lcva2

Introduction

Investors are aware that agriculture is becoming more and more a key industry, with strong tailwinds that seem to be long-lasting. If we look at the agriculture machinery manufacturing industry, we also find out that we meet an oligopoly of a few competitors. I mostly cover three of them: CNH Industrial (CNHI), John Deere (NYSE:DE) and The AGCO Corporation (AGCO). In this article, we will focus on Deere, as it has already released its FY22 results. Last, I covered John Deere in August.

Summary of previous coverage

Last year, I published several articles on all three of these names. The thesis I developed was simple.

- Demand for new and more technological equipment was (and still is) strong

- Supply chain issues hindered to some extent order intakes and shipments

- In this case the industry leaders can’t satisfy the total demand for their products

- Hence, some of this demand shifts down to other suppliers

- These suppliers have the chance to sell their products to customers used to buying premium products

- This increases pricing power of the new suppliers that can close the gap on profitability

In other words, I saw CNH Industrial as the company set to benefit the most from this environment. In fact, it is the second largest company in the industry after Deere and it has the advantage over AGCO to be already rooted in North America. Not surprisingly, while Deere saw in the first half of the year a lot of pressure on its margins, CNH Industrial saw always double-digit margins for its agriculture division (80% of total revenues).

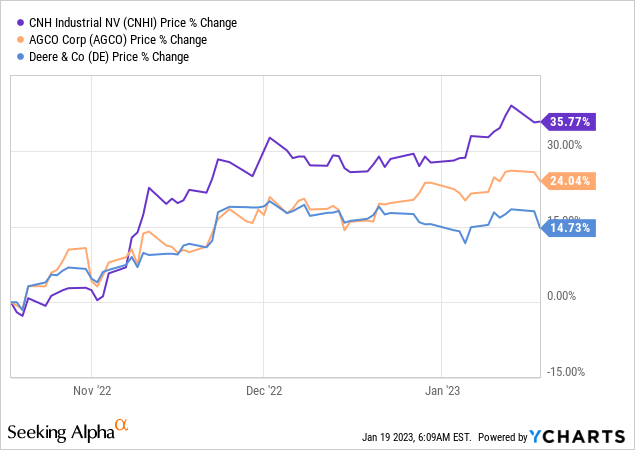

I think this can also explain why, in the last 3 months (and also over the last 6 months), it outperformed its peers, closing up a bit of its valuation gap.

On its side, AGCO owns a very strong brand like Fendt, but its footprint is still largely in Europe and it needs to expand in North America in order to increase its margins that were in the high single digits.

However, in the second half of the year, both AGCO and Deere seem to have reached their turnaround quarters, with the former achieving double-digit margins and the latter set to reach once again margins in the low 20s.

Now, I while we wait for upcoming earnings, I think it is interesting to use Deere’s 2022 Annual Report to gather some data to look at the industry and understand if it is still offering interesting value for investors.

Three general agriculture trends

Before we turn to some financials, it is wise to have in mind some of the macrotrends impacting agriculture equipment manufacturers.

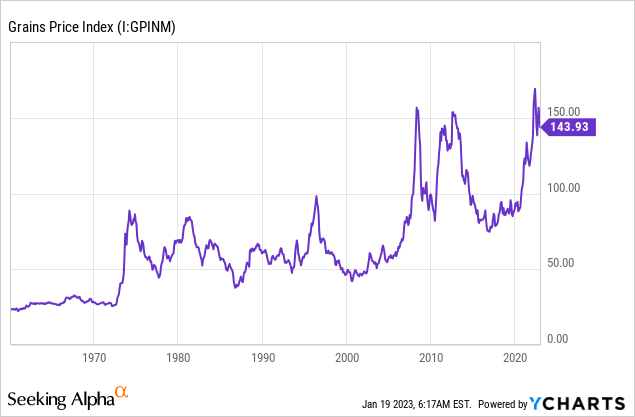

Let’s use the grains price index as a proxy.

This shows that farmer net income should still be high in the upcoming years. In addition, with energy prices cooling off a bit, farmers should see lower pressure on their margins compared to what we expected just a few months ago. In addition, stocks-to-use ratios for key grains are still low because exports from the Black Sea region down about 40% due to the war in Ukraine. This tight supply situation won’t be eased quickly, even though we know the Canadian harvest has been one of the best in the last 100 years. It will take at least a two or three growing seasons to change a tight supply situation. This should keep crop prices high, supporting farmer net income.

