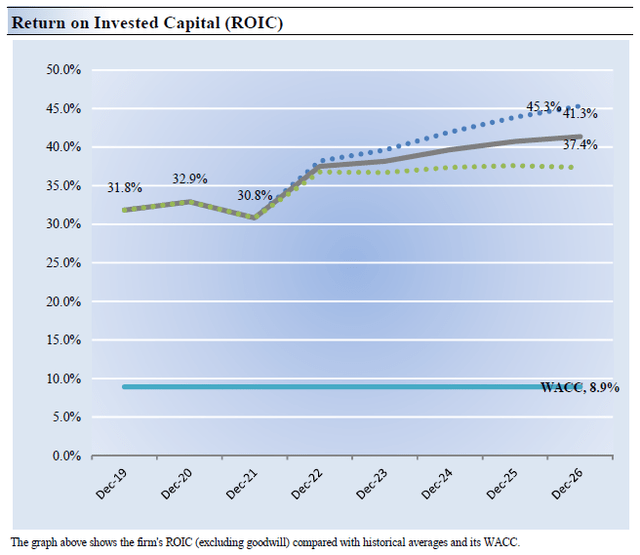

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital (‘ROIC’) with its weighted average cost of capital (‘WACC’). The gap or difference between ROIC and WACC is called the firm’s economic profit spread. 3M’s 3-year historical return on invested capital (without goodwill) is 31.8%, which is above the estimate of its cost of capital of 8.9%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Historically, 3M has been a solid generator of shareholder value and for now, we expect that will continue being the case. With that in mind, its business model is currently undergoing major changes and how those changes will impact its ROIC performance over the long haul remains to be seen.

3M’s Cash Flow Valuation Analysis

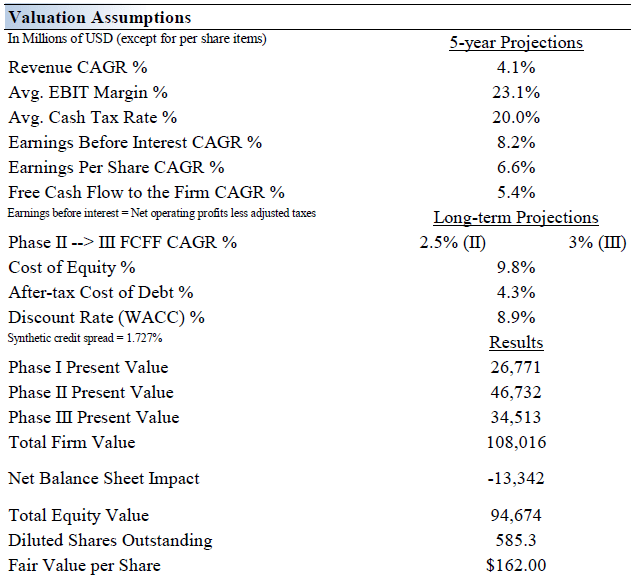

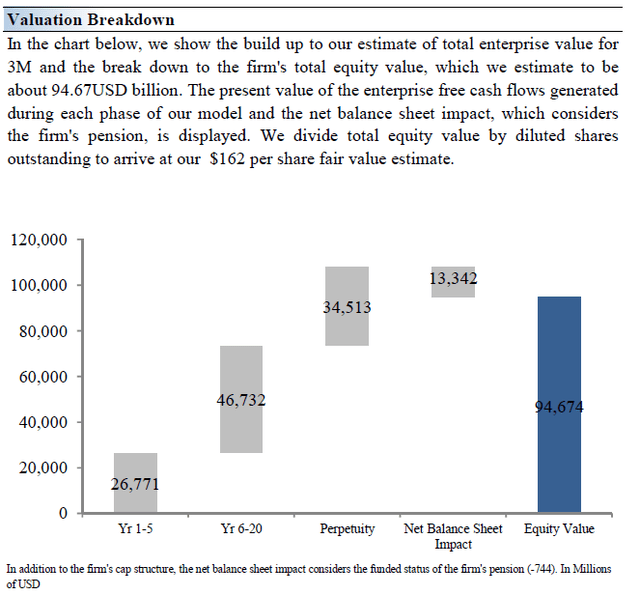

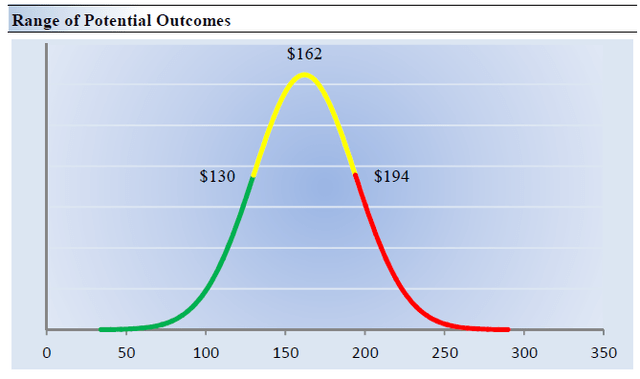

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of balance sheet considerations. We think 3M is worth $162 per share with a fair value range of $130.00 – $194.00. Shares of 3M are trading below the low end of our fair value estimate range as of this writing, indicating shares of MMM could be undervalued however, please note that our enterprise models do not incorporate the potential hit to 3M’s business that its various potential legal risks could result in. Should 3M’s net debt load swell higher to fund future potential legal settlements, that would weigh negatively on the intrinsic value of its equity.

The near-term operating forecasts used in our enterprise cash flow models, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 4.1% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of 2.6%. Our model reflects a 5-year projected average operating margin of 23.1%, which is above 3M’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 2.5% for the next 15 years and 3% in perpetuity. For 3M, we use an 8.9% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum Image Source: Valuentum

3M’s Margin of Safety Analysis

Although we estimate 3M’s fair value at about $162 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for 3M. We think the firm is attractive below $130 per share (the green line), but quite expensive above $194 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Very few firms have the free cash flow profile of 3M, and at its core, the company is a solid enterprise. However, its mounting legal risks and complexities arising from its ongoing restructuring programs underpin our view that investors would be better served looking elsewhere for dividend growth and capital appreciation upside. The company’s outlook is deteriorating, seen through the cut to its guidance during its second quarter earnings update. Should 3M reach legal settlements as it concerns its PFAS and earplug-related liabilities, then the company may be worth taking a closer look at, though for now, we wouldn’t touch 3M with a ten-foot pole.

Be the first to comment