Images By Tang Ming Tung

Investment Summary

We remain long Hologic, Inc. (NASDAQ:HOLX) shares with the long-term investment thesis still intact. HOLX continues to demonstrate factors of resiliency amid the current landscape and is a defensive position for those investors looking to move up the quality spectrum.

This is particularly true now that equity markets have reversed course since H2 FY22 amid more stable bond yields and a potential cooling of inflation. Moreover, after reconciling necessary adjustments to HOLX’s financial statements, we note that measures of corporate value are even more appealing. We rate HOLX a buy with a price target of $122, noting we’d pay fair price at current market capitalization and enterprise value.

Exhibit 1. HOLX 6-month price action

Data: Refinitiv Eikon

Q3 earnings mixed, downside temporary

It was a mixed period for HOLX segmentally in Q3. Diagnostics contracted ~13.5% to $560 million YoY. Ex-Covid assay revenue, turnover was up 15% YoY in this segment. The molecular segment also saw a 22% YoY gain in organic revenue as utilization crept up across its assay menu. Curiously, Covid-19 revenues came in with a ~$73 million surprise to the upside, surpassing guidance of $100 million. This stemmed from ~8.1 million tests shipped during the quarter on an average sale price of ~$21. Geographically, the US still takes up ~60% of Covid-19 related revenue, and will be the key data to watch looking ahead.

Breast health saw global sales tighten by 18% YoY to ~$283 million and this was expected due to supply shortages management outlined in previous market updates. Ex-US however, breast sales grew ~400bps and this was underlined by further uptake of the Brevera needle segment. Meanwhile, the surgical business was a portfolio leader and grew 10% YoY, contributing ~24.6% to the top. Trends were helped by a continued recovery in surgical volumes and patient turnover on the national hospital level. Skeletal sales were also down 14% YoY to $21 million due to similar supply-based reasons.

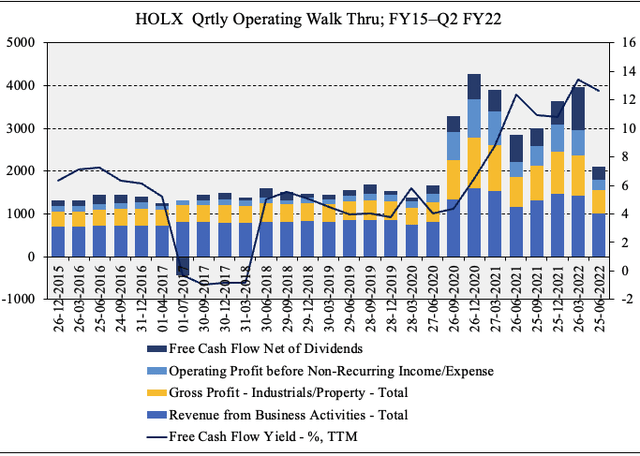

Despite the wind-back in segmental revenue, operating metrics remain on-trend with longer term averages. As seen in Exhibit 2, strength is garnered further down the P&L in strong FCF of $305 million, down from $1 billion sequentially but in-range. Moreover, FCF yield has stretched up substantially since FY20, despite GAAP operating income narrowing sequentially from high’s in FY21. Nevertheless, HOLX brings a great deal of fundamental momentum into the forward-looking regime, and this is an attractive resiliency feature.

Exhibit 2. Operating performance continues to remain resilient as Covid-19 income continues to incrementally decline

As discussed below, after adjusting for non-cash measures, Q3 FY22 operating measures show more attractive results

Data: HB Insights, HOLX 10-Q: Q3 FY2022

Adjustments to reflect cash earnings

We’ve noted that several adjustments are required for a more accurate snapshot of HOLX’s financials. After capitalizing the R&D expenditure and removing non-cash expenditures, and adding stock based compensation of $51 million, adjusted gross profit creeps to $634 million, whereas operating income arranges from $261 million to $515 million. That’s an additional ~$1.02 in EPS below the bottom line, as seen in Exhibit 4. We argue to capitalize and amortize R&D versus expense it due to its creation of economic value. We assume a 5-year useful life and straight line expenditure.

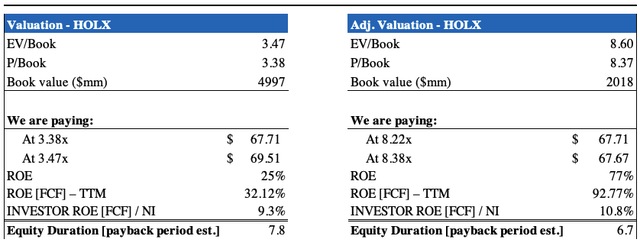

Data & Image: HB Insights Estimates

In addition, the company holds $3.2 billion of goodwill on the balance sheet, and adjustments must be made for this to reflect a more tangible value to gauge correctly what we’re buying in HOLX. After doing so, we see total assets rest at $6.1 billion and there’s a 60% reduction to the book value of equity. This could be an issue seeing as it distorts book value heavily to the downside, and at its current market cap and enterprise value (“EV”), now trades at a substantial multiple. After running the comparisons we note that, thankfully, the impact to the price we’d pay is negligible.

