Thinkhubstudio/iStock via Getty Images

The Glimpse Group’s (NASDAQ:VRAR) shares have plummeted since the turn of the year, standing down 57% over that period. This performance doesn’t buckle any trend in the micro-cap space, with the vast majority of more speculative micro-caps standing down significantly year-to-date. The iShares Micro-Cap ETF (IWC) is an indication of this:

It gets even worse when you take a look at most Metaverse ETFs such as Roundhill Ball’s ETF (METV), conveying the speculative nature of the Metaverse right now:

Despite this turmoil, Glimpse’s acquisition strategy has been undeterred due to the large cash pile it had accumulated from equity offerings at higher prices, acquiring Brightline Interactive, this follows on from the acquisition of Sector 5 Digital (S5D) in February. The company also most recently acquired PulpoAR – set to become a subsidiary of QReal. Each new addition provides different benefits. All of these acquisitions are structurally aligned with shareholder interests. Following these acquisitions my bullish stance has been reinforced, add to that the strong Q3 results, I believe Glimpse remains a ‘strong buy’ at these levels – but only for the most risk-prone investors.

Q3 results

Q3 was on balance a strong quarter for Glimpse, the stock price jumped following the results, though the figures weren’t too surprising. Glimpse had previously mentioned that the company was on a run rate of $10 million+ following the acquisition of S5D, considering that the results included two months of S5D’s numbers, revenue of $2.1 million for the three months was largely to be expected. If S5D’s January revenues were included revenue would have come to $2.3 million for the quarter. This is slightly lower than the forecasted run rate if this figure was annualised because this is historically a slower period for the company.

These results likely provided some comfort to the market that the company was on track as no mishaps occurred during the quarter. There was also comments that alluded to partnerships:

Entered into new paid customer agreements with several Fortune 500 companies. While we cannot name these currently and these are initial contracts, they add to our existing cadre of top tier global customers across industries, further demonstrate our capabilities and ability to deliver to global enterprises and have the potential for significant growth.

Glimpse shares reached all-time highs ($21) as they secured a Master Services Agreement with a ‘leading social media company’ in November. I believe this is most likely Meta Platforms (META) as they also called the firm a ‘leading social media company’, however this hasn’t been fully disclosed and therefore remains speculation. Since then investors haven’t been given much detail regarding this agreement or any new partnerships with other prominent corporations. These contracts will be small in terms of economic value, but may provide the platform to secure long-term more valuable contracts. A ‘stronger’ ecosystem may also aid Glimpse in achieving these long-term relationships, S5D has completed projects for Halliburton and American Airlines for example.

Cash Burn

Cash burn remains controlled, management also noted that they continue to monitor the economic environment and have the ability to make adjustments to their expense structure if needed. Net cash used in operating activities for the nine months was $3.67 million. Glimpse highlighted in the quarterly press release that cash burn is expected to be between three and four million for the Full-year of 2022, not too unreasonable considering the cash balance and the 150 software engineers the firm had at the end of the quarter. Management has continually exhibited consideration for the importance of cash flow management (vital for a micro-cap). Which is one of the main reasons getting an equity raise away at $10 was so important – Glimpse ended the quarter with a $20 million cash balance. At the higher-end of the forecasted cash burn rate, Glimpse would have a cash runway of 4-5 years.

However that ignores future obligations in relation to acquisitions such as S5D and Brightline. Glimpse paid $3 million in cash and $5 million in common stock as an initial consideration for Brightline. The other $24.5 million is dependent on milestones, with $12 million of that paid in cash. Considering these are revenue milestones, when/if Brightline does achieve them, there is a risk Glimpse will still be cash flow negative, therefore increasing the likelihood of future equity raises. Though I do believe these milestones will be aggressive and probably a long way off achievement. If they are achieved, shareholders most likely will be looking at a far higher share price as Glimpse will have outperformed expectations on the organic growth front. A break down of consideration for both S5D and Brightline is provided below:

| Sector 5 Digital (S5D) | Brightline Interactive | |

| Initial Cash | $4M | $3M |

| Initial Stock | $4M | $5M |

| Future Cash | $2M | $12M |

| Future Stock | $17M | $12.5M |

| Total | $27M | $37.5M |

I believe both are well-structured because:

- A large amount of payment is in common stock, ensuring cash balance remains healthy

- This common stock has an issuance floor of $7

- Management from both companies are joining Glimpse

This isn’t to say future equity raises aren’t part of Glimpse’s plans – they certainly are. However I think the structure of these acquisitions (inclusion of $7 floor price for equity issuance), does highlight that management intend to deliver for shareholders and particularly those that backed them on the initial IPO. Therefore raising capital below the $5 level appears unlikely and won’t be necessary to keep the ‘lights on’. There is the risks of future selling pressure from stock issuance to management, however the fact key management of both firms are staying on and the floor issuance is $7, it is unlikely management-related selling pressure will be experienced at these prices.

Brightline providing scale

Lyron Bentovim (CEO & President) recently discussed the importance of scale in emerging industries when he sat down to speak with Scott Amyx. He highlighted the difficulty of ‘building scale where scale doesn’t exist’. That is how Glimpse was initially born and now following the recent acquisition of Brightline, Glimpse has improved its ability to scale faster.

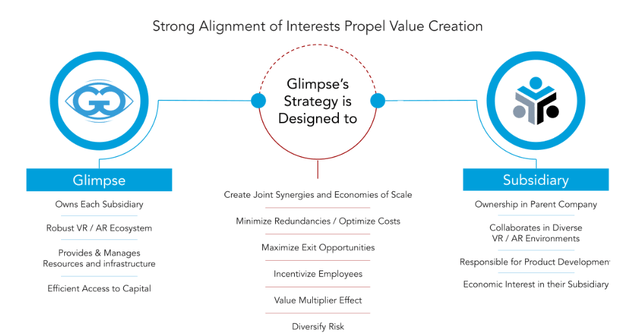

Glimpse Group Ecosystem (Glimpse Presentation)

This was one of the large drivers behind the public listing of Glimpse. It gave the company the capital to acquire businesses. The focus is on bridging the gap between entrepreneurs and end-users, leveraging each subsidiaries abilities to secure new partnerships. Greater scale means greater appeal to larger organisations. The fact Glimpse is now one of the largest independent VR/AR software should improve the firms chances of securing larger software service agreements.

Brightline interactive creates immersive VR/AR technology for training simulation and brand experiences. Brightline provides solutions for Government, Military and Brands. Similar to S5D, I believe Brightline has the ability to expand Glimpse’s offering and reach. Brightline has experience in building custom creative technology, as highlighted by its work with different Universities to create in-person immersive installations. S5D has also created similar immersive installations for the likes of American Airlines and the EDCC.

Capabilities remain paramount

Those familiar with Strategic Management may be aware of the ‘resource based view’, within this view a firm’s resources and capabilities are what give it a competitive advantage. Whilst I think the view as a whole is quite simplistic, I do believe it has practically application and substance to Glimpse. Glimpse is operating in an early stage, fragmented market where building capabilities remains paramount. That’s exactly what makes Glimpse’s model attractive – the stronger the ecosystem gets with acquisitions, the stronger the whole firm’s capabilities become. I believe obtaining a first-mover advantage in such a large industry is one of Glimpse’s great strengths. The bigger players may have bigger capital bases, but Glimpse isn’t looking to directly compete with these companies, instead partner with them (due to its B2B focus). Securing these partnerships early may allow Glimpse to secure bigger contracts and build strong long-term partnerships.

The acquisition of PulpoAR will add 40 software developers to Glimpse’s strong and growing cohort, further improving capabilities. This now gives the firm a prominent presence in Turkey, with over 100 of its software developers now based there. Onur Candan Founder and CEO of PulpoAR, who create AR plug-ins for ecommerce platforms, discussed improving capabilities as a reason for joining Glimpse:

Glimpse has built an extraordinary and far-reaching AR and VR ecosystem, with tremendous benefits for its underlying subsidiary companies. We believe that by joining, we can focus on our core, significantly accelerate our growth, expand our market presence and enhance our capabilities

Much of the work Glimpse performs right now is largely experimental, though some work (such as the partnership between Qreal and Snap) has shown the material benefits of using AR in terms of improving ecommerce conversion rates. This was most likely a big driver behind the acquisition of PulpoAR and shows the potential positive impact of incorporating them into Qreal.

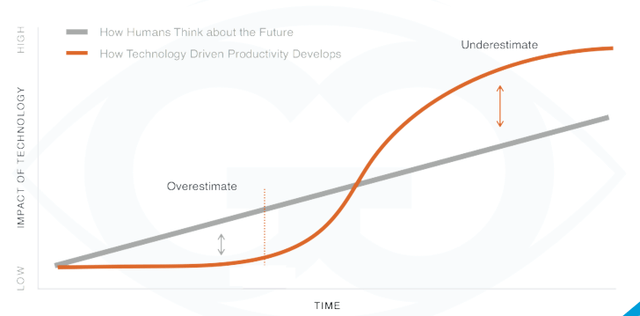

The truth is, however, that much of the work produced in the VR and AR space underwhelms at the moment. That isn’t purely isolated to Glimpse, but the larger players like Meta. Such as the recent reaction to its launch of digital meta clothes as highlighted in this Twitter (TWTR) thread. This is a common trend among tech cycles, and considering we are at the start of a new one (if you believe in the potential of VR and AR), Glimpse will underwhelm initially but as capabilities improve and capital investment continues, the sector will start to outperform.

Roy Amara depicted this theory well in Amara’s law where he states:

We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run

Or if you prefer in more visual form:

Risks

Economic conditions

I would strongly urge short-term investors to steer clear of Glimpse. Macro conditions and perception towards riskier assets mean that microcap conditions have completely flipped. Equities can no longer rely purely on ‘sentiment’ to deliver significant near term value. That was the case in 2020 and 2021, however the prospect of monetary tightening has flipped this completely. The market has moved from ‘ I will wait’ to a ‘show me now’ stance. Glimpse’s stock price is highly unlikely to ride higher on ‘Metaverse hype’, the market will want to see material progression in growth before a reprice occurs, which I believe the company can deliver.

Big firms may develop in-house

The bulk of firms building into the Metaverse will likely occur in-house with limited outsourcing. This may limit Glimpse’s role and ability to secure long-term material partnerships. Though because Glimpse is trading from a small-base, a few material partnerships or numerous smaller partnerships will allow shareholder value to be unlocked.

Hard to gauge the success of Glimpse’s projects right now.

Due to the nature of Glimpse’s reporting it’s hard to see what projects have been successful and what hasn’t. The company doesn’t provide a breakdown of each subsidiaries revenues. Therefore investing in Glimpse is exactly that – a bet on Glimpse’s success not its subsidiaries. You have to believe in management.

Concentration of customers

In the SEC Filing accompanying Glimpse’s latest results, the company noted that 61% of revenues for the quarter came from three customers. This follows a consistent trend of tight revenue concentration among a few customers. This highlights the importance of larger customers towards revenues. If Glimpse experiences a high customer churn, it may put future growth at risk. This concentration also has the potential to lead to volatile revenue figures as contracts are completed and if Glimpse shifts between different customers. I believe that one of these customers is most likely Snap (SNAP), due to the continued work and success of QReal, a long time partner.

Conclusion

The significant decline in Glimpse’s stock price highlights the speculative nature of the investment, only suitable for risk-prone investors in a balanced portfolio.

Nonetheless, I believe Glimpse’s positioning in an industry with strong growth industry growth trends gives appealing asymmetric reward at this level. The current forward P/S of 3 (and next year 1.7x P/S), with a large cash buffer of over $15 million (depending on price of PulpoAR deal) and controlled cash burn provides the company with the time and platform to attempt to take a piece of the enormous pie that is the immersive technology market. At the moment the potential is large, but information is limited, so for those (like me) that believe management can steer the firm to success in the market (target the right verticals) – the stock remains a ‘strong buy’.

Be the first to comment