bodnarchuk/iStock via Getty Images

Introduction

Canada-based IAMGOLD Corporation (NYSE:IAG) reported the first quarter of 2022 on May 3, 2022.

Note: I have followed IAG quarterly since 2014 with 48 articles and counting. This new article is a quarterly update of my article published on March 28, 2022.

1 – 1Q22 results snapshot

The company recorded $356.6 million in revenues and posted an income per share of $0.05 with a net income of $23.8 million. The adjusted earnings were $26.1 million or $0.05 per share from a solid operating performance at Essakane and improvements at Rosebel.

Production for 1Q22 was 174K Au oz compared to 156K Au oz produced in 1Q21.

The company revealed the appointment of the current Chair of the Board, Maryse Bélanger, as Interim President and CEO.

1Q22 Presentation Highlights:

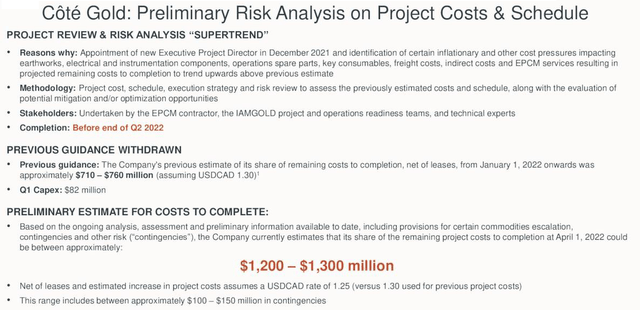

IAG 1Q22 Highlights (IAMGOLD) The company stated it currently estimates that its share of the remaining Côté project CapEx to completion as of April 1, 2022, could fetch between approximately $1,200 to $1,300 million, net of leases (initially $710 million to $760 million). That compares to the company’s previous assessment of between $710 million and $760 million needed and represents an eye-popping 90% cost increase after adjusting the figure for the $78.5 million spent in the first three months of the year. It includes approximately $100 million to $150 million in contingencies. The company incurred $617 million as of 1Q22, with $130 million this quarter. IAG: Cote Gold Preliminary risk analysis (IAMGOLD presentation) CapEx continues to be high due to the Côté Gold project, with 49% overall project completed and 96.6% detailed engineering achieved by the end of March. It is a big headache for the company and a painful issue for shareholders. Below is a complete report as of March 31, 2022: IAG Cote Gold project as of March 31, 2022. (IAMGOLD) The higher CapEx had a severe effect on the stock price. Following the announcement, the company declared it is withdrawing its 2022 and 2023 Côté Gold project costs guidance and warns that this is only a preliminary estimate. The immediate consequence is that the timing of commercial production is expected to be pushed to approximately the end of 2023, which, while consistent with previous guidance, is still a four to five months delay due to COVID absenteeism, weather, lower contractor productivity rates, and impact from the batch plant fire. So far, no financing has been disclosed for the project, but the company may need external funding in 2022, which could further affect the stock price.

2 – Stock performance

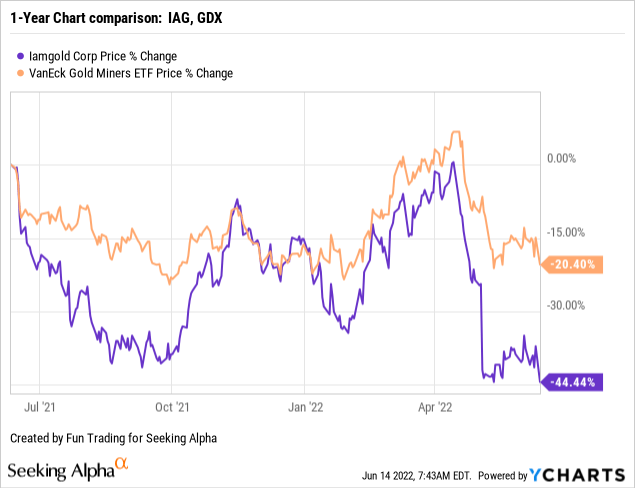

IAMGOLD dropped precipitously in early May and is now down 44% on a one-year basis, underperforming the GDX and most of its peers.

3 – Presentation

IAMGOLD is a mid-tier gold mining company operating in three regions: North America, South America, and West Africa.

