Olemedia

Investment Thesis

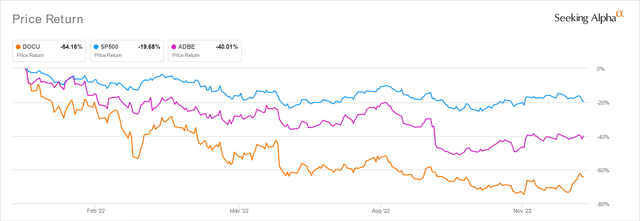

DOCU YTD Stock Price

DocuSign, Inc (NASDAQ:DOCU) has certainly been saved by its excellent FQ3’23 earnings call. Despite the rising inflationary pressure, demand is growing in the small and medium-sized business markets, as well as the mid-market and enterprise markets. At a time of aggressive corporate job and spending cuts, DOCU proved the bears (including myself) wrong, with the raised forward guidance of FQ4’22 revenue of up to $641M, with the projected YoY subscription revenue growth of 11.34% and billing growth of 6.71%. Otherwise, a guided FY2022 revenue of up to $2.497B against consensus estimates of $2.48B.

These naturally triggered DOCU’s stock rally by 33.72% in the days after its earnings call, significantly aided by the upbeat November CPI and the Fed’s walking the 50 basis points talk. In the long-term, the global digital signature market size is also expected to expand to $25.2B by 2027 at a CAGR of 35.6%, indicating the company’s long runway for growth indeed. However, it remains to be seen if this optimism level will hold through the raised terminal rates of up to 5.1%, since we may see prolonged elevated interest pain through 2024. Investors, take note since this rally may also be digested ahead.

There Is Still No Moat In DOCU’s Technological Offering – Though Growth Is Excellent

DOCU’s situation is somewhat similar to Twilio’s (TWLO), in that multiple Big Tech companies, such as Microsoft (MSFT), prefer to partner with the former instead of developing their own electronic signature platform. Interesting indeed, since we reckon that the technology is simple enough, especially for one as experienced as MSFT. Either way, the deepened partnership between DOCU and MSFT proves that the legacy software company believes in the former’s integration capability across the latter’s applications and cloud services.

MSFT may still consider a DOCU acquisition, since it would be revenue and consumer base accretive in the long term, while strengthening the latter’s existing services in the consumer and enterprise end-market by bringing it all under one roof. The legacy company has more than enough cash to acquire DOCU, seeing that it is willing to pay $69B to acquire Activision (ATVI) in an all-cash deal, attributed to the former’s total of $138.51B in cash/investments and total receivable in the latest quarter. The company already has a history of acquiring smaller companies in the name of bundling the services together under a single integrated business solution, namely: PowerPoint back in 1987, Excel in 1991, Hotmail in 1997, and Skype in 2011.

At that time, MSFT may potentially integrate DOCU’s digital signature offering into a single Microsoft 365 Family account, keeping consumer friction at a minimum across the board. On top of the accretive value towards the potential business opportunities, we believe the proposed acquisition would also provide significant cost synergies in the long run. This is made sweeter by DOCU’s leading share of the global electronic signature market at over 77% by October 2022. Though Adobe (ADBE) offers a similar segment through Acrobat Sign with an approximately 10% in market share, we suppose the market is large enough to accommodate multiple winners, since DOCU continues to strengthen its marketing and R&D efforts as well.

By the last twelve months [LTM], DOCU grew its Selling & Marketing expenses by 14.95% to $1.23B and Research & Development expenses by 19.65% to $0.48B against FY2022 levels of $1.07B and $0.43B, respectively. As with most high-growth tech companies, the company also recognizes the importance of hiring talent to ensure strategic growth and technological advancement. Naturally, triggering the expansion of its Stock-Based Compensation to $0.51B in the LTM, increasing by 32.36% from FY2022 levels.

A lack of economic moat is good as well, since it allows DOCU to shine along with its competitors, such as ADBE. By FQ3’23, the former reported an excellent subscription revenue growth of 18% YoY to $624.1M and billing growth of 17% YoY to $659.4M. ADBE reported a similar subscription growth by 2.51% QoQ/ 11.01% YoY to $4.23B in FQ4’22, otherwise, by 12.45% to $16.38B for FY2022. Its subscription gross profits also expanded remarkably by 2.28% QoQ/10.78% YoY to $3.8B in the latest quarter and 11.75% to $14.74B for the fiscal year, respectively.

These point to the strength of consumer demand for business media offerings with the ongoing digital transformation post-reopening cadence, despite the worsening macroeconomics supposedly tightening company discretionary spending. The notable strength of DOCU’s operating metrics should put the bulls at ease, regardless of a soft landing or recession in the coming quarters.

So, Is DOCU Stock A Buy, Sell, or Hold?

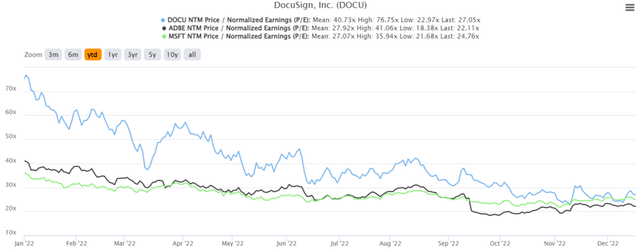

DOCU YTD EV/Revenue and P/E Valuations

DOCU is currently trading at an NTM P/E of 27.05x, lower than its 3Y mean of 165.95x and YTD P/E mean of 40.73x. Despite so, it is apparent that there is a notable baked-in premium embedded in DOCU’s valuations compared to other software peers, such as ADBE at 22.11x and MSFT at 24.76x. The optimism is surprising indeed, since DOCU is only expected to report FY2025 EPS of $2.42 compared to ADBE at $17.56 and MSFT at $13.17. Furthermore, its net income margins also pale in comparison at 19.5% in FY2022, compared to the ADBE at 36.7% and MSFT at 35% at the same time.

In the meantime, prior to the realization of the acquisition hearsay, we reckon DOCU remains a speculative stock, since MSFT is still facing tremendous regulatory scrutiny for the ATVI deal. The former’s premium valuations also hinder a potential takeover, since it is currently valued at a market cap of $11.31B. Expensive, in our opinion, due to its one-trick pony. Furthermore, macroeconomics remains volatile and the funding market is tight, reducing the likelihood of a take-over in the intermediate term. Our aggressive price target for DOCU would be $65.46 (based on its current P/E and FY2025 EPS), which suggests minimal upside from current levels as well, significantly limited by the tremendous 41.38% rally from November’s bottom of $39.80.

Therefore, we prefer to exercise caution for now, due to the minimal margin of safety for next decades’ investing and portfolio growth. Patience for now.

Be the first to comment