Andrii Yalanskyi

Greenhill (NYSE:GHL) is a well-respected name in the industry, even though its smaller scale makes its revenue patterns more idiosyncratic and its market share more volatile. This quarter saw flat growth but important bookings have leaked into Q4. In addition to deals that have long been in the pipeline, we think that GHL is in a position to benefit substantially on new activity in both restructuring and M&A as the macro environment undergoes some key changes. They have sat on talent for now and have operating leverage into next year as the velocity of closes looks to rise.

Q3 Breakdown

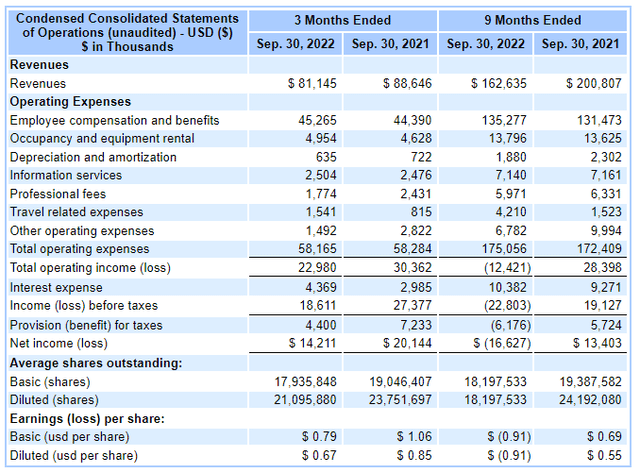

Comp ratios have gone up but only a function of revenue. Comp expenses are the same YoY. Revenues fell at the beginning of the year together with the rest of the industry as deal volumes precipitously declined in the broader market. 9 month revenue is only down about 25%, which is better than one would expect.

And this year, for random reasons, all of our largest fees look set to land in the last 3 to 4 months of the year. As a result, despite unfavorable credit and equity markets, our expectations of a strong second half and a respectable full year revenue outcome remain in place.

Q4 should see some of the big, needle-moving deals close just as Q3 closes. 9 month revenue declines should be even more limited relative to peers which owes to GHL’s smaller size, and plucky ability to buck trends coming off a smaller market share. Moreover, the company has already cited an uptick in restructuring activity which is consistent with what PJT Partners (PJT) reported.

Bottom Line

Management appears confident in a pretty resilient year already, but we think that while the CPI peak doesn’t exactly spell a good state for the global and US economy, it does introduce one key element in the mix that the capital markets industry responds to with a lot of volatility: certainty. The back of inflation can be broken, it’s not propagating alarmingly, and this is enough for markets to finally price products.

In particular this was needed for debt markets, especially LevFin, and now that they can price products effectively, the secondary market should calm down and new issues can start again. Sponsor activity, which is expected to be a little dead for the time being, will pick up once the LevFin markets have a pulse. Otherwise, even regular, well-capitalized, strategic M&A from public market corporates will also resume at a higher pace now that the error bands can be decided around key macro variables like rates.

Finally, restructuring, even if rates show a peak after a few more hikes, will also continue to gain momentum. Just because a recession isn’t aggressive, any recession on top of higher rates will do a fair bit to grow restructuring mandates. But a resumption in LevFin markets is paramount to be able to finance restructuring plans.

Comp expenses are flat YoY, and all the company needs is restructuring mandates to really take off for operating leverage to grow their profits, which aren’t bad this quarter at all. Annualizing this quarter’s net income prices Greenhill at 5x PE. If we get more restructuring, and even more M&A which we should see already in Q4, profits are going to grow a lot in our view.

Overall, we understand why the price rallied 66%. Certainty is the key variable for these companies whose activity has declined substantially, and will be the catalyst for restoring much of it, if not all of it for companies that are capable of capitalizing on restructuring activity. Greenhill would be capable of that. Compared to an issue like PJT, we’d actually prefer Greenhill, also because of its small market cap at $200 million and ability to buck trends.

Be the first to comment