Sundry Photography

Solar PV adoption has grown dramatically over the past few decades. Despite the consistent gains made by the industry, solar PV manufacturers have fared terribly. Although this fact may be surprising at first, it makes complete sense upon closer inspection. The reason why solar PV adoption has been skyrocketing is because solar PV costs have been plummeting. The relentless downward pricing pressures faced by solar PV manufacturers have made solar PV manufacturing unsustainable for many.

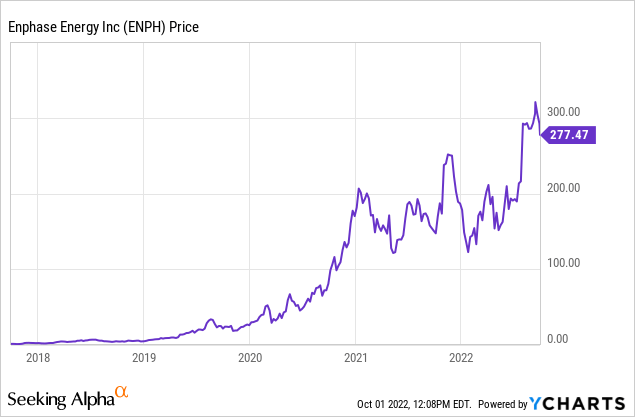

I have long maintained that in order to take advantage of the solar boom, it would be better to invest in solar component/accessary companies as opposed to solar PV manufacturers. In fact, my highly bullish thesis on solar component manufacturers like Enphase (NASDAQ:ENPH) and SolarEdge (SEDG) back when these companies were valued in the low single-digit billions have turned out to be accurate given their skyrocketing valuations. Enphase, in particular, has grown to become a dominant presence in the solar industry.

Enphase has seen its valuation explode over the past half-decade as a result of its focus on solar components as opposed to solar PV manufacturing.

The Rise of Microinverters

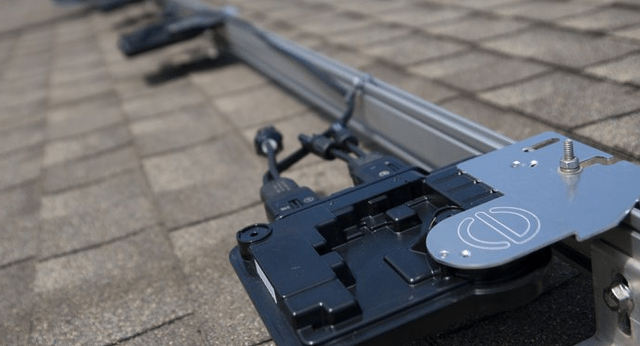

Solar MLPE (module-level power electronics) have become an integral part of the solar PV system equation in recent years. Enphase has largely led this charge with its flagship microinverter product. The microinverter, which converts DC to AC at the panel level and collects data to ensure maximum performance, has become increasingly popular, especially in the residential and commercial segments.

Enphase appears to be edging traditional string inverters in a growing number of markets. Despite being relatively expensive, microinverters can vastly improve the long-term output of individual solar panels compared to string inverters. The market has taken a clear liking to this product as Enphase has shipped ~48 million units to date, which represents a whopping 15 GW.

The popularity of microinverters has only grown in recent years despite competition from power optimizers and traditional solar inverters.

Expanding Ecosystem

Enphase is leveraging its success with microinverters to take market share in the broader home energy solutions market. In fact, Enphase now has one of the most comprehensive suite of home energy products with Enphase Ensemble. The products include, but are not limited to, battery storage, cloud monitoring, and microinverters. Many of these technologies, like battery storage or cloud monitoring, are witnessing major technological advancements due to the success of other industries like EV and cloud.

The company’s successful move into the home energy space bodes well moving forward, especially as grid decentralization and distributed solar grows more popular. Enphase is essentially offering an entire home energy solution, reducing the friction that homeowners may have to deal with when purchasing a wide array of products separately. Enphase has successfully integrated its suite of home energy products into one convenient platform.

Financials Remain Strong

Enphase continued its streak of strong quarterly performances with a stellar Q2, growing its revenue +67.8% YoY to $530.2 million. More impressive, however, is the fact that the company reported a gross margin of 41.3%. Even in the midst of an economic downturn, Enphase has managed to consistently post strong quarterly results. At this point, Enphase has firmly pulled past competitors like SolarEdge.

Challenges Remain

The solar MLPE industry is still in its early stages, which means that newer technologies will almost certainly emerge. A superior technology could easily put Enphase’s business in danger given how reliant the company is on its microinverters. Even today, there is debate on whether optimizers, microinverters, and traditional inverters will dominate the industry over the long term.

There is also a compelling argument to be made that Enphase will have a hard time maintaining a technological edge given that solar MLPE products are not exactly the most sophisticated to manufacture. However, Enphase is expanding far beyond just its microinverters, which should help create a stronger moat around the company.

Conclusion

Enphase has firmly cemented itself as not only a standout in the solar industry, but also in the wider energy industry. Even at its current valuation of ~$37.5 billion and forward P/E ratio of ~68, the company still has more room for upside. While Enphase is no longer doubling its revenue every year, the company is still posting impressive 60%-70% YoY revenue growth with no signs of slowing down.

Be the first to comment