Torsten Asmus

The economic environment has changed significantly just in the last several months. With consumer spending levels beginning to fall significantly and growth rates becoming more anemic, market conditions have been very fluid this year.

One type of investor that has been negatively impacting the most by inflation and higher prices has been those seeking regular and substantial payouts. With markets still near record highs and prices still at elevated levels, dividend investors have increasingly had more difficulty getting adequate income despite the growing number of equity options for these individuals.

One well-known exchange-traded fund that is marketed as being focused on dividends and income is the WisdomTree U.S. Quality Dividend Growth Fund ETF (NASDAQ:DGRW).

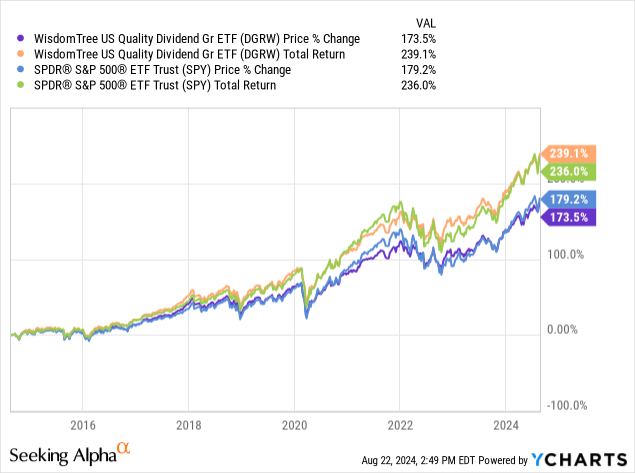

This WisdomTree fund has offered investors total returns of 239.1% over the last 10 years, while the S&P 500 (SPY) has offered investors total returns of 236% during the same timeframe.

I last wrote about the WisdomTree U.S. Quality Dividend Growth Fund in October 2023, and I rated the fund a hold. Today, I am downgrading this fund to a sell. This fund has offered investors minimal dividend payouts, and the income will likely be limited moving forward as well, since the ETF is significantly overweight to the large-cap tech sector. There are also increasing signs of an economic slowdown, this fund’s overweight position in cyclical sectors and exposure to forex moves.

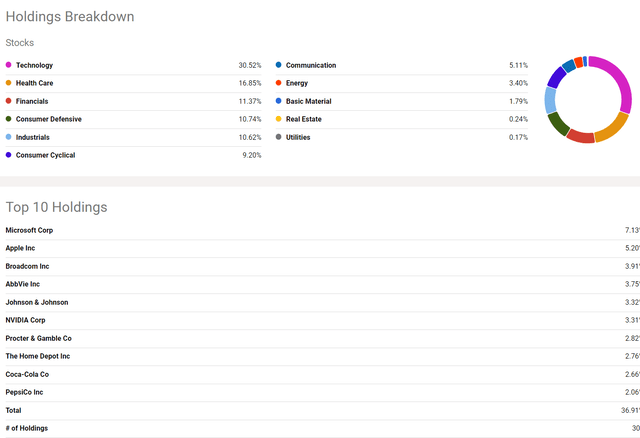

DGRW has an expense ratio of 0.28%, $14.14 billion in assets under management, and a dividend rate of 1.52%. DGRW’s sector allocation is 30.52% technology, 16.85% health care, 11.37% financials, 10.74% consumer defensive, 10.62% industrials, consumer cyclical, 5.11% communication, 3.40% energy, 1.79% basic materials, 0.24% real estate, and .17% Utilities.

A Chart of DGRW’s Sector Allocation and Holdings (Seeking Alpha)

The fund’s largest holdings are Microsoft (MSFT), Apple (AAPL), Broadcom Inc (AVGO), and AbbVie Inc. (ABBV). These four equity positions make up a combined 20 percent of the ETF’s holdings.

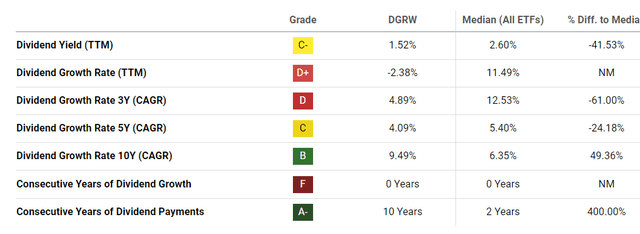

DGRW has paid out only minimal income since the fund’s inception in May 2013. While the ETF has a respectable dividend growth rate of 9.49% since 2014, the fund currently yields just 1.52%, and the dividend growth rate over the last 5 years has been just 4.09%.

A chart of DGRW’s Dividend Growth (Seeking Alpha)

The primary reason DGRW has paid out minimal income since the fund’s inception 11 years ago is because the ETF is heavily overweight the tech sector, and the exchange-traded fund also has minimal holdings in sectors such as the energy industry that put more of an emphasis on returning cash to shareholders. This is a growth fund, not an income-focused investment.

There are also a number of signs that the economy is increasingly slowing down. A number of retailers have reported concerning consumer spending levels in the last several months, the nonfarm roll jobs report was recently revised down by nearly 30 percent, and expected growth rates in China have also been brought down as falling housing prices negatively impact consumer spending in the world’s second-largest economy. While July retail sales rose 1%, ahead of analysts’ expectation for an increase of .3%, recent consumer spending data has still been consistently negative, and credit card debt is close to all-time high levels at $1.14 trillion as well, and higher rates are limiting refinancing options for struggling consumers.

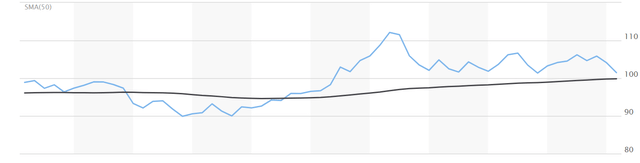

DGRW is also a large-cap fund, and the ETF has increased exposure to forex moves, particularly since the fund is heavily overweight the large-cap tech sector. Even though the Fed is expected to end the current rate cycle sooner with economic data worsening, the ECB has been more aggressive in focusing on cutting rates than Powell has been, and the US economy remains stronger than the EU or China. The Fed has repeatedly stated the bank’s focus on controlling inflation as well, the central bank is not likely to aggressively cut rates. The forex market appears to have overreacted to the recent economic data, the US dollar is likely to rise against major currencies moving forward from current levels.

A Chart of the US dollar (Marketwatch)

All investment theses have risks, and if prices fell significantly, the Fed would likely be more willing to pursue aggressive rate cuts. An end to the war between Russia and Ukraine could bring down food and grain prices significantly, and a resolution to tensions in the Middle East would likely bring down oil prices as well. Consumer spending levels would also likely rebound nicely if price levels were to fall significantly.

Still, interest rates are likely to be at elevated levels for some time since prices remain high, and consumers are increasingly facing tougher choices with credit being more expensive. Growth rates in China and the EU also continue to fall, with the structural problems in the Chinese housing market beginning to have a significant impact on the second-largest economy in the world. While DGRW is a well-balanced and diversified fund that should appeal to some more aggressive, most dividend and income investors should be able to find better value and more appealing income options.

Be the first to comment