maybefalse/iStock Unreleased via Getty Images

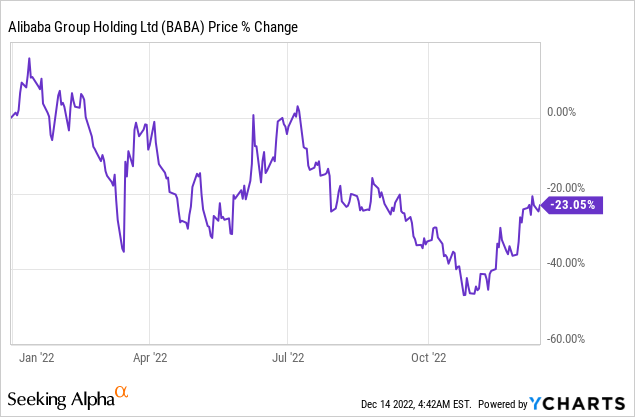

Shares of Alibaba Group Holding Limited (NYSE:BABA) have revalued 23% lower in 2022 and are now trading 71% off their all-time highs. The last two years have been disastrous for Alibaba shareholders, including me, and since I started to recommend Alibaba at a significantly higher valuation (~$160), I am owning up to the mistakes I made in the last year. However, I am also going to take a look at Alibaba’s potential in FY 2023, which could be driven by a general reopening of the Chinese economy and, especially, the Cloud business, which I believe has a lot of long term potential for Alibaba!

My mistakes in 2022

Obviously, with Alibaba’s shares revaluing to the downside and losing about a quarter of their value in 2022, it is hard to defend my call to invest money into the Chinese e-Commerce company at the end of last year in “Alibaba: A Top Turnaround Stock For 2022.” A couple of factors weighed on Alibaba’s business performance as well as investor sentiment in this year, including:

- Unprecedented, large-scale COVID-19 lockdowns across China.

- A slowdown in Alibaba’s e-Commerce business which was partially offset by accelerating growth in Local consumer services.

- Continual fear about increasing involvement of authorities into Alibaba’s business.

- The risk of a delisting after the SEC warned that Chinese companies could face consequences if they don’t open their books to U.S. auditors.

- General market concerns over a post-pandemic market slowdown and high inflation weighing on consumer spending.

- Alibaba’s top line growth slowing to 0% in the June-quarter.

Because of all of these reasons, Alibaba drastically underperformed my expectations in 2022, as I clearly misjudged Alibaba’s upside and underestimated the company’s down-ward revaluation potential. However, not all is bad. While Alibaba under-performed, I believe a general reopening of the Chinese economy could reboot Alibaba’s e-Commerce business in 2023, and the Cloud business makes Alibaba attractive in the long term as well.

China’s economy is set to reopen

Alibaba’s revenue growth dropped to zero in the June quarter due to wide-spread COVID-19 lockdowns which had a chilling effect on consumer demand. However, a reopening of China’s economy, which is expected in the short term, could be a powerful catalyst to unleash pent-up demand for Alibaba’s struggling e-Commerce business. Alibaba is still widely dependent on e-Commerce revenues for its overall growth as e-Commerce has a top line share of 73% (both China and international). Besides a general reopening, I believe investors should take a closer look at Alibaba’s Cloud business.

Alibaba’s potential in 2023 and beyond: Cloud

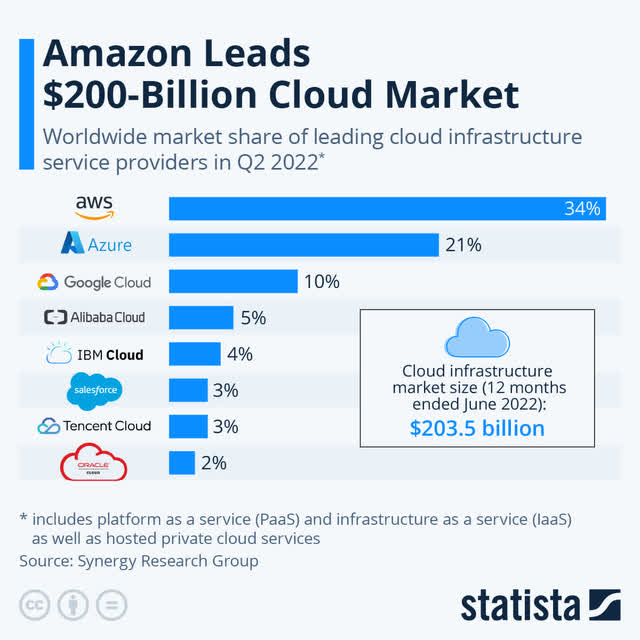

Amazon (AMZN) Web Services (“AWS”) is the uncontested leader in the Cloud business with a market share of 34%. The second-largest player in the market is Microsoft’s (MSFT) Azure with a share of 21%. The third-largest company, Alphabet (GOOG, GOOGL), captures about 10% of the industry. Alibaba is only the fourth-largest company with a market share of 5%, but I believe the Chinese e-Commerce company has potential to grow its market penetration as well as deliver strong revenue growth in this growing business going forward.

The global Cloud opportunity is obviously enormous at around $200B and the market is set to continue to grow in size as more companies require cloud-based solutions to expand and scale their businesses. According to consulting company McKinsey, China’s public cloud market is expected to triple in size from $32B in FY 2021 to $90B by FY 2025 which is why I believe Alibaba’s Cloud segment could surprise to the upside regarding both growth and margins going forward.

