imaginima/iStock via Getty Images

(Note: This article was published in the newsletter on June 19, 2022)

Back in November 2021, I wrote that it was probably time for a value strategy to outperform the stocks that had long led the market. Growth and story stocks had dominated for so long, that many still think that those stocks will continue to dominate. But the market rotates sectors and changes favorites all the time. Now the new favorites are likely to continue for a while. That means that shareholders of Enterprise Products Partners (NYSE:EPD) can expect continued market outperformance for some time to come.

Long term, this company is likely to match or do better than many buy-and-hold strategies. The large distribution will likely remain above the average to lead that good return as long as the distribution is about equal to the 8% average return of long-term investors. It will get that return with the considerably lower risk of a midstream company. The oil and gas midstream companies are often thought of as the utilities of the oil and gas industry because of their long-term contracts. Business often remains remarkably steady throughout the industry cycle.

More importantly, many of these midstream companies are in a position to transport materials needed for the green revolution. So, the outlook is bright for the midstream industry in the future.

Since The Last Article

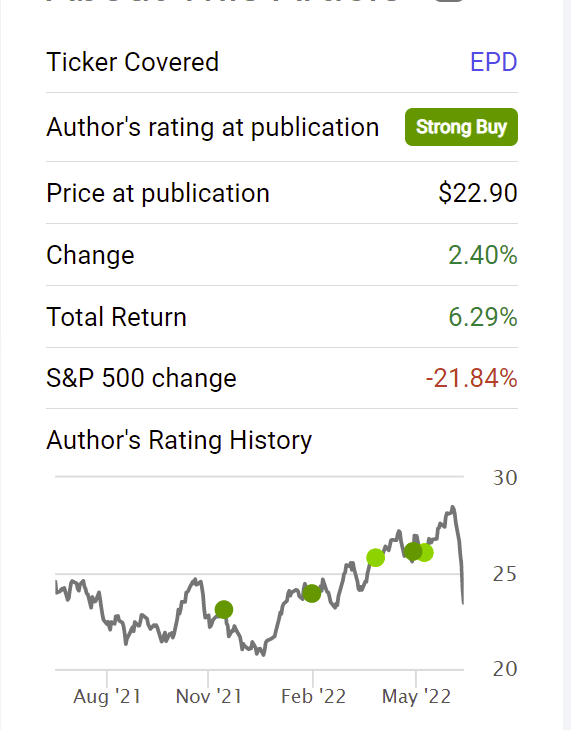

The price of the common units when the last article was published was listed by the website at $22.90. The common units did appreciate from there. But the latest market downturn brought it back to near where the common unit price was originally.

Enterprise Products Partners Common Stock And Total Return History (Seeking Alpha Website June 19, 2022.)

The distribution combined with a very minimal amount of appreciation has led to a significant outperformance of the tech-heavy S&P 500. As the correction of the very overpriced tech stocks will likely continue, more expected outperformance is likely.

Since Mr. Market generally goes to extremes, the tech correction will likely proceed until tech stocks are screaming bargains. That means there is probably a fair amount of downside left to the current movement for many stocks. A partnership like this one with a well-supported distribution should hold up rather well in the current environment.

Technology-type stocks have a very different cycle from oil and gas. But that cycle exists. Periodically, the survivors of the latest “one decision” era will likely be valued as other tech stocks instead of the sky-high valuations that existed for a long time. This has been happening periodically for as long as I can remember. It happened to such famous survivors as Apple (AAPL) and Cisco Systems (CSCO). Both those companies have an earnings and cash flow multiple that is nothing close to the original going public valuation. That probably means the current downward trend has a long way to go.

Enterprise Products Partners Growth Plans

As is typical for many value stocks that emphasize income (in this case with a generous distribution), the rate of growth will likely remain in the single digits. That means that the combined rate of return will be in the teens. That is a very attractive risk-adjusted return for any investor.

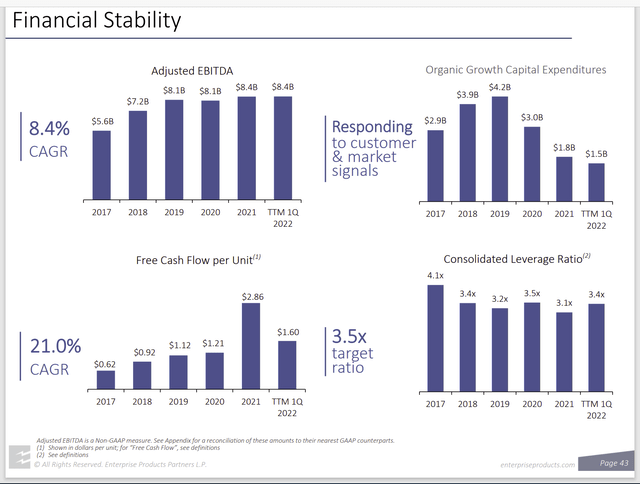

Enterprise Products Partners Financial Results History (Enterprise Products Partners June 2022, Investor Presentation)

Some have pointed to the low capital expenditures by stating that this partnership will not be growing. But good management, like the management here, often surprises to the upside. In this case, management spent money purchasing a pipeline to the Midland Basin. When that is combined with the capital expenditures shown above, the company actually spent as much or maybe more growing the business than it did when the boom times last prevailed.

The market often does not value anything it cannot see in tangible form. Therefore, oftentimes, good management has very little value to the market. But this management has one of the best financial ratings in the midstream industry and has been increasing distributions for more than two decades. That steady record is likely to continue well into the future even if that forecast is not tangible enough for Mr. Market.

Green Revolution Participation

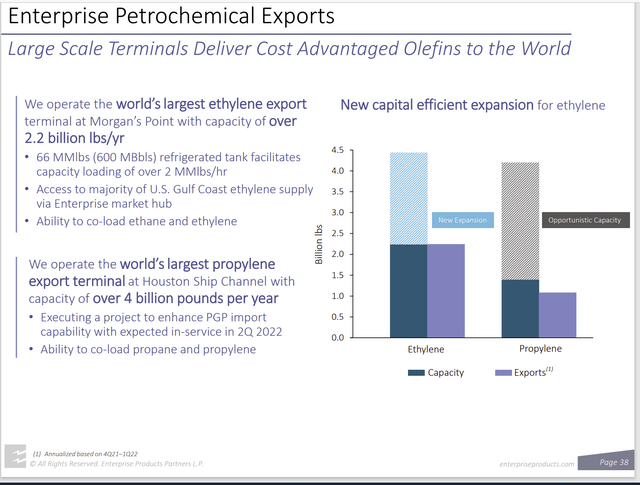

The partnership provides a solution to the country’s balance of payments deficit by providing vital export facilities.

Enterprise Products Partners Ethylene And Propylene Export Facilities (Enterprise Products Partners June 2022, Investor Presentation)

Enterprise Products Partners has long transported and performed related services for both propylene and ethylene. Both of these materials are needed to make a lot of materials in the green revolution. Both materials have rapidly growing markets as a result. North America has a considerable surplus of these materials. The rest of the world needs to largely import our excess. The partnership has taken advantage of the situation by building and managing sizable export terminals.

In many ways, the company is a “one-stop-shop”. The company will gather ethane and propane while providing some key services along the way to get these materials to customers as propylene and ethylene. Other vendors currently provide varying amounts of services along the way as well.

Natural gas is also a preferred source of the rapidly growing hydrogen market. Management is monitoring this situation to take advantage of any transportation services that would result as the market continues to grow. Similarly, management also noted in the presentation that it signed an agreement with Occidental Petroleum (OXY) to potentially transport and dispose (or sell) carbon dioxide to lessen the proposed effects of global warming. Carbon dioxide turns out to have a lot of industrial uses as well. The efforts to reduce pollution could lead to lower costs for users of this very important industrial gas.

The Future

The common units will likely continue to outperform the more usual growth suspects for probably the next 6 to 12 months. That can easily be adjusted as the future unfolds. Even when that outperformance fades, these common units provide a relatively low-risk way to outperform the long-term investment results of many investors. As such, the units deserve consideration by a variety of investors.

The distribution is well covered. The financial strength is among the highest-rated for the midstream industry. This is a very suitable company to buy and probably never sell as long as the future continues along the lines of the past. This management will likely continue to grow the company in the single digits. That should provide a total return from the distribution and the appreciation in the teens for the average investor.

Management does issue a K-1. But that can be easily handled. Nonetheless, it is recommended that investors discuss all the basics of a K-1 with their favorite tax person before they invest. Part of the benefits of the partnership organization is that a part of the distribution is tax-deferred each year. For those in high tax brackets, that tax deferral can be an advantage.

Be the first to comment