Sergei Dubrovskii

Six months ago, I urged readers to consider an investment in shares of leading offshore energy specialty services provider Helix Energy Solutions Group, Inc. (NYSE:HLX), or “Helix” to gain exposure to an anticipated multi-year recovery in offshore oil and gas services.

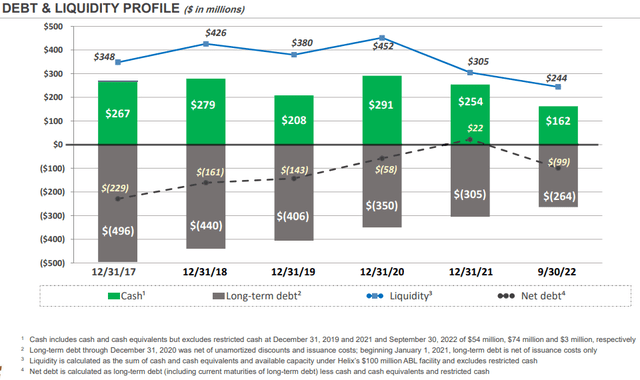

In contrast to many offshore drillers, the company has done quite well for most of the industry downturn as cash flows have been boosted by a number of high-margin legacy contracts. As a result, the company has not only managed to stay afloat but also reduced debt substantially in recent years:

Please note that the decrease in cash this year has been caused by the recent acquisition of the Alliance Group of Companies (“Alliance”) for $120 million in cash, a Louisiana-based provider of services in support of the upstream and midstream industries in the Gulf of Mexico shelf, including offshore oil field decommissioning and reclamation, project management, engineered solutions, intervention, maintenance, repair, heavy lift, and commercial diving services.

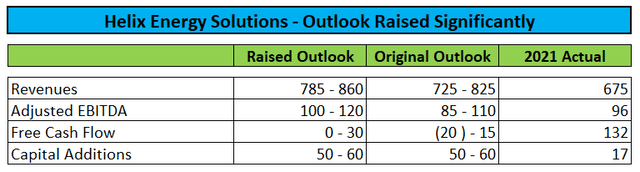

That said, management has warned investors of 2022 being a transition year with several vessels undergoing regulatory inspections, a slow return for the North Sea market, and a number of units performing short-term work at reduced rates with the company’s two modern well intervention vessels in Brazil causing an estimated $35 million EBITDA hit alone.

But as it has turned out, the second half of the year will be much stronger than originally anticipated as worldwide demand for specialty offshore services has continued to increase:

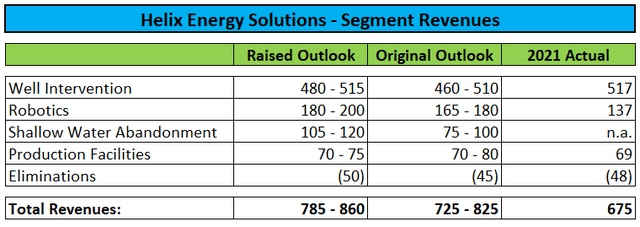

Particularly, the recently acquired Shallow Water Abandonment segment (the former Alliance business) is expected to outperform initial expectations significantly:

On the Q3 conference call, management viewed the quarter as an inflection point for Helix and stated expectations for further “significant improvements in 2023” (emphasis added by author):

Last quarter, we provided a list of events that should contribute to a significant improvement in ’23 versus ’22. What I can say now is that our confidence in significant year-over-year improvement is even stronger today than last quarter. The market demand continues to increase along with utilization and rates.

In fact, it’s beginning to appear that we may become asset constrained to cover all this demand that we’re seeing. Rates improved rapidly during 2022, but we had already offered customers rates that hedged utilization before we realized the extent of the demand increase. This means that while we expected the returns as a result of rate increases improve in 2023, there’s still headroom for further rate improvement beyond 2023. Of course, we’re all aware of inflation in the state of the global recovery.

The rate that demand rose in 2022 was dramatic, but we all know that the market can collapse just as rapidly. Our strategic goal remains to manage the balance sheet, maintaining the capacity to cash settle our 2026 converts should the capital markets warrant. For the foreseeable future, we anticipate Helix will be meaningfully free cash flow positive. Ahead of this ongoing demand increase, it’s our intent to add incrementally to the 3 legs of our energy transition model of, number one, maximizing remaining reserves; two decommissioning; and three, renewables, specifically offshore wind.

Given strong visibility, I would expect management to provide decent full-year 2023 guidance when the company reports Q4/2022 results next month.

Personally, I am projecting Adjusted EBITDA of at least $225 million in 2023, almost double the high end of the company’s increased outlook for this year.

Market participants have been warming up to the company’s story in recent months with shares now up by more than 100% over the past six months.

Just two weeks ago, BTIG analyst Gregory Lewis named Helix his top pick for the first half of 2023 with a price target of $10:

After years of building out its fleet, and with offshore spending growth expected to accelerate, Helix is positioned to move into harvest mode and generate free cash flow, the analyst tells investors in a research note, adding that with fewer competitors, utilization for the company’s core well Intervention assets is improving as the offshore oilfield service cycle ramps.

Bottom Line

Suffice it to say, this idea has played out even better than expected by me with shares up 120% since I initiated coverage of Helix last summer.

With shares now trading above my initial price target, a downgrade might be warranted but given the company’s very strong prospects and management’s stated expectations of meaningful cash flow generation “for the foreseeable future“, I would advise investors to use any major weakness to initiate or add to existing positions.

Be the first to comment