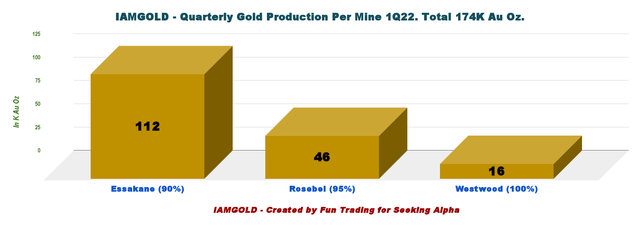

The company also owns the Côté Gold construction project in Canada and the Boto Gold development project in Senegal. The flagship mine Essakane in West Africa represents 64.4% of the company’s total output in 1Q22.

IAG Quarterly production per mine 1Q22 (Fun Trading)

4 – Investment thesis

The investment thesis for IAG is a complicated one. If you like mid-term gambling, you could eventually invest in IAG, waiting for the Côté Gold project’s completion.

The stock has significantly corrected recently, which makes a slow accumulation easier. However, the risk of another cost increase at Côté Gold and the need to finance the project may push IAG further down and potentially below $1.50.

Conversely, if you do not have enough confidence in IAG and feel the risk level is too high, then I suggest trading the stock occasionally.

Hence, the trading strategy I recommend is to trade short-term LIFO about 70% of your position and keep a small core long-term position for a much higher target. Trading LIFO is the most adapted strategy that allows you to profit while waiting for a significant uptrend.

IAMGOLD Corp. – Financial Snapshot 1Q22 – The Raw Numbers

| IAMGOLD | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Total Revenues in $ Million | 297.4 | 265.6 | 294.1 | 294.6 | 356.6 |

| Net Income in $ Million | 19.5 | -4.5 | -75.3 | -194.1 | 23.8 |

| EBITDA $ Million |

114.7 |

86.2 |

15.8 |

-187.2 |

134.9 |

| EPS diluted in $/share | 0.04 | -0.01 | -0.16 | -0.40 | 0.05 |

| Operating Cash flow in $ Million | 101.7 | 37.3 | 78.5 | 67.5 | 142.3 |

| Capital Expenditure in $ Million | 102.9 | 161.1 | 139.1 | 266.8 | 169.1 |

| Free Cash Flow in $ Million | -1.20 | -123.8 | -60.6 | -199.3 | -26.8 |

| Total cash $ Million | 967.8 | 829.8 | 748.3 | 552.5 | 524.4 |

| Long-term Debt in $ Million | 466.7 | 456.5 | 466.8 | 464.4 | 463.3 |

| Shares outstanding (diluted) in Million | 480.9 | 476.6 | 476.8 | 476.8 | 482.4 |

Data Source: Company release

Gold Production And Balance Sheet Details

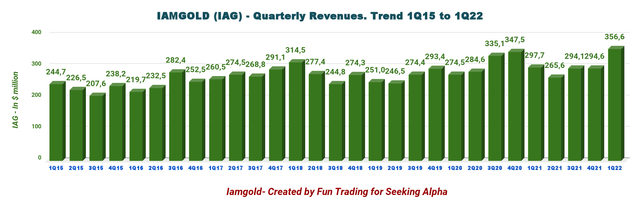

1 – Revenues were $356.6 million in 1Q22

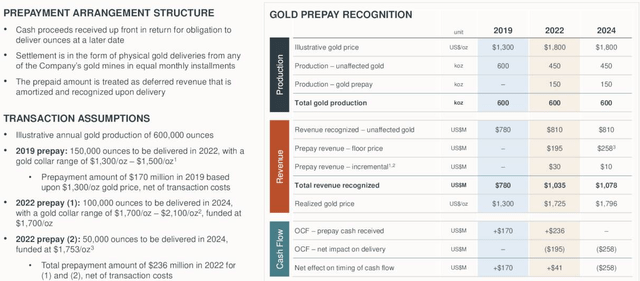

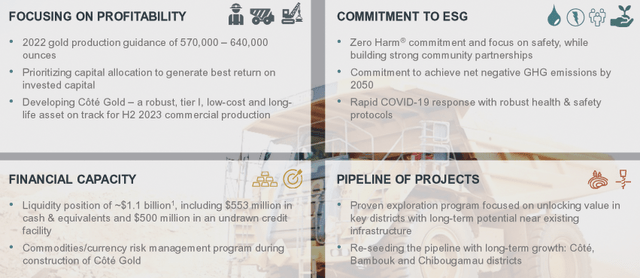

IAG: Quarterly Revenues history (Fun Trading) For the first quarter ended March 31, 2022, quarterly revenues came in at a record $356.6 million, up 19.9% from the same quarter last year. Net cash from operating activities for the first quarter of 2022 was $142.3 million, an increase of $74.8 million from the prior quarter, mainly due to higher net cash earnings and proceeds from the 2022 Prepay Arrangements. IAG Prepayment structure Presentation (IAMGOLD) The net earnings and adjusted earnings per share attributable to equity holders were $0.05. Also, EBITDA was $134.9 million, and adjusted EBITDA was $137.6 million. IAG: Global presentation 1Q22 (IAMGOLD)

