Stadtratte/iStock via Getty Images

Investment Thesis

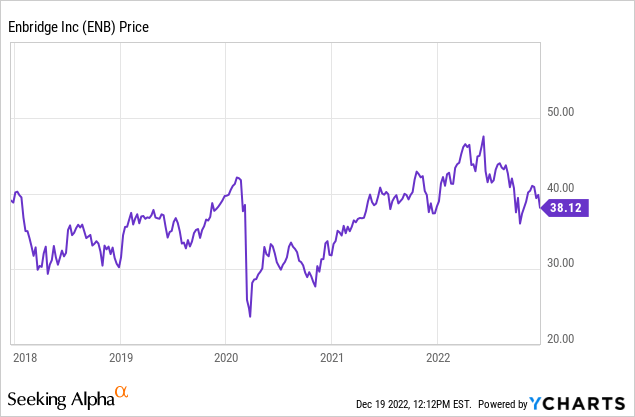

Enbridge Inc. (NYSE:ENB) is an energy infrastructure company operating in the United States and Europe. Since 2020, the company has been on an upward trend that peaked in June this year due to the high prices of gas and oil brought about by supply bottlenecks due to the sanctions placed on Russia. Recent share price declines, however, suggest the corporation is losing momentum.

The company’s recent negative trend may be traced back to its intensive development projects to meet the EU’s goal of reaching zero greenhouse gas emissions by 2050 as a strategy to address climate change.

With a dividend payout ratio of over 100%, the company is paying out more in dividends than its earnings can cover, which makes me concerned that there won’t be enough money left over to subsidize the business’ growth. The company’s dividend policy is unsustainable, and I anticipate further dividend cuts or a complete distribution halt.

Furthermore, the stock is trading at a fair price, another factor contributing to my hold rating. While I anticipate the firm’s share price to continue going downward for the foreseeable future, I expect a significant upward trend in the company’s share price immediately following the completion of its current investments. I believe in the company’s long-term viability, so interested parties should wait for a low entry price before investing.

The EU Resolution

By 2050, the European Union plans to have achieved “climate neutrality,” or an economy with zero net emissions of greenhouse gases. The European Green Deal’s primary focus is on reaching this very goal, along with the European Union’s pledge to take global climate action under the Paris Agreement.

According to the EEA’s study “Trends and Projections in Europe 2021,” the European Union met its three climate and energy targets for 2020: a 20% reduction in greenhouse gas emissions from 1990 levels, a 20% increase in the share of renewable energy consumption, and a 20% improvement in energy efficiency. The EU has recently announced a net emissions reduction target of 55% by 2030, which factors in carbon removals from forestry activities. If this goal is met, the European Union will be able to become carbon neutral by the year 2050.

ENB Conformity With The EU Resolution

The EU has committed to zero greenhouse gas emissions by 2050 as part of its efforts to tackle climate change, necessitating changes in how the energy sector operates. Due to the inevitability of this massive change in the energy sector, ENB is well on its way to completing its revolution.

“Energy-wise, the situation in Europe has brought security and reliability back into focus while ensuring we’re on track to reduce emissions. The investment required to meet energy demand for both conventional and low-carbon supply is only half of what we need, which has led to sustained high prices.” – Al Monaco

In light of these comments from the CEO, I believe it is necessary to explain to inventors the steps the company is taking to comply with the EU resolution. This year, they plan to put into service projects worth about $3.8 billion, which will boost their cash flow in 2023 and beyond. The good news continues to roll this quarter, with organic growth, tuck-in M&A, and capital recycling contributing to the overall success. ENB got another $3.8 billion in projects, with their critical South expansion in BC getting the most money. This year’s new growth is now $8 billion, which shows how the company is committed to expanding its growth, which, I will demonstrate in this section, is in line with the EU resolution.

ENB is updating its infrastructure, generating its power from renewable sources, and planning to ensure that any new investments will help them meet its emissions reduction goals. Also, during the Q3 2022 transcript call, the CEO announced that they are increasing spending on low-carbon technologies. Two things must be available for low carbon energy dream to actualize: transportation and storage. Regarding these two aspects, the company appears to be in a good position in gas transmission; they are working on projects worth about $10 billion, including their annual modernization program and new projects.