It does suggest, however, that we’d be paying a fair and reasonable price for the stock at its current levels. In addition, FCF ROE is spectacular post-reconciled earnings, and lend investors a c.11% return on equity with an equity duration of below seven years (see Exhibit 6). In the current environment, this is extremely attractive.

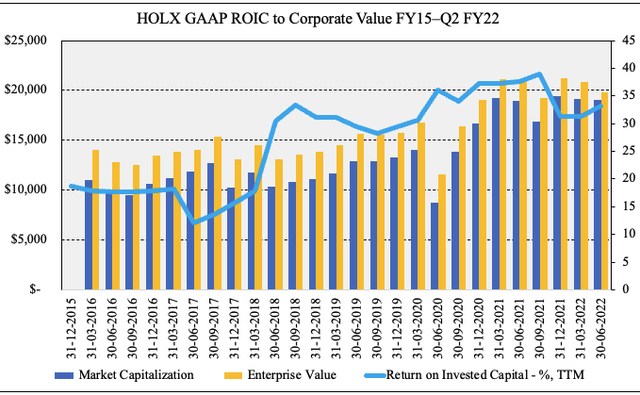

Furthermore, HOLX continues to be a long-term cash compounder, generating a double-digit quarterly return on investment (“ROIC”) since FY17. As seen in Exhibit 4, HOLX’s ROIC has crept up in cyclical fashion alongside hospital CAPEX cycles. In addition to the below chart, investors should note the respective improvement in net operating profit (“NOPAT”) and ROIC when making the necessary adjustments described above.

Exhibit 4.

Data: HB Insights, HOLX SEC Filings

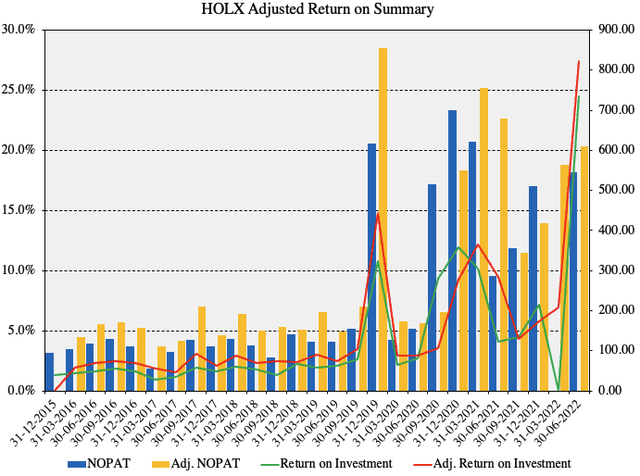

Post-adjustment ROIC creates a positive spread above pre-adjusted measures, as seen below, and therefore increases the corporate value for HOLX. In particular, during down periods there is less peak-to-trough, whereas in upswings the upside is greater [observe the red line]. This is essential information for investors to recognize as it demonstrates that, on an apples-to-apples comparison, we can’t simply use GAAP measures to value HOLX to gain an accurate snapshot.

Exhibit 5. Post-adjustment return on investment demonstrates a positive spread above GAAP measures

In effect, the company’s reported earnings don’t reflect the true corporate value and therefore may unfairly reduce the image of value in HOLX

Data & Image: HB Insights

Valuation

The question we have to answer is if the price of $67 is worth the expected return on the stock. Valuation by estimate is a combination of earnings, FCF and investment – what’s real/ happened, and what’s expected. This is measured in shorthand with book value and earnings ratios. First we’ve shown the strength’s in HOLX’s return on investment. Next, we note the stock is priced at 13.5x forward P/E. Prescribing this to our FY22 adjusted EPS estimates of $7.92 arrives at a price target of $106.92. With the same using 3-year normalized P/E of 14.3x we see $113.

Finally, adjusting for the stock’s equity risk premium (“ERP”) of 5.5% [its FWD earnings yield minus 10-year yield] we set a fair forward P/E of 18.8x [1 / ERP] and setting this to our FY22 estimates values HOLX at $148. Therefore, blending all 3-measures of earnings on an equal weight basis sets a price objective of $122.

On these basic calculations [subject to sensitivity analysis] suggests there is compelling value on offer. At current multiples we are paying fair value of ~$67 to receive upside potential of 82%.

Exhibit 6. Valuations remain steady post-adjustment however ROE measures improve for investors, narrowing the payback period

Data: HB Insights Estimates

Based on the factors discussed throughout this report we remain bullish on HOLX and note the long-term thesis remains intact. Shares look priced fairly at $67, however they lend investors substantial upside potential by our estimate. Rate buy price target $122.

Be the first to comment