naphtalina/iStock via Getty Images

Published on the Value Lab 1/13/22

Evercore (NYSE:EVR) is a respected shop known primarily for M&A and advisory services, but in the last decades also for some of their research and trading capacities, as well as asset management. In the current market, asset management is relatively stable, as are businesses buoyed by volatility. Non-M&A advisory also does well, and in general, the declines in M&A and advisory comprehensively have been limited across peers at an average of 30% according to our coverage for 3 months’ results. The weak areas are ECM and DCM. In general, EVR like other shops are pressured, but the macro indicators are pointing to what will be a return to stability, which is all that’s needed to substantially increase activity, especially on the sponsor side which has become a bigger wallet. It’s unclear what exactly will happen in 2023, but private equity will roar again.

Q3 Discussion

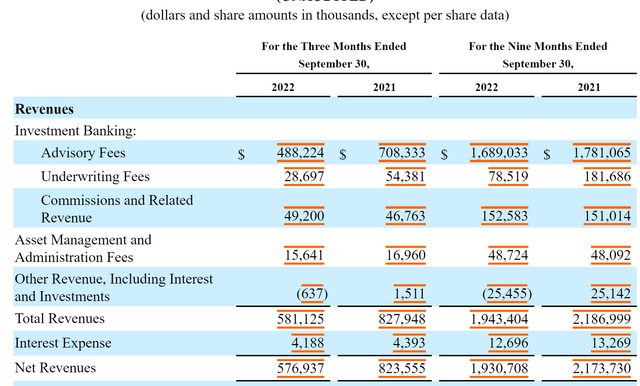

It helps to start with a discussion of Q3 results, and a disaggregated chart is a way to visualise it.

The majority of revenues are from advisory, and this includes M&A but also other types of non-M&A advisory. Activist defense is at record levels both in the US and EU as an example of non-M&A advisory. Restructuring is also beginning to pick up finally after months of just dialogue. M&A advisory is reportedly the weaker area as the size and number of deals fall, with sponsors especially taking a step back because of their lessened debt capacity in the current markets. Even sponsors are slowing down the pace of their M&A considerations, especially in the big league corporate world that EVR covers.

Underwriting includes ECM and DCM and is a disaster as financing activity tanks. Commissions and other revenue are doing strongly, even growing almost 10% thanks to volatility in the equity trading and resilience in research. Asset management, primarily levered to fund flows, does decently as well with pretty limited 14% declines. Asset management will almost always be less volatile than M&A and advisory, which after all was down 30% for the reasons explained before, with the decline being very much in line with the big-league peers. Mid-market players did better.

Bottom Line

Sponsors are a latent factor in the EVR story, as it is for other shops. We covered some PE houses here and there, and what you see is double than normal allocations in 2021, all of which performed miserably in 2022. They are reticent in making further moves as they likely have lots to answer for with LPs. In particular, debt markets especially LevFin markets have been incredibly pressured with very little new issuing activity, reflected somewhat in EVR’s own declines in underwriting revenues. The reliance on loose money for financing levered transactions means sponsors are struggling to make allocations now, and uncertainty continues to keep the LevFin market paralysed as secondary markets for high yield debt take front stage.

Stability in markets, even if it just means easing inflation and stable interest rates on top of limited economic decline, will mean a lot for primary issuers of debt financing to restart their work and get sponsors going again. Corporates should pick up too. With plenty of expensive leverage still in the corporate guts, restructuring and strategic advisory should continue. Underwriting activities would pick up as well thanks only to stability.

Good economic conditions aren’t strictly required, only assurances that things won’t get worse. With inflation indeed easing, as are inflation expectations, on top of jobs data that continues to show a growing pool of money making residents, a soft landing is probably coming – stability is even more likely to come if not mild-to-good economic conditions.

EVR should see recovery in M&A advisory, closing back that 30% decline at least partially, and forward expectations supporting the 11x PE forward multiple should be achievable with income mid-pointing the high highs and low lows of 2022. Underwriting revenue should also improve after being decimated to add to restoring the earnings power of the company. While operating leverage remains a risk, and unexpected events could still throttle markets, especially geopolitical ones as power struggles take center stage, EVR is by no means free of risk. But in terms of playing the higher probability factors of 2023, with the assumption of stability only, EVR and other IBs will regain footing meaningfully.

Be the first to comment