Digital Vision./DigitalVision via Getty Images

Investment Thesis: In spite of consolidation in the past year, the potential for a strong rebound across the Brazilian travel market this year could lift the stock higher.

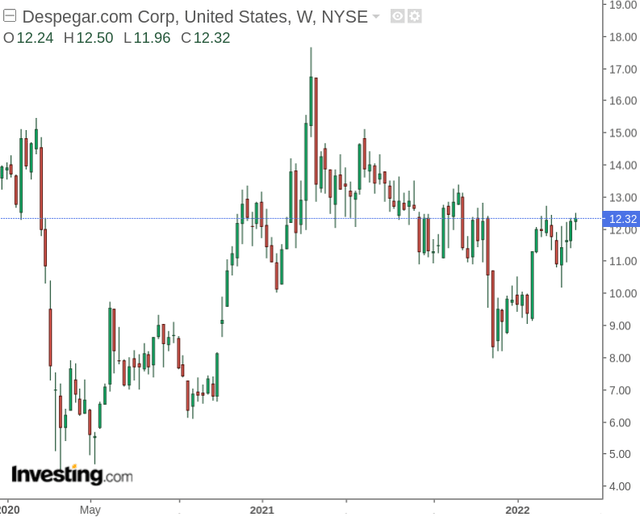

Despegar.com (NYSE:DESP) saw a strong rebound post the early 2020 drop, having subsequently consolidated at $12.32 at the time of writing.

In a previous article back in July 2021, I made the argument that while further upside in the stock could be possible, the stock may be too risky due to continued travel restrictions and the potential for further COVID outbreaks.

The purpose of this article is to reassess the potential trajectory for Despegar in light of more recent performance.

Performance

With Despegar being the leading online travel agent in the Latin American market – the company has been significantly dependent on attracting U.S. customers looking to book holidays in key regions. I had originally cautioned that while interest in Latin American travel could see higher levels than usual given the travel restrictions between the United States and Europe, ongoing extension of non-essential travel restrictions to from the U.S. to Mexico at the time could see significant downward pressure on booking interest.

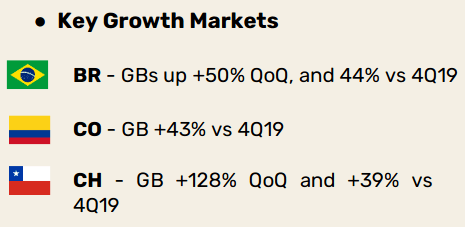

For the most recent quarter, while the omicron variant still had an impact on travel appetite – the company’s key growth market still saw strong double-digit growth as compared to the fourth quarter of 2019.

Despegar.com 4Q21 Earnings Conference Call

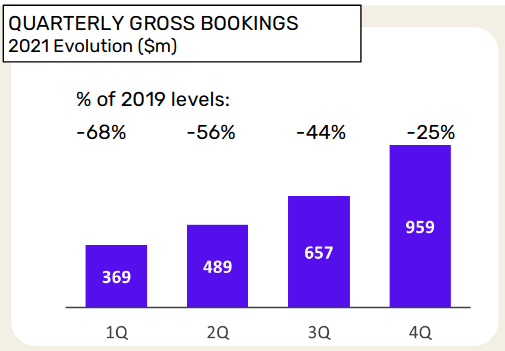

Additionally, when looking at quarterly gross bookings overall, we can see that the recovery towards 2019 levels by quarter has been quite significant:

Despegar.com 4Q21 Earnings Conference Call

Moreover, comparable adjusted EBITDA was up by 30% to $16.3 million as compared to Q4 2019 despite gross bookings being at 75% of pre-pandemic levels.

From this standpoint, this is a good signal that Despegar is seeing significant profitability among those customers who are returning.

Additionally, from a balance sheet standpoint, we can see that Despegar also has a strong cash flow position as the company took the opportunity to conserve cash when bookings had originally fallen during the pandemic.

| Dec 2020 | Sep 2021 | Dec 2021 | |

| Cash and cash equivalents | 334430 | 263204 | 246078 |

| Current liabilities | 385523 | 403145 | 473753 |

| Long-term debt | 10367 | 12241 | 11382 |

| Cash to current liabilities | 0.86 | 0.65 | 0.52 |

| Cash to long-term debt | 32.25 | 21.50 | 21.61 |

Source: Cash, current liabilities and long-term debt figures (in thousands U.S. dollars) sourced from Despegar Q4 2020 and Q4 2021 Earnings Reports. Ratios calculated by author.

We can see that while Despegar’s cash reserves have decreased over the past year, the company still has a strong supply of cash to cover its long-term debt, with the cash to current liabilities ratio still remaining above 50%.

Looking Forward

In terms of the potential trajectory ahead for Despegar, Mexico showed the best rebound in performance as compared to Q4 2019, with gross transactions up by 20% and Mexico accounting for 22% of overall transactions in the quarter.

Brazil – accounting for 33% of all transactions in the quarter – saw a very strong rebound in gross bookings of 81% year-on-year. In spite of gross bookings being 44% lower as compared to Q4 2019, the rebound in Brazil’s growth has been quite encouraging.

Should we see such growth continue to rebound in 2022, then I take the view this could serve as a catalyst for further upside in the stock.

Moreover, the company has been making significant moves to expand its footprint in Brazil, with the company having reached an agreement to acquire the vacation rental manager Stays for $3.1 million. This gives Despegar access to the company’s inventory of 17,000 properties across the country. This also marks quite a good opportunity for Despegar, as only 10% of owners in the LATAM region use digital channel management as compared to 90% in Europe – meaning that the potential for market growth across these accommodations is substantial.

In terms of broader travel demand across the Brazilian market, travel restrictions are relaxing significantly with the cruise season coming back online, along with incoming travellers no longer required to quarantine.

From this standpoint, this could mark a significant growth opportunity for Despegar this year, as transaction volume across Brazil is significantly higher than that of Mexico which had previously seen the strongest recovery in 2021.

Conclusion

To conclude, while I initially cautioned that ongoing COVID restrictions could make the stock a risky proposition, the potential for a rebound in growth is significant given the potential for strong performance across the Brazilian market this year. In spite of recent consolidation, I take the view that the stock could see some upside going forward.

Be the first to comment