Andressa Anholete

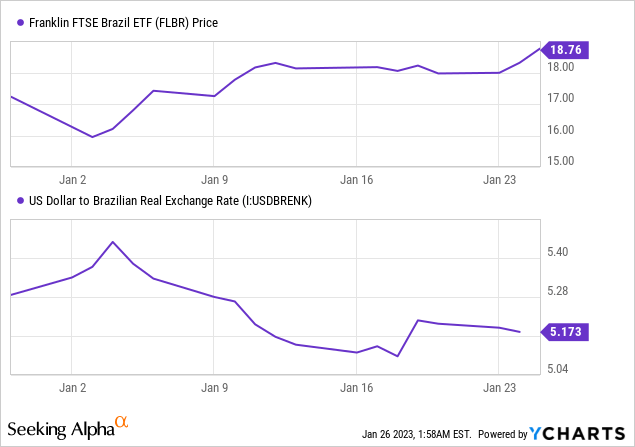

The rally across risk assets and emerging markets this year on the post-COVID reopening in China, as well as slowing Fed hikes, has boosted the appeal of gaining exposure to post-election Brazil. A low-cost vehicle available to US investors is the Franklin FTSE Brazil ETF (NYSEARCA:FLBR), which tracks the FTSE Brazil Capped Index, a proxy for Brazilian large and mid-cap stocks. At the time of writing, the ETF has risen ~17% YTD – not a bad return given President Luiz Inácio Lula da Silva’s (‘Lula’) less-moderate-than-expected turn in his third term.

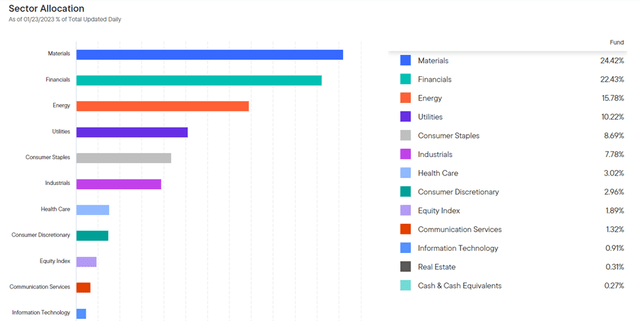

With public spending set to rise, though, and with little fiscal discipline shown so far with regard to the deficit implications, I am concerned that the post-election selloff in November/December 2022 could still have legs. Plus, FLBR is heavy on state-influenced or state-owned companies (‘SOEs’) (Vale SA (VALE) and Petrobras (PBR) are the largest holdings) and could be vulnerable to less-shareholder-friendly capital allocation policies in line with President Lula’s emphasis on ‘green’ policies, social programs and economic support. Finally, Brazil is far from stable politically or socially, and this could weigh on the currency – the recent storming of government buildings is a case in point. Net, even with the overall P/E still at a relatively undemanding ~5x (trailing-twelve-month basis), the risk/reward of FLBR isn’t compelling here.

Fund Overview – A Low-Cost Vehicle for Brazil Exposure

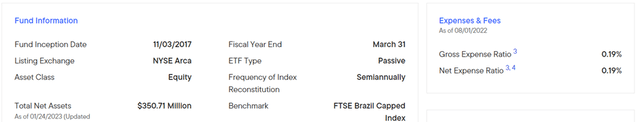

The NYSE-listed Franklin FTSE Brazil ETF seeks to track, before fees and expenses, the performance of the FTSE Brazil Capped Index, a market cap-weighted index comprising Brazilian large and mid-cap equities. The ETF held $351m of net assets at the time of writing and charged a 0.19% expense ratio, making it a cost-effective option for US investors looking to access Brazilian equities.

As reflected in the graphic below, the fund’s sector allocation skews toward the materials (24.4%), financials (22.4%), and energy (15.8%) sectors, which accounted for a combined 62.6% of the total portfolio. The fund’s largest holdings are metals and mining company Vale SA (18.1%), state-owned petroleum multinational Petrobras (7.3%), and financial services company Itau Unibanco (ITUB) (6.0%).

On a YTD basis, the ETF has returned 17.6% but has declined in value since its inception in 2017, only slightly below the benchmark. Income dividends are paid out on a semi-annual basis, while capital gains, if any, are paid out on an annual basis. Thus far, the fund has distributed $2.07/share for 2022 out of income (implied ~11% yield). Last year benefited from higher than usual dividends, however, likely helped by the fund’s exposure to mining and oil & gas; historical distributions indicate a run rate closer to around half of last year’s, so that’s where I think investors should peg their expectations.

A Play on the Post-Election Brazil Theme

Handling the economic and fiscal challenges is key for President Lula’s third term (2023-2026), but early signs haven’t been good. Broadly speaking, the focus seems to be on populism over fiscal responsibility; case in point – the decision to extend the fuel federal tax exemption for another two months. While the plan is to resume fuel taxes afterward, the net fiscal impact is likely to be a wider deficit and higher short-term inflation.

Efforts to introduce a more flexible spending ceiling via a proposed constitutional amendment (‘Transition PEC’) don’t bode well for the fiscal outlook either. Congress has already allowed an additional BRL168bn in fiscal spending in FY23 (mostly attributed to a raised spending cap in excess of inflation) but hasn’t accounted for a corresponding funding source. While the 2023 budget concerns have been acknowledged by the Lula administration via new measures to reduce the primary deficit (>2% of GDP since ‘Transition PEC’), the measures are overly reliant on higher revenue projections rather than spending cuts. Given the uncertainty around whether the estimated revenue growth will materialize, I would be hesitant to underwrite a moderation of the deficit anytime soon.

Also concerning is the future path of the Lula administration’s policymaking – during his inauguration speech earlier this month, he not only criticized the spending cap as “stupidity” but also made clear his emphasis on social welfare over profitability, citing the use of public banks and SOEs as vehicles to provide economic support. The latest CEO appointment at Petrobras (the second largest ETF holding), Jean Paul Prates, for instance, has stated his intention to transition the company away from a focus on shareholder returns toward ‘green’ investments. While an increased ESG emphasis could make Petrobras a more attractive destination for ESG flows, elevated investments will also mean lower dividend payments and, by extension, lower distributions for ETF holders going forward.

Potential FX Downside as Additional Risks Loom

Investing in Brazil comes with many known risks, but the unknown risks are worth monitoring as well. The pro-Bolsonaro Congress riots earlier this month, for instance, were not anticipated by any market watchers, highlighting that the social/political risks cannot be underestimated. Given President Lula won the election by the slimmest of margins as well, his administration likely won’t have the will to enact socially unpopular measures to preserve fiscal stability. So the probability of a fiscal consolidation scenario, with higher taxes to match the increased spending, seems slim at best.

Beyond equities (as discussed earlier), this has implications for the currency as well, which ETF holders have benefited from this year. While the BRL has been stronger this year on higher carry and delayed expectations for interest rate cuts, this could quite easily reverse should investor confidence wane on fiscal concerns. On the monetary policy front, political noise is set to ramp up in the coming months, with the deputy governor in charge of the central bank’s monetary policy up for reappointment. President Lula has been critical not only of high-interest rates but also of the central bank’s independence; thus, a more dovish appointment or a curtailing of policymaking ahead of the Monetary Council meeting on inflation targets in June poses a risk to the BRL’s YTD strength.

A Bumpy Ride Ahead

The risk-on sentiment YTD might have some investors looking closely at gaining low-cost exposure to post-election Brazil via FLBR, but I would hold off for now. This is still an SOE-heavy ETF and could suffer from a governance overhang should President Lula follow through with his plans to use SOEs (like Petrobras, the fund’s second-largest holding) as vehicles for economic/social support. His less-moderate-than-expected stance also doesn’t bode well for the FX and investor flows – plans to raise public spending alongside the deficit could trigger further selloffs. Plus, the risk of additional social and political unrest cannot be ruled out, particularly following the recent Capitol riots. The trailing P/E is relatively low at ~5x, but relative to the risks and uncertainty of investing in post-election Brazil, the risk/reward doesn’t seem particularly attractive.

Be the first to comment