peterschreiber.media

DaVita (NYSE:DVA) is one of the most prominent kidney dialysis companies in the US. They went public in 1995. Their main competitor is Fresenius, which also holds significant market share. In the US, they provide their services via a network of almost 3,000 outpatient dialysis centers. In addition they have over 300 centers in 10 different countries outside the US.

BRK.A is the largest shareholder of DVA with 40.1% ownership stake (the largest of any of BRKs stock portfolio). In spite of the size of the stake, DVA is still a passive investment for BRK. They don’t have anyone on the board and don’t try to make changes.

One of Berkshires’ two investment officers, Ted Weschler was a long time DVA shareholder before joining BRK and personally owns around 1% of the company still. It’s been a position in BRK’s portfolio since 2011. It is assumed, but not officially confirmed, that he was responsible for this purchase.

While this was a stock picked by Buffett himself, it has many of the characteristics of a Buffett-style investment. The revenue is stable and predictable, EPS continually grows, market share is significant, and the lack of meaningful competition has shown that the moat is durable.

Below is the return on capital metrics:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

DVA |

5.6% |

13.9% |

4.9% |

13.6% |

15.3% |

|

4.5% |

10.9% |

5.7% |

0.5% |

1.3% |

|

|

7.1% |

-30.9% |

9.3% |

15.6% |

10.5% |

The kidney dialysis industry is forecast to grow at 5.73% till 2029. In spite of challenges brought by the pandemic, DVA’s revenue still grew slowly and EPS increased every year.

Capital allocation

A dividend has only been paid only three times. Acquisitions have been a consistent driver of growth over the long run, they have acquired almost 30 companies. Share count began to be meaningfully reduced starting in 2015, and currently sits 54% lower than that point. Below we take a look at how capital was allocated, all figures in millions:

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

FCF |

551 |

1,156 |

817 |

849 |

1,134 |

1,002 |

785 |

1,306 |

1,304 |

1,289 |

|

Repurchases |

0 |

0 |

0 |

550 |

1,098 |

803 |

1,162 |

2,384 |

1,459 |

1,599 |

|

Acquisitions |

4,296 |

314 |

307 |

114 |

550 |

809 |

202 |

110 |

204 |

201 |

|

Investment Purchases |

11 |

13 |

481 |

1,719 |

1,147 |

244 |

14 |

107 |

154 |

34 |

|

Debt repayment |

39,286 |

66,724 |

60,046 |

53,922 |

52,116 |

50,837 |

59,240 |

40,606 |

4,110 |

861 |

Long-term debt currently sits at $11.42 billion. Management did say in the Q3 call that debt/EBITDA is higher than they would like, and that paying down debt will take a higher priority over repurchases. We can see that they aggressively deleveraged for most of the past ten years. With such strong FCF, there’s no reason to think this won’t happen again.

Risk

The fact that DVA has duopoly status along with FMS takes a lot of risk off the table. This is not a sector where high flying newcomers can aggressively take market share. DVA and FMS have both consolidated many clinics, and will continue to do so as much as possible.

DVA has had a significant market share for a long time and it continues to grow, currently at 37%. I would say the biggest risk is a combination of losing market share over time and too much leverage. I view both of these as a low probability, which means the real risk for a long-term investor would come from overpaying.

Valuation

Shares are down 43% from their peak in 2021, so it wasn’t spared from the drawdown that affected so many.

Below is the multiples comp between peers:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

DVA |

1.3 |

7 |

13.2 |

3.3 |

n/a |

|

FMS |

0.8 |

4.7 |

10.3 |

0.6 |

4.5% |

|

HCA |

1.8 |

8.8 |

25.2 |

-88.2 |

0.9% |

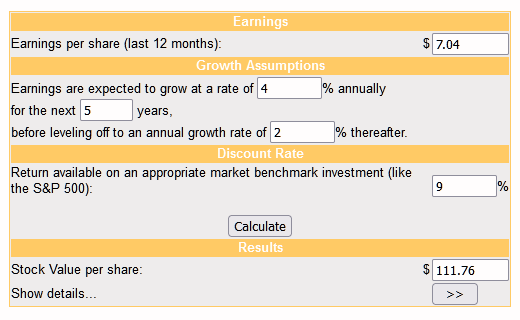

Below is the dcf model:

moneychimp

I gave a fairly optimistic earnings growth estimate, partly because I expect buybacks to ramp up again after a period of deleveraging. The company is definitely undervalued on an intrinsic basis and now is an ideal time to begin a position for longer-term investors.

Conclusion

DVA has been owned by BRK since 2011 and likely will be held for the long run. The company and industry are fairly stable and predictable despite challenges brought by the pandemic. Debt levels are high, but the company has shown a willingness to aggressively pay down debt in the past and this should continue. Bolt-on acquisitions will continue along with repurchases once more debt is paid down. Right now is a good opportunity to buy shares on an intrinsic basis.

Be the first to comment