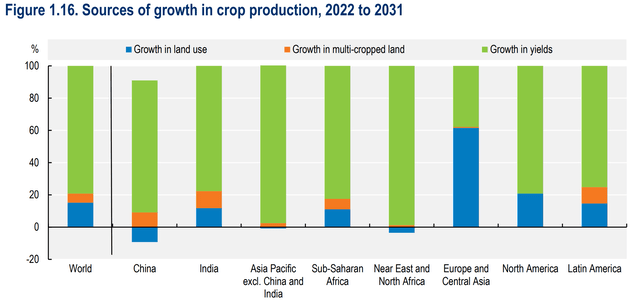

While farmer net income is projected to remain high, it is more susceptible of drawdowns in case of a big recession, there is another tailwind that I don’t think will be easily wiped out. I am talking about precision agriculture. The need to boost crop yields pushes farmers to invest in new equipment to save on input costs. Farmers have to produce more with less available workforce. Therefore, what men can’t do must be replaced as much as possible by machinery. Actually, the major source of growth in crop production for the future decade won’t be from the expansion of farmed land, but rather from growth in crop yields, as we can see from the graph below where the FAO shares its forecast of sources of growth in crop production for this decade.

OECD-FAO Agriculture Outlook 2022-2031

As we can read in the OECD-FAO Agricultural Outlook 2022-2031:

Global food consumption, which is the main use of agricultural commodities, is projected to increase by 1.4% p.a. over the next decade, and to be mainly driven by population growth. […] Over the next decade, global agricultural production is projected to increase by 1.1% p.a., with the additional output to be predominantly produced in middle- and low-income countries.

As a consequence:

Investments in raising yields and improved farm management are foreseen to drive growth in global crop production. Assuming continuing progress in plant breeding and a transition to more intensive production systems, yield growth is projected to account for 80% of global crop production growth, cropland expansion for 15%, and increasing cropping intensity for 5%. Cropland expansion is expected to be regionally concentrated in Asia, Latin America, and Sub-Saharan Africa.

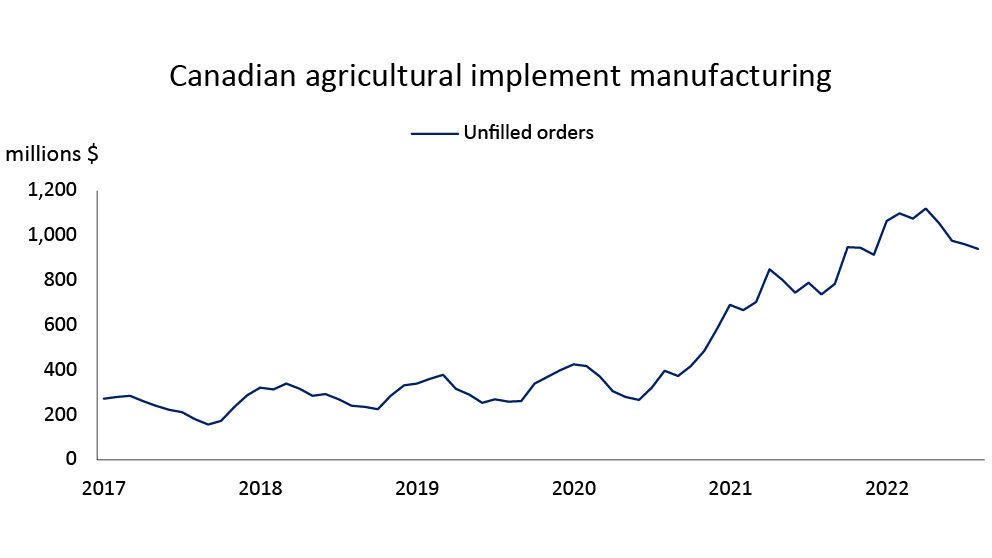

Thirdly, we must not forget that there is still quite a bit of pent-up demand for new farming equipment. In addition, post-pandemic supply chain constraints hindered the normal equipment replacement cycles. As a consequence, fleets are aging at a faster pace compared to before the pandemic. This strengthens the spare parts business and leads to the conclusion that demand to replace older equipment won’t go easily away soon. We can see this from the graph below; it deals with Canada, but it paints a picture that is common to many countries in the Western world. The graph is clear: unfilled orders are still at very high levels compared to the situation prior to the pandemic. This means that agriculture equipment manufacturers have a lot of incoming revenue in their pipelines.

