Abstract Aerial Art/DigitalVision via Getty Images

Introduction

Eneti (NYSE:NETI), formerly known as Scorpio Bulkers, is a renewable energy pureplay currently operating five wind turbine installation vessels, and the company also has a couple additional newbuilds on order.

NETI conducted a significant acquisition last year, when it decided to purchase Seajacks, an owner and operator of wind turbine installation vessels (WTIVs). This provided them with the necessary expertise and commercial footprint to expand in the sector.

Stock price performance has been very weak since the company announced the Seajacks acquisition, and especially after the company conducted a $175M offering at $9.00/sh. The stock is now trading at what I believe to be a very attractive valuations, but there are still significant associated risks.

However, the recent developments in Ukraine have exacerbated energy security concerns for European nations, which will most likely lead to increased spending on renewable energy capacity going forward. NETI is in a good position to benefit from these shifting macro tailwinds.

The Seajacks Acquisition

Eneti was formerly focused on the bulker markets, but management decided to push for a tectonic shift and focus on the wind turbine installation segment. They were not experts in the segment, and to add to their expertise and operational capabilities, they ultimately decided to acquire what already was a significant player in the market they were entering, namely Seajacks.

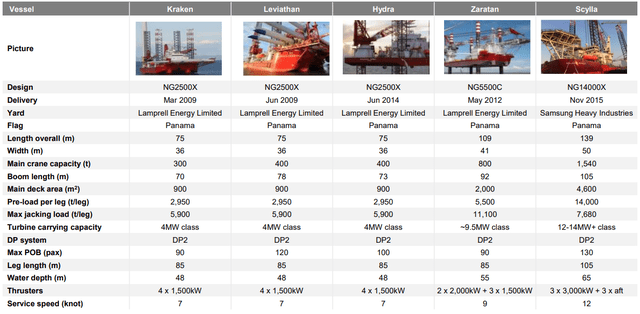

The fleet of the acquired company was composed of five vessels, which can be seen in the image below. It is very important to differentiate between the Scylla and arguably also the Zaratan from the other three vessels, which have significantly worse capabilities, and whose work mainly revolves around maintenance contracts at notably lower rates than the bigger and more capable Scylla and to a lesser extent Zaratan. Furthermore, not only are rates lower, but utilization levels also tend to be notably worse.

Neti’s Seajacks Acquisition Presentation, slide 12. (Eneti)

The transaction was financed with the issuance of 8.13M NETI shares to the sellers, the assumption of $302M of outstanding net debt on Seajacks, the issuance of $74M of redeemable notes, and $12M of cash. The deal resulted in the sellers owning 42% of pro-forma Eneti shares.

When NETI announced the deal on August 5th, it was trading at around $16.85/sh, which implies the share-based component of the deal was valued at around $137M, a far cry from the around $50M the shares would be worth at current market pricing. Therefore, total consideration for the deal approached $525M.

Fleet value was estimated at around $600M, derived from the “average of two independent brokers [valuations] received in July 2021” (Seajacks Acquisition Investor Presentation, slide 8).

Since the acquisition was conducted, performance from the acquired assets has been volatile to say the least. During Q3 NETI ended up reporting adjusted EBITDA of $0.7M, and an adjusted net loss of $8.2M, whereas revenue minus operating expenses & project costs was $37M for the quarter (although the transaction was conducted on August 12th, so NETI’s attributable portion was closer to $16.6M. Q4’s adjusted EBITDA came in at negative $10.6M, whereas the adjusted net loss was closer to $26.7M (and the difference between revenue minus opex & project costs was a mere $1.4M).

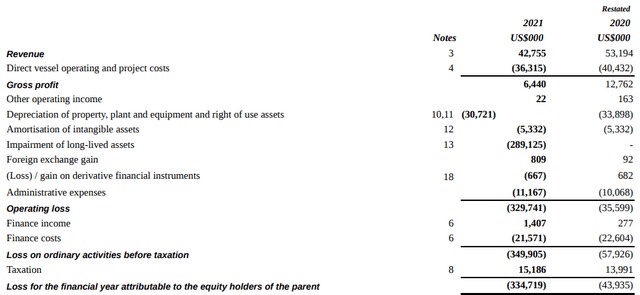

Furthermore, performance prior to the acquisition was also lackluster, as can be seen in the image below, which portrays Atlantis Investorco Limited’s earnings for the years ended March 31st, 2021, and 2020 (Atlantis Investorco Limited was Seajacks parent company prior to NETI’s acquisition).

Audited Consolidated Financial Statements of Atlantis Investorco Limited as of March 31st 2021 and 2020 (Seajacks’ parent company), page 7. (Eneti)

The 2021 results should certainly be adjusted for the $289.1M impairment, but the company still lost a whopping $45.6M during the period, a slight deterioration over the previous year’s $43.9M loss.

Overall, the Seajacks acquisition added five vessels, only two of which have real WTIV capabilities in the current market environment. However, it made sense for NETI to acquire the company to gain Seajacks’ expertise, adding the in-house structure to manage the to-be-delivered newbuilds. Additionally, and although cash flows from operations have been low so far, they help cover G&A expenses, which remain quite high for a company this size (more on this below).

To Be Delivered Newbuilds & Jones Act Ambitions

When the former Scorpio Bulkers announced its intent to change its business and focus on the offshore wind turbine installation market, management disclosed they had signed a Letter of Intent to construct a wind turbine installation vessel, and that they would hold options to construct up to an additional three units.

However, when management announced they had executed the first newbuild order, they also disclosed they would only have one additional option for another WTIV. Furthermore, when the push into the sector was announced, management initially guided for total costs per unit to range from $265M to $290M, but the first order was executed with a price tag of closer to $330M, whereas the second option, which was executed more recently, had a price tag of $326M.

This is not entirely surprising due to the inflationary pressures we have seen in the shipping newbuild markets, both due to upwards pressure from raw materials (i.e., steel) and a flurry of orders from other segments (mostly containerships and LNG carriers) which allowed shipbuilders to increase pricing, expanding their operating margin, but underpins that management did not secure a firm commitment when they initially announced their intentions.

The first vessel is expected to be delivered in Q3-24, whereas the second one is expected in Q2-25. So far, management has not announced the signing of any charters associated with these two newbuilds, which for some, has come as a surprise, since most of the vessels ordered in the sector come associated with charter agreements with leading companies in the wind turbine market.

For instance, Cadeler (OTCPK:CADLF), a publicly traded peer in the Norwegian market (Oslo Bors: CADLR) secured a contract for a newbuild even before the actual order was placed on a firm basis with the shipyard! The contract per se amounted to €74.5M in firm revenue plus a further €25.3M in options, and the charterer is Siemens Gamesa, one of the largest wind turbine makers in the world.

This helps illustrate that NETI’s two newbuilds should be able to secure juicy contracts prior to their startup, which will derisk the company financially while most likely also acting as a catalyst for share pricing.

Eneti’s management had also mentioned a potential push into the Jones Act WTIV market, although those plans were more recently scrapped since they cannot secure enough equity capital at attractive pricing (at current share pricing growth would not be accretive). For those not familiar with what the Jones Act provision is, it is basically a law that requires goods shipped between US ports to be transported by vessels built, owned, and operated by United States citizens or residents.

Eneti’s plan was to own up to 49.9% of such a vessel, and alongside Q3-21 earnings management mentioned they were “in advanced discussions with US shipbuilders for the construction of a Jones Act WTIV”, but those plans were ultimately scrapped, when alongside Q4-21 earnings, the company mentioned they had “discontinued discussions with US shipyards to construct a Jones Act compliant WTIV”.

Given the amount of offshore wind turbine projects being announced alongside the US coast, this would potentially be an interesting growth avenue if NETI was trading at or very close to a fair valuation; however, at current pricing, the company cannot access sufficient equity capital to finance such endeavor at attractive pricing.

Additionally, it remains to be seen how exactly will the US market be serviced, since Maersk recently ordered a newbuild set to operate in the US Coast that will not be compliant with the Jones Act, but signed a commercial agreement with Kirby, which will supply JA compliant barges and tugboats to transport the turbines from the South Brooklyn Marine Terminal to the WTIV. This way, the WTIV will not travel between US ports, and therefore not be in breach of the Jones Act regulations.

