sankai

Energy Income Performance

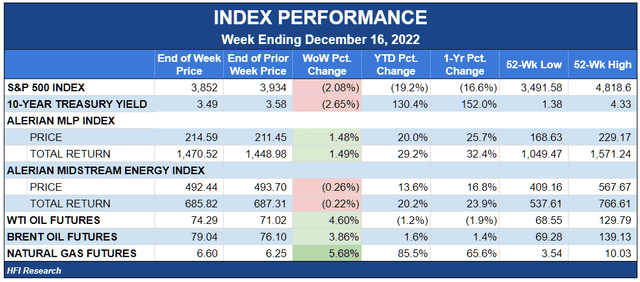

It was an ugly week for equities. The S&P 500 (SP500) fell 2.1% due to weak retail sales and industrial production data releases, which raised concerns about a recession and weaker corporate earnings. The 10-year Treasury yield fell 2.7% as inflation cooled off and the Fed raised interest rates by 0.5%, as expected.

Despite the “risk off” nature of trading, the energy sector was the lone sector to post a gain. The (XLE) rose 2.0%, and the (XOP) gained 3.7%. Midstream joined in the gains, with the Alerian MLP Index (AMLP) rising 1.5%, though the gains didn’t filter through to the broader Alerian Midstream Energy Index, which fell 0.2%.

Energy stocks drew support from rising oil and natural gas prices. WTI and Brent snapped back as the physical market firmed up. Over the course of the week, oil futures curves transitioned from contango in the near-month contracts back to backwardation. Among other developments were the IEA hiking its 2023 oil-market demand forecast and EIA data showing large inventory builds. The market looked through the builds in anticipation of a draw next week.

Natural gas also ended the week higher despite a mid-week selloff spurred by forecasts for warmer weather in late December. Prices could gain support over the coming weeks if Freeport LNG resumes exports.

The Biden Administration Strikes a New Tone

This week saw a marked change in the Biden administration’s tone toward the oil and gas industry. Whereas in the past its tone has ranged from antipathy to outright hostility, this week it shifted toward support.

On Wednesday, Energy Secretary Jennifer Granholm attended a meeting of the National Petroleum Council, an energy industry trade group. With major oil CEOs in attendance, she reportedly said that she recognizes that oil and gas will be around for a long time and that the administration is “eager” to work with the industry. The new tone marks a shift from the administration’s prior threats of windfall profits taxes and accusations of price gauging and war profiteering.

Then yesterday, the administration announced it would buy back 3 million barrels of oil for February delivery to refill the U.S. strategic petroleum reserve. Buying oil for the SPR in the mid-$70s per barrel after it was sold at $96 makes financial sense. But the administration is also conducting the SPR purchases to “encourage firms to invest in production,” as the White House stated in its initial announcement on replenishing the SPR. If the purchases are large enough to support oil prices, they will do just that.

Will the Industry’s Cooperation with the Administration Lead to Higher Output?

From an oil market perspective, the administration’s new tone and helpful measures raise the specter of higher U.S. production in 2023.

Today, the watchword among E&P capex decisions is discipline. But if oil prices go back up and the administration demands a production boost in return for its support, it could provide E&Ps with cover to justify an output boost.

While this is a valid risk for higher oil production – and potentially for lower oil prices – we don’t believe it will result in a significant increase beyond our current 2023 forecast. Still, it’s a risk for E&Ps worth exploring, while it could be a boon for midstream.

The Oil Majors Would Lead the Pack

A meaningful production boost brought about by cajoling from the administration is likely to come from oil majors rather than independent shale producers. Independents today are staring down the barrel of shortening reserve lives, while their executive compensation is more directly tied to the amount of free cash flow their companies generate and how much of that cash flow is returned to shareholders.

The oil majors, by contrast, have a much higher profile and are therefore more susceptible to political pressure. They could easily allocate capex from development projects in their portfolios to projects that generate output more rapidly. If these companies decided to increase their production, they would do so in the Permian, which delivers the biggest production bang for the capex buck in the shortest amount of time.

