Viorel Kurnosov

Investment Thesis

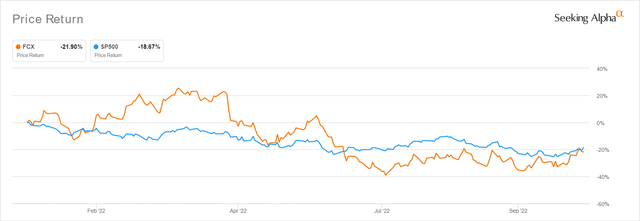

The Freeport-McMoRan (NYSE:FCX) stock has been massively beaten up with a -21.90% plunge YTD, compared to the S&P 500 Index’s -18.67% at the same time. However, we expect these to be temporary headwinds, since there are promising signs of market recovery ahead, as witnessed by the 9.99% rally on 21 October. This is attributed to the growing optimism that the Feds may potentially pivot during its upcoming November meeting with a 50 basis points hike, similar to those by the Bank of Canada. Depending on the Fed’s eventual action and dovish/ hawkish commentary on 02 November, we expect to see more short-term volatility in the stock market and copper prices, alike.

Nonetheless, given the massive global investments in global electrification, we do not expect to see demand destruction for copper ahead. In fact, things are only starting to accelerate with more and more EV/battery/solar investments announced every quarterly. Thereby, prompting certain analysts’ optimistic projection of FCX FQ4’22 EPS at $0.38, indicating an excellent 46.15% growth QoQ, though still a massive distance away from FQ4’21 levels of $0.96. We’ll see if this stock rally will hold through the difficult next two weeks.

FCX Continues To Be Bogged Down By Higher Costs

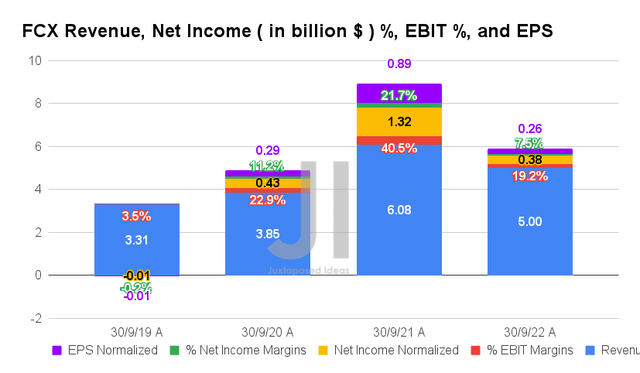

In its FQ3’22 earnings call, FCX reported revenues of $5B and EBIT margins of 19.2%, indicating a notable decline of -7.62% and -12.9 percentage points QoQ, respectively, attributed to the -22% moderation in copper prices from H1’22 levels. Otherwise, another drastic YoY plunge of -17.76% and -21.3 percentage points YoY, respectively, due to the rising inflationary pressures and elevated operating expenses. These have contributed to the increase in the company’s net cash costs of $1.75 per lb of copper in the last quarter, compared to $1.24 in FQ3’21, $1.32 in FQ3’20, and $1.59 in FQ3’19.

These issues naturally impact FCX’s profitability to net incomes of $0.38B and net income margins of 7.5% for FQ3’22, representing another decline of -56.08% QoQ and -71.6% YoY. Therefore, we are not surprised by the continued decline in its EPS to $0.26, with more pain ahead in FQ4’22 as the management guided lower three months forward copper prices of $3.46 and open market pricing of $3.37 by mid-October, compared to FQ3’22 average of $3.51. Thereby, impacting its stock performance thus far, compared to the hyper-pandemic and H1’22 levels.

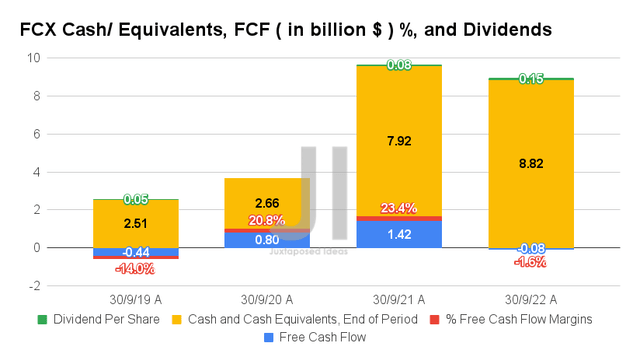

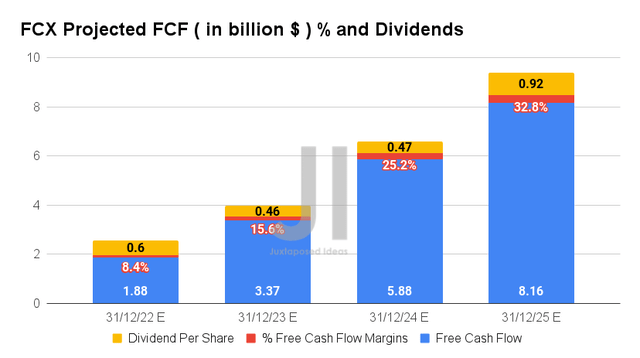

Though FCX investors may be concerned by the reduced Free Cash Flow (FCF) generation of -$0.08 in FQ3’22, these are attributed to its elevated capital expenditure of $3.19B in the last twelve months, indicating a massive increase of 84.35% sequentially. However, with the management guiding a reduced expenditure of approximately $278M for the upcoming quarter compared to FQ3’22 levels of $836M, we expect the company to report improved FCF of approximately $250M then. Assuming higher realized copper prices from the Fed’s speculative pivot, we may see a higher sum as well.

In the meantime, we expect FCX to similarly payout $0.15 in dividends for FQ4’22, in line with previous quarters, as the macroeconomics remain uncertain. Again, these levels represent a tremendous expansion from FQ4’19 levels of $0.05.

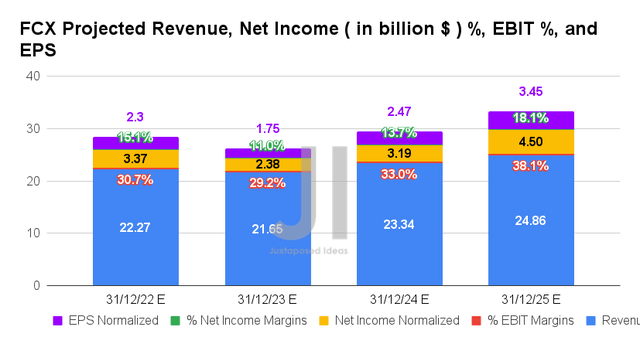

Over the next four years, FCX is expected to report a deceleration in revenue and net income growth at a CAGR of 2.1% and -0.8%, respectively, compared to hyper-pandemic levels of 25.9% and 1,031.2% between FY2019 and FY2019.

It is apparent that analysts are relatively pessimistic about copper futures during the impending recession, due to the downgrades in FCX’s top and bottom line growth by -8.68% and -20.93% for FY2023, respectively, since our previous analysis in September 2022. Nonetheless, investors may be encouraged by the apparent upgrade in its FY2025 profitability by 25.34%, triggering an excellent net income margin of 18.1% compared to 0.2% in FY2019 and 20.3% in FY2021.

In the meantime, FCX’s performance in FY2022 has also been discounted by -3.59% in revenue and -14.46% in net income estimates, indicating Mr. Market’s temporal pessimism in copper prices through Q4’22. Nonetheless, with the projected EPS of $2.3 for FY2022, we are still looking at an excellent improvement compared to pre-pandemic levels of $1.52 in FY2018 and $0.02 in FY2019.

Furthermore, the expansion in FCX’s operating efficiency and profitability is impressive, from EBIT/FCF margins of 25.5%/10.2% in FY2018, to 36.6%/24.5% in FY2021, and finally settling at 38.1%/32.8% by FY2025. Combined with accelerating capital expenditure at a CAGR of 8.4% through FY2024, it is apparent that copper prices/supply/ demand are expected to rebound by H2’23 once macroeconomics improves and remains elevated through FY2025. This will likely lead to the company’s excellent cash from operations of $8.05B then, compared to $3.86B in FY2018 and $7.71B in FY2021.

Thereby, also boosting FCX’s dividend payouts to $0.92 by FY2025, indicating a speculative dividend yield of 2.85% then based on current stock prices, against its 4Y average of 1.16% and sector median of 2.08%. Decent indeed. In the meantime, we encourage you to read our previous article on FCX, which would help you better understand its position and market opportunities.

- Freeport-McMoRan: Testing The Bottom At The Fed’s Next Cue

So, Is FCX Stock A Buy, Sell, Or Hold?

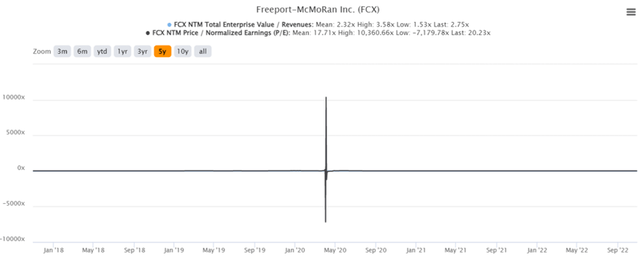

FCX 5Y EV/Revenue and P/E Valuations

FCX is currently trading at an EV/NTM Revenue of 2.75x and NTM P/E of 20.23x, higher than its 5Y mean of 2.32x and 17.71x, respectively. The stock is also trading at $32.20, down -38.06% from its 52 weeks high of $51.99, though at a premium of 29.83% from its 52 weeks low of $24.80. Nonetheless, consensus estimates remain bullish about FCX’s prospects, given their price target of $35.17 and a 9.22% upside from current prices.

FCX YTD Stock Price

It is evident that FCX continues to trade at a premium compared to its historical valuations. However, these are given attributed to the importance of copper to the global electrification efforts post-reopening cadence, significantly aided by multiple legislative acts in the US and EU. Thereby, explaining the stock’s elevated prices, above its 50 and 100-day moving averages. The fact remains that FCX is an excellent stock for long-term investing and portfolio growth, directly linked to the massive digital transformation through the next decade.

The caveat is that those who add at these levels should also be aware of the potential for volatility as the Fed raises interest rates and October labor, PPI, and CPI reports are released in the coming two weeks. Therefore, portfolios should also be sized accordingly, in the event of more retracement ahead. In the meantime, a massive load-up in the mid to higher $20s could be just a matter of luck for bottom-fishing investors, potentially yielding an excellent yield of 3.68% by FY2025.

Be the first to comment