FG Trade/E+ via Getty Images

In this article, we will analyze the development prospects of one of the most attractive divisions of General Electric (NYSE:GE), which will become an independent company in early 2023. GE Healthcare is one of the world leaders in the development of medical devices, pharmaceutical diagnostics and digital solutions that enable doctors to make accurate and fast decisions, thereby saving the lives of millions of patients around the world. This unit has a variety of FDA-approved instruments, including a variety of ultrasound systems, which play a key role in diagnosing diseases of the internal organs. The company’s portfolio includes systems that, despite the high measurement accuracy, are small in size, which favorably affects their price and maintenance costs, which is critical for small medical organizations. Thanks to debt relief, the company has resumed its M&A deals by acquiring BK Medical, a leader in the fast-growing field of surgical imaging in 2021, thereby strengthening GE Healthcare’s business.

Source: UBS Healthcare Conference

GE Healthcare’s Financial Position

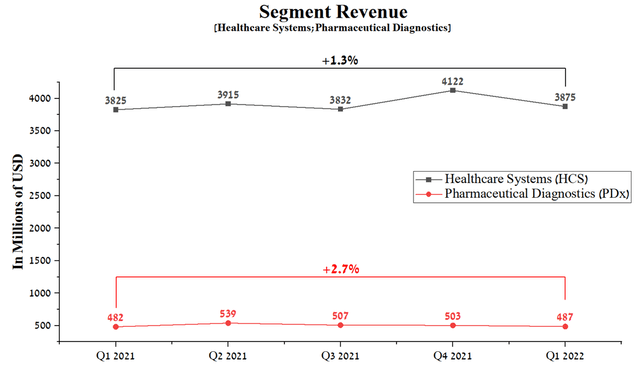

Pharmaceutical diagnostics revenue was $487 million in Q1 2022, up 2.7% QoQ. While the healthcare systems revenue was $3875 million in Q1 2022, showing a smoother increase compared to the previous year. A small increase in revenue was due to the recovery of testing volumes and doctor visits to pandemic levels, however, due to the restrictive measures caused by COVID-19 in China in 1H 2022, this did not allow the company to show more significant results.

Source: Author’s elaboration, based on quarterly securities reports

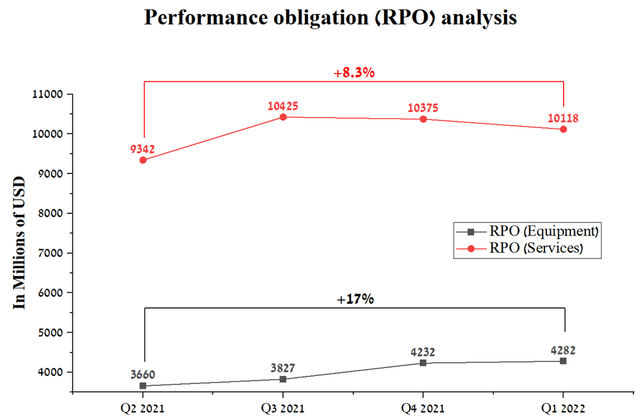

Given the COVID-19 pandemic and its consequences, which lead to various complications on the human body, this will contribute to an increase in the use of the company’s diagnostic equipment, which will accordingly lead to an acceleration in the revenue growth rate of the GE division. The challenging supply chain situation has led to an increase in performance obligations (RPOs), which stands at around $14,399 million at the end of Q1 2022. This is a negative moment that puts pressure on GE’s business, but in light of the latest news about the easing of restrictive measures in China, it increases the likelihood that GE Healthcare management will be able to cope with this challenge.

Source: Author’s elaboration, based on quarterly securities reports

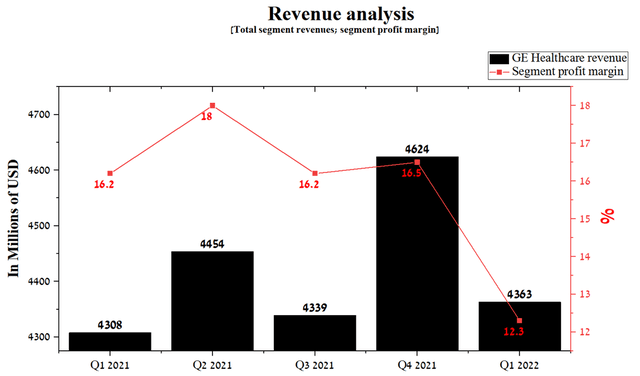

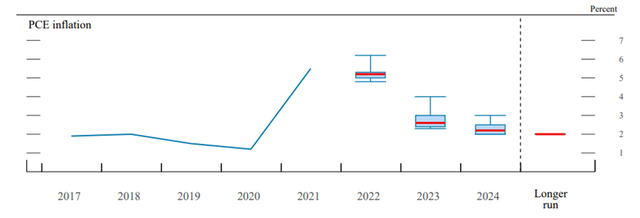

GE Healthcare has one of the highest profit margins in the structure of General Electric, which was 12.3% in Q1 2022. Due to the significant increase in inflation that occurred during the period from November 2021 to March 2022, this led to a decrease in this indicator by 3.9% relative to the previous year.

Source: Author’s elaboration, based on quarterly securities reports

In my estimation, the margin situation should gradually improve due to the company’s new policy, according to which it is planned to increase the price of GE products by $500 million and reduce costs by $2 billion in 2022. In addition, the Fed has begun to pursue a more aggressive policy, which in theory should slow down inflation, but its effectiveness will be noticeable only in the second half of 2022. So, at the last meeting of the Federal Open Market Committee (‘FOMC’), its members expect the next trend in rising prices for goods and services.

Thus, goods and services prices are expected to peak in the current year, and the situation will gradually start to improve, which is a positive factor for improving GE Healthcare’s margins ahead of the spin-off.

GE Healthcare’s Most Promising Products

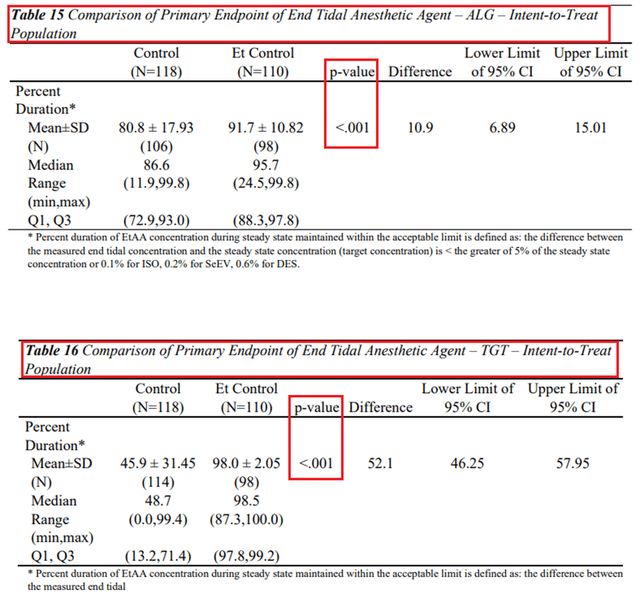

One of GE Healthcare’s most promising products is the Aisys CS2Anesthesia. The Aisys CS2Anesthesia is one of the best-selling anesthetic-breathing machines that allows you to effectively deliver anesthetics and perform mechanical ventilation in the most difficult patients, including newborns. On April 4, 2022, the FDA approved the End-Tidal (‘ET’) Control software for general anesthesia with control of oxygen and anesthetic concentration at the end of exhalation, which reduces the burden on doctors and increases the accuracy of anesthesia. This technology is currently being used in more than 100 countries, and with over 300 million patients worldwide undergoing surgery each year, this represents a huge opportunity for the company. According to a clinical study, End-Tidal Control has been shown to be effective compared to traditional methods of delivering anesthetic gas during anesthesia.

Source: Author’s elaboration, based on FDA

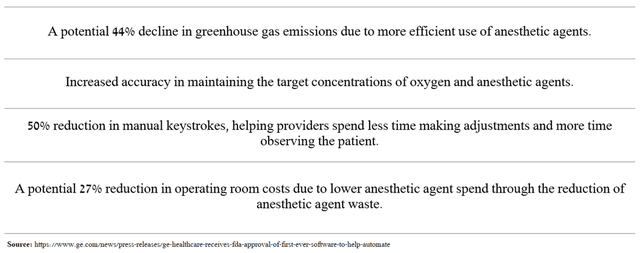

In addition, this GE Healthcare software can provide the following benefits over a manual process.

Source: Author’s elaboration, based on GE press release

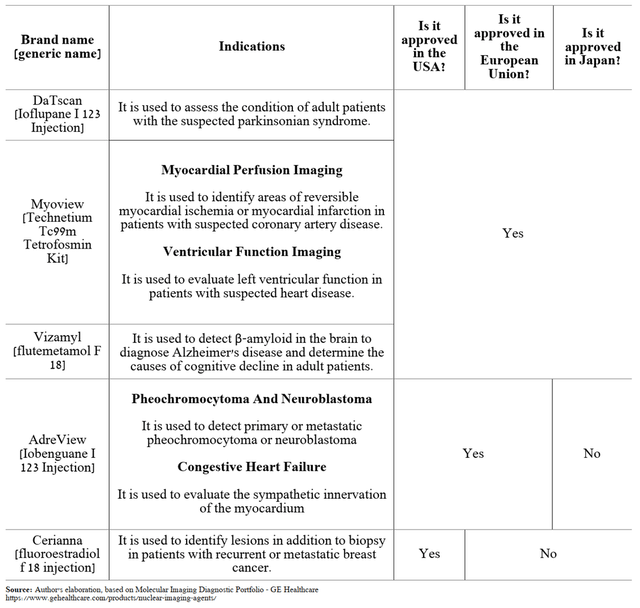

As such, I believe Aisys CS2Anesthesia will continue to lead the way in this vital area of healthcare well into the future. In addition, GE Healthcare is the world market leader in radiopharmaceutical imaging agents that are used in a variety of therapeutic areas to diagnose millions of patients worldwide. Currently, the company’s portfolio consists of the following diagnostic products, some of which are approved for use in more than 40 countries around the world.

Source: Author’s elaboration, based on Molecular Imaging Diagnostic Portfolio – GE Healthcare

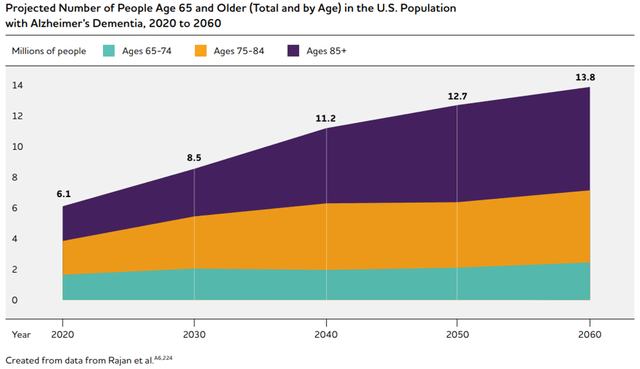

In my estimation, the following General Electric diagnostic agents will be able to show the fastest sales growth in subsequent years. The first of these is Vizamyl (flutemetamol F 18), which is used to detect β-amyloid in the brain to diagnose Alzheimer’s disease and determine the causes of cognitive decline in patients. According to a report by the Alzheimer’s Association, it is expected that by 2060, about 13.8 million people over 65 will suffer from Alzheimer’s dementia if humanity does not find an effective method to treat or slow down this disease. The increase in patients is more than 100% relative to 2020, which creates an urgent need for increased investment in this therapeutic area.

Source: 2022 Alzheimer’s Disease Facts and Figures

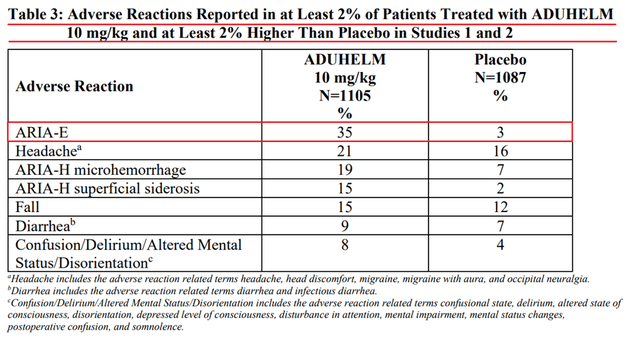

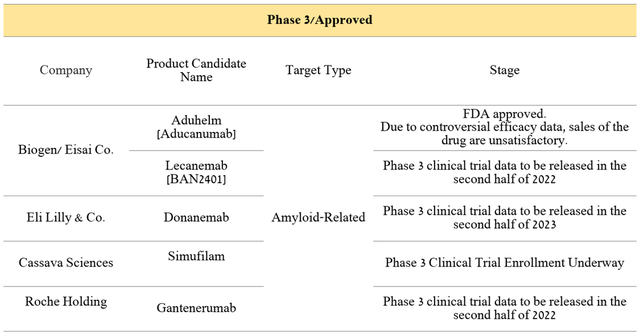

Even though Vizamyl is actively used in medical practice, however, the demand for it will increase significantly in the event of the appearance of drugs aimed at the treatment of Alzheimer’s disease. The first FDA-approved drug in recent years for the treatment of Alzheimer’s disease was Aduhelm (aducanumab-avwa), which reduces beta-amyloid plaques. However, this medicine had controversial efficacy data from phase 3 clinical trials and a non-ideal safety profile. So, the most common side effect was cerebral edema, which was observed in 35% of patients who took Aduhelm.

Source: Author’s elaboration, based on FDA document

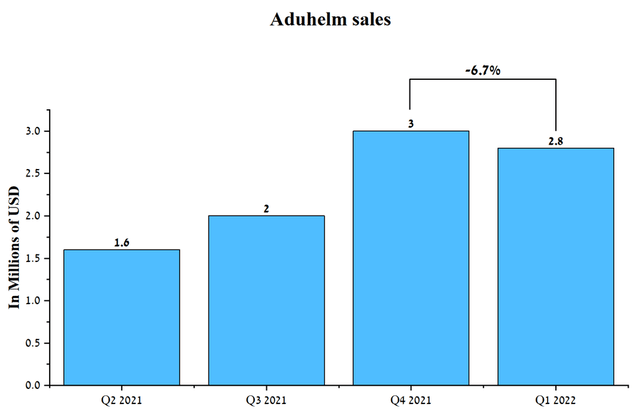

In April 2021, the CMS published a final policy that Aduhelm would only be covered by Medicare for patients who are enrolled in ongoing clinical trials. Thus, this decision significantly limits the market potential of Biogen’s medicine (BIIB), which also affects dismal sales. As a result, Aduhelm’s sales were $2.8 million in Q1 2022, down 6.7% from the previous quarter.

Source: Author’s elaboration, based on quarterly securities reports

Global pharmaceutical companies continue to search for new treatments for Alzheimer’s disease. Several clinical trials are currently underway in the final stages, which, if they reach the primary and secondary endpoints, could be a lifesaver for millions of patients and their families around the world.

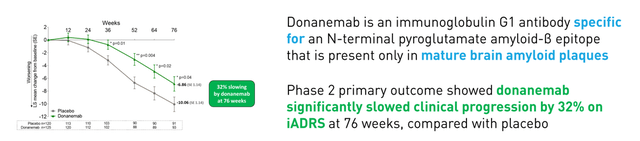

In the second half of 2022, the publication of data on the efficacy and safety of Biogen/Eisai (OTCPK:ESALY) and Roche (OTCQX:RHHBY) candidate products is expected. In addition, Phase 3 results, which evaluate the efficacy and safety of donanemab, are expected in Q3 2023. It should be noted that donanemab in the phase 2 clinical trial showed preliminary evidence for improvement in combined measures of cognitive function with use.

Source: Neuroscience Investor Presentation

Thus, if at least one product candidate reaches the endpoints, it will contribute to a significant increase in the demand for Vyzamil, which will become a widely used diagnostic agent for a more accurate diagnosis of Alzheimer’s disease. Thus, Vyzamil can become the locomotive of General Electric Healthcare’s pharmaceutical business in the coming years. And GE Healthcare’s second most promising diagnostic agent is Cerianna. The drug was developed by Zionexa, which was then acquired by GE in 2021.

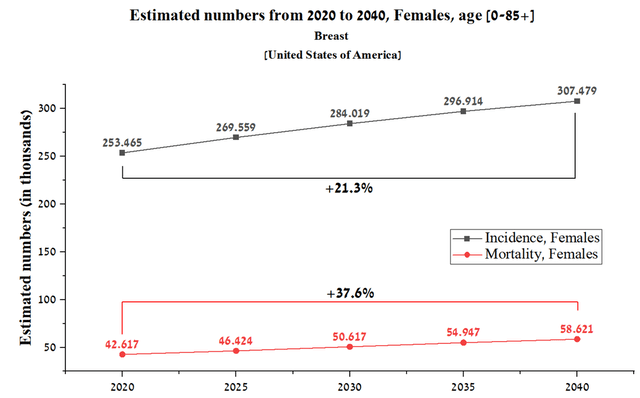

Cerianna was approved by the FDA in 2020 and is used to detect estrogen receptor positive lesions to determine the most effective treatment for patients with recurrent or metastatic breast cancer. Conventional imaging techniques are only able to produce contrast images for FDG PET/CT scans in a specific region of the body. While Cerianna binds to estrogen receptors, which allows the specialist to diagnose the entire body of the patient and not a specific area. Thus, by using GE’s diagnostic agent before a biopsy, the physician has more information available about possible lesions, which increases the likelihood of a correct diagnosis. According to the International Agency for Research on Cancer, about 307,479 women will be diagnosed with breast cancer in the US in 2040, representing a 21.3% increase from 2020.

Source: Author’s elaboration, based on IARC

Given the fact that cancer diagnosis is becoming more personalized and GE Healthcare continues to expand the geography of the use of Cerianna, this will increase the rate of sales of this drug. In addition, the company is not going to stop at the progress made and is developing a new generation of diagnostic agents that are able to provide more accurate information about the patient’s health to attending physicians.

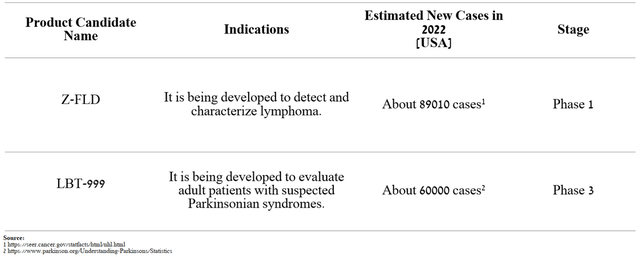

GE Healthcare Radiopharmaceutical Product Candidates

The company is developing the following innovative product candidates for PET imaging.

On March 28, 2022, the company announced that it had recruited the first patient for a phase III clinical trial evaluating the performance of LBT-999 for PET molecular imaging compared to a reference SPECT technique using DaTscan. The aim of this clinical trial is to evaluate a new radiopharmaceutical imaging agent and technology for diagnosing patients with suspected parkinsonism. The main advantage of PET technology over single-photon emission computed tomography (SPECT) is the higher spatial resolution of the resulting images, which increases the accuracy of diagnosis.

General Electric Healthcare Spin-Off Plan

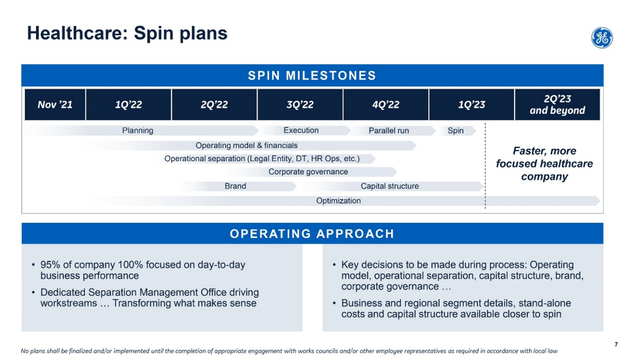

General Electric management continues to prepare General Electric Healthcare for a spin-off from the company. At the UBS Healthcare Conference, Helmut Zodl, who is the CFO of General Electric Healthcare, stated the following.

“But we have really what we call 95% of our teams 100% focused on the day-to-day business, which is really important. So we run the day-to-day business, and we have a small team that is executing the spin work, which is progressing very, very well. So with that said, overall, I’m really excited as we spin off, execute on our financial operating model, we become a faster, more focused health care company. It’s really here to serve patients and customers alike.”

In general, the time intervals for the onset of key milestones that should occur in the next three quarters were disclosed.

Source: UBS Healthcare Conference

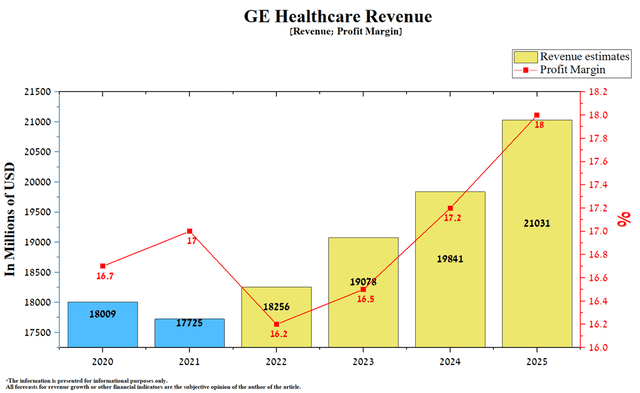

Therefore, the spin-off of GE Healthcare will occur in the first quarter of 2023, creating a more mobile and focused healthcare company. Overall, I expect this GE unit’s revenue to start growing by 3% between 2022 and 2023, as well as the profit margin. However, both revenue and margin growth will accelerate starting in 2024, driven by the launch of next-generation diagnostic equipment, the expansion of drug indications, and the greater adoption of Edison, GE Healthcare’s intelligence platform.

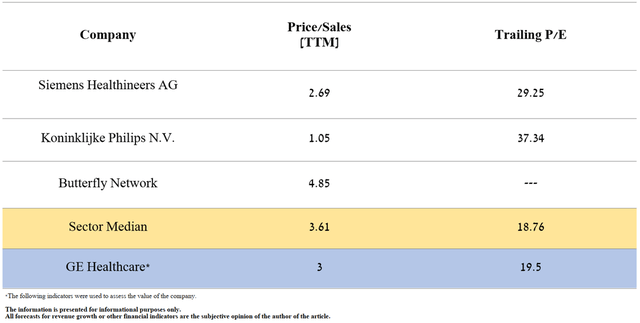

Currently, there is no form S-1 that would provide more detailed financial information about GE Healthcare, which is necessary for a more accurate assessment of the company’s value. However, based on current information, I estimate the value of GE Healthcare at $47-52 billion.

Risks

According to my assessment, there are three main risks that could negatively affect the company’s financial position.

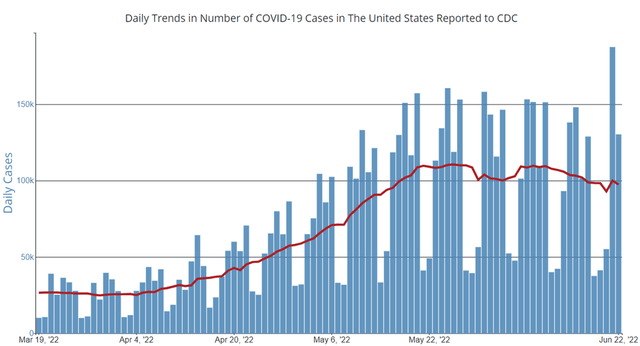

BA.4 and BA.5 variants of COVID-19

Even though about 60% of the world’s population is vaccinated, the number of new cases of COVID-19 is growing. The main reason for this is the rapid mutation of the virus, which leads to a decrease in the effectiveness of existing vaccines. For example, on June 22, 130,274 new cases of COVID-19 were detected in the United States.

If the current increase in patients continues, this could lead to a decrease in the number of visits to doctors and performed diagnostic procedures, which will negatively affect the revenue of GE Healthcare. On the other hand, the situation with COVID-19 continues to improve in China, but it is not entirely certain that this will be for a long time due to new variants of the virus. As a result, there is a possibility that the Chinese government will again tighten restrictive measures in key regions of the country. As a result, this will negatively affect the supply chain and create delays in the delivery of materials for GE products.

Macroeconomic risks

The current policy of the Fed, aimed at reducing inflation by raising interest rates, could lead to a recession in the economy. As a result, this will significantly reduce economic activity in the US and most regions of the world, thereby negatively affecting the company’s financial position.

Risks associated with the development of diagnostic equipment

General Electric Healthcare is a leader in diagnostic equipment, but it does business in a competitive environment with established companies such as Siemens Healthineers (OTCPK:SEMHF) (OTCPK:SMMNY), Koninklijke Philips N.V. (PHG), and Canon Medical Systems (CAJ). While GE is constantly innovating and developing best-in-class products, it must be taken into account that competitors do not stop there. As a result, there is a possibility that General Electric Healthcare’s efforts will not lead to a commercially successful product and, as a result, the profit will be lower than the costs that were spent on its marketing or development.

Conclusion

GE Healthcare is one of the world leaders in the development of medical devices, pharmaceutical diagnostics, and digital solutions, thanks to which thousands of doctors use the company’s products. Thanks to GE’s debt reduction, the company’s medical division has become more actively involved in M&A deals, which help strengthen its position in the diagnostics industry. As a result, I believe that GE Healthcare is a promising asset along with GE Aviation, which may be of interest to long-term investors. In addition, as a result of the decline in the price of GE shares, I bought them in accordance with the plan described in the previous article, thus becoming an investor for the coming years.

Be the first to comment