The Demand-Side for WTIVs

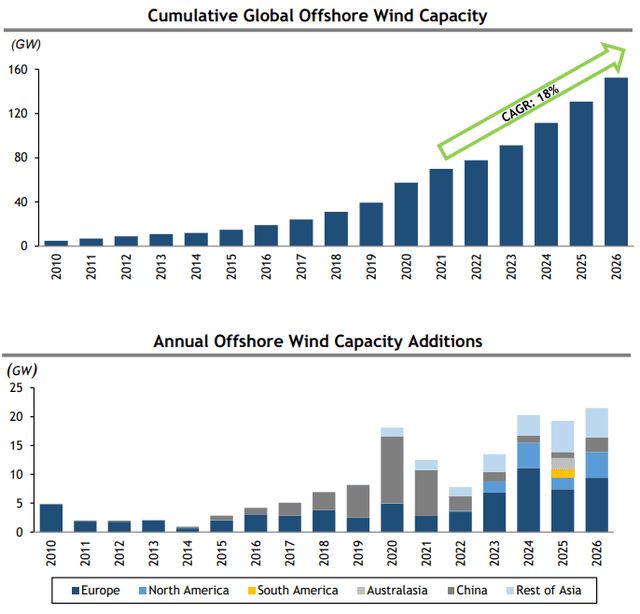

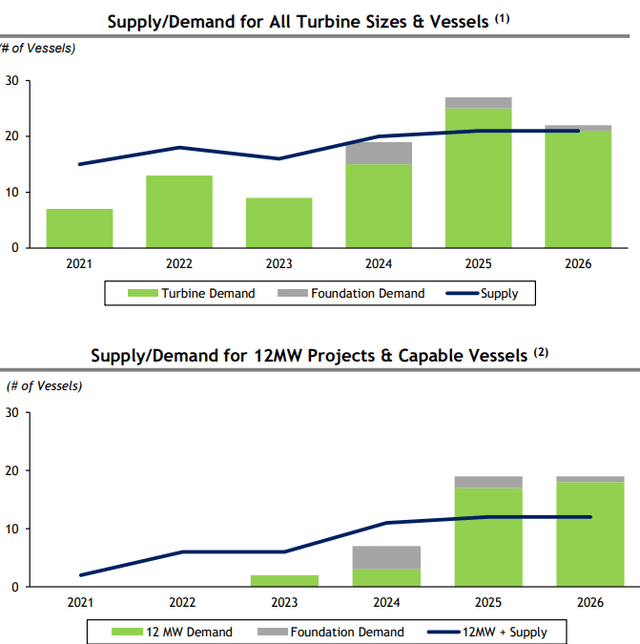

Demand for Wind Turbine Installation vessels emanates from offshore wind turbine installations, which as can be seen in the image below, are set to grow significantly going forward, with an expected 18% CAGR between 2021 and 2026. Capacity additions were very strong during 2020, but slowed down going into 2021, and a further slowdown is expected looking at 2022. However, growth is set to pick up again in 2023, and to further increase in 2024 (surpassing 2020’s capacity additions).

Eneti’s Q4 earnings presentation, slide 8. (Eneti)

This data was presented by NETI alongside its Q4 earnings presentation, and its primary source is the October’s edition of 4C Offshore. However, keep in mind that since then, projects have continued to be announced on a weekly basis.

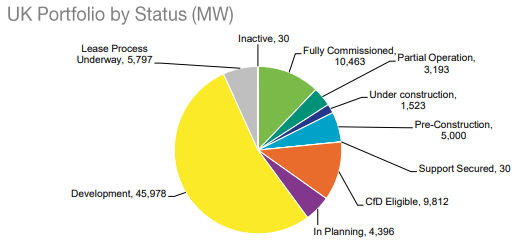

For example, it was recently reported that UK’s total pipeline of offshore wind projects stood at 86 GW, which represents a 60% increase over the same figure 12 months ago. Additionally, the total global offshore wind pipeline was estimated at 517 GW (with UK being the largest component of it followed by China with 75 GW and with the US in third place, with 48 GWs).

Additionally, the UK has not only been only nation whose pipeline has seen massive growth over the past twelve months considering the world’s total pipeline also expanded by an estimated 200 GW. Keep in mind that by pipelines they refer to “fully operational projects, under construction, consented to, in the planning system, or being developed for submission into planning), but it underpins that the sector is set to grow notably going forward, and that growth seems to be accelerating.

As can be seen in the image below, a significant portion of the pipeline is still far away from construction (at least in the UK), but this underpins that demand for WTIVs should increase noticeably going forward as these projects continue their development and are constructed.

UK Bolsters Offshore Wind Pipeline to 86 GW, Splash247.com. (Splash247.com.)

Furthermore, note that since Russia’s invasion of Ukraine, European nations have announced very aggressive plans to decouple from Russian energy imports. For example, on March 8th, the European Commission laid out a plan to decouple from Russian fossil fuels, calling for member nations “to reduce Russian natural gas imports by two—thirds by next winter and to end them altogether by 2027” (source).

This has caused upheaval in the world energy markets, with commodity pricing increasing noticeably (although I’m not going to dwell into this here), while also providing an uplift to the prospects for the offshore wind turbine market; not only has its relative attractiveness cost-wise increased (since fossil fuel pricing has risen), but it helps achieve some of the climate targets European governments have committed to.

Part of the sky-high energy pricing we have seen through Europe can be attributable to the focus governments have put on renewable energy (potentially losing sight of energy security per se), but this is not the point; the point is to illustrate that the Ukrainian crisis will most likely accelerate European investments in renewables in the medium-term.

WTIV’s Supply

As most can imagine, under the bright prospects of the offshore wind turbine market, owners have gone to the yards to order WTIVs to satisfy the market’s demands. As can be seen in the image below, vessel supply is set to increase going forward, but herein lies a very relevant distinction: not all vessels are created equal, and as offshore wind turbines grow in size, only the largest and more capable vessels will secure strong utilization and high day-rates.

Eneti’s Q4 earnings presentation, slide 8. (Eneti)

Per NETI’s management estimates, the supply of vessels capable of installing 12MW turbines is set to skyrocket from around two vessels to closer to twelve vessels by 2025, and I believe the ultimate number may end up being a tad higher by 2026.

Market prospects in the near-term are not outstanding, since vessel supply is forecasted to surpass demand until 2024, but NETI should manage to remain cash flow positive until better markets present themselves in 2025 and 2026 (more on this below).

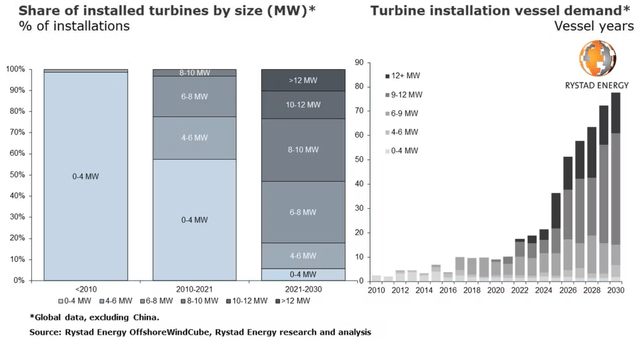

As can be seen in the image below, offshore wind turbine sizes have increased noticeably over the past couple of decades. Pre-2010, virtually 100% of wind turbines were on the 0-4MW segment, whereas those decreased to closer to ~57% market share in the 2010-2021 period and are expected to represent around 5% of total installations between 2021 and 2030.

More Installations Vessels Needed to Meet Larger Turbine Demand, Offshore-Magazine. (Offshore-Magazine)

That the overall turbine size has increased noticeably is unsurprising given the benefits of constructing bigger turbines due to the economies of scale and better economical returns, but this has also weighed on vessel orders. Assets that were ordered during the 2010s have seen their useful lives diminished due to ever-increasing turbines, which has deemed them obsolete for the installation of the larger currently en-vogue turbines, while being relegated to the installation of smaller turbines and maintenance work.

Expensive retrofits can be conducted to improve the capabilities of older assets, and Cadeler, NETI’s most direct peer decided to conduct two such retrofits to improve crane lifting capacity at a total cost of $102M (or $51M per unit), whereas offhire to install the new cranes is expected to be of around six months.

Additionally, note that Maersk recently entered into the WTIV market with a newbuild order. Maersk’s newbuild is set to be employed in the installation of the Empire 1 and 2 offshore wind farms in the US, and the actual cost for the vessel is estimated at $400M. Additional newbuild orders are a negative for Eneti and the companies that have already ordered vessels but underpin that market participants believe the supply-demand balance will be very tight going forward.

Overall, and although the WTIV fleet is set to grow significantly over the next few years, the market will be very tight starting in 2024 if no additional newbuild orders are placed (although this remains unlikely and is also the main risk for the sector). High commodity pricing will continue to put a lid on ordering, whereas newbuild ordering in other shipping segments will most likely continue to apply upwards pressure on newbuild pricing, decreasing its attractiveness.

Financial Position: Additional Equity Requirements?

NETI finished the quarter with $154M in cash and cash equivalents, and keep in mind the company also holds a significant stake in Scorpio Tankers (STNG), which had a total value of $27.6M as of Q4-end. Note that the company’s stake (2.16M shares to be exact) has appreciated significantly in value over the past few months, so the company will record a sizable gain on equity investments alongside Q1 results.

As of quarter end, the company had total bank loans outstanding of $87.7M (which were fully repaid post-quarter end), plus a further $53M in redeemable notes, which were issued alongside the acquisition of Seajacks. These notes come due in March 2022, and I expect NETI to repay them in full at maturity.

Therefore, NETI’s net cash position amounted to $13.3M as of year-end, and the company had a further 2.16M STNG shares, which currently have a valuation of around $44M, for a total net cash position of around $57.3M.

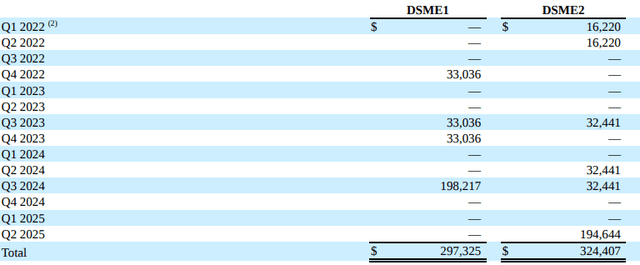

This would be all nice and cozy if not for the significant capex commitments the company is facing in the near/medium-term, which can be seen summarized in the image below. Overall, the company is set to face total outflows of $65M during 2022, $99M in 2023, $263M in 2024, and a further $195M in 2025.

NETI’s Q4 earnings SEC filing, page 3. (Eneti)

However, a significant portion of these outflows is expected to be covered by debt financing. Alongside Q4 earnings, management guided for around $393M in debt financing to be secured as the vessels are delivered, which would amount to a 59.7% debt to assets ratio (considering the total price tag for the vessels is set to amount to $657.8M considering remaining capex and the $36M the company has already paid).

Additionally, note that the company secured in February a $175M (including up to 50% in euros) facility composed of a $75M Green Term Loan, a $75M revolving credit facility, and a $25M revolving credit facility “available for performance bonds”. The facility has a 5-year tenor and is priced at “the applicable benchmark” plus 3.05%-3.15%, which is a notable improvement over the financing previously outstanding (priced at 8%).

When Eneti announced the closing of the five-year $175M financing package, the company also disclosed it had repaid the $87.7M of the 8% subordinated debt due September 2022 (which decreased the amount outstanding to $0, fully liquidating the facility).

Overall, the company’s total liquidity position (prior to capex requirements) amounts to

+$175M in green financing

+$154M in cash and cash equivalents

+$44M in STNG shares (2.16M shares valued at $20.37)

-87.7M in 8% subordinated debt due in September 2022

-$53M in redeemable notes

=$232.2M

Additionally, the equity portion of newbuild capex amounts to around $228.7M assuming management is ultimately able to fulfill its expectations regarding debt financing (namely that they are able to secure $393M in financing for the newbuilds, which would amount to a 60% LTV).

Overall, NETI has done a good job transforming Seajacks’ balance sheet, concretely restructuring the liabilities side, and it seems they will be able to cover newbuild capex as long as operating cash flow is positive between now and 2025 (NETI should be able to operate with a $70M+ cash balance).

Valuation

I’ll start this section by stating it is difficult to assess the concrete value that should be assigned to the vessels NETI acquired from Seajacks but note that brokers valued the fleet at $600M, whereas NETI’s total disbursements for the deal were of around $525M given where NETI’s shares were trading at. I believe the share component was done on an NAV-to-NAV basis (meaning NETI’s shares were valued higher for the purpose of the transaction), but to be on the conservative side I’ll start-up by valuing the Seajacks fleet at $525M.

To that number, we should add the current net cash position (including the Scorpio Tankers stake), which amounts to $57M, and the $36M in capex the company has already disbursed for its newbuilds. In total, this equates to $618M, which is more than double NETI’s current market capitalization (which is currently sitting at circa $260M).

With around 39.7M shares outstanding, this would derive an NAV of close to $15.57/sh, more than double its current pricing. However, note that the company needs to remain cash flow positive to be able to finance its newbuilds without further equity issuance, whereas the premise that they will be able to finance the equity portion of the newbuilds is also based on assumptions regarding the debt financing they will be able to secure (especially considering that the term loan portion of the $175M facility amortizes by $12.5M/year; this accretes shareholder value, but also further weighs on liquidity).

Cadeler, NETI’s Norwegian publicly traded peer recently presented its annual earnings (link), from which we can derive a net asset value (NAV) estimate. The two X-Class newbuilds will have a total cost of €548M (or $651M), of which €137M have already been paid throughout 2021. Therefore, €411M remain outstanding, or $488.3M (at the same exchange rate).

The new cranes are set to cost €83M (or $102M), of which €7M (or $8.6M) were disbursed during 2021. The company also finished the year with a net debt position of $71M. Regarding the two on-the-water vessels, Cadeler completed two independent appraisals of its vessels during the second half of 2021, one completed by Fearnleys Asia, which valued the vessels at $370M, and the second one by Clarksons, which valued the vessels at $390M-$430M.

Therefore, we are looking at:

+$162.7M in newbuild pre-payments

+$7.72M in crane improvement pre-payments

+$400M in vessels on-the-water (although the appraisals varied from $370M to $430M)

-$71M in net debt

=$500M in net asset value

Considering that the company’s market cap amounts to $600M, the firm is trading at 1.20x NAV, which is a notable premium over NETI’s valuation relative to NAV. However, note that part of Cadeler’s premium is arguably justified by the company’s lower G&A costs, better management alignment, and assets with better capabilities (although that should be included in the fleet valuation appraisals).

Cash Flow Potential

Calculating operating cash flows for shipping firms is usually quite straightforward, since costs are largely fixed. However, in NETI’s case, operating costs have been rather volatile as of late, and management guided for opex/day for the larger two vessels of the fleet to come in at $50k/day and at $20k-25k/day for the smaller vessels.

However, management did mention that prior to COVID, operating costs for the larger vessels (namely the Zaratan and the Scylla) were significantly lower, estimated at closer to $35k/day, and that the increase is largely attributable to higher crewing and travel costs (whereas they have also “been running an additional crew to help us deliver on projects and timing, which is hopefully going to stop”).

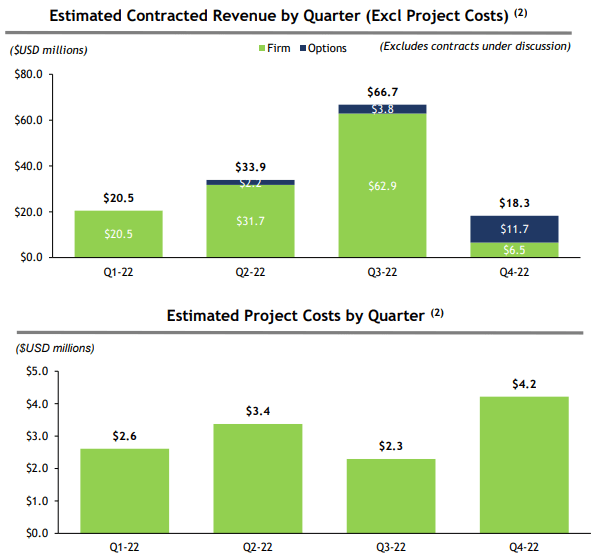

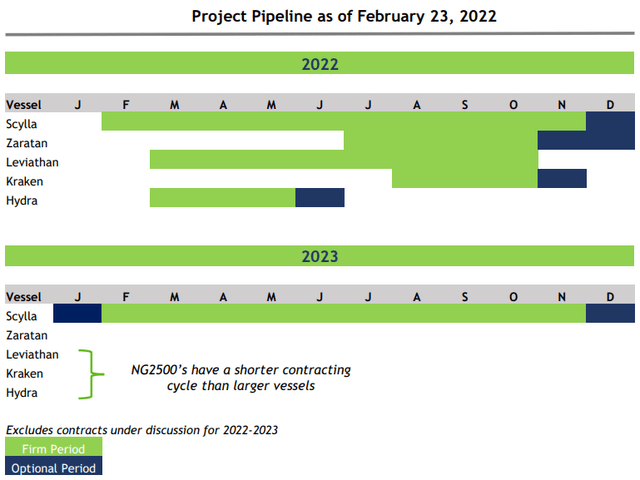

To assess operational performance, we also need to deduct project costs, which are incurred by NETI and not reimbursed by the charterer (the amounts are included in the total amount to be paid as charter-hire when the contract is signed). The current estimates for the year are shown in the image below, both regarding charter hire and expected project costs.

NETI’s Q4 earnings presentation, slide 10. (Eneti)

Assuming the company’s estimates of incurring on an average $50k/day in costs for the larger two vessels and around $22.5k/day on the three smaller vessels, operating costs should come in at around $60.3M for the year.

Therefore, to calculate operating cash flow for 2022 we need to deduct from expected revenues (estimated at $139.4M including options or $121.7M without) project costs, estimated at $12.5M, operating expenses, estimated at the aforementioned $60.3M, and cash G&A, which management guided to come in at between $7M and $7.5M per quarter ($29M for the year at the mid-point).

This would equate to operating cash flows before cash interest expenses of circa $19.9M if options are not exercised or closer to $37.6M if they are (although project costs would most likely also increase a tad). However, this is based on the numbers that the company posted alongside Q4-21 earnings, and the company signed a new contract for one of the smaller vessels for a duration of between 90 and 180 days in Q2 and Q3-22.

Eneti disclosed this charter was set to generate between $3.85M and $7.45M depending on whether duration was 90 or 180 days. Keep in mind this can be virtually fully added to the operating cash flow calculations above, since only project costs for this contract are not included in the calculation (operating expenses and cash G&A were already included).

In the image below we can see the company’s charter book, to which we need to add the latest contract (although it is not clear whether the contract was for the Hydra or the Kraken. Note the company still has a significant amount of open exposure, especially towards the end of the year on the smaller vessels, and additional charter additions would accrete significant value for the company.

NETI’s Q4 earnings presentation, slide 7. (Eneti)

The start-up for the Zaratan contract was pushed out from April to July, but in Q4’s conference call, management mentioned this was fully attributable to client delays, and that they would be claiming compensation for these circumstances, since they were not attributable to them.

Overall, it seems the company will remain cash flow positive during 2022, and although 2023 is for now fully open (except for the Scylla, which is fully contracted), the company should be able to remain cash flow positive too.

Upcoming Catalysts

NETI has traded very weakly since the Seajacks acquisition, and even more so since the share offering at $9.00/sh. However, there seems to be a lot of value in the company, and now I’ll look into some of the catalysts I believe could help unlock this value.

The clearest are contract signings, which is closely related to the company’s cash flows and its need to issue equity. If the company can secure additional contracts for 2022, this will be a very positive development because those will virtually fully flow to the bottom line, whereas adding coverage for 2023 would also be a significant positive.

Additionally, note that the newbuilds remain unfixed, and management is actively looking for contracts for those vessels. Although I previously expected the company to have signed contracts by now, it seems management is trying to wait for a project that maximizes returns. I expect them to announce something prior to year-end, but I would not be surprised either if they end up waiting until 2023.

Regarding 2023 coverage for the Zaratan, in the latest conference call management mentioned they are mostly looking at Taiwanese projects, while also mentioning “the available supply in the Asia Pacific region is very limited, so I would say that the prospects of Zaratan in 2023 are very positive, and we’re definitely – I think we are actually the only available vessel for the periods required during the 2023 period”. A big contract for the Zaratan would be a very positive development, further solidifying 2023’s cash flows.

ESG flows could also potentially provide a boost, but I do not like relying on this kind of catalyst. Overall, I believe share pricing will appreciate once it’s clear the company does not need to issue additional equity; when that will happen is anyone’s guess, but as long as the firm keeps on delivering, they should keep trending higher.

As mentioned before, the company’s total liquidity position amounts to $232.2M, whereas the equity portion of newbuild capex amounts to closer to $228.7M. However, we need to take into consideration the amortization of the Green Term Loan ($12.5M/year), which decreases total liquidity to $195M by end-2024.

