Susumu Yoshioka/DigitalVision via Getty Images

Dear readers/followers,

In this article, I’m going to be looking closer at the Genuine Parts Company (NYSE:GPC). This is one of those hold-forever sorts of businesses (potentially) that you can really look at as a lifetime sort of investment. I’m going to show you the reasoning behind saying this, and what we can expect from the business going forward.

Concisely speaking, GPC is a top-tier level sort of investment at the right price. Its services are near-timeless and you can probably expect a significant sort of upside, provided you keep an eye on valuation.

Let’s dig down a bit into the company.

What does Genuine Parts Company do?

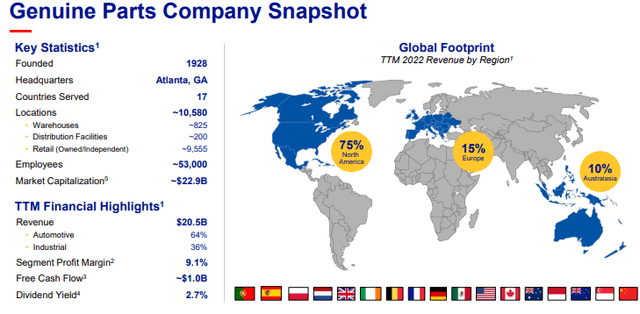

GPC is essentially a business holding multiple subsidiaries distributing a variety of products. These products come in the subsectors/areas of automotive parts and industrial parts.

The company is a dividend king, having paid an unerring dividend since 1948 when it went public.

The business is massive, offering millions of individual products and parts. Primary markets for the business are North America, Australia, New Zealand, and Canada as well as Europe.

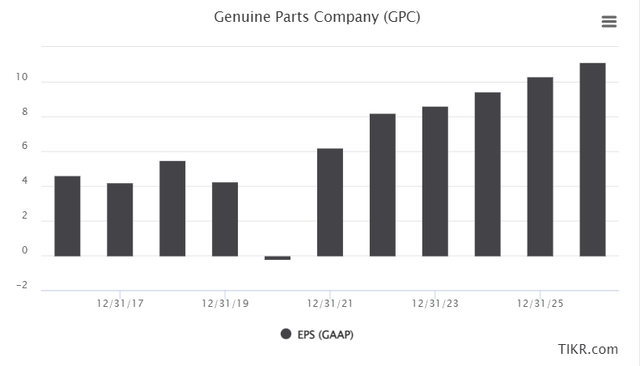

It’s all about the company’s ability to use its massive scale and logistics to drive company margins in the right direction. The company is M&A-heavy, combining organic growth with a very active sort of acquisition of adjacent businesses. GPC has managed to increase sales and profits in 88 and 77 years out of its 94-year history, which is superb, and the latest dividend marks the 66th consecutive year of dividend increases.

The company has a 10-year Revenue growth of 6% CAGR, and 8% EBITDA CAGR – meaning EBITDA is actually growing faster than revenues, implying efficiencies and profit increases on the “right” side of the trend, as opposed to profits increasing slower than revenues.

The primary segments are Automotive and Industrial. The company has partnerships with some of the major players in the industry and is the largest global auto parts network in existence, managing 170 distribution centers, and 9,500 stores of which 2,800 are company owned. This also includes over 25,000 global repair center partnerships, and 85% of the company’s sales are private label product sales, meaning profit margins are good and more under the company’s control.

80% of sales here are commercial, and only 20% are Retail/DIY. Growth opportunities in the segment primarily come from further efficiencies, promotions, inventory management, SCM, marketing investment, and expansion of the footprint. Nothing strange or particularly innovative here – just basic marketing and sales strategies, which implies a relatively low rate of growth on an annual basis.

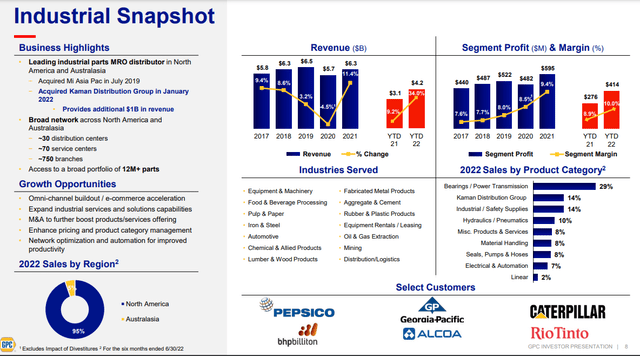

Industrial meanwhile is a bit heavier on the NA emphasis.

However, from the partnership and growth perspective, it’s much the same. This is a business with decades of synergistic experiences. It also sells products that, strictly speaking, can’t often be sold through standard retailers due to product size or logistical complexity, leaving the company to be a solution that also includes transport/freight and supply solutions.

The company has somewhat shifted its emphasis since 2019. It has left behind the lower-margin area of office products, as well as abandoned the electrical fields for similar reasons. Its simplified, two-segment structure and newly created cost structure have resulted in good execution even throughout the pandemic, and the company has managed to withstand and deliver good results even during the pandemic.

Its Vision 2025 is fairly generic, though it has targets that can be somewhat “followed”.

GPC IR (GPC IR)

A lot of buzzwords in the company’s vision mean that we need to look closely at what the company actually achieves in terms of earnings and margins, to make sure our investment keeps meeting our expectations. The expectations on GPC are high in a troubled world.

The company does, however, have addressable markets of a combined amount around $450B, and that’s just NA/Australiasia for Industrial. It also has a proven ability to consolidate and drive sales in these markets, and it holds several advantages over competitors, who don’t come with the company’s track record or overall experience, or let’s face it, scale.

GPC is in a position to not only buy at low prices, but to sell at incredibly attractive prices due to the integration and scale of its business model and processes. It’s a leading global distributor, and the #1 in many of its fields and geographies. There are always inherent advantages to this.

A few things worth noting though. GPC’s yield is only around 2.27%, which in today’s inflation-wracked world is on the low side. The company has a market cap of $27B, and carries a Baa1 from Moody’s but does not pay for a rating from S&P Global.

We can point to several fundamental advantages implying the company’s strengths here. This includes impressive working capital development. From a WC of 22% of sales back in 2011, the company currently has a cash conversion cycle of 6 days (down from 79 days 10 years back) and a WC of higher than 6% for 2021. For 2022E, the cash conversion cycle is down to 2 days.

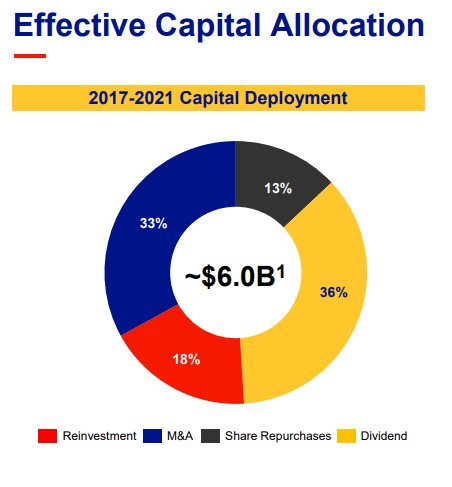

Operational cash flow has stayed strong, and YTD cash flow is higher than it was YoY. The company has a well-laddered maturity schedule and a total debt/adj EBITDA of 1.8X on a TTM basis, with the lion’s share of its debt not due before later than 2030. The capital allocation priorities are also clear.

GPC IR (GPC IR)

The company continues its intentions for M&A with attractive targets, is planning for further buybacks, and is reinvesting over $300M in CapEx. The company has streamlined its portfolio and has the history to match its ambitions. The latest results for GPC confirm the positive thesis for the overall business.

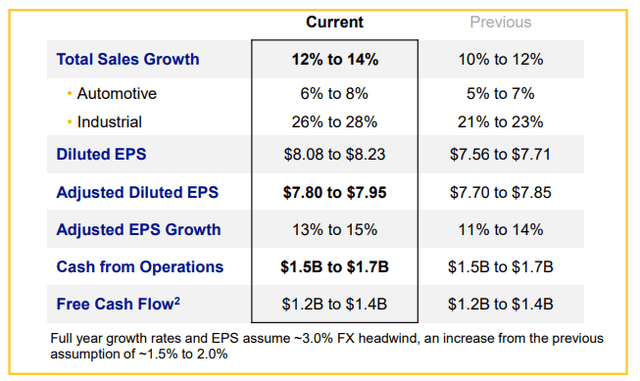

The most recent set of earnings show another record quarter following the last, showing double-digit sales and EPS increases, with a trend continuing through all 2Q22 months. Total sales are up 20%, and EPS up 26%. Operations continue to show resilience, including in automotive and industrial businesses. This wasn’t just a matter of revenue increases either – the company managed to even improve its margins thanks to excellent M&A’s, market expansion, new market brand rollouts, B2B investments and pricing efficiencies.

Industry tailwinds certainly played a part here, with a continued increase in driven miles overall, and the average age of vehicles rising. This is a similar trend I’ve also pointed out when reviewing Oshkosh (OSK). This aging vehicle trend is benefiting a few key players in the industry, and GPC is one of them.

PMIs continue to imply manufacturing expansion, and industrial production, despite everything, continues to be strong. Both of the company’s segments showed sales increase and profit increases – but industrial has clearly outperformed out of the two, with segment profit increases of 50% and sales increases of close to 35%. M&A’s are the big reasons for this, with KDG onboarded this quarter. The company improved its industrial segment margin for the 8th consecutive quarter and saw a 240 bps margin improvement for the 2/3-year perspective.

Despite ongoing inflation and cost increases, company non-OP expenses were actually down in terms of sales by half a percent. Most of the company’s YTD capital has gone to the KDG acquisition (65%), and the company is targeting further bolt-ons as we move forward into 2022.

In short, this is a grower that continues to grow – but with a very strong historical trend going for it as well.

The outlook for the business is absolutely stellar.

With those expectations, we move into valuation for the company, because this isn’t quite as great as we might expect given the circumstances.

Genuine Parts Company – The valuation

So, the valuation for GPC isn’t the greatest out there. It’s not overvalued, but it’s not one of the best opportunities out there either. GPC tends to trade at around 17-20x P/E – a premium that’s justified based on the company’s history, fundamentals, and performance.

GPC has a few competitors worth mentioning – though none are as big or significant. These are companies like LKQ (LKQ), Pool (POOL), and Uni-Select (OTCPK:UNIEF). None have the market cap or exposure that GPC has though, and in terms of P/E, only LKQ is really significantly below GPC at this time.

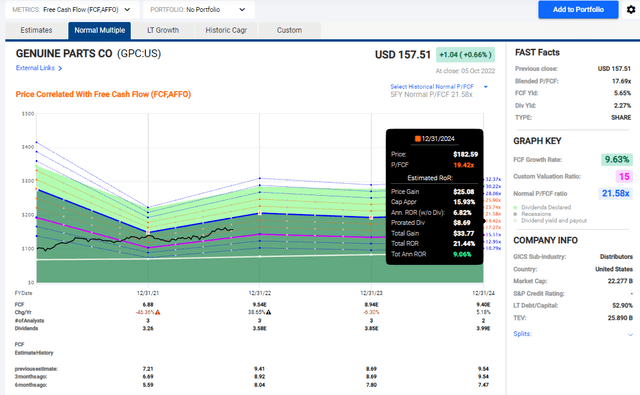

Investing in GPC means accepting a bit of a premium to get incredible safety and tradition. GPC is expected to improve EPS by around 38% this year, followed by a slight decline, then stabilization. If the current trends hold as is expected, then investors can expect an RoR of 21.44% until 2024E, or 9% per year for the next 3 years.

Not the greatest upside, especially not when you consider the market we’re currently in. But the question here is whether GPC is buyable. And I would consider that the company, while expensive, isn’t at a level that could be considered “excessive”.

In the next few years, I forecast a mid-to-high single-digit EPS growth, which analysts currently mostly agree with (more this year). I also don’t believe in the 2023E decline, instead forecasting a small amount of growth here as well in terms of GAAP.

I consider an 18-19x P/E premium to be valid for this company. My target for the company is $158/share, representing an 18.5x forward normalized P/E premium. The targets, looking at other analysts, are similar. The range for the company is between $130- $165 for S&P Global, with an average of around $157, close to my target. Now this means that the current target is fairly close to the most I would be willing to pay for the company – and this is close to the truth. This also comes into line with the around 9% potential annualized RoR we’re currently seeing – which isn’t that great, but still “okay” for what we’re buying.

GPC isn’t my favorite buy at this time – but it’s a solid company worth highlighting, and for the sector of industrial/automotive supplies, this company is about as “good as it gets” in terms of safety and fundamentals.

You could buy this company, make around 2-3% yield, and if that’s all you wanted, GPC would deliver (in addition to a high likelihood of growth).

So, not the greatest opportunity – but a “BUY” with a single-digit percentage upside to the PT, and a 9% potential annualized forward RoR. That’s what I see here.

Thesis

The thesis for Genuine parts company is as follows:

- GPC is one of the most significant automotive and industrial supply companies in the world. It’s a dividend king, with superb fundamentals, and very good future prospects. A combination of tack-on growth and organic growth coupled with efficiencies, scale and modernization is making further return growth a very likely scenario here.

- I consider the company a “BUY” at a good price, but I wouldn’t go higher than $158 for the company.

- At the time of writing this article, that makes GPC a “BUY” to me.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment