jetcityimage

Eli Lilly (NYSE:LLY) has been one of the best performing large cap pharmaceutical equities over the last two years, but it just laid an egg of an earnings report. The negative reaction to the company missing Q2 revenue expectations took shares in LLY from near their all-time highs back towards the bottom of a multi-month trading range. Now, if LLY shares cannot quickly regain their composure, they appear to have the potential to quickly test the $280s.

LLY daily candlestick chart (Finviz.com)

Eli Lilly’s global Q2 revenue declined by about four percent to $6.5 billion. It appears as though one of the larger variables that missed expectations was related to sales from COVID-19 antibodies which declined by about 13% compared to the same quarter a year earlier, to around $129 million. This was also a significant drop from the $1.5B billion in from COVID-19 antibody sales LLY realized in Q1 of 2022.

Eli Lilly also noted that some of the decline in sales was due to an 11% decrease to realized drug pricing, as well as a three percent impact due to foreign exchange prices. Domestic revenue declined by around six percent to roughly $3.9 billion, while international revenue fell around 16% to roughly $2.6 billion. LLY lowered its full year 2022 earnings guidance to a range between $6.96 and $7.11 on a reported basis, from the prior range of $7.30 to $7.45 that it provided last quarter.

Meanwhile, LLY saw strength from multiple drugs, including Trulicity, Verzenio, and Jardiance. Trulicity’s quarterly sales came in at $1.9 billion, while Jardiance brought in around $461 million. Eli Lilly also noted that Alimta, the company’s lung cancer drug, saw revenue decline by over 60% to around $227 million due to a loss of patent protection that now allows generic competition.

A substantial part of Eli Lilly’s strength over the last few quarters has been due to its pipeline that includes some real promising drugs. One of the most important such potential treatments would be donanemab, which is LLY’s experimental Alzheimer’s medication. Eli Lilly indicated that the FDA accepted the company’s application with an accelerated priority review. Eli Lilly also has tirzepatide, an experimental weight loss drug that was initially developed as a type 2 diabetes medication. Much of LLY’s strength over the last several quarters was likely due to the potential of these two potential treatments.

At the moment, LLY appears as sensitive to the future of donanemab and tirzepatide as it is to the actual performance of its existing portfolio of medications. As a result, there is likely to be a fair amount of risk in the equity related to the possible failure of each treatment. Tirzepatide’s possible future as a weight loss drug would make it a differentiated blockbuster, but its failure to gain approval to treat obesity is likely to cause a significant decline to the share pricing.

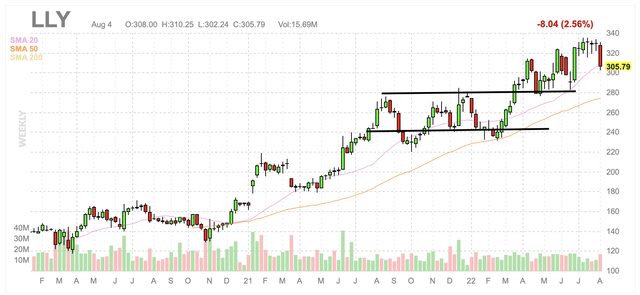

This recent post earnings drop takes LLY shares just above $300 per share, which does appear to be a supportive level. Beyond it being a nice and round number, as well as close to the bottom of LLY’s recent trading range, shares did hover near $300 for much of the second quarter. There also appears to be support at around $280, which is also close to LLY’s 50-day moving average.

LLY weekly candlestick chart (Finviz.com with lines by Zvi Bar)

If $280 cannot hold, it appears possible that LLY shares are destined to return to the trading range that they were stuck within during the second half of 2021, between around $240 and $280.

Conclusion

Eli Lilly is one of the best large cap pharmaceutical companies, but is also one of the most expensive. This recent post earnings sell-off may continue, and especially if the broader market sells off. Further, LLY’s recent reduction to guidance, though small, is likely to require a wave of analyst revisions in the coming weeks. Moreover, large drug companies often underperform in advance of elections due to the potential for them to be targeted as part of campaigning and through post-election legislation.

Since such concerns are usually overstated, any further weakness to Ely Lilly shares during this quarter and the next one are likely to be strong long term buying opportunities. I am waiting to see if $300 can hold, with the belief that if it does not hold, the low $280s are likely to occur shortly thereafter. If the low $280s do not hold, it appears $240 is possible in an extreme sell-off, but that also looks like an extremely supportive level and a great buying opportunity for the long term.

Be the first to comment