lucadp/iStock via Getty Images

Like it or not, we’re in a period where it is difficult to own software stocks. There were a few years when the entire cohort moved together, and it was generally up. But software investors need to be much more diligent stock pickers. Both quality of the product and valuation of the stock must align to provide solid expected returns.

Freshworks Inc. (NASDAQ:FRSH) sells high-quality software that demands high net revenue retention and low churn but I think it is a sell due to valuation concerns. Only with very optimistic assumptions, the expected IRR from owning the stock at today’s price would provide good returns. This leaves investors without a margin of safety. In this article I’ll discuss the product, financials and a potential pair trade to capture the upside if software stock multiples expand.

The Product

CRM software is mission-critical and difficult to change once in place. I’ve worked at companies that have changed platforms and I can attest to the fact that it is an expensive and timely process. The business will inevitably get interrupted, contractors and consultants are hired and retained, and planning takes time and attention away from the actual business. With this in mind, companies like Freshworks spend a lot of money to gain customers as the long-term value of each customer is quite high.

As an investor it’s difficult to pinpoint exactly why Freshworks’ products are better than a competitors products, say HubSpot, Inc. (HUBS). The important KPIs for each business are quite similar. Freshworks’ net revenue retention in 2019, 2020 and 2021 was 115%, 111%, and 114%. HubSpot’s net revenue retention for those same years was 100%, 102% and 115%. Freshworks’ growth of customers spending more than $5,000 was 34.7% and 28% in 2020 and 2021. HubSpot’s customer growth for the same years was 41.5% and 30.2%. These metrics are quite similar and show that each company offers products that are sticky and attractive to new customers. So for our purposes, I am assuming that Freshworks sells high-quality software that will allow for high growth for a long period of time.

Both of these companies are also targeting what they call underserved markets of small to medium sized businesses, and they are attempting to differentiate by offering low cost, easy to use software.

Financials

Freshworks is a classic high-growth software story. But while the growth is surely impressive, how will this translate to the stock price over time? In this section I will pencil out optimistic assumptions to see what types of returns an investment in Freshworks today will provide by 2030.

To start, I will point out what I think is Freshworks’ biggest competitive advantage over its competitors: an employee base mainly located in India. At the time its S-1 was filed in August 2021, 88% of its employee population resided in India. This is a competitive advantage not due to some inherent advantage of the geography but due to lower average wages in India. Freshworks’ operating expense per employee is much lower than the typical software company.

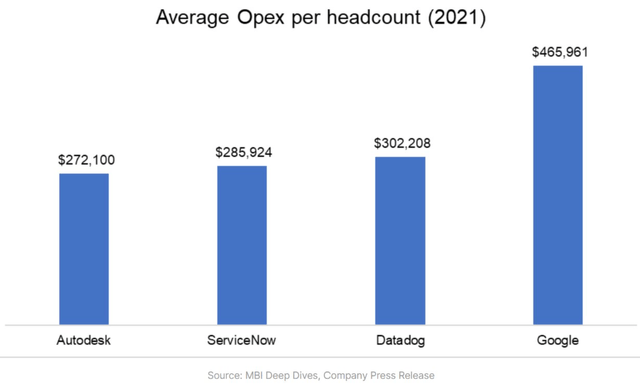

Average OpEx per Headcount at Tech Companies (MBI Deep Dives – Autodesk 3Q’FY 2023 Earnings Update)

In 2021 Freshworks had $108,000 in operating expenses per employee. HubSpot had $186,000 in operating expenses per employee in 2021. Alphabet Inc. (GOOGL) had an astounding $465,000 in operating expenses per employee. Because software engineers command such high salaries when compared to U.S. GDP per capita, it can be very difficult for software companies to control expenses. If Freshworks can maintain this level of operating expenses per employee over a long period of time it will have a much easier time achieving solid profitability than will competitors such as HubSpot.

Assumptions

Freshworks is guiding for about $495 million in revenue for 2022 and a non-GAAP loss from operations of about $29 million. To get an estimate of GAAP loss from operations I subtracted projected stock-based compensation (SBC) of $151 million to get a loss of $230 million.

My 2030 assumptions include revenue growth of 25% per year, 12% growth in headcount per year, $108,000 of operating expenses per employee, and for the share count to increase 4% per year. This results in revenue of $2.95 billion, a headcount of 13,800, operating expenses of $1.49 billion, operating profit of $837 million, a fully diluted share count of 387 million shares, and a 25 times EBIT multiple on the target market cap.

| 2022 | 2030 | ||

| Revenue | $495,000 | 25% growth per year | $2,950,430 |

| Gross Profit | 390,555 | 78.9% gross margin | 2,327,889 |

| # of Employees | 5,600 | 12% growth per year | 13,800 |

| OpEx per Employee | $108 | same OpEx per employee as 2022 | $108 |

| Operating Expenses | $604,800 | $1,490,400 | |

| EBIT | $(214,245) | $837,489 |

|

EBIT Multiple |

25x |

| Market Cap | $20,937,231 |

| Diluted Share Count | 387,658 |

| Stock Price | $54 |

This results in a $21 billion market cap and a stock price $54 using a share count of 387 million. If one purchased the stock today at $14 this would provide an IRR of 21%. This is a great return but it assumes a very optimistic scenario with sustained high growth and very well controlled costs. For example, holding all else equal, if the growth rate drops to 22% the expected IRR falls to 10%. So an investment today provides little to no margin of safety if financial results fall short of optimistic assumptions.

Possible Pair Trade

For a pair trade with a short position in Freshworks, I would look for another software company that is trading at a similar EV/Sales ratio, that is also tied to the general success of small to medium sized businesses. The one that comes to mind is Paylocity Holding Corporation (PCTY). Paylocity currently trades at about 13 times TTM revenue while Freshworks trades at about 10 times TTM revenue. Freshworks has also grown faster than Paylocity the past few years, with revenue growth in the 30%-40% range while Paylocity has grown revenue more in the 25%-35% range.

While its not growing as fast and is more expensive on a sales multiple basis, I cite a few reasons why I think Paylocity will be a better performing software stock over the next few years.

First, it is actually profitable with a 10%-12% GAAP operating margin over the past few years. This is very important in a market where long-duration stocks are getting penalized as discount rates rise.

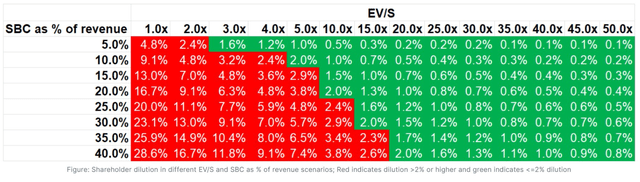

Second, and this is somewhat related to the first point, SBC is much more reasonable at Paylocity. In FY 2022 SBC was 11% of total revenue. At Freshworks, I expect SBC to be 40% of revenue for CY 2022. For investors with long holding periods this makes a massive difference in potential returns. In fact the high EV/Sales multiple for Paylocity along with the reasonable SBC numbers means dilution will be quite low over the years. The diluted share count has increased only by about 10% since 2016. For Freshworks, if SBC remains at 40% and if the stock continues to trade with a 10x EV/Sales ratio, dilution will be about 3.5% per year. Over a 6-year period, this dilution would amount to 22%.

Effects of SBC on Dilution (Mostly Borrowed Ideas (@borrowed_ideas) Twitter Account)

Finally, Paylocity operates in an industry that is less ripe for disruption. HCM software has been around for a long time with big legacy players such as Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX) that have grown for multiple decades. The large players in the CRM business generally started in the early 2000s.

Often the best moats are not business specific but industry specific. Look at rails, tobacco and the defense industry. All of these industries have strict regulations and businesses in these industries have had decades and decades of earnings growth along with little to no competition along the way. I don’t mean that the HCM software business has strict regulations but I simply have more confidence that this industry will have less disruption and competition than will the CRM business, leading me to have more confidence in long-term growth for Paylocity than for Freshworks.

The biggest risk in a long Paylocity, short Freshworks position is the risk that Freshworks is bought out in a private deal. Even if Paylocity would provide better return than Freshworks, at a $12 billion market cap it is sufficiently large where it would be difficult for it to be bought out by a private equity firm. Freshworks, at a $4 billion market cap, is in the sweet spot. As a comparison, Coupa Software Incorporated (COUP) was trading below a $4 billion market before rising 40%+ on news that it may be bought out in a private deal. Coupa is similar to Freshworks in that it is an unprofitable SaaS company that trades at a high EV/Sales ratio. Similar news could take Freshworks’ stock up so I would be cautious with a short position.

Final Thoughts

By all metrics, Freshworks sells high-quality software. But valuation matters especially in a bear market and with even very optimistic assumptions, Freshworks is not cheap. To offer good returns for investors, growth must continue at a high clip for years, they must keep OpEx low by hiring employees very conservatively (something most SaaS businesses struggle with), and the market must assign a healthy EBIT multiple to the stock. This leaves little to no margin of error.

If one was to short Freshworks’ stock I would pair it with a long position in Paylocity. Paylocity is another software company with a high EV/sales multiple that rides upon the success of small to medium size businesses. The two companies differ because Paylocity is much more profitable than Freshworks, uses reasonable amounts of stock based compensation to pay its employees, and I believe it has a longer runway of growth given the past growth of other HCM software companies. These factors lead me to believe that Paylocity will provide better returns over time than Freshworks.

Be the first to comment