CEO Maryse Belanger said in the conference call:

I just spent the weekend at Côté and was very impressed to see the ramp up of activities as the weather improved. I am confident we will address the crew in near-term challenges and know that we remain fully focused on our goal of becoming a leading high margin gold producer.

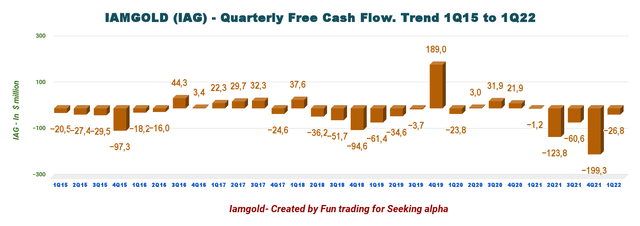

2 – Free cash flow was a loss of $26.8 million in 1Q22.

IAG Quarterly Free cash flow history (Fun Trading)

Free cash flow has been a recurring issue for many quarters and will continue until the Côté Gold project is completed. Elevated CapEx will continue to affect free cash flow until the end of 2023.

IAG’s trailing 12-month free cash flow is now a loss of $410.5 million and another $26.8 million in the first quarter.

3 – Gold Production Details; Total Production Was 174K Au Oz In 1Q22

3.1 – Gold production details

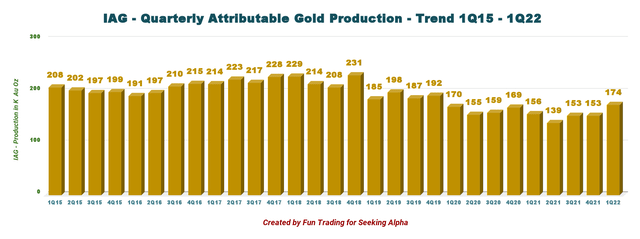

IAG Quarterly attributable gold production history (Fun Trading)

IAMGOLD produced 174K Au oz during the first quarter of 2022, compared to 156K Au oz during 1Q21 on continued strong performance from Essakane and improvements at Rosebel, as shown in the graph above.

Cash cost per ounce sold in the first quarter was $1,017, down $196 per ounce or 16% from the prior quarter on strong gold sales. AISC per ounce sold of $1,490 was down $47 per ounce or 3% from the preceding quarter due to higher sales volume of $235 per ounce sold, offset in part by higher sustaining CapEx of $179 per ounce sold.

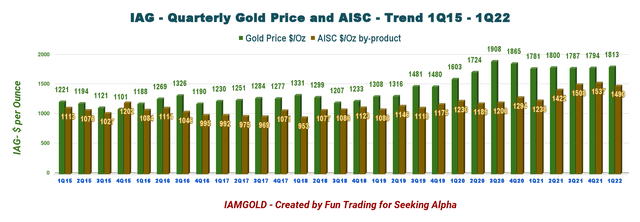

3.2 – Quarterly AISC and Gold price.

AISC is now $1,490 per ounce, which is high.

IAG Gold price and AISC history (Fun Trading)

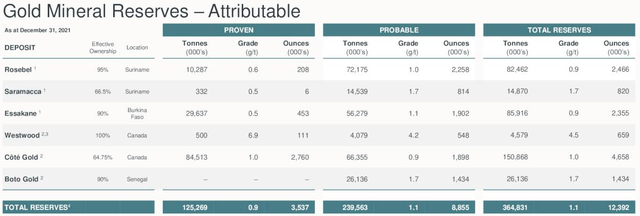

3.3 – Mineral Reserves and 2022 guidance (unchanged from my preceding article).

3.3.1 – This segment is unchanged from the preceding quarter. The gold mineral reserves P1 and P2 are slightly down YoY with 12.392 Moz and could translate to an excellent cash flow.