Farm Credit Canada (FCC)

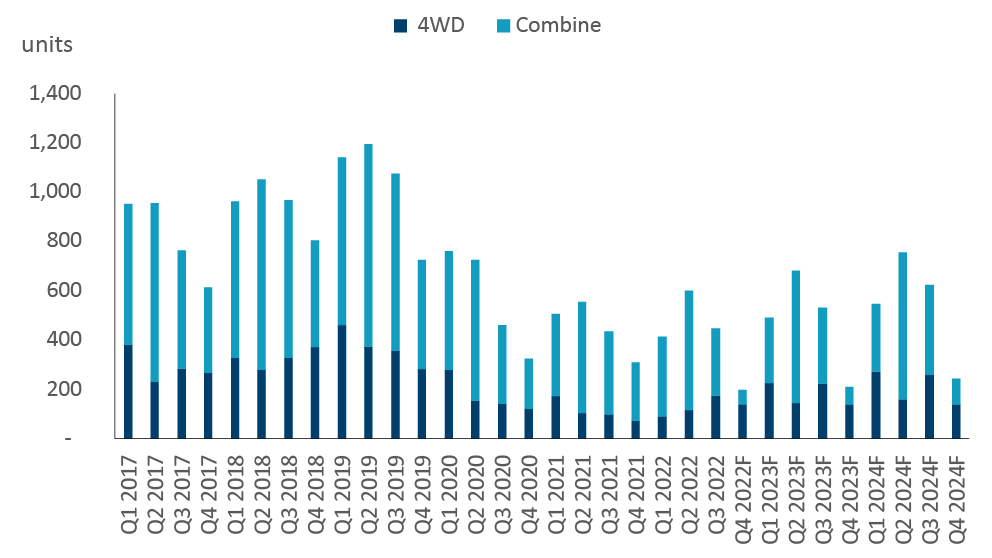

In addition, inventory levels for 4wd tractors and combines – the top tier products – are still far from recovering with projections seeing them rather tight through the end of 2024. Not by chance, sales of these products are once again increasing.

Farm Credit Canada (FCC)

Deere’s results

Two months ago, after reading the reports from CNH Industrial, AGCO and Caterpillar, I thought it was rather easy to forecast that Deere was expected to post a blow-out quarter, as it actually did. Here is a table with my forecast and the actual results.

| My forecast | Actual | |

| revenues | $13.3 billion | $15.5 |

| operating margin | 16% | 21% |

| EPS | $7.17 | $7.44 |

Now, I was expecting a 30% revenue growth YoY, and I thought I was being generous. Needless to say, Deere just crushed my forecast, with a 40% growth in net sales YoY.

Overall, for fiscal year 2022, revenues went up 19% to $52.6 billion, while net sales for the equipment operations were up 21% to $47.9 billion. Net income reached $7.1 billion which then became $23.28 per diluted share.

Just three quarters ago, Deere was posting shrunk operating margins at below 9%. Now we are really back on track as inventories have been cleared. But, in the meantime, as we have seen, demand is still strong and the company disclosed during the Q4 earnings call that order books extend into the second half of 2023, which can make many investors confident of the results the company will release in the next few quarters.

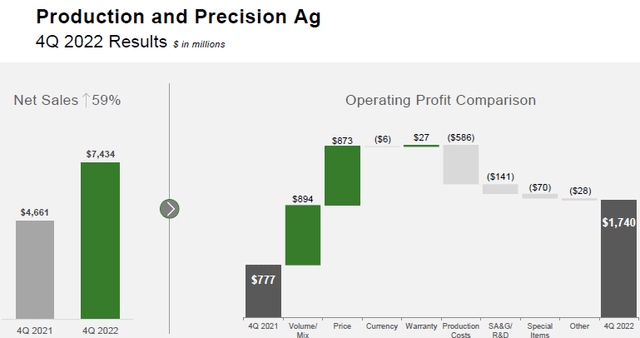

Now, what has enabled Deere to recover so quickly? The YoY operating profit waterfall graph is clear: volume/mix and pricing have more than offset production cost increases.

Deere Q4 2022 Results Presentation

Let’s take a look at pricing. Deere saw a benefit of $873 million, while it had to meet higher production costs for $586 million. This means that every $1 of extra production costs became an additional $1.49 of revenue. This is pricing power and only companies with a brand value like Deere’s can do so. If we considered that during the Q4 earnings call Deere’s management disclosed there are additional price increases for 2023, we can expect this trend to keep going up.