Oil Majors Could Boost Permian Production

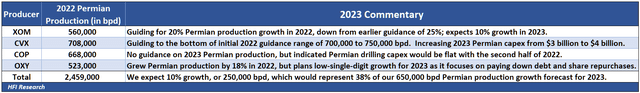

Among the oil majors, Exxon Mobil (XOM), Chevron (CVX), ConocoPhillips (COP), and the smaller Occidental Petroleum (OXY) have significant production in the Permian.

The following table shows their 2022 Permian production growth and their own commentaries on their 2023 Permian production outlook.

Based on guidance to date, we expect the majors to increase their Permian production by 10% in 2023. This will add an incremental 250,000 bpd, which is 38% of our 650,000 bpd Permian growth forecast for 2023. If pressed, we suspect the majors could collectively boost their Permian growth to 15%, but this would only amount to an additional 175,000 bpd.

If other Permian producers joined the majors, Permian production growth could increase by an additional 250,000 bpd, taking basin-wide growth to 900,000 bpd. The additional production would shrink the global oil supply deficit we forecast for 2023. Depending on how large the deficit is, it could also lower global oil prices.

Importantly, we don’t believe an additional 10% growth out of the Permian – or 15%, for that matter – will be enough to eliminate the supply deficit, which we expect to be in the range of 500,000 bpd to 1 million bpd next year. Shale will not be releasing a flood of oil onto the market as it did in its heyday. OPEC would therefore remain in the driver’s seat when it comes to managing supply to influence prices.

Implications for Energy Income

Of course, a material boost in Permian production would benefit midstream. Permian natural gas volumes are already bumping up against takeaway capacity constraints. As a result, regional price differentials support higher tariff rates on existing pipelines and incentivize the construction of new infrastructure. The current market dynamics would be exacerbated if production were increased.

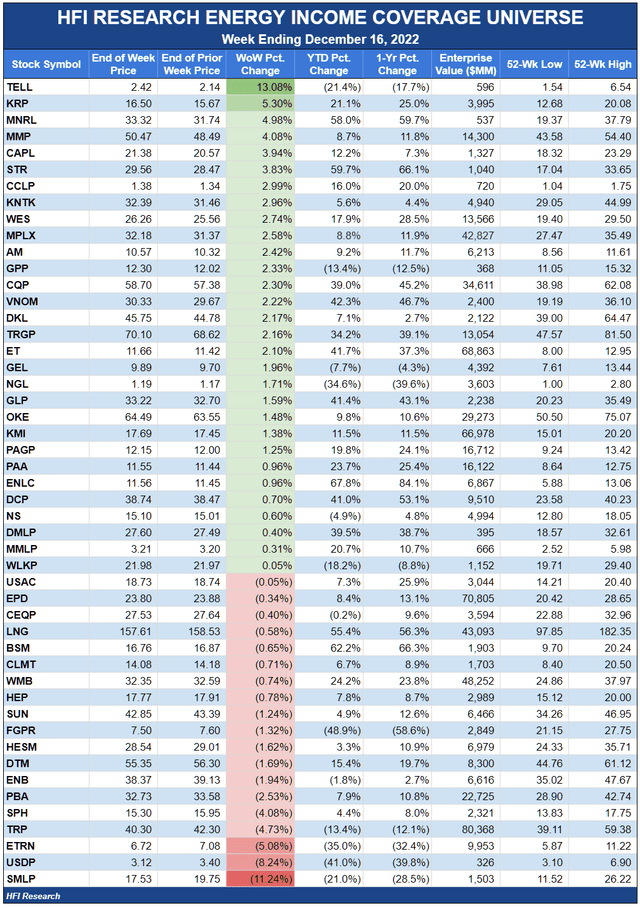

Shares of independent G&Ps would have the most to gain, including Kinetik Holdings (KNTK), Western Midstream Partners (WES), Plains All American (PAA), and EnLink Midstream (ENLC), all of which we own and rate as a Buy.

Increased production volumes of both natural gas and liquids would also be favorable for integrated midstream players with a downstream presence, such as Targa Resources (TRGP), Enterprise Products Partners (EPD), and Energy Transfer (ET). We own these as well and rate them as a Buy.