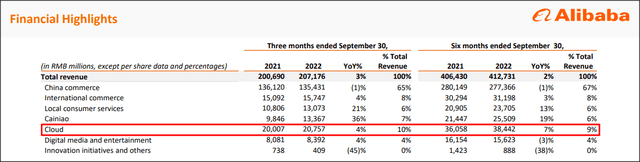

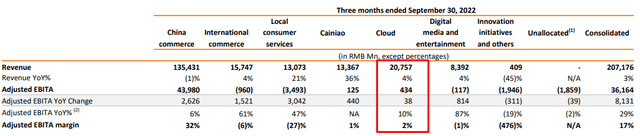

Alibaba’s Cloud segment generated 20.8B Chinese Yuan in revenues (which calculates to approximately $2.9B) in the September-quarter, showing 4% year over year growth. The segment saw robust demand especially from the financial services, telecommunication and public services industries in the last quarter and although growth has slowed after the pandemic, the business is in a long term upswing.

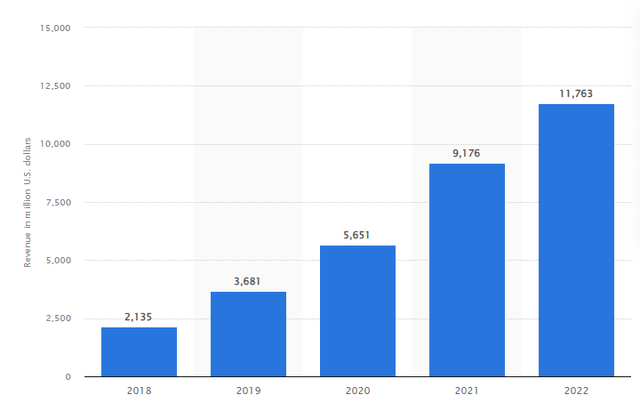

Alibaba’s Cloud growth has been impressive before and during the pandemic and only recently slowed as concerns over China’s economic growth grew. Between FY 2018 and FY 2022, Alibaba has increased its Cloud segment revenues by a factor of 5.5 X and grew revenues to a record $11.7B.

Alibaba’s Cloud segment is now the second-largest business regarding revenue contribution and it is even bigger than Local consumer services and Cainiao, which is Alibaba’s integrated smart logistics enterprise. It also is the second-most profitable segment, based off of EBITA margins. Given the strong forecast for Cloud market growth, Alibaba Cloud is set to increase its penetration in the market in the long term while a reboot of economic activity after the devastating lockdowns of 2022 could also be a catalyst for Alibaba’s short term growth.

Alibaba’s valuation

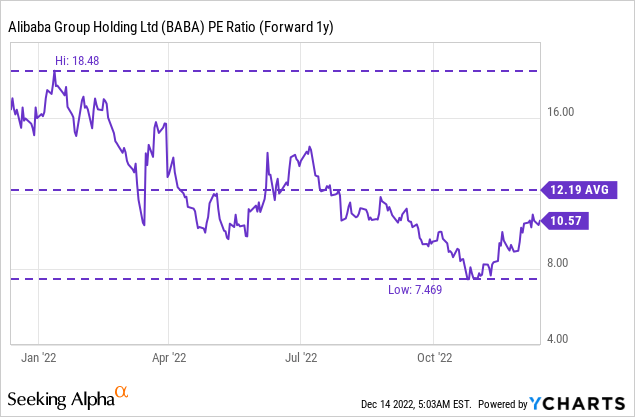

How investors see Alibaba’s valuation largely depends on their attitude towards risk. Some investors don’t like to invest in Chinese companies given the uncertainty about the regulatory environment and the potential for political interference. Based off of earnings, however, shares of Alibaba don’t seem to be overvalued. Shares are trading at a P/E ratio of 10.6 X, which is slightly below the 1-year average P/E ratio of 12.2 X.

Risks with Alibaba

The big risk for Alibaba in 2023 is that the e-Commerce business will continue to be a drag on the firm’s commercial performance, but considering that China is planning a broad reopening of its economy, the e-Commerce business may do unexpectedly well next year.

The regulatory landscape also poses a challenge to the company and its investors as Beijing could interfere with Alibaba’s business at any time and it has shown a willingness to do so in the past. A major negative event would be if Beijing forced Alibaba to divest of Ant Group, which owns the mobile payment platform Alipay.

Rating change

Because Alibaba’s stock price has risen 58% from its low in October, I am changing my rating from strong buy to hold.

Final thoughts

2022 was another terrible year for Alibaba, and my call to buy the Chinese e-Commerce retailer was clearly wrong and came at the wrong time. Due to a variety of factors, most notably a slowdown in Chinese e-Commerce sales due to COVID-19 lockdowns, Alibaba’s top line growth slowed to zero in the June-quarter which I did not foresee. While there are still challenges going forward, I believe it would be a mistake to write off Alibaba as uninvestable for either political or economic reasons.

Looking forward into the 2023, I believe Alibaba will see single-digit consolidated revenue growth, as the e-Commerce market is likely to recover due to the unleashing of pent-up demand. One segment that could do well, in FY 2023 and beyond, could be Alibaba’s Cloud business… which is not only in a long term revenue upswing, but now also the second-largest segment based on revenues and already profitable!

Be the first to comment