In addition, 2023 seems to be a very promising years, since Deere’s management was eager to explain the situation with orders:

order books are extended into the second half of ’23, providing visibility and confidence in the new fiscal year. […] Not only are they extending into the third quarter of 2023, but the velocity in which they fill remains really encouraging for us. Recall that our order books are still on an allocation basis when those orders ship, they generally retail right away and almost all of those machines have a customer’s name on them when they go down the production line.

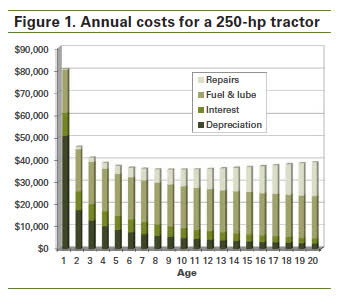

I think this makes sense, given the charts we have seen above. Supply is still tight and demand is strong, driven both by major geopolitical events and by supply chain bottlenecks. This situation will probably cause the agriculture equipment replacement cycle to extend as demand outstrips supply. An interesting article published by the Department of Economics of the Iowa State University shows a very useful chart for us investors. We see that the cost of owning farming equipment goes down quickly at first because of how depreciation works. However, starting from year 9, repair costs begin to increase faster than depreciation and interest costs decrease. Usually, a machine needs to be replaced after a life of 9 to 15 years.

Iowa State University

As a consequence, I expect 2023 to turn out to be an even better year for Deere in terms of shipments, with the advantage that, while fleets age, repairs and spare parts revenues increase, too.

In fact, Deere provided a 2023 guidance with net sales up between 15% and 20%, supported by 11 points of positive price realization but dragged down 1 point because of negative currency translation. For the segment’s operating margin the company’s year forecast is between 22% and 23%, putting Deere back to its usual margins.

Probably, Q1 2023 will be rather pleasing for investors as its YoY comps are easier to beat.

As per interest rates impacting farmers, the segment that might be slowed down the most is the small ag one, as it is more linked to housing in general. Precision Ag should do rather fine, with big farmers having plenty of cash at the moment that defends them from having to take on new debt. I think this is actually true since Deere had to report that in 2022 it saw “lower penetration rates at John Deere Financial because customers were using more cash to finance that acquisition”.

Speaking of John Deere Financial, let me spend a quick word on an aspect of Deere’s balance sheet that may not be well understood. The company carries right now $53 billion in debt. This may lead many to think the company is highly leveraged since its EBITDA is just $10 billion. However, we have to consider that most of this is not industrial debt. In fact, most of this comes from the financial activities and is thus a very different kind of debt. This explains why Fitch Ratings awards Deere with an A, Moody’s with an A2 and Standard & Poor’s with an A.

Valuation

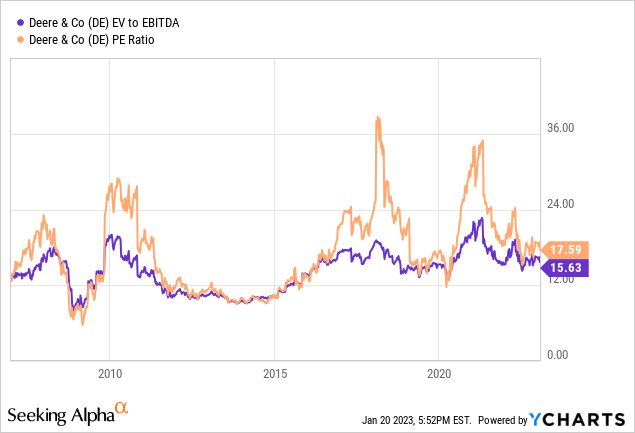

Now, if we look at two simple metrics like PE and EV/EBITDA we see Deere trading at a rather attractive valuation compared to its past, especially the most recent one.

Its price/free cash flow ratio also is just 13.85, which is only a slight premium of 6.8% to the industry average.

All these metrics may suggest we are getting close to a buy zone. But what I think is quite important to look at to decide whether or not it is time to buy Deere are the profitability metrics. In fact, Deere scores an A here, with high margins, a high return on equity (almost 37%) and strong generation of cash from operations. This makes me think in the following way: if one is looking at Deere for a short-term trade, then today’s price is quite dangerous. However, for those investors who want to go long Deere for the long-term, relying not only on the macroeconomic environment, but also on the compounding strength Deere has among its peers, then now maybe the time to start picking some shares. In any case, I think below $400 we are in buy territory, as Deere’s profitability is back on track. This is why I revise my rating upwards moving it from a hold to a buy.

Be the first to comment