So while higher Permian production may be a marginal negative for E&Ps insofar as it lowers oil prices, it would be a boon for midstream. It would come on top of an already constructive outlook for 2023. Already, midstreamers are guiding to growth next year, and we believe their guidance will prove to be overly conservative.

The benefits that accrue to midstream equities from stepped-up U.S. production make them an important part of a diversified energy portfolio. We believe it’s important that income investors maintain exposure to the sector due to its cheap valuation, inflation resistance, robust free cash flow, and attractive growth prospects.

Weekly HFI Research Energy Income Portfolio Recap

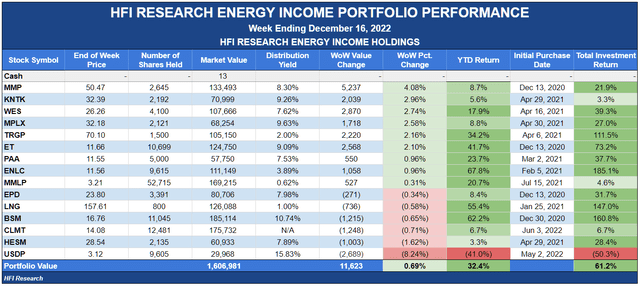

Our portfolio traded 0.7% higher during the week but trailed the Alerian MLP Index by 0.5%. As has been the case for several weeks, our large holding in Calumet Specialty Products Partners (CLMT) has been a drag on our portfolio’s performance. CLMT was down another 0.7% this week.

We’ve shared our thoughts on CLMT and why we don’t see a good fundamental-based reason for its selloff. Their recent decline from above $19 to $14 has moved them to “pound the table” buy territory. We believe they’ll fare well in the first half of 2023 as the company’s renewable diesel manufacturing facility enters service and the market more fully recognizes its value.

USD Partners (USDP) was the worst performer as another week went by without an announcement of new DRUbit by Rail contracts. At this point, we believe a distribution cut is in the cards, but we also believe the medium-term outlook will be supported by contract wins as crude-by-rail economics turn for the better.

Magellan Midstream Partners (MMP) was surprisingly strong, ending the week up 4.1%. We suspect the market priced in better results from the company’s storage assets as contango took hold in near-month WTI futures contracts. However, the contango reversed late in the week, with the oil market reverting to a shallow backwardation. We don’t expect contango to be sustained, so we wouldn’t view it as a driver of outperformance for MMP. However, we do believe MMP units are cheap and rate them as a Buy.

News of the Week

Dec. 14. Plains All American (PAA) announced the sale of its 21% ownership interest in the Keyera Fort Saskatchewan facility to Keyera Corp. for $270 million. We estimate the assets fetched an 11-times multiple of 2023 EBITDA, which is attractive for PAA. The deal increases Keyera’s stake in the facility to 98%. In the deal, PAA will maintain its customers and contracts and lease back fractionation and storage capacity for a multi-year transition period. We aren’t sure how PAA will spend the proceeds. The company already expected to reduce its leverage ratio to 4.0 times, at the low end of its targeted range. We would support additional debt paydown, but given the discount that exists on PAA units, we would rather the proceeds be used to repurchase units. We rate PAA units as a Buy and maintain our $13.00 price target.

Dec. 15. The FERC granted the Spire STL pipeline a permanent certificate to operate in Missouri and Illinois. The pipeline has been fully operational since 2019 but became the object of environmental activists who charged that the pipeline had been approved without adequate review. Last year, a three-judge panel of the U.S. Court of Appeals for the District of Columbia ruled that the FERC had not demonstrated a need for the project and vacated the pipeline’s approval. This week’s decision by the FERC was made after it conducted a thorough review. It allows the pipeline to operate on a permanent basis. We’re delighted to see sanity prevail for this pipeline that provides energy for 650,000 homes. Before the adverse court ruling put its future into doubt, the pipeline had already received operational certificates four times, each time due to its necessity for the communities it serves.

Capital Markets Activity

Dec. 14. New Fortress (NFE) announced a secondary offering of 6.9 million shares at $46.00 per share, resulting in $317.4 million in proceeds for the selling shareholder, Great Mountain Partners. The sale was priced at a 5.9% discount to the prior day’s closing price. Great Mountain continues to own 25.5 million NFE shares.

Be the first to comment