They have already spent $3.5 billion on Gas Distribution and plan to finish five of the 27 new community expansions by the end of the year. They sent in their utility rebasing application this week, which will set rates until 2028. They also gave the green light to two new RNG projects in Ontario. In terms of green energy, renewables are doing well, and they have ten solar cell power projects worth $2.9 billion in the works.

In the Liquids field, mainline volumes showed encouraging signs of recovery in the third quarter, and the industry anticipates high utilization through the end of the year and into year 23. After signing an evaluation agreement with the Alberta government, they plan to drill two wells in 2023 to validate the geology of their Wabamun CCS project.

Considering these developments revolve around ratifying the EU resolutions, the company’s future appears bright. Nonetheless, I have doubts about the company’s ability to pay for the developments from its earnings, as evidenced by its excessive dividend payout ratio suggesting they have no retained earnings to fund the expansion. That leaves just debt financing, which will have consequences upon debt maturity. Total debt now stands at $59.54B, or around 78% of its $77.69B market worth. Unless the company changes its dividend policy, it may be difficult to repay its debt if it continues to rely on debt to fund its development.

Inane dividend policy

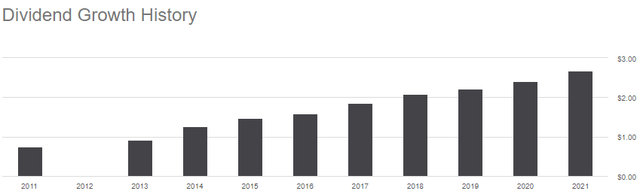

ENB has been a consistent dividend payer since 2013. Over the years, it has consistently exhibited yearly growth from an annual dividend of $0.92 in 2013 to $2.68 in 2021. This growth has marked a 191% growth in 8 years.

Their payout ratio, which is 112.09%, is a parody. This high payout ratio means that the company is giving out more dividends than it can pay for with its earnings, and it also means that the company has no retained earnings to pay for new projects. I think this is a big problem for the long-term success of this policy. This high ratio needs to be changed to a lower, more realistic number, or the dividend payments will stop in the long run.

I anticipate a drastic reduction in that ratio, either to around the median for the industry of 27.79% or the entire cessation of dividend payments, given the company’s recent decision to undertake several intensive development projects.

Valuation

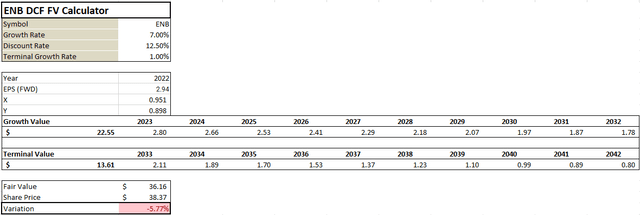

As a C-rated stock, ENB’s current price aligns with its true worth. My analysis of the company’s share price potential is based on an earnings per share EPS-based DCF model. For this analysis, I utilized a higher growth rate of 7% and a discounting rate of 12.50%, although the company has EPS FWD Long Term Growth [3-5Y CAGR] of 6.23%. The company has a downside potential of around 6% if these assumptions hold. If you are a value investor, I recommend holding off until the stock reaches this low price before purchasing.

Conclusion

To meet the EU’s goal of zero greenhouse gas emissions, ENB is implementing intensive development programs. In my opinion, the company will flourish after the projects are finished. Investors should be mindful of the risk posed by the company’s absurd dividend policy, which is eating into profits and requiring the firm to rely on debt to fund its expansion plans.

I expect the dividend payment to be terminated if it is not reconsidered. Based on the DCF model’s negative forecast, I am pessimistic about the stock in the near future, but I have high hopes for the company’s future. Due to these factors, I am holding off on deciding on the company’s rating until all of its development projects are complete.

Be the first to comment