IAG Reserves (IAMGOLD)

3.3.2

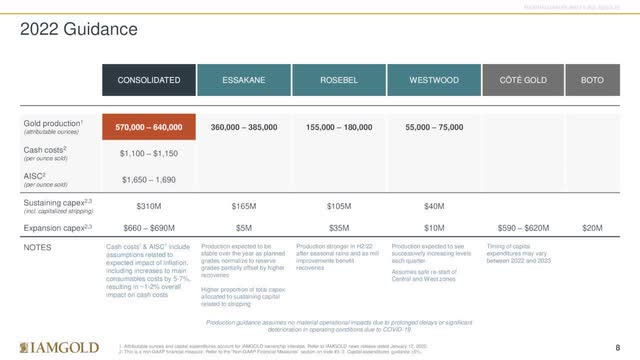

Looking ahead our attributable gold production guidance for the year remains unchanged and is expected to be in the range of 570,000 to 640,000 ounces. Cost guidance for 2022 is also unchanged at this time with cash costs expected to be between 1100 and 1150 per ounce sold and all our sustaining costs expected to be between 1650 and 1690 per ounce sold. As previously reported these estimates issued in January included an inflation assumption of 5% to 7% on key consumables.

IAG 2022 Guidance (IAMGOLD)

4 – The company had no net debt and strong liquidity of $1 billion on March 31, 2022.

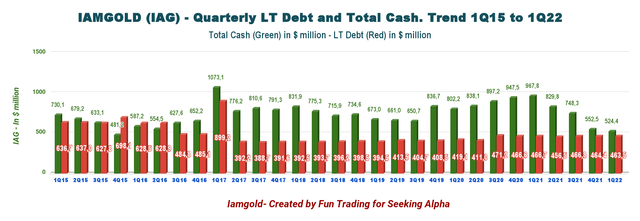

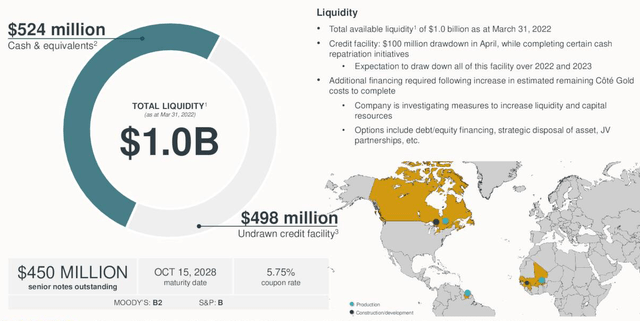

IAG Quarterly Cash versus Debt history (Fun Trading) IAMGOLD has no net debt and total liquidity of approximately ~$1.0 billion (including the undrawn credit facility of $498 million and not including restricted cash) as of March 31, 2022. Total cash is now $524.4 million. IAG Liquidity (IAMGOLD)

Technical Analysis (Short Term) and commentary

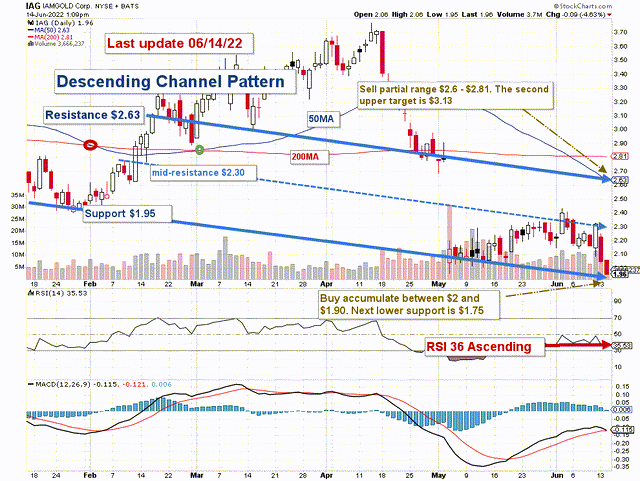

IAG TA Chart short-term (Fun Trading)

IAG forms a descending channel pattern with resistance at $2.63 and support at $1.95.

The short-term trading strategy is to trade LIFO about 75% of your position. I suggest selling between $2.60 and $2.81 and waiting for a retracement at or below $1.95.

However, the mid-resistance/support is now $2.30 and could be used for trading in correlation with the RSI.

The gold miners suffered a terrible week and lost over 10% in a few days. I think we are close to an oversold situation now.

The gold price is down significantly this week and is reacting to the FED’s decision to hike interest this week for the second time this year. With the recent CPI numbers, the market now expects a 75-point hike. However, if the FED decides on a 50-point instead, we may get a good bounce in gold, and IAG could go up to $2.30.

Watch the gold price like a hawk.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long-term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote for support. Thanks.

Be the first to comment