Therefore, if NETI’s management wanted to operate with an $80M cash position, total FCF between now and end-24 should amount to $113.7M. 2022’s FCF can easily amount to $30M, but if FCF for 2023 is lower than $50M, management may decide to issue some shares to increase liquidity levels (since I’m already taking into consideration the STNG stake as cash).

Another catalyst could be further insider buys. Robert Bugbee, President of the company has been consistently buying shares and calls (now holding thousands of $5.00 call contracts expiring in August as well as hundreds of thousands of shares, bought at prices ranging from $5.27/sh to $9.00/sh. Note that both Bugbee and Scorpio Services Holding Limited participated in the $9.00/sh offering, so insiders seem to believe in the value in the company.

Management Concerns

NETI seems to be very discounted, and although I believe the discount is too large, part of it could be warranted by management’s actions. In hindsight, they decided to exit the dry bulk market at the worst possible time (and this is an understatement). If they had remained in the bulker market, they would now be most likely trading north of $80/sh.

Turning back to present-day NETI, there are also certain aspects a bit worrying. For example, and as mentioned before, in Q4’s conference call, management mentioned they expected cash G&A to come in at between $7M and $7.5M per quarter going forward, significantly higher than that of peers (and of my previous expectations). When called out about it by an analyst, who mentioned that peers were running at closer to $3M-$3.5M per quarter in cash G&A, management’s response was very lacking: “I think it’s difficult to say why or compare, because I’m not familiar with other companies. So we are only telling you what we are ourselves. I don’t have the means to compare myself with other companies operating in the same space. As we discussed, we are just opening. This is the first quarter that we announced as a fully integrated company after the merger with Seajacks, so there may be changes going forward, but this is what it is today. So we’re guiding you to where we are.”

This answer was very underwhelming, although later on they provided some further commentary, stating that part of the discrepancy was attributable to NETI being larger (regarding its fleet) and having more offices around the globe. However, this initial response is definitively not a positive, and management should do their best to try and lower their cash G&A expenses if possible, and if not, to show better operational performance than peers.

Additionally, keep in mind that the closing of the Seajacks transaction not only expanded NETI’s fleet, but also generated a windfall for NETI’s management: “As a result of the transaction, provisions in the employment contracts of certain Eneti executives will trigger payments in the aggregate amount of $30 million. In order to avoid adverse US tax consequences, the Company is required to incur these costs at the time of the transaction. The U.S. senior executive officers receiving these payments have agreed not to receive salaries for a period of three years and bonuses for a period of four years.” (link).

For a company now worth below $260M, this is quite surprising (to not say unacceptable), and it is worrying to see that although these senior executive officers “agreed not to receive salaries for a period of three years and bonuses for a period of four years”, the company’s G&A is still wildly above that of peers!

When the company files its annual report with the SEC, we will have more information regarding this one-off payment, but it illustrates one of the main concerns I have with this company, which is that common shareholders’ and management’s interests may not be fully aligned. However, note that insiders (with Robert Bugbee being the largest exponent) have been buying shares and calls, which is a positive.

Conclusion

NETI is a very discounted play on an ESG sector, namely the offshore wind turbine market. The stock has traded abysmally since the closing of the Seajacks transaction, and even more so since the offering last fall at $9.00/sh.

Whether additional equity will be required to finance its two newbuilds is somewhat contingent on market performance. I believe they will be able to pull it off, especially given ongoing macro tailwinds, but should they have any trouble securing contracts during 2023, an equity raise might be in the cards.

I view the company as a high-risk high-reward play: if NETI can deliver their two newbuilds without issuing equity, I believe they can easily trade in the $15.00-$20.00/sh range by 2024, but at the same time, there is a non-negligible risk of dilution if markets trend downwards.

Furthermore, note that NETI trades at a very substantial discount to its Norwegian publicly-traded peer Cadeler. Part of the premium can be arguably justified by lower G&A costs, better management alignment, and stronger operational capabilities (although that should be included in NAV calculations), but the disconnect seems too large, and herein lies the opportunity.

However, governance is questionable: the closing of the Seajacks transaction triggered a substantial payout for NETI’s management, whereas exiting the dry bulk sector just prior to a historic run was also a catastrophic decision in market timing. Nonetheless, I believe there is substantial value in NETI, and the risk/reward setup appears attractive here, although certain inherent risks remain.

Be the first to comment