Kwarkot/iStock via Getty Images

Investment Thesis

Gladstone Commercial (NASDAQ:GOOD) is a commercial real estate business dealing in office and industrial properties. The company has recently acquired two industrial properties in Jacksonville, FL, and Fort Payne, AL which I believe can accelerate the company’s growth. The company has an attractive dividend payout, making it an excellent investment opportunity for retired and risk-averse investors.

About GOOD

Gladstone Commercial is a real estate investment business that mainly deals with acquiring, owning, and managing office and industrial properties. The business is geographically diversified, and the tenants include various business sectors ranging from small to large private & public sector companies. The portfolio of the company consists of single-tenant office and industrial properties. While it has plans to acquire multi-tenant office and industrial properties, its primary focus will continue to be on single-tenant properties.

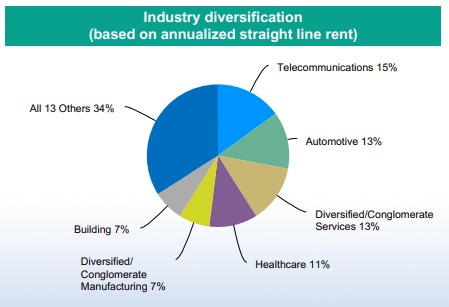

Industry Diversification (Investor Presentation: Slide no:14)

The company earns revenue mainly through ownership of income-producing real estate property. As of June 2022, the company owns 136 properties totaling 17.0 million square feet, and the occupancy rate was recorded as 97.3%. It operates in 27 states and has leased properties to 112 tenants across 19 industries, including Telecommunications, Building, Automotive, Diversified/Conglomerate Services, Diversified/Conglomerate Manufacturing, Healthcare, etc.

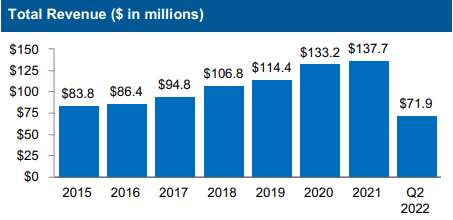

Revenue Trend (Investor Presentation: Slide No:16)

The company has managed to keep its growth consistent in terms of revenue and distributions despite global pandemic scenarios. Since 2012, the company has diversified its asset base with a CAGR of 15%, which reflects that the company is well-positioned in the competitive market, making it a very good investment opportunity. I believe this growth can be consistent as the company has been acquiring properties and expanding its business in the market, which I will explain in detail in the next section.

Acquisitions of Prime Properties

After the pandemic, the commercial real estate industry has seen a demand recovery and intensifying competition. This competition is mainly based on factors such as the quality of properties, leasing terms, location convenience, and tenants’ creditworthiness. In the current global economy, the industry is forced to be competitive in all the above-mentioned terms to get less affected by inflationary pressure and other market conditions. The industry also faces challenges of revenue volatility due to its cyclical nature. I believe that business expansion is necessary to remain competitive in the market.

Identifying this need, the company has recently announced the acquisition of two industrial properties located in Jacksonville, FL, and Fort Payne, AL which together account for 116,706 square feet. GOOD has purchased both properties for $13.6 million at a 7.45 weighted GAAP capitalization rate. The company acquired the Jacksonville property with twenty years of remaining triple net lease (NNN) term in a sale/leaseback transaction, whereas it acquired the Fort Payne with 14.8 years of remaining NNN term through a UPREIT transaction. These acquisitions might strengthen the company’s portfolio significantly as both the assets acquired by the company are high-quality, fungible buildings with strong fundamentals in the industrial market, which is constantly growing. As the properties acquired are in prime locations, GOOD can potentially generate more revenue in the form of lease rents, which can further expand the company’s profit margins. Also, in this industry, some tenants cannot make payments due to debt obligations and changing economic conditions, which can negatively affect the company’s performance, so it becomes essential to mitigate this risk.

In such cases, ensuring the properties are leased to credit-worthy tenants is essential. I believe the company has managed to mitigate the risk for these acquired properties as the company has already confirmed that the tenants are creditworthy. After considering all these factors, I think these acquisitions can increase the profit margins and increase the company’s industrial concentration by improving the weighted average lease term.

9.75% Dividend Yield

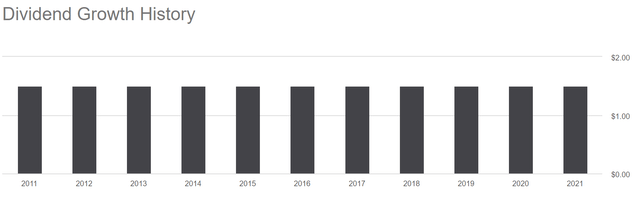

The company pays an attractive monthly dividend of $0.1254. As per my analysis, I believe this dividend payment can be sustainable for the coming periods as the company is well-positioned since it has managed to maintain sustainable revenue growth and stable funds from operation. The company has recently announced the acquisition of two industrial properties in Jacksonville and Fort Payne, which can result in high-profit margins and help it maintain a stable dividend payment. I estimate that the dividend of $0.1254 per share can remain constant for the coming periods, which is $1.50 per share annually, representing a 9.75% dividend yield at a current share price of $15.43. This attractive dividend payout makes Gladstone an excellent and ideal investment opportunity for risk-averse and retired investors who aim to generate fixed income through investments. The company has a long history of dividend payments. The company has been paying the same amount of dividend payment since 2011, which assures investors about the dividend payment in the coming years.

Dividend History (Seeking Alpha)

What is the Main Risk Faced by GOOD?

Fluctuating Interest Rates

The company may encounter interest rate volatility in conjunction with mortgage loans on real estate or other variable-rate debt that it may occasionally acquire. Part of long-term mortgages and the interest rate on the credit facility are both variables, and certain leases contain escalations based on market interest rates. As of December 31, 2021, the corporation has $16.3 million in outstanding principal on variable-rate mortgages. Holding cash & cash equivalents in the short term also exposes the company to the effects of interest rate changes. To limit its exposure to interest rate changes on all outstanding variable rate mortgages as well as the outstanding Term Loan components of the Credit Facility, the company has engaged in interest rate caps. It may also be challenging for the business to refinance mortgage debt as it matures or restrict the availability of mortgage debt, thereby restricting acquisition and/or refinancing activities. These factors include increases in interest rates or decreased access to credit markets as a result of, among other things, stricter lending requirements or a high level of leverage. Due to rising financing costs and other uncontrollable factors, even if the company is able to secure mortgage debt on or otherwise refinance mortgage debt, it may not be able to do so before the mortgage debt matures or may be subject to unfavorable terms, such as higher loan fees, interest rates, and periodic payments if it does so. It can have a negative effect on the company’s financials if interest rates change significantly.

Valuation

The company has recently announced the acquisition of two industrial properties in Jacksonville and Fort Payne. As both the properties are in prime locations, I believe this can significantly help the company to accelerate its growth through higher lease rents which can further expand the profit margins. Also, this acquisition can help the company to create a strong presence in the market as it is expanding across the Southeast USA by acquiring industrial facilities in the growth market. The company has managed to maintain a stable FFO per share since 2017. I believe the company can slightly exceed its traditional 5-year average FFO per share of $1.56 with these acquisitions. After analyzing all the above factors, I am projecting an FFO per share of $1.60 for FY2023, giving the forward P/FFO ratio of 9.64x. According to my analysis, the company is undervalued as its forward P/FFO ratio is lower compared to the sector median of 12.51x. The fluctuating interest rates might act as a primary risk factor for the company in the coming years and force it to trade below its 5-year average P/FFO ratio of 12.82x. After considering all these factors, I believe the company might trade at a P/FFO ratio of 11.9x, which gives the price target of $19.04, representing a 23.4% upside from the current share price.

Conclusion

The recent acquisition made by the company can accelerate its growth as both the property locations can help to generate more revenue and create a strong industrial presence. The fluctuating interest rates in the market might act as a primary headwind for the company in the coming years. The company pays an attractive dividend yield of 9.75%, which makes it an ideal investment opportunity for retired and risk-averse investors. According to my relative P/FFO ratio analysis, the company is undervalued and can give a price return of 23.4% from the current share price. With a price return of 23.4% and a dividend yield of 9.75%, the investors can earn a total return of 33.15%. After considering all the above factors, I assign a buy rating to GOOD.

Be the first to comment