Anne Czichos/iStock Editorial via Getty Images

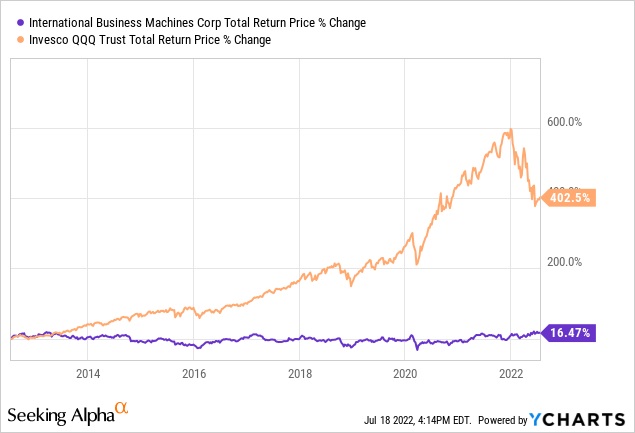

International Business Machines (NYSE:IBM), the artist formerly known as “Big Blue,” has seen better days. The once loved tech darling has struggled to beat 30 year Treasury bonds over the last decade and has lagged the Invesco QQQ Trust (QQQ) by 385%.

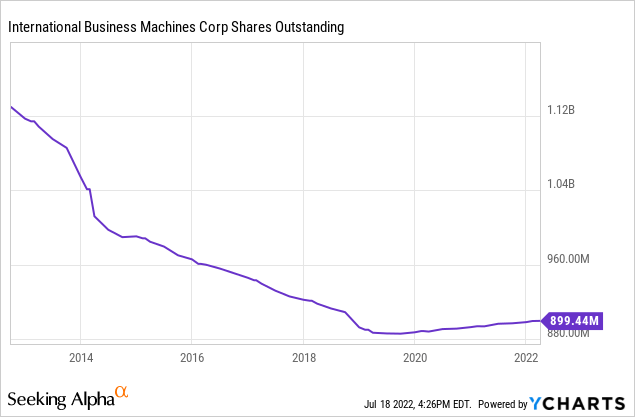

It has not been for a lack of trying. IBM has certainly tried the buyback method.

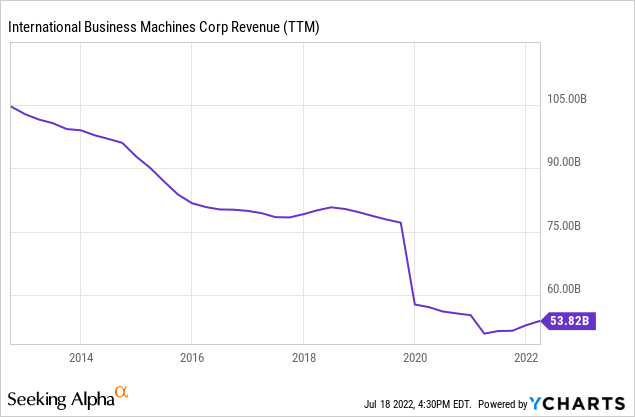

It also tried buying “growth.” While nothing has worked in the past decade, IBM did turn around one worrisome metric recently.

Yeah, we’re referring to that revenue number which has finally decided it did not want to trek all the way to zero. With an important quarterly set of results being announced, we decided to dive in and see whether this was the turnaround bulls have been hoping for.

Q2-2022

At first glance this was a good report. Revenues came in at $15.5 billion, up 9 percent and that was 16% if you removed the currency impact. All segments grew strongly with infrastructure revenue actually delivering a scintillating 25% on a constant currency basis. IBM beat estimates on top (by 2%) and bottom line and delivered $2.31 in non-GAAP earnings. The stock was down more than 4% in the after hours. What went wrong? Sometimes reactions are just that, where participants sell because they have made up their mind to. In the case of IBM, there were a few issues that investors could use as reasons to push this lower.

The first is that IBM is a US company and revenues matter in US dollars. Constant currency metrics are great for revealing the strength of the underling business, but at the end of the day, the net number that counts is that in USD. The differential this quarter between actual numbers and constant currency numbers was quite wide. Investors might have predicted some of this, but there are timing issues with when cash comes and when revenue is booked. So there likely was some shock with the spread.

This also translated through to guidance.

Revenue growth: The company continues to expect constant currency revenue growth at the high end of its mid-single digit model. The company also expects an additional 3.5 point contribution from incremental sales to Kyndryl. At mid-July 2022 foreign exchange rates, currency is expected to be about a six-point headwind.

Free Cash Flow: The company now expects about $10 billion in consolidated free cash flow.

Source: Q2-2022 Earnings Press Release

Compare that with the guidance after Q1-2022.

Revenue growth: The company now expects constant currency revenue growth at the high end of the mid-single digit range. The company also expects an additional 3.5 point contribution from incremental sales to Kyndryl. At mid-April 2022 foreign exchange rates, currency is expected to be a three to four point headwind.

Free Cash Flow: The company continues to expect $10 billion to $10.5 billion in consolidated free cash flow.

Source: Q1-2022 Earnings Press Release

That expanding currency headwind and free cash flow drop is what we think investors are focusing on, first and foremost.

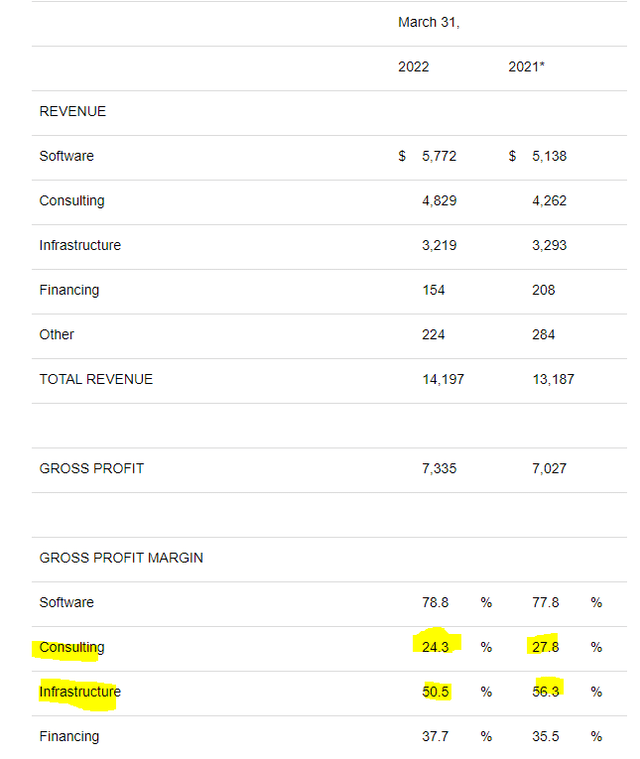

The other thing that we noticed was that gross margins dropped sharply in two of three major segments (financing is a minor segment).

Q2-2022 Earnings Release

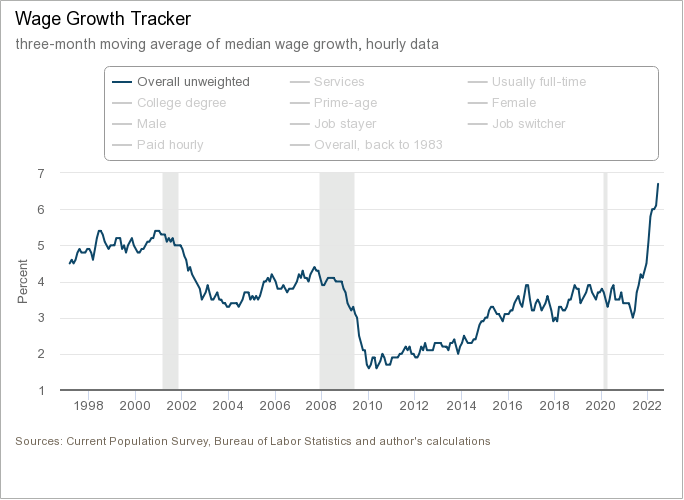

We have seen a big move in wages across the board and the Atlanta Fed Wage Tracker is kicking in at 6.2% year over year.

Atlanta Fed Wage Tracker

This likely has not fully played out and we can expect more compression ahead.

Outlook

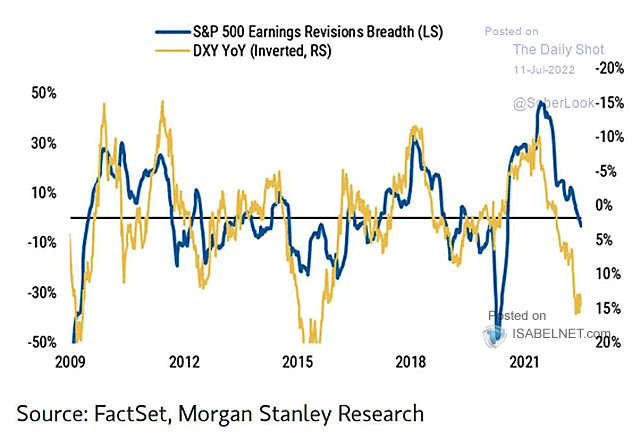

There are three cyclical headwinds here and the US dollar is the first and foremost. Not only does it hamper revenues directly, but it also makes it harder for US firms to compete with European and Asian counterparts. Based on US dollar strength, we would estimate that the earnings revisions have not even begun to price it all in.

FactSet, Morgan Stanley, Via Twitter

IBM via its global reach is going to be definitely impacted.

The second aspect here is the generalized slowdown in the world economies, brought about by rising interest rates and higher inflation. The fiscal cliff ahead in the US will make this worse. Without getting into the micro, we can tell you that it won’t be pleasant.

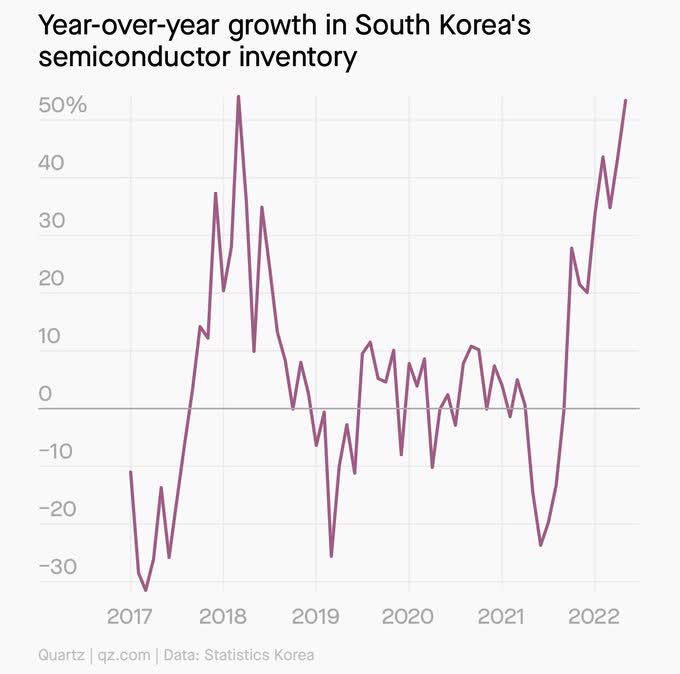

Finally, we think technology is likely to get a larger share of the slowdown as it benefited the most from the 2021 euphoria. One data point showing just how bad it’s going to get comes from the semiconductor chips building up at breakneck speed.

Statistics Korea

Valuation

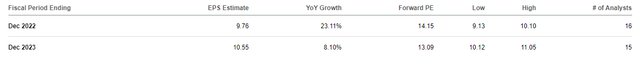

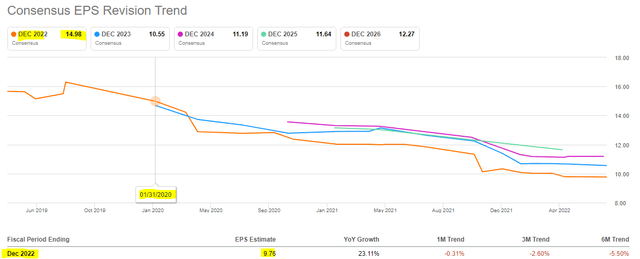

Of course all of this could be priced in, in which case you could make a case to buy. On that front, we don’t buy that it has been priced in. Sure, if you went by consensus earnings estimates and used the non-GAAP variety, it looks fine at 13X 2023 earnings.

Seeking Alpha

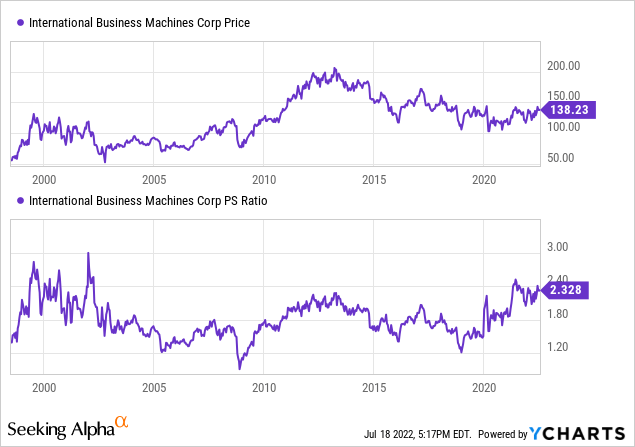

We think those are overly optimistic and both revenues and margins will disappoint. Our favorite metric for IBM, which strips out the junk of non-GAAP impacts, is the price to sales number.

By this one, we don’t remotely think IBM is cheap. Ideally you want to buy this below 1.5X sales to have a good chance of making dough.

Verdict

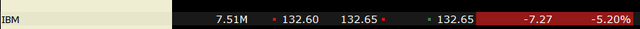

Big Blue saw Deep Red in the after hours.

Interactive Brokers July 18, After Hours

That could certainly change tomorrow, but we would be cautious in making a bullish case here. Yes, IBM is reversing its revenue declines and doing so in the face of an ultra-strong US dollar. That’s good. At this stage of the business cycle though, we think valuation is quite expensive. Analysts are always optimistic and keep in mind that they expected almost $15.00 in earnings for 2022, at the beginning of 2020. We’re now sub $10.00.

Seeking Alpha

We might get interested in IBM in the high double digits, but for now, we stay out.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment