Solskin

A Quick Take On FIGS

FIGS (NYSE:FIGS) went public in May 2021, raising approximately $580 million in gross proceeds for the company and selling shareholder Tulco from an IPO that priced at $22.00 per share.

The firm sells direct-to-consumer healthcare apparel to users in the United States and elsewhere.

I’m cautious about the firm’s ability to grow revenue and retain margins in a supply-constrained environment.

So, I’m on Hold for FIGS in the near-term.

FIGS Overview

Santa Monica, California-based FIGS was founded to develop an integrated healthcare apparel company that sells directly to end users in a historically fragmented market.

Management is headed by co-founder and co-CEO Catherine Spear who was previously an Associate at the Blackstone Group.

The other co-CEO and co-founder is Heather Hasson, who was previously the founder of Heather Hasson bags, a high-end bag line.

The firm sells its healthcare professional apparel directly to consumers via its website and mobile app.

FIGS’s Market & Competition

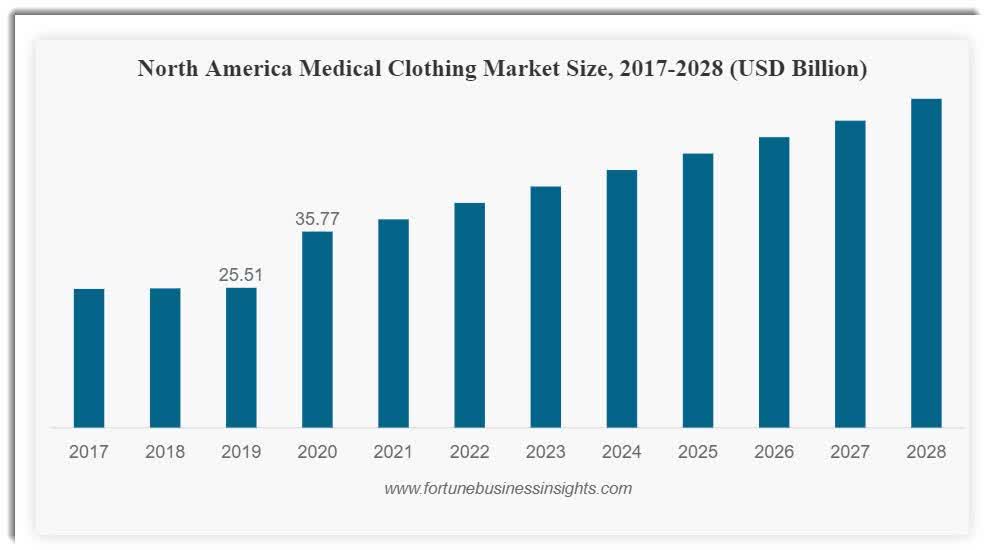

According to a 2020 market research report by Fortune Business Insights, the global market for medical clothing was an estimated $86 billion in 2020 and is forecast to exceed $140 billion by 2028.

This represents a forecast CAGR of 5.9% from 2021 to 2028.

The main drivers for this expected growth are an increased focus on safety from contaminants and body fluids as a result of the COVID-19 pandemic.

Also, a continued rise in hospital acquired infections among patients, especially as the number of patients grows due to global populations aging, will serve as a demand driver for patient clothing.

Below is a historical and projected U.S. market growth trajectory for medical clothing:

N. America Medical Clothing Market (Fortune Business Insights)

The North America region accounted for $35.77 billion in sales in 2020.

Major competitive or other industry participants include:

-

Careismatic Brands

-

Barco Uniforms

-

Landau Uniforms

-

Superior Group of Companies

-

Scrubs & Beyond

-

Uniform Advantage

-

Jaanuu

FIGS’s Recent Financial Performance

-

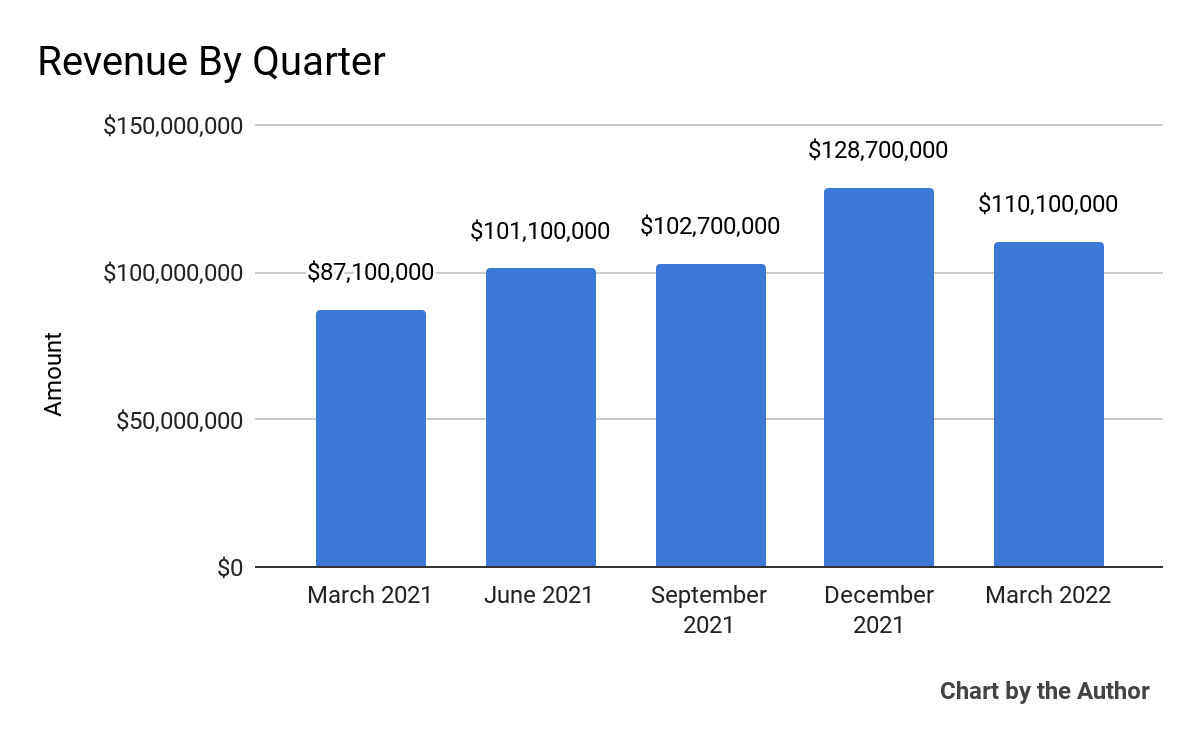

Total revenue by quarter has grown markedly over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

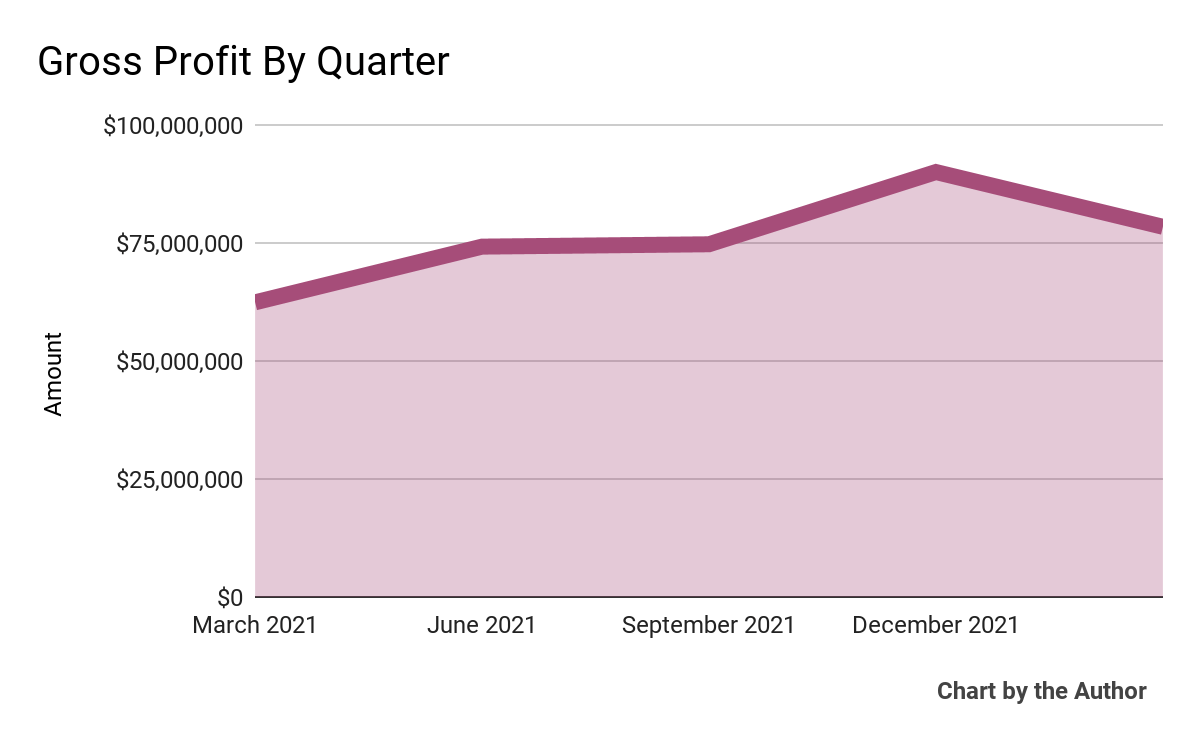

Gross profit by quarter has followed approximately the same trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

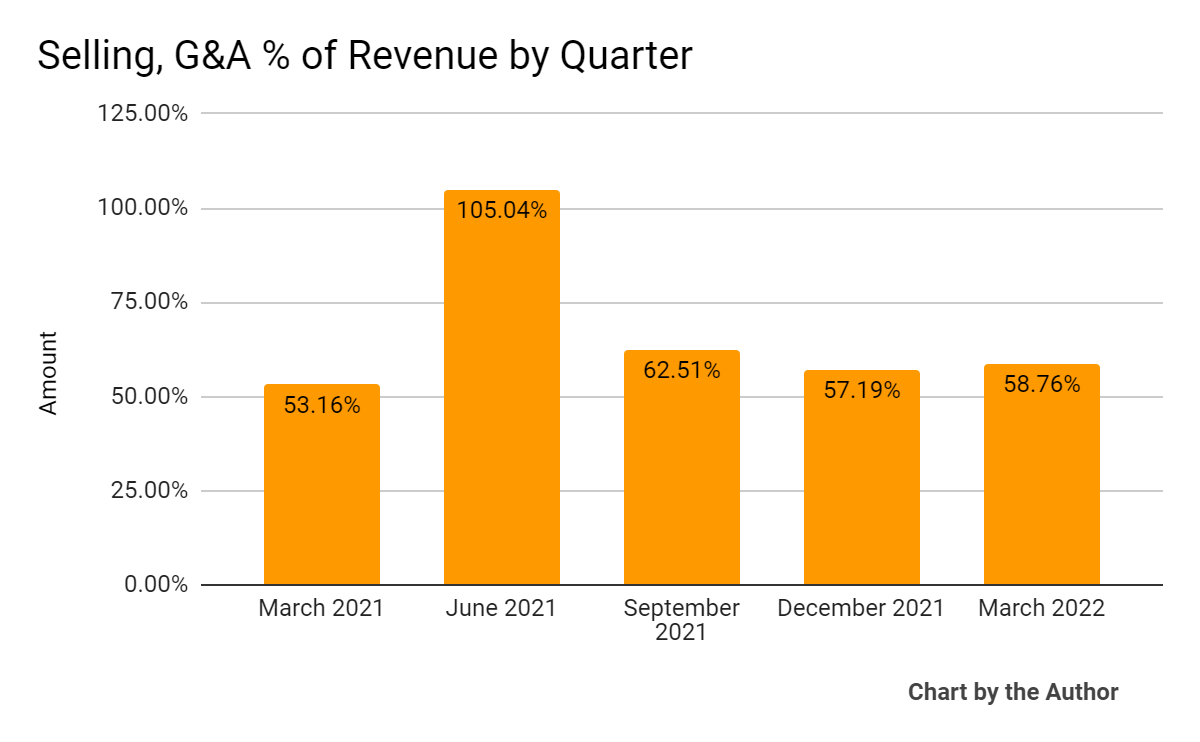

Selling, G&A expenses as a percentage of total revenue by quarter have remained relatively stable except for the IPO quarter which saw much higher stock-based compensation:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

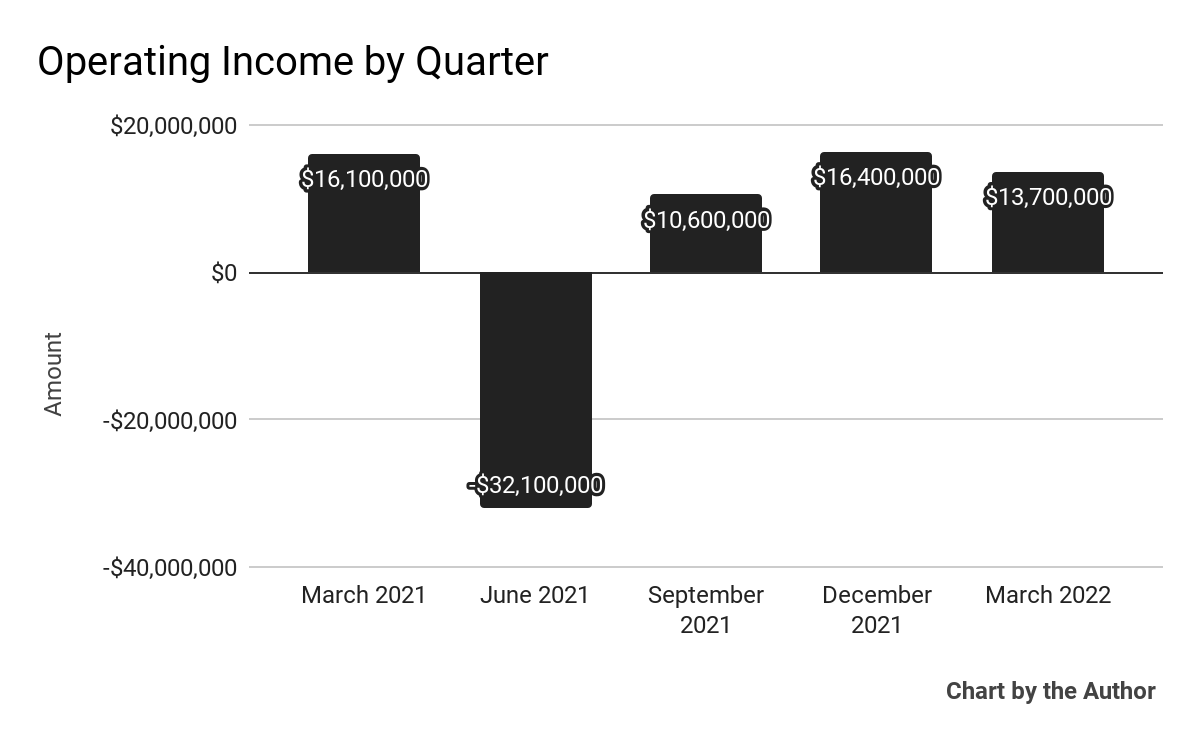

Operating income by quarter has remained positive in the past 3 quarters:

5 Quarter Operating Income (Seeking Alpha)

-

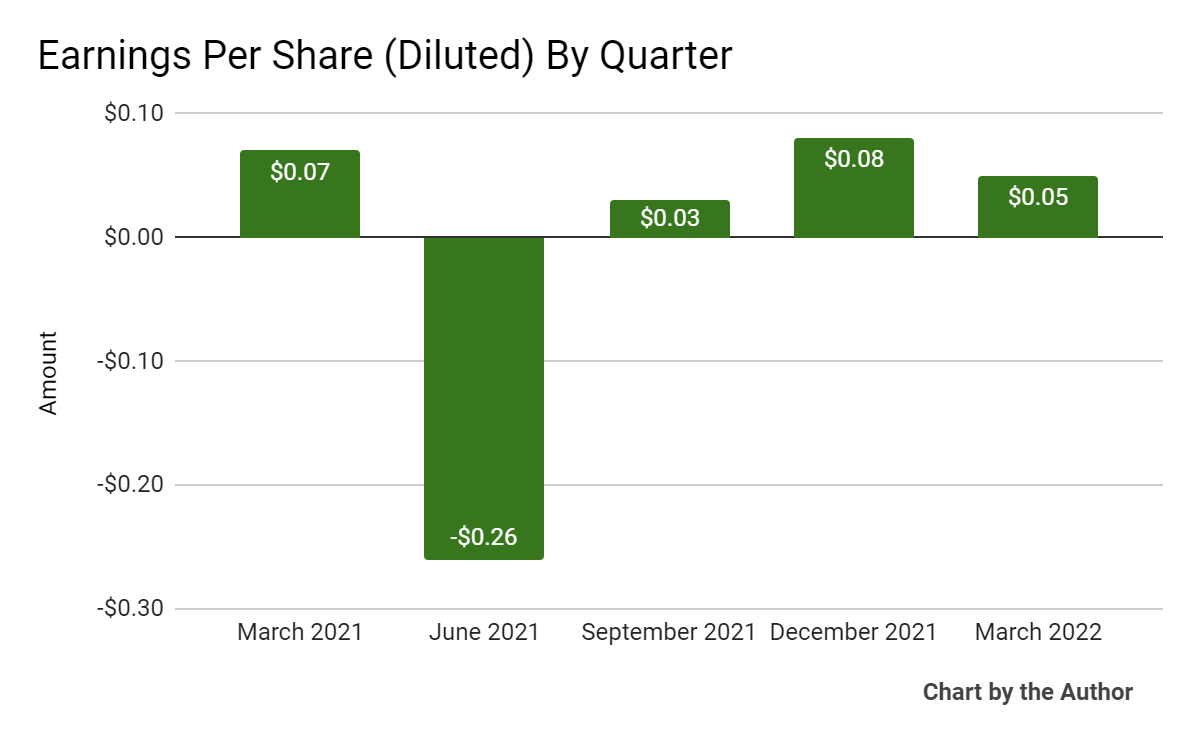

Earnings per share (Diluted) have also remained positive in recent reporting periods:

5 Quarter Earnings Per Share (Seeking Alpha)

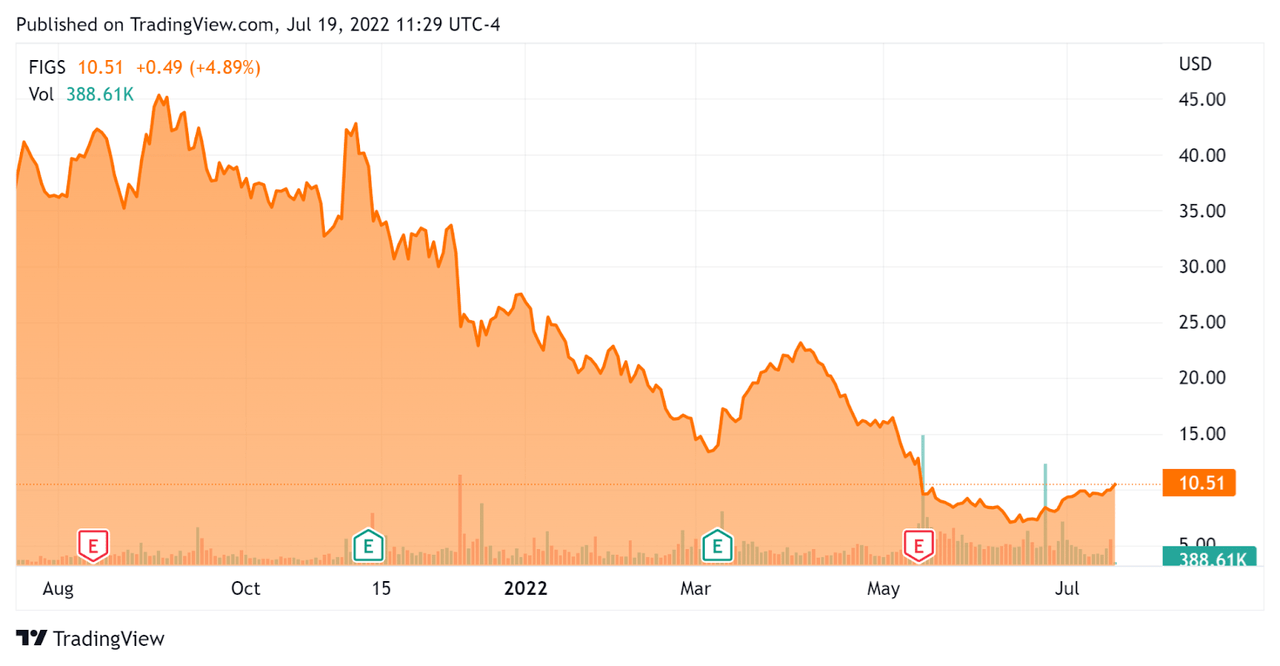

In the past 12 months, FIGS’s stock price has dropped 57 percent vs. the U.S. S&P 500 index’s fall of around 8.3 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For FIGS

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$1,480,000,000 |

|

Market Capitalization |

$1,650,000,000 |

|

Enterprise Value / Sales [TTM] |

3.35 |

|

Price / Sales [TTM] |

3.66 |

|

Revenue Growth Rate [TTM] |

39.09% |

|

Operating Cash Flow [TTM] |

$42,310,000 |

|

CapEx Ratio |

16.92 |

|

Earnings Per Share (Fully Diluted) |

-$0.10 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Superior Group of Companies (SGC); shown below is a comparison of their primary valuation metrics:

|

Metric |

Superior Group |

FIGS |

Variance |

|

Enterprise Value / Sales [TTM] |

0.78 |

3.35 |

329.5% |

|

Price / Sales [TTM] |

0.52 |

3.66 |

603.8% |

|

Operating Cash Flow [TTM] |

$10,610,000 |

$42,310,000 |

298.8% |

|

Revenue Growth Rate |

-5.9% |

39.1% |

-767.1% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On FIGS

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted increasing average order value, revenue per customer and a quickly growing active customer base which grew by 31% over the previous 121 months.

Its Lifestyle business now represents 18% of total revenue, while its international business is now 8% of total revenue.

However, management has been contending with unpredictable supply chain slowdowns, causing out-of-stock issues which have limited revenue growth.

As to its financial results, the firm produced revenue growth of 26% year-over-year and an adjusted EBITDA margin of 23%, which were lower than management’s expectations.

Due to its supply chain vulnerabilities, the company will use air freight transportation options to a much greater degree which will be more costly and will impact margins.

Additionally, FIGS has seen changing consumer spending patterns likely a result of softening macroeconomic conditions.

For the balance sheet, the firm finished the quarter with nearly $190 million in cash and equivalents. Since FIGS has a history of generating free cash flow, its cash position is not an issue.

Looking ahead, management reduced its revenue outlook for 2022 due to supply chain disruptions, but believes ‘these headwinds are temporary and do not structurally change our long-term margin profile.’

Regarding valuation, the market is valuing FIGS at a trailing EV/Sales of around 3.35x.

The primary risk to the company’s outlook is continued supply chain delays and higher costs associated with switching to more expensive air freight transportation.

A potential upside catalyst to the stock could be stronger revenue growth in the second half of 2022 due to successful planned new product launches or improving supply chain dynamics.

After selling off from the Q1 results and forward guidance reduction, the stock has potentially formed a bottom.

However, I’m cautious about the firm’s ability to grow revenue and retain margins in a supply-constrained environment.

So, I’m on Hold for FIGS in the near-term